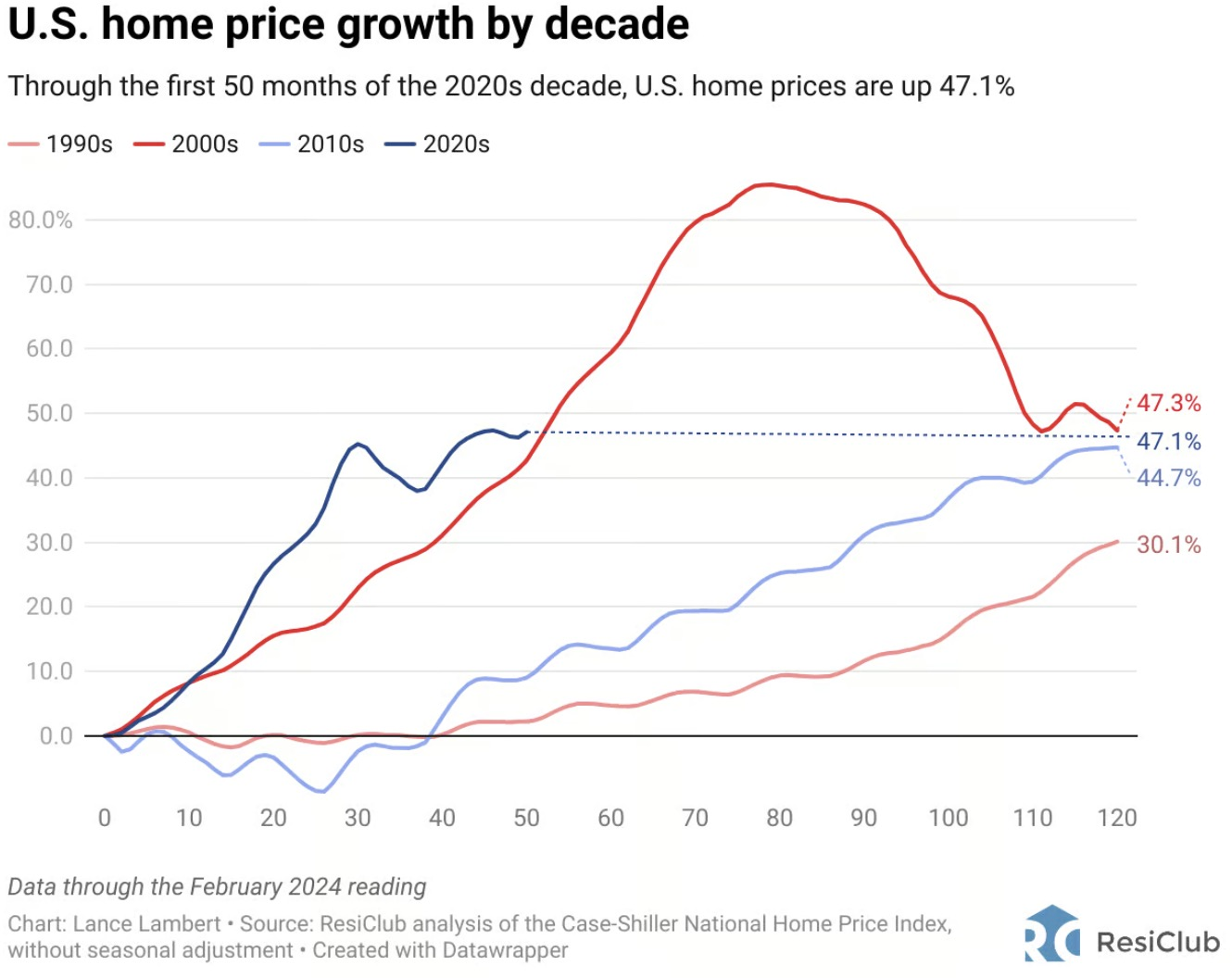

- Home Price Growth by Decade – “Through the first 50 months of the 2020s decade, U.S. home prices have risen by 47%. This already surpasses the total national appreciation witnessed throughout both the 1990s and 2010s [full] decades:”

- 1-Year Growth – Home prices have risen 6% over the last year, and hit a record high 8 months in a row.

