Here are a few interesting personal finance pieces from the past month:

Artificial Intelligence

- Nvidia CEO on 60 Minutes – A good interview with Jensen Huang. It highlights how AI is being applied across a number of industries. Examples include: developing proteins to fight cancer, weather prediction, and converting text into movie backdrops.

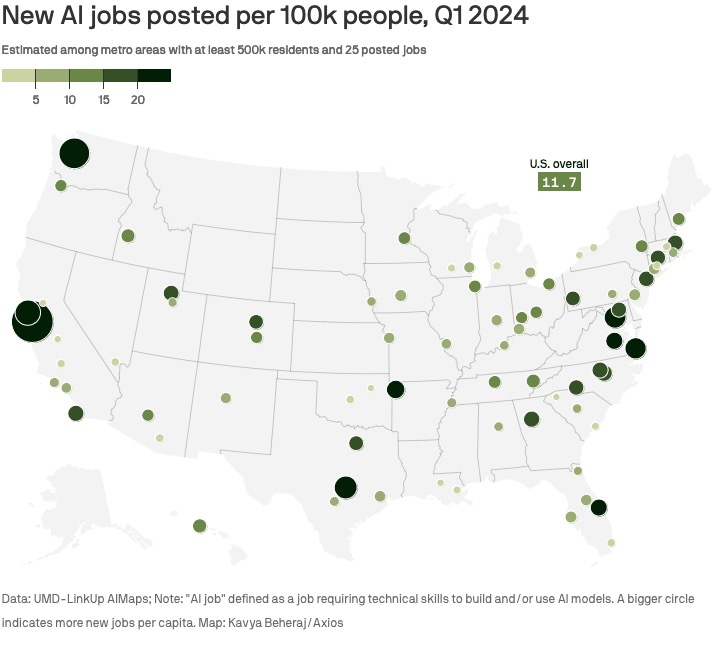

- AI Jobs Posted per 100k People – In San Jose and San Francisco, 7.5% and 3.2% of all jobs posted were in AI. Seattle is also a hot spot.

Investing

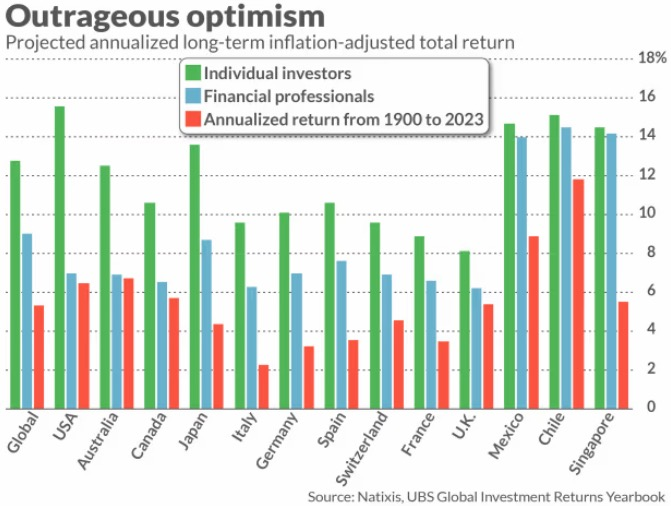

- Optimistic Investors – US investors expect their stock market to beat inflation by almost 16% per year!

- That’s about triple the historical result (within the US).

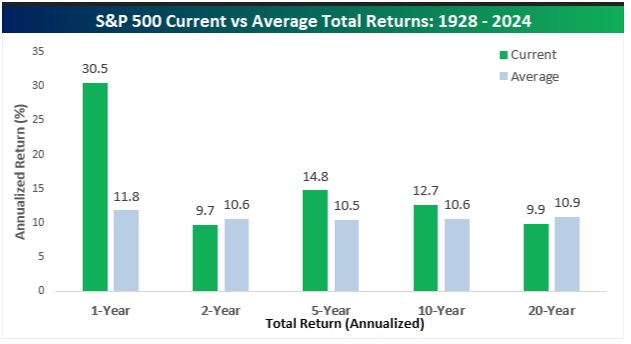

- Recency Bias – The reason for this investor optimism is likely a result of exceptional recent returns.

