Q3 Highlights

Markets rallied during the first half of the third quarter. However, economic data continued to show that we are not out of the woods yet. The Federal Reserve and other central banks around the world remain focused on addressing high inflation amid geopolitical issues. This led to a decline in the second half of the third quarter that brought performance for stocks and bonds to new lows.

The major themes we’ve been experiencing throughout the year have continued to drive the markets: inflation, central bank policy, and the ongoing war in Ukraine. The Federal Reserve raised the Fed Funds rate by 0.75% at each of their two meetings during the quarter, aiming to rein in inflation.

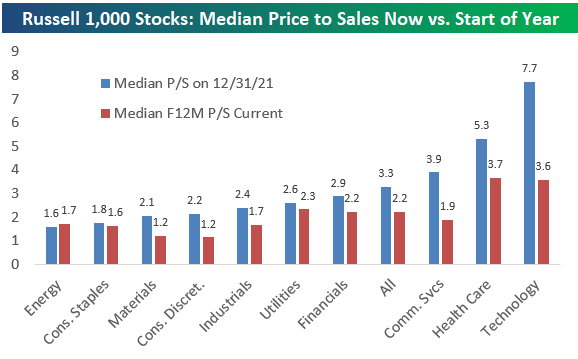

On a positive note, corporate earnings have shown resilience and global stock valuations are now cheaper on a price-to-earnings basis than their 20-year average. In other words, this year’s stock market decline is due to a reduction in valuations, not a decline in earnings. Simply put, investors are less willing to pay high prices.

This is shown in the chart below, which compares the price-to-sales ratio of various sectors at the end of 2021 versus October, 2022. Note that the technology sector had the steepest decline:

During Q3, economic conditions showed modest growth while unemployment fell. Oddly, positive economic news is now seen by some as bad news. Many have been looking towards a slowing in activity as evidence that the Federal Reserve’s actions are having the intended outcome. When positive news emerges, it shows that the Fed’s actions are not yet having their intended effect, and that more interest rate rises (which may be painful) are ahead.

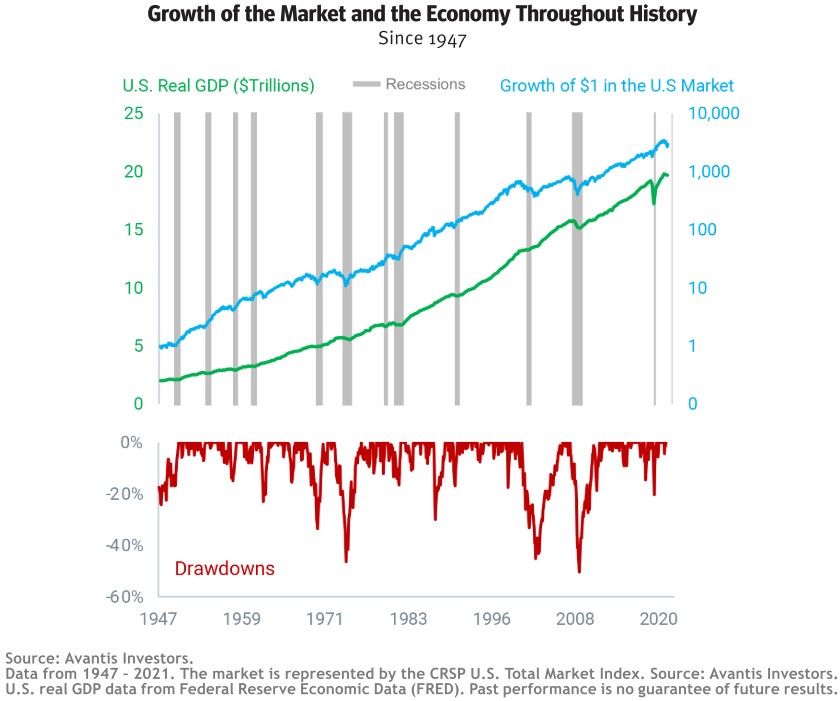

While volatility and drawdowns are never welcomed, they are an inevitable part of investing. Financial success requires that you ride out the bumpy periods in order to realize the rewards that markets have delivered over time.