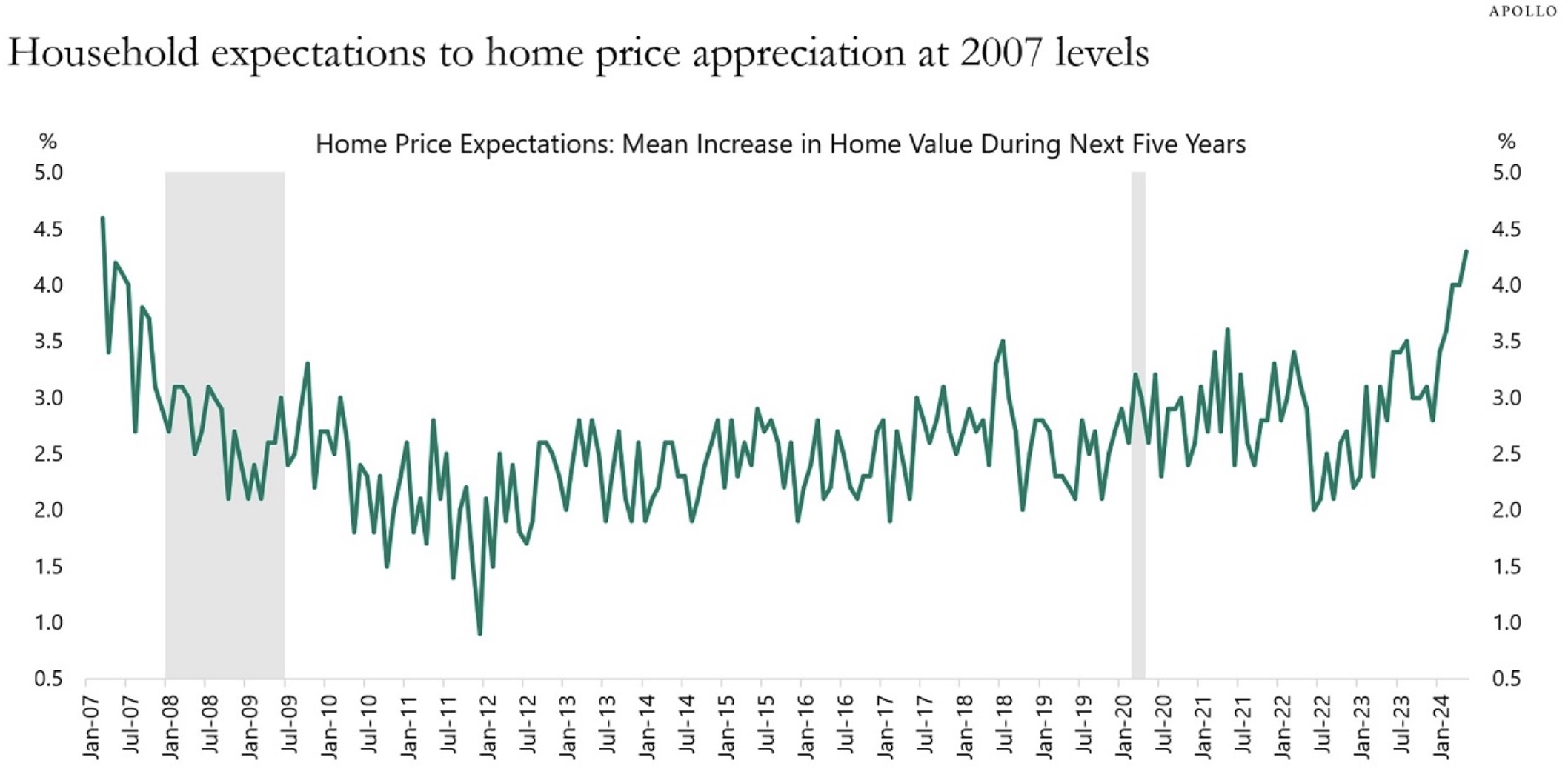

- Expectations for Future Home Price Appreciation – Probably because home prices have done so well lately, expectations for future appreciation are at the highest level since 2007:

- Million-Dollar Cities – Also as a result of the recent appreciation, there are now 550 U.S. cities where the typical home value is $1 million or more.