- Below is a chart showing the returns of the S&P 500 (representing large US stocks) over different time periods.

- Over the past 1, 5, and 10 years, performance is well above average:

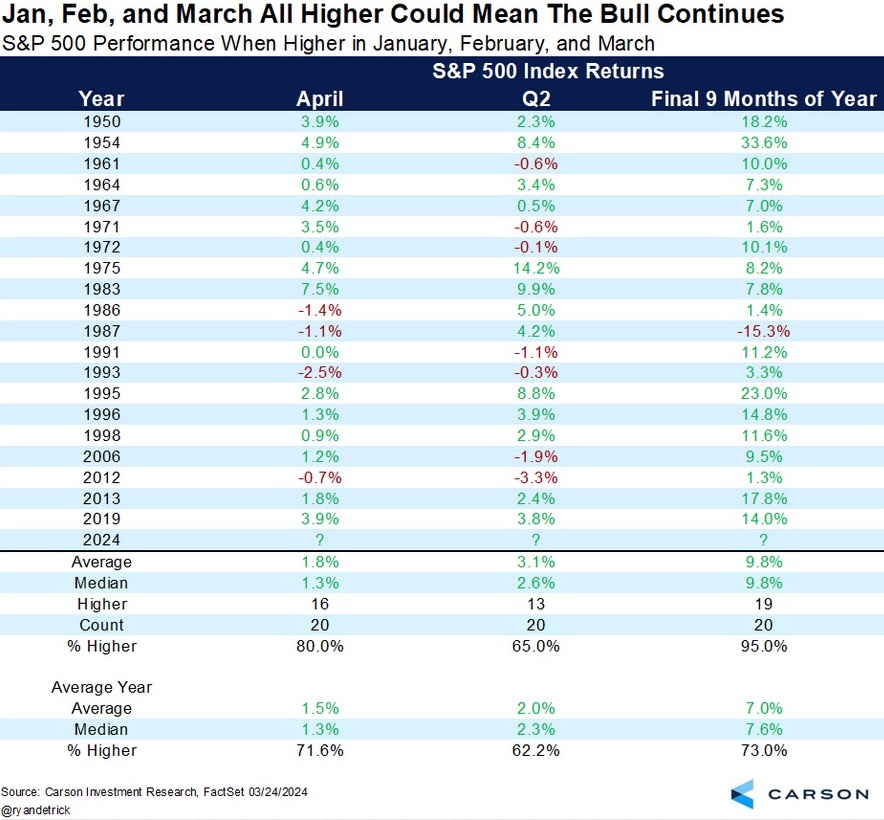

- Predicting the Future – It’s impossible to predict the future, but its fun to try.

- US stocks were positive in January, February, and March. According to Carson Research, the previous 20 times that happened since 1950, the rest of the year – meaning the final nine months – were higher 19 out of 20 times:

Inflation

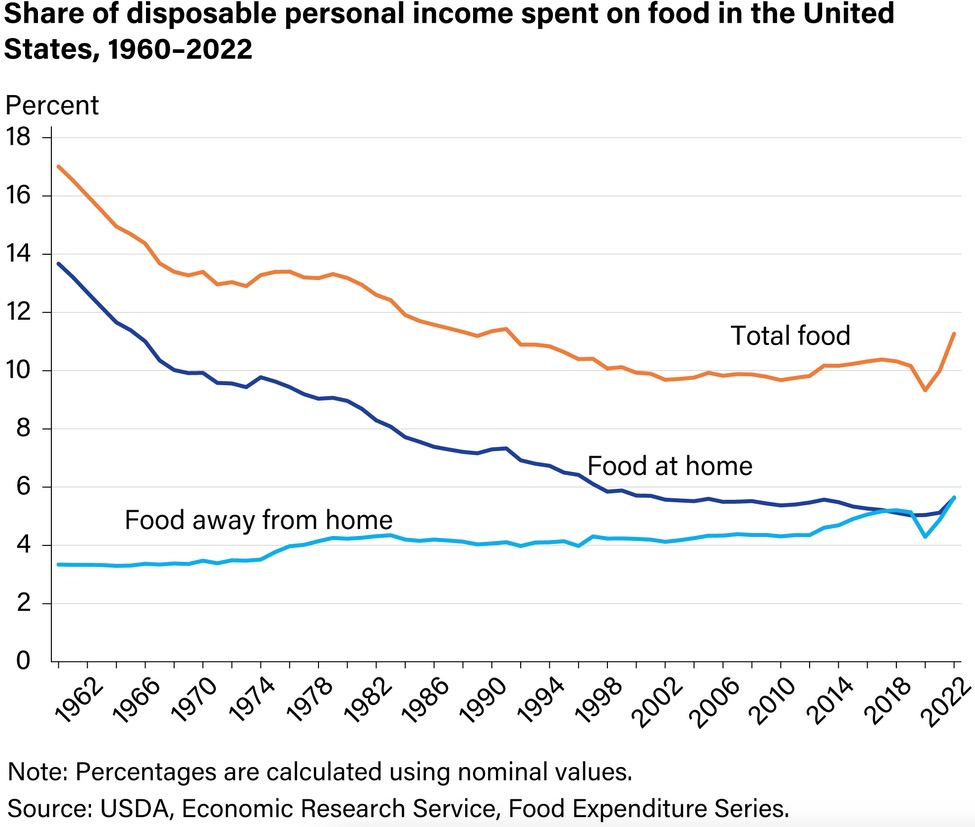

- Food Inflation – Chances are you are spending more at the grocery store and at restaurants.

- US consumers spent an average of 11.3% of their disposable income on food in 2022. As a share of spend, this level has not been reached since the 1980s:

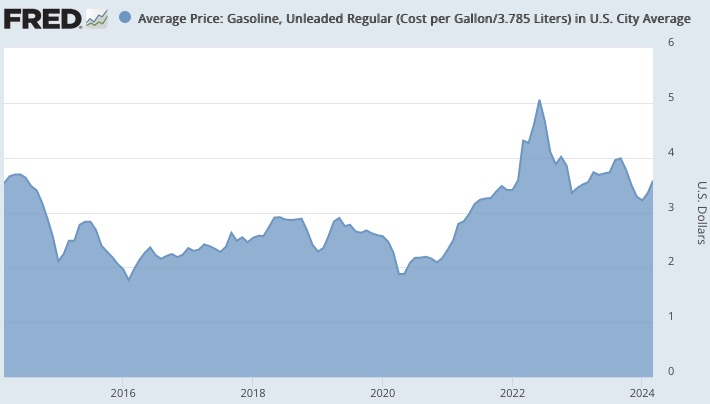

- Gas – Another high-profile area of spend is gas. The national average is approximately $3.60.

- That will feel cheap to Californians, where the average price of regular of $5.35.