US Stocks

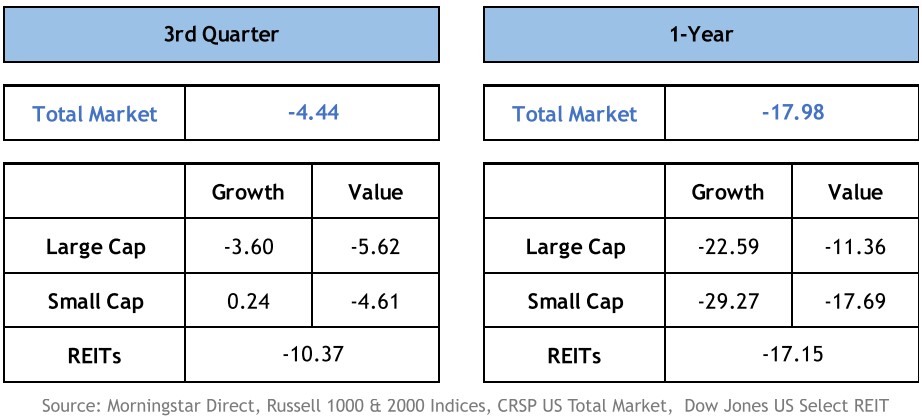

The US stock market declined 4.4% during the third quarter.

This year we’ve seen value stocks perform better than growth stocks. This is counter to the past decade or so, in which growth stocks provided much better returns. This yin and yang over time is normal, and in fact, it’s one of the reasons for Think Different’s passive, market-capitalization investment approach. You benefit from the sectors and industries that are performing best during different cycles.

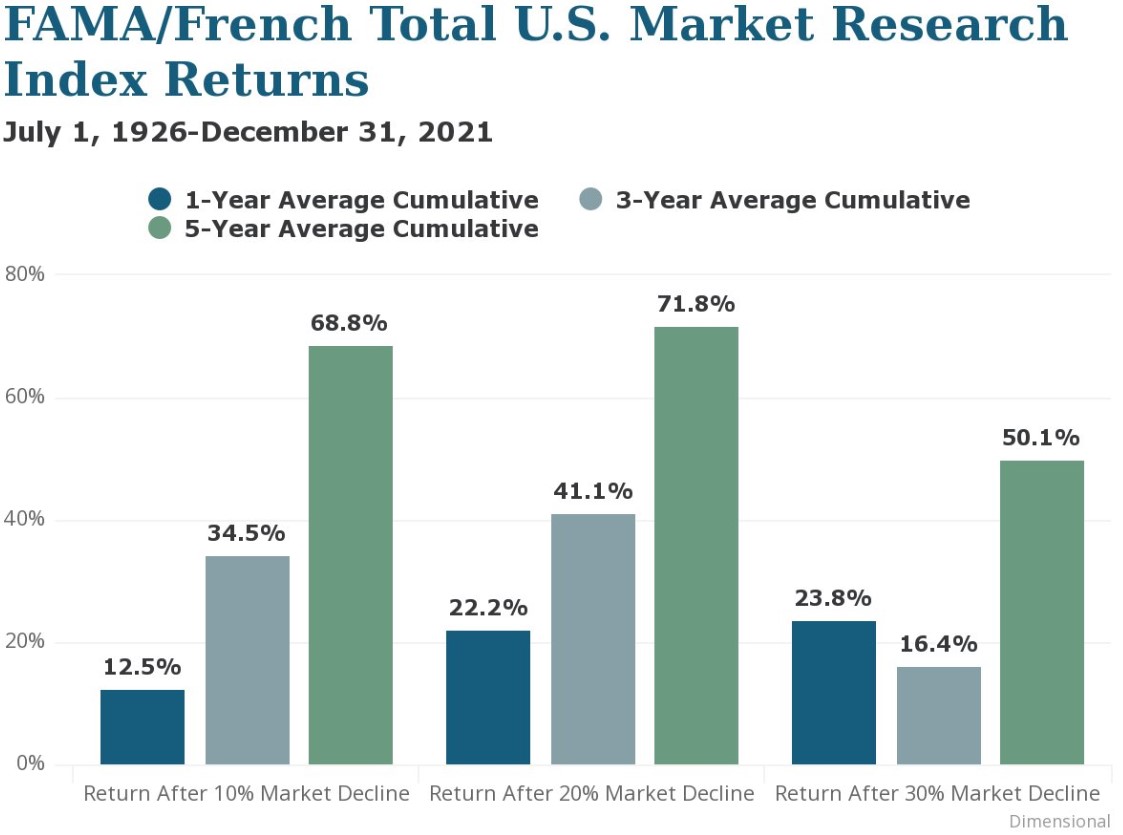

With this year’s stock market decline of more than 20%, it is officially a “bear market.” The encouraging news is that after stocks have dropped 20% or more, the average 3- and 5-year return is 41% and 71%, respectively.