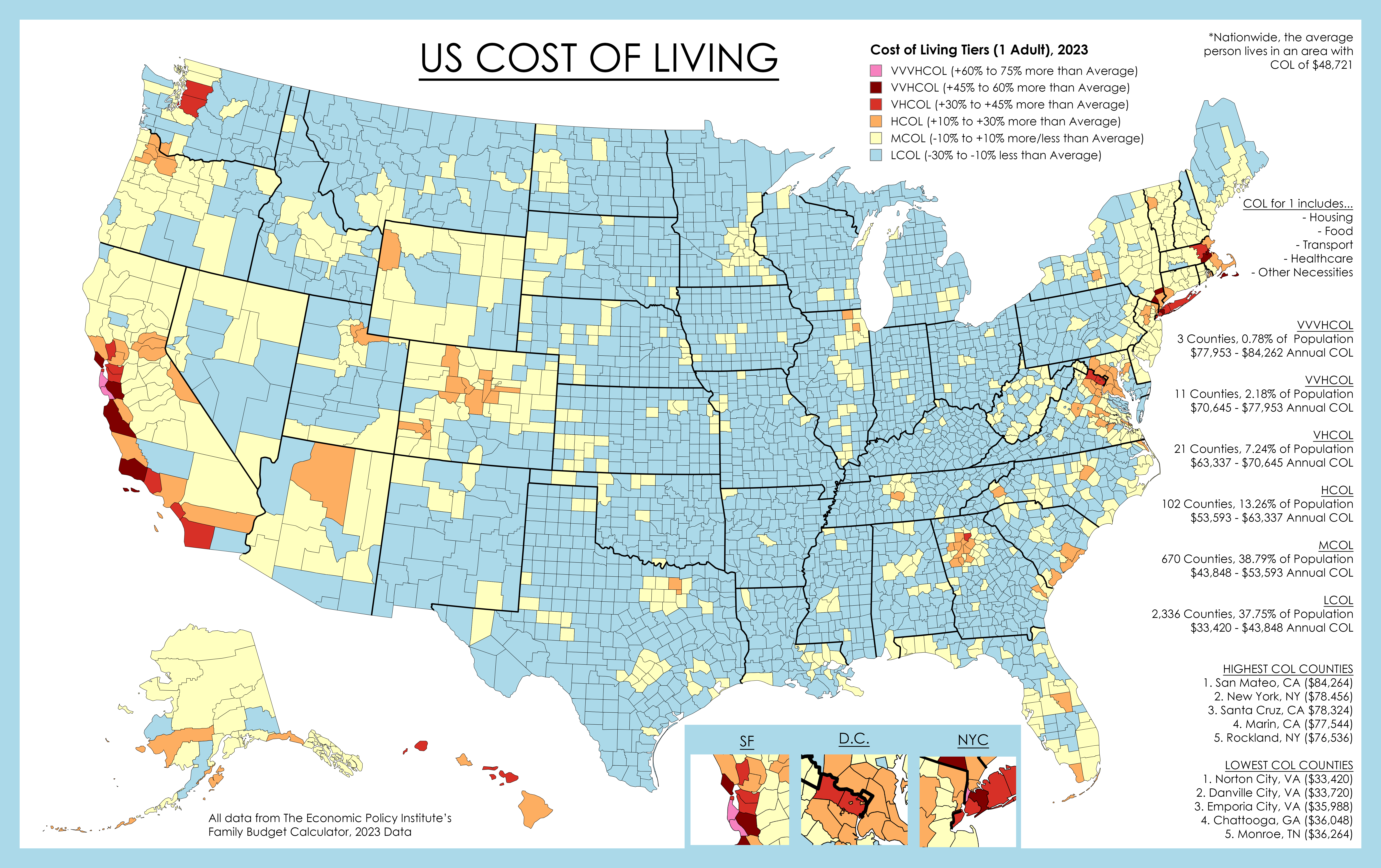

- Cost of Living, by County – The most expensive county to live in: San Mateo.

