I hope you’re having a great week.

Please see this week’s articles, chart, and quote below, along with two bonus posts written by me.

3 Articles

How Much Money Do You Need To Make To Be Considered Rich?

Ben Carlson, A Wealth of Common Sense

Nearly 40% of households in the United States earn less than $50k a year. Two-thirds of households make less than six-figures. And anything over $200k a year puts you in the top 10%.

SPACs, NFTs, and GameStop

Peter Mallouk, Creative Planning

This article summarizes some of the trendier finance topics that have been in the headlines lately.

The Agony of High Returns

Morgan Housel, The Motley Fool

This is an old article from 2016, but the counterintuitive lessons remain. It’s about how even with a time machine a lot of people wouldn’t want to own the best-performing stocks. One of the companies it focuses on is Monster Beverage, which was the best-performing stock from 1995 – 2015, earning a return of 105,000%, which would have turned a $10,000 investment into more than $10 million.

1 Chart

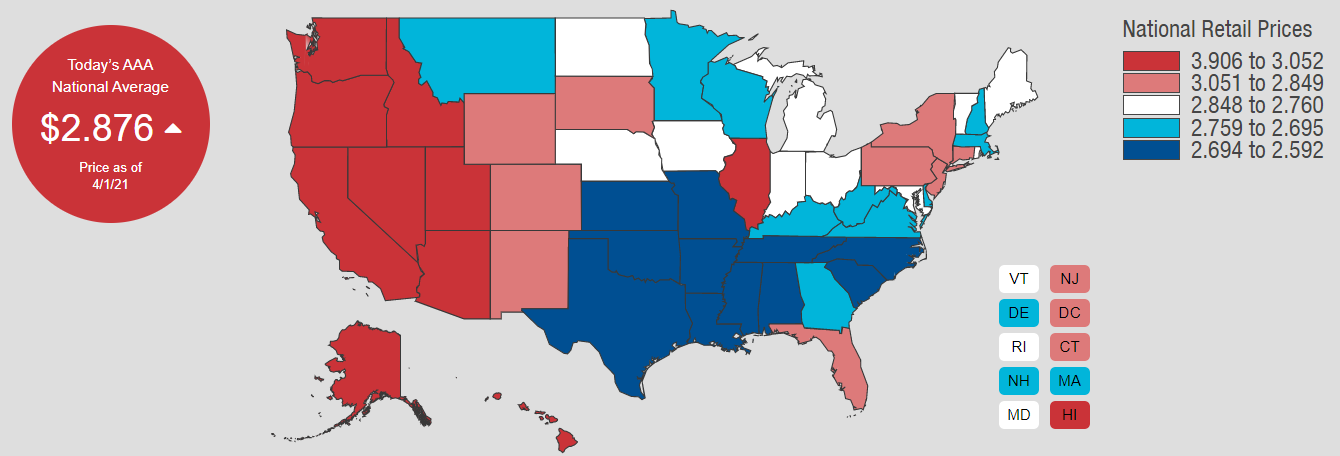

Nationwide gas prices are 84 cents more expensive as compared to a year ago.

The top 5 most expensive states are: California ($3.87), Hawaii ($3.64), Washington ($3.32), Nevada ($3.31), and Oregon ($3.17).

1 Quote

“Investing is much like dieting: It is simple, but not easy. Everyone knows what it takes to lose weight (eat less, exercise more). Nothing could be simpler, but few things are harder in a world full of chocolate cake and Cheetos.

Likewise, investing is simple: Diversify, buy and hold, keep costs low. But simple isn’t easy in a market seething with “free” online trades, funds that promise to transform losses into gains, and TV pundits who shriek out trading advice as if their underpants were on fire. The real secret to being, or becoming, an intelligent investor is bolstering your self-control.”

– Jason Zweig

Bonus Content | Articles by Will This Week

Saving Rates vs. Investment Returns

This article answers the question, what matters more: a) how much you save in your investment account, or b) your investment’s rate of return?

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.