Marking the end of 2020, the fourth quarter reflected the forward-looking nature of markets. With COVID vaccine rollouts underway, more political clarity, and a generally optimistic view for economic improvement moving into 2021, the equity markets continued their rally from their March lows. While US markets generated the strongest gains for 2020, emerging market and international developed market stocks outpaced the US during the quarter.

Fixed income markets also generated positive returns as interest rates remained largely steady. The Federal Reserve continues to hold short-term rates near zero and expectations are for the Fed and other global central banks to remain accommodative for the foreseeable future.

While many of these broad trends continued on from the middle of the year, there were some shifts in the underlying leadership of the markets. After several years of headwinds, the fourth quarter saw outperformance by small US stocks and international stocks. Time will tell whether these are short-term changes or the beginning of longer-term themes.

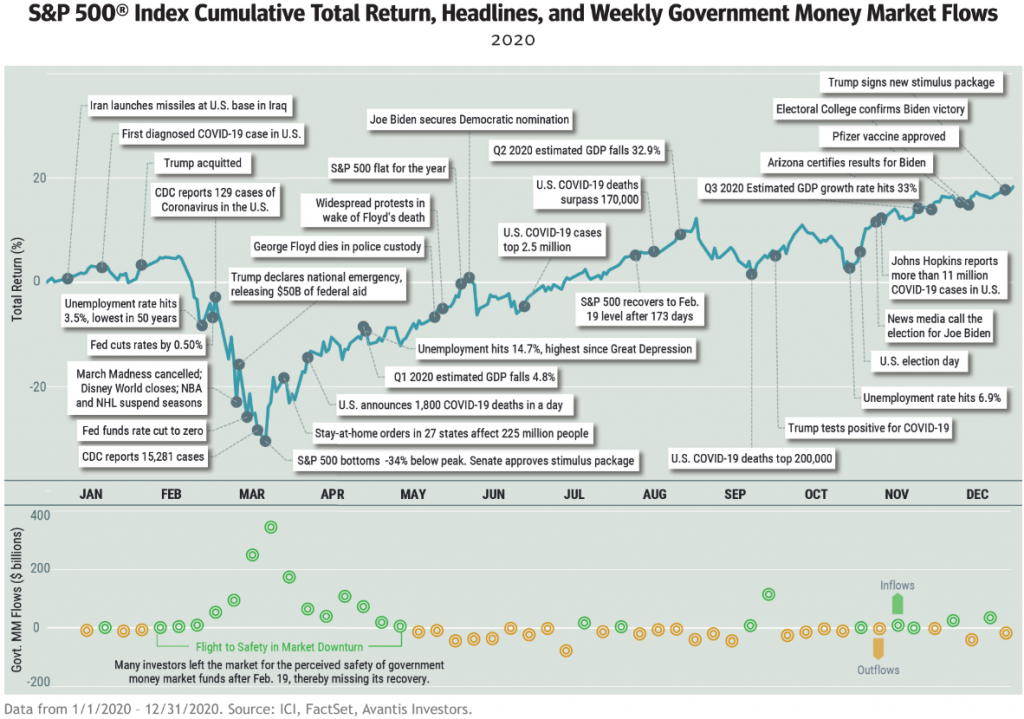

As many reflect upon the past year, the frequently used word is “unprecedented.” That is certainly an accurate word in many regards. The following chart, created by Avantis Investors, helps to provide a useful narrative as we look back on 2020. The events, headlines, and experience of last yera were certainly nothing anyone could have predicted.

However, what was not unprecedented was the reaction of some investors to the market performance earlier in the year (shown in the bottom chart) as assets flowed to government money market funds in a classic “flight to safety.” A fundamental component of our philosophy is that understanding and education around market history combined with patience and a long-term focus is a far superior approach to trying to predict market direction or making reactionary moves.

Investment dollars moved to the sideline in March would have missed out on the rebound as well as the further gains of the market throughout the year. All along the way in 2020, the headlines and news challenged even the most disciplined.

One of the key takeaways from 2020 was the value of preparation and understanding that market disruptions will occur, and having a defined process and approach to avoid making emotional decisions when they do.

