Fees

$15,000 Per Year

Why A Flat Fee?

Traditional financial advisors base their fee on the value of your portfolio. This approach, known as “Assets Under Management,” typically costs 1% of your managed money per year.

We don’t believe the value of your portfolio should determine how much you pay. Here’s how our flat fee sets up apart:

Transparency

Our flat fee is simple and straightforward. You’ll always know exactly what you’re paying.

Alignment

Our flat fee reduces conflicts of interest. It allows us to provide advice without worrying how, for example, a withdrawal from your portfolio might affect our revenue.

Savings

Our flat fee can result in significant cost savings. See how in the example below.

Example

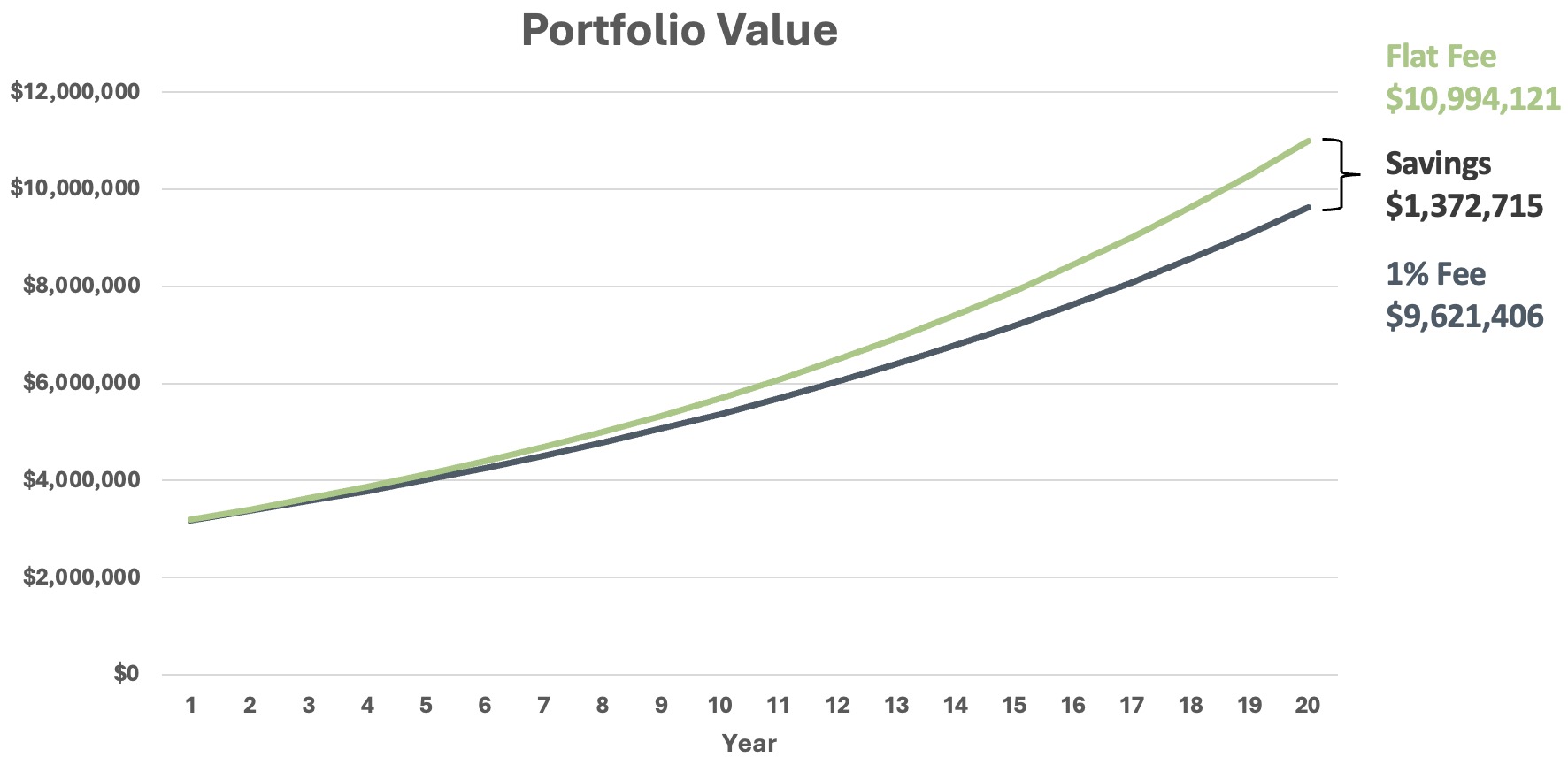

Starting with a $3 million portfolio and assuming a 7% annual return over 20 years, an advisor charging 1% would charge $30,000 in the first year. Those fees also increase as your portfolio grows.

With our flat fee structure, your portfolio could be worth nearly $1.4 million more after 20 years.

If you are interested in working with a flat fee advisor, we look forward to hearing from you.