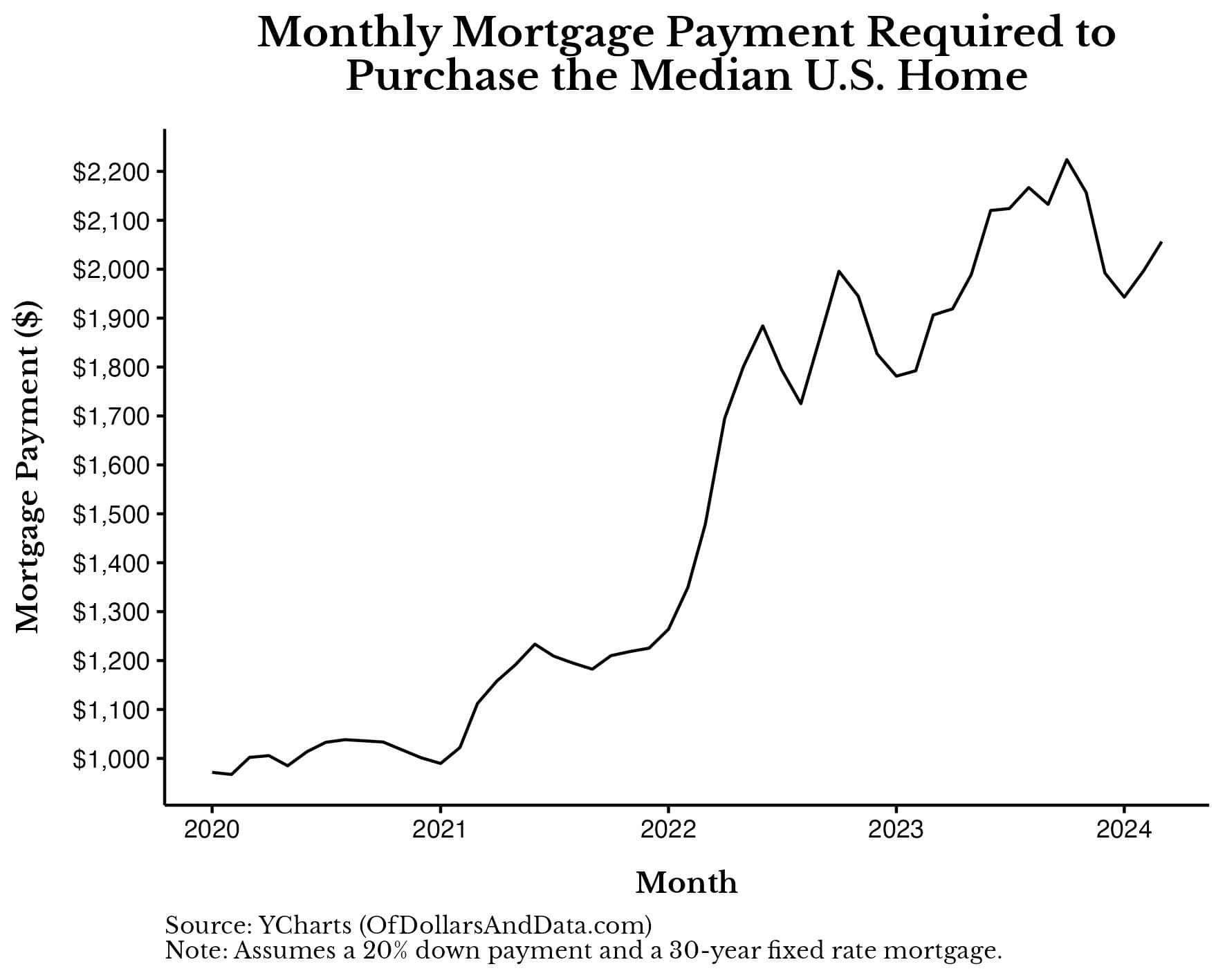

- Monthly Mortgage Payment – Unfortunately, the monthly mortgage payment required to purchase the median U.S. home has doubled since 2021:

- First Time Home Buyers – Even with high interest rates and prices, first-time home buyers remain the majority of buyers, purchasing 58% of all homes.

- Home Sales Slowdown – High housing costs are having an impact on purchase activity. The number of homes that sold in April fell 1.9% as compared to March. That was the second consecutive monthly decline.