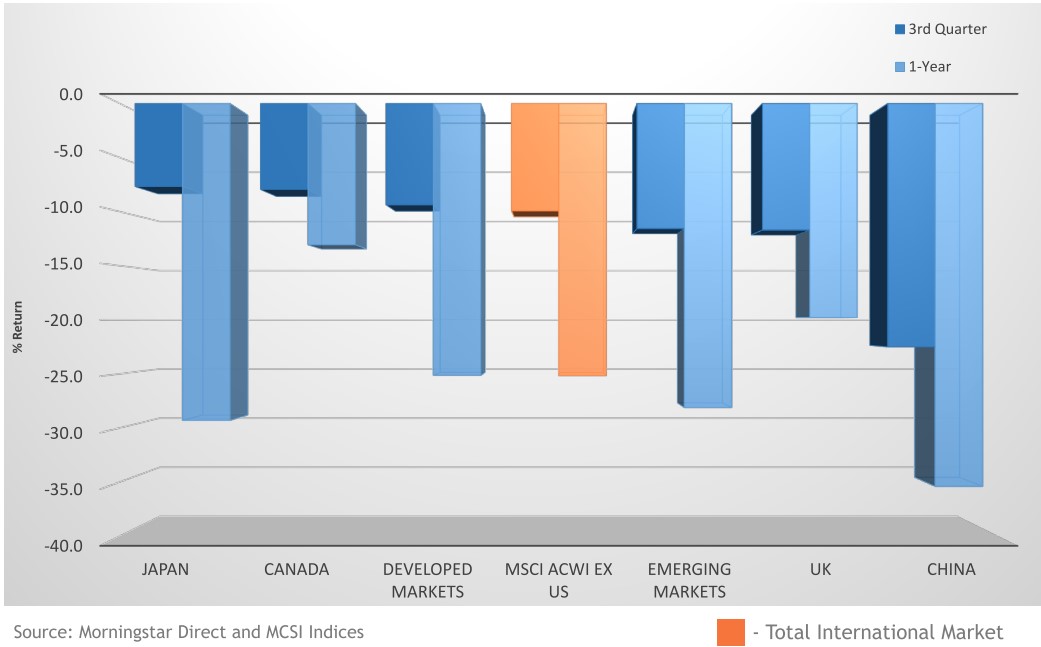

International Stocks

International markets have trailed the US over both the quarter and year, with emerging markets (considered a riskier area) seeing the largest declines.

While all areas of the market certainly faced pressure, international stocks in particular were hurt by the strengthening of the dollar, which lowers the value of investments denominated in other currencies.