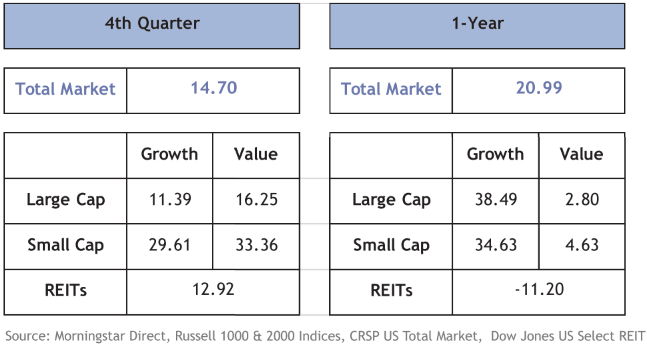

US Stocks

The overall US stock market gained almost 15% during the fourth quarter and finished with a 21% gain for 2020. The divergence among equity styles remains wide over the past year, with the difference in returns between large cap growth and small cap value over 30%. In the fourth quarter, small cap and value both outperformed. Small cap, in particular, had a very strong quarter with returns of 30%. Real estate investment trusts (REITs) have continued to underperform the broader market and are one of the few market segments that finished negative for the year.

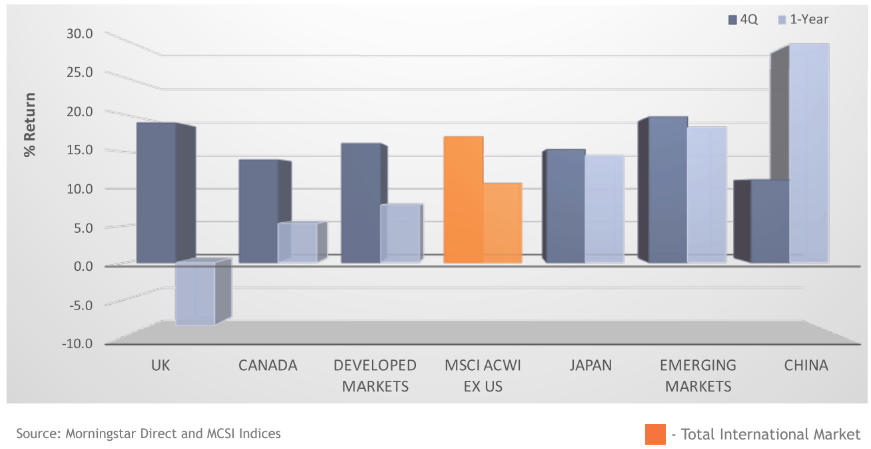

International Stocks

International stocks also gained during the quarter, appreciating 17%, bringing the 1-year returns to just over 10%. Emerging markets outperformed developed markets, gaining 19.7% for the quarter and 18.3% over the past year. While relatively weaker for the quarter, China remains among the stronger performing countries over the past year. Conversely, while making up some ground in the fourth quarter, areas of Europe (particularly the UK) have faced larger headwinds over the past year.