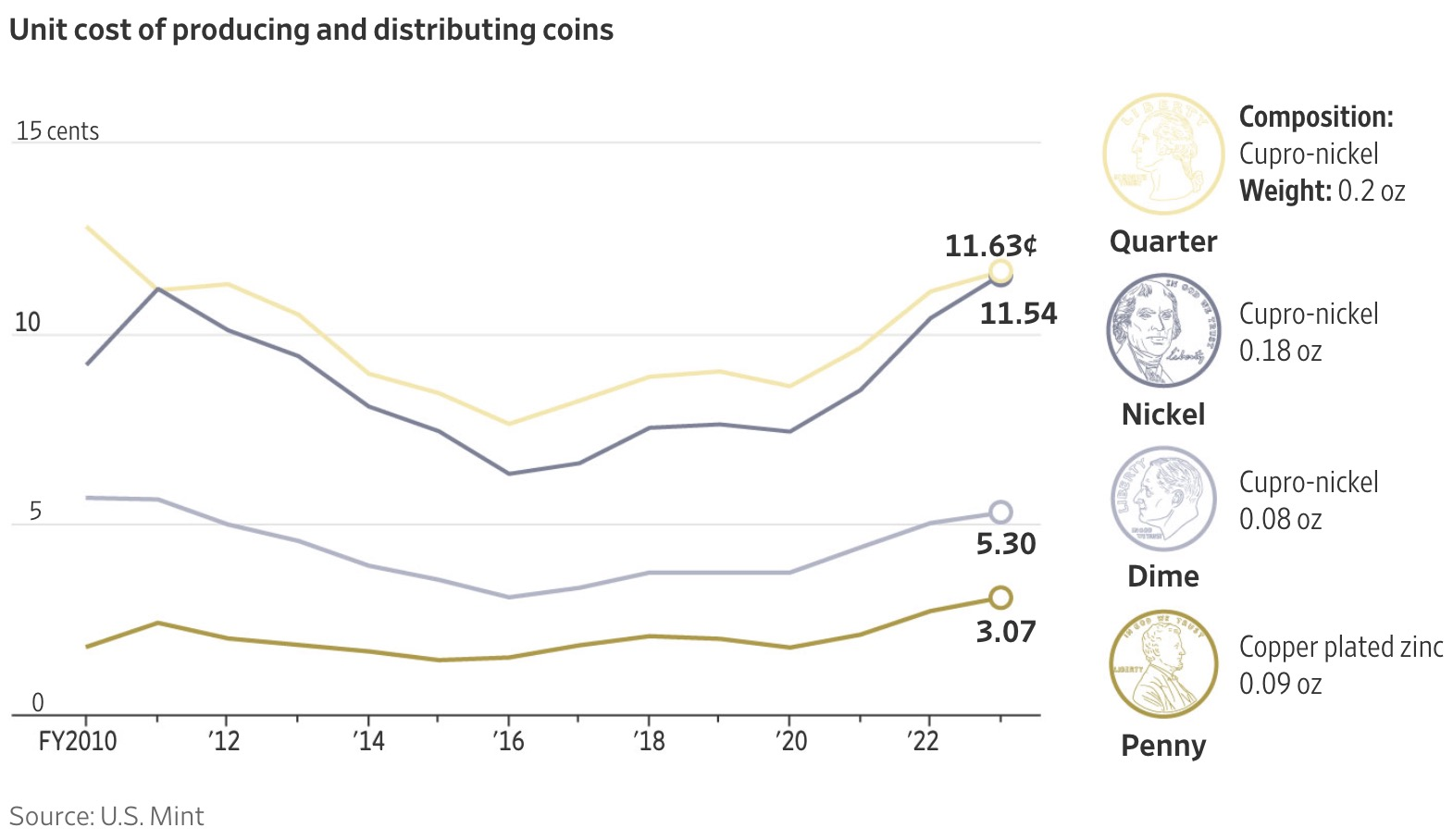

- The Cost to Make Money – It costs three cents to make one penny.