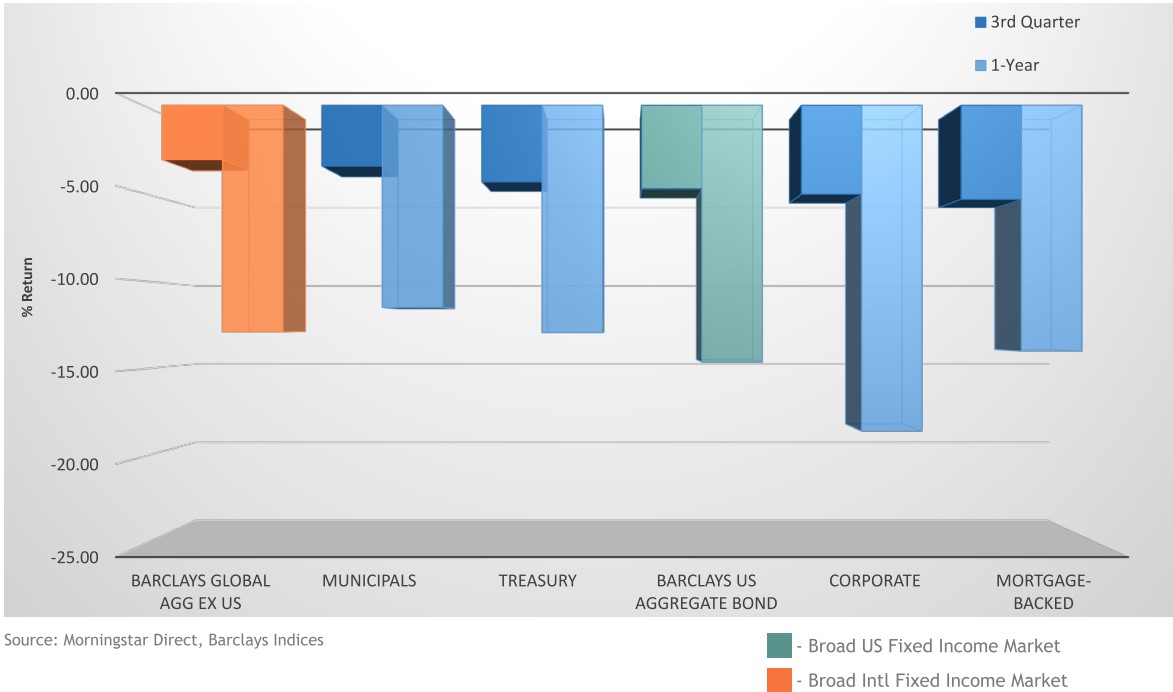

Bonds

Unfortunately, bonds are on track for their worst year in history. The speed of Federal Reserve’s action and the magnitude of interest rates rises has been dramatic.

In Q3, bond prices fell and bond interest rates rose. The reflects the repricing of expectations for interest rates and inflation in the future.

It’s critical to remember that, barring any defaults or credit issues (which are rare in investment-grade bonds), bonds will return to their par values at maturity. While it will take time for recovery, over appropriate time horizons investors can benefit from higher interest rates over time as bonds mature and coupons are reinvested at now-higher rates.

Real Estate

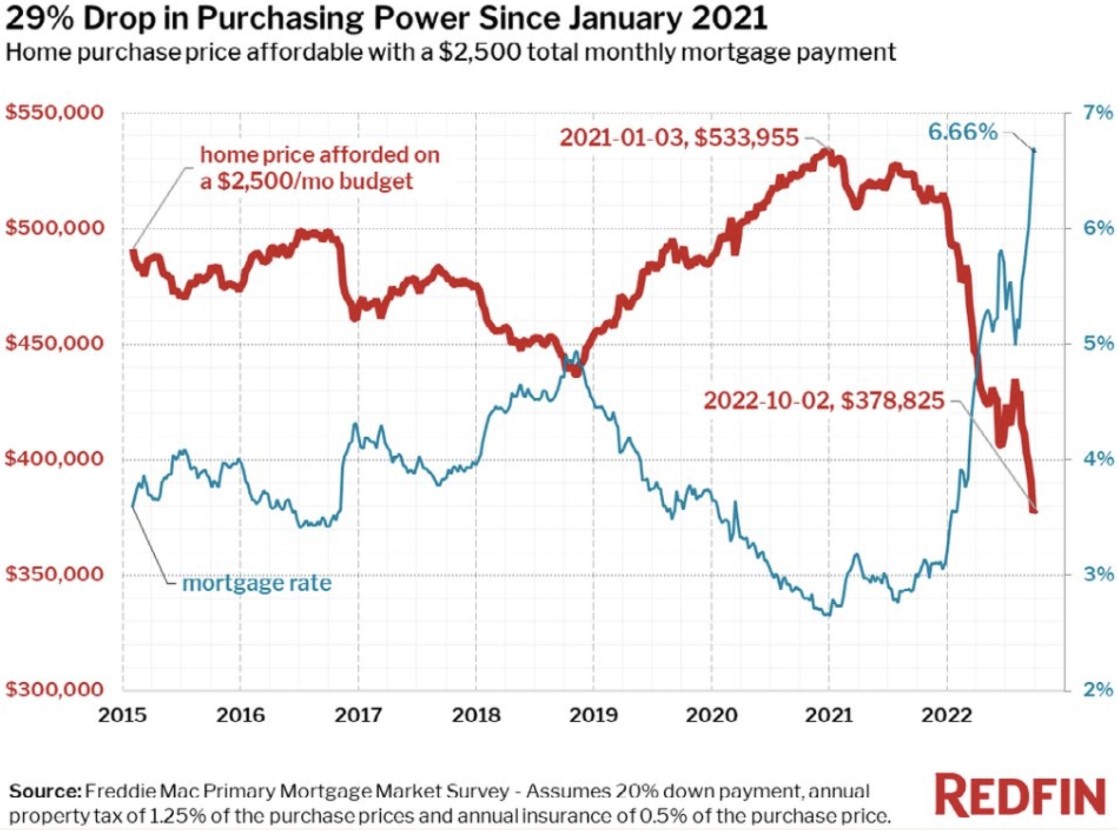

Mortgage rates have more than doubled from their low in 2021, and are nearing 7%. This has led to a decline in purchasing power of about 30%.