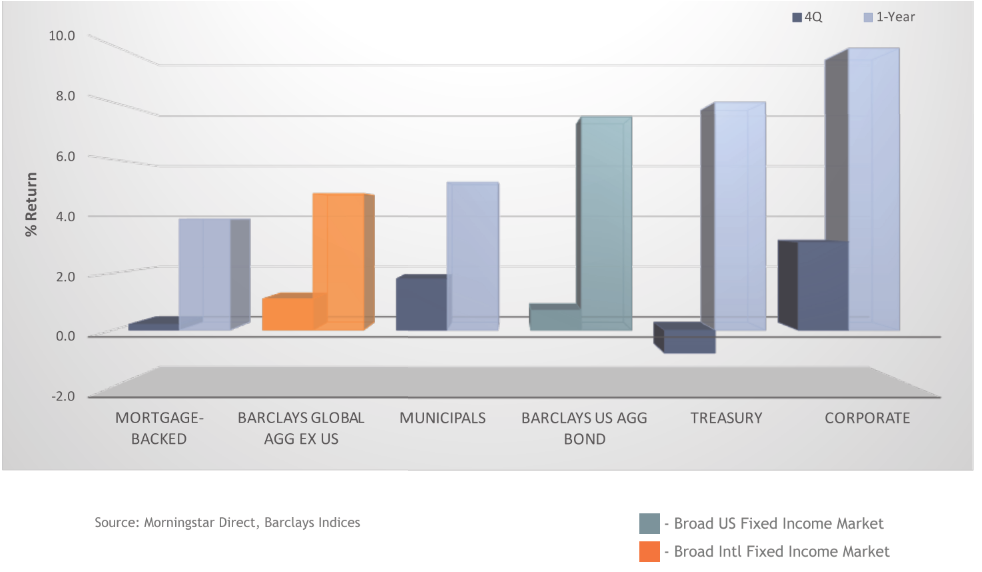

Bonds

Recent returns within fixed income continue to be led by corporate bonds. Despite the pressures in the first part of the year, corporates finished 2020 ahead of treasuries while mortgage bonds underperformed. Largely related to the more meaningful drop in yields in the US bond markets, hedged international bonds trailed for the year while outperforming for the fourth quarter. Municipal bonds gained just under 2% for the quarter and 5.2% for 2020.

Parting Thoughts

Parting Thoughts2020 was certainly unprecedented in many ways, with a global pandemic essentially shutting down the global economy, massive global monetary and fiscal stimulus, and the speed with which the equity market drawdown occurred as well as the speed it rebounded, to name a few.

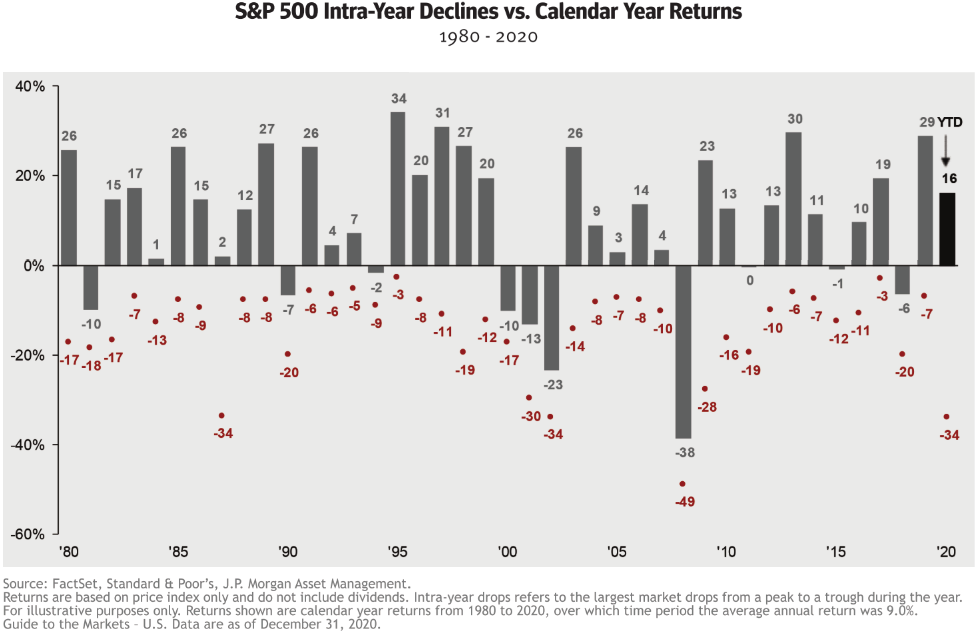

While certainly no one could have predicted the path we have travelled through 2020, the overall outcome was one that was not outside of the historical experience. The below illustration comes from J.P. Morgan’s Guide to the Markets and is one that we have used regularly as an educational tool regarding market drawdowns.

Looking back to 1980, the illustration shows both the final return for the S&P 500 by calendar year and the largest intra-year drawdown experienced. The data shows that over the last 40 years, the S&P 500 has been positive in 75% of the years, despite an average intra-year drawdown of approximately 15%. With that history as a guide, we have noted that long-term investors have to be prepared to experience:

– 10% or greater declines each year

– 10-20% declines at least once every two or three years

– Greater than 20% declines at least once every five or six years

While 2020 was certainly a severe event, years like 1987 and 2009 show similarly large drawdowns with positive results for the year. Some years, like the early 2000’s show drawdowns that do not recover nearly as quickly.

When the next market drawdown will occur and what will trigger it is ultimately unknowable. We believe the evidence is clear that trying to time markets and avoid drawdowns is a fruitless exercise.

The best alternative path is to understand that risk is an inherent part of investing, and steel ourselves for the next unknown market shock with the confidence that the long-term benefit from staying invested in the market has proven itself time and time again and rewards those who follow their investment strategy through both good and challenging times.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.