The Problem

High earners pay a lot in taxes. To minimize those, many people contribute to a pre-tax 401(k). This reduces your taxable income and lowers your tax bill.

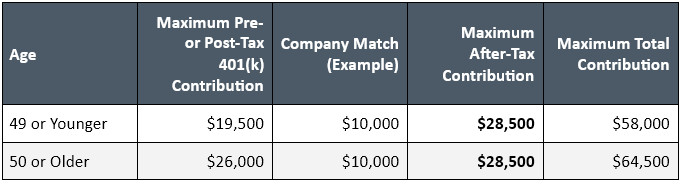

The problem with 401(k)’s is that the maximum single-year contribution is limited to $19,500, or $26,000 if you are over age 50.

What can high earners do to save more in a tax-aware way?

The Solution

Two 401(k) features that are available at some publicly-traded technology companies (e.g., Apple, Alphabet, Facebook, Microsoft, and others) provides a fix: 1) after-tax contributions and 2) Roth in-plan conversions.

These features allow you to save much more than the regular 401(k) limits. This lesser-known strategy, also known as the “Mega Backdoor Roth,” is used by savvy investors to save significant amounts of money.

How Does It Work?

Throughout the year you can contribute to the after-tax portion of your 401(k) via paycheck deductions. Like Roth contributions, after‑tax contributions are made with after‑tax dollars. The contributions are not tax deductible. You will not owe taxes on a withdrawal of your after-tax contributions, however, you will owe income taxes on any investment gains those contributions produce.

To avoid this future taxation, you can utilize the “Roth in-plan conversion.” This converts your after-tax contributions to your Roth 401(k). This means that both your contributions and investment gains can be withdrawn tax-free in retirement (assuming you are at least age 59 ½ and you made your first Roth contribution five years earlier.)

Some companies even allow automatic in-plan conversions, which makes this process even easier. All you need to do is decide how much to contribute.

How Much Extra Can I Contribute?

This will depend on your company’s 401(k) match. In the example below, we’ve assumed the company matches $10,000 per year. In that scenario you would be able to contribute an extra $28,500 per year.

Summary

If you max out your traditional or Roth 401(k), do not need the additional cash, and are looking to save more for retirement in a Roth account, consider after-tax contributions and Roth in-plan conversions. It’s an effective way for high earners to save significant amounts of money tax-free beyond the traditional routes.

If you have questions about your after-tax 401(k), please let us know. We are happy to help.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.