For example, if a prospective home buyer could afford a monthly payment of $2,500, they can currently afford a home worth $379,000. Last year, when mortgage rates were 2.65%, they could have afforded a $534,000 home.

Parting Thoughts

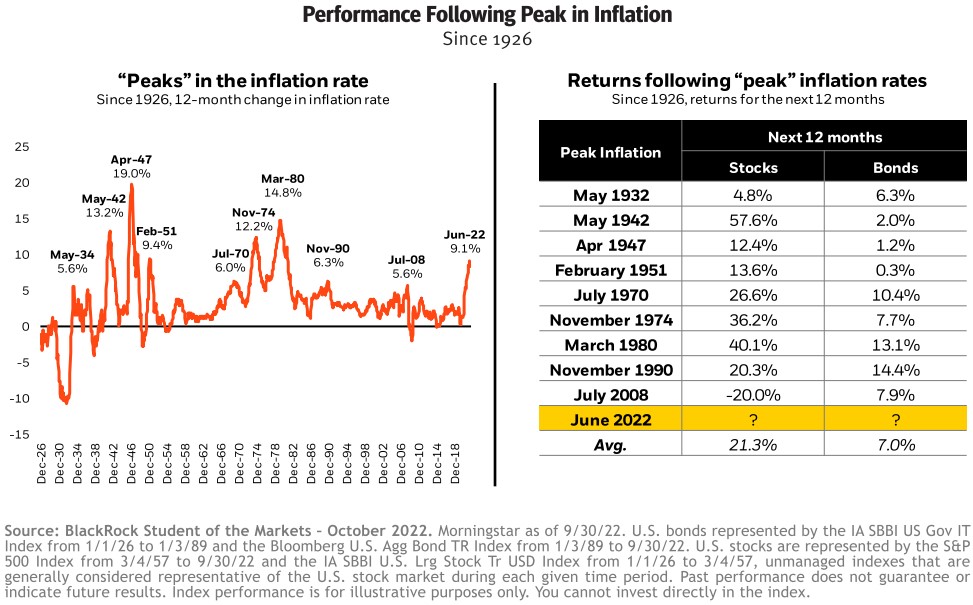

While we know past performance is no guarantee of results looking forward, as a popular quote often attributed to Mark Twain says: “History never repeats itself, but it does often rhyme.” As such, evaluating historical periods with similarities to the current environment can help provide investors some context and perspective.

This first illustration looks at the performance of stocks and bonds following previous peaks in inflation. While the peak of the current inflation cycle will only be clear in hindsight, it’s interesting that both stock and bond prices have reacted strongly and favorably in many instances in the one-year period following prior peaks.

This second illustration provides a higher-level perspective on the market. It plots several important data points, going back in history to 1947. On the top section, US real GDP (which adjusts for inflation) and the Growth of $1 invested in the stock market are overlaid on gray bars that indicate recessionary periods.

These two lines appear fairly smooth and consistent over this long perspective. However, the bottom section helps us see the reality. The bottom section represents market drawdowns (measuring market declines from a peak to the trough, and back again). From this view, we see many periods of significant declines that are embedded in the long-term upward trajectory of GDP and market returns, highlighting the actual volatility and challenging periods along the way.

Accompanying the illustration is an important metaphor:

Market downturns are like traffic. When we drive, we may be slowed by traffic, but that doesn’t prevent us from getting to our destination.

If we chose not to drive in order to avoid traffic, we wouldn’t get anywhere.

Similarly, if we stayed out of the market to avoid downturns, we wouldn’t reach our financial goals.

No one likes a market decline, but like traffic, it’s inevitable from time to time. Think of it as a temporary setback on a long haul, and (to hammer the analogy home) do your best to avoid road rage!

If you have any questions or concerns, please reach out.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: Investments are not guaranteed and are subject to investment risk, including possible loss of the principal amount invested. Past performance is no guarantee of future results. All allocations and opinions expressed are as of the date of this presentation and subject to change. The information contained herein does not constitute investment advice or a solicitation. Information obtained from 3rd parties is believed to be accurate, but has not been independently verified.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.