- Dimes also cost more to make than they are worth:

College Costs

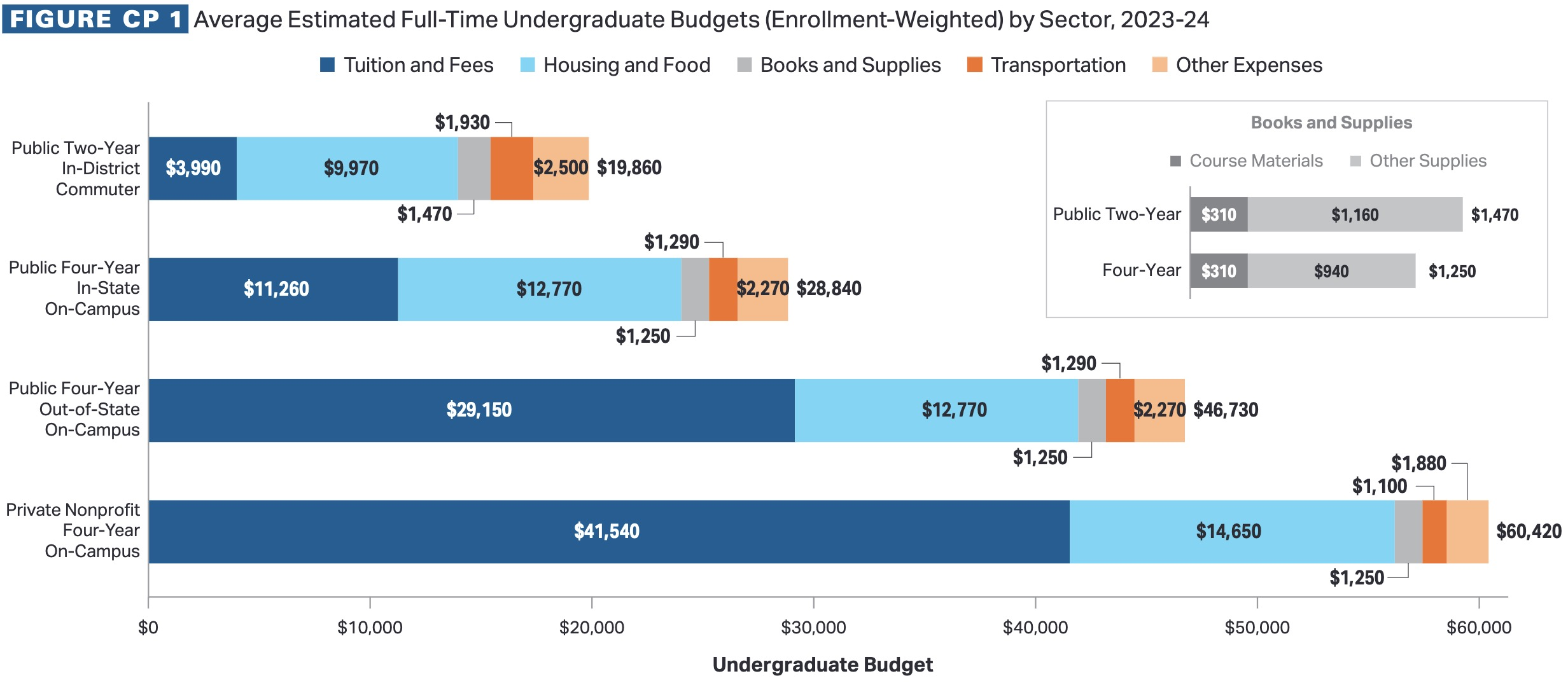

- Average College Cost – If you have kids approaching college age, you might be interested in the following data points:

-

-

- At private, nonprofit four-year colleges about 16% of students paid full sticker price (2019-20).

-

-

-

- At in-state public colleges, about 25% of students paid the posted sticker price (2019-20).

-

-

-

- Net Price: The calculator from the US Department of Education is a helpful tool. It aims to show you the amount a student will pay in a single academic year after subtracting scholarships and grants the student receives.

-

-

-

- To dive further into specific college costs, some colleges offer merit estimators on their websites.

-

-

-

- Or if they do not, you can check the college’s “common data set,” which among other things includes information on financial aid awarded. (Search online for the college’s name and “common data set” if you don’t find it on a school’s website).

-

I hope you found these interesting.

As always, please reach out if you have any questions or would like to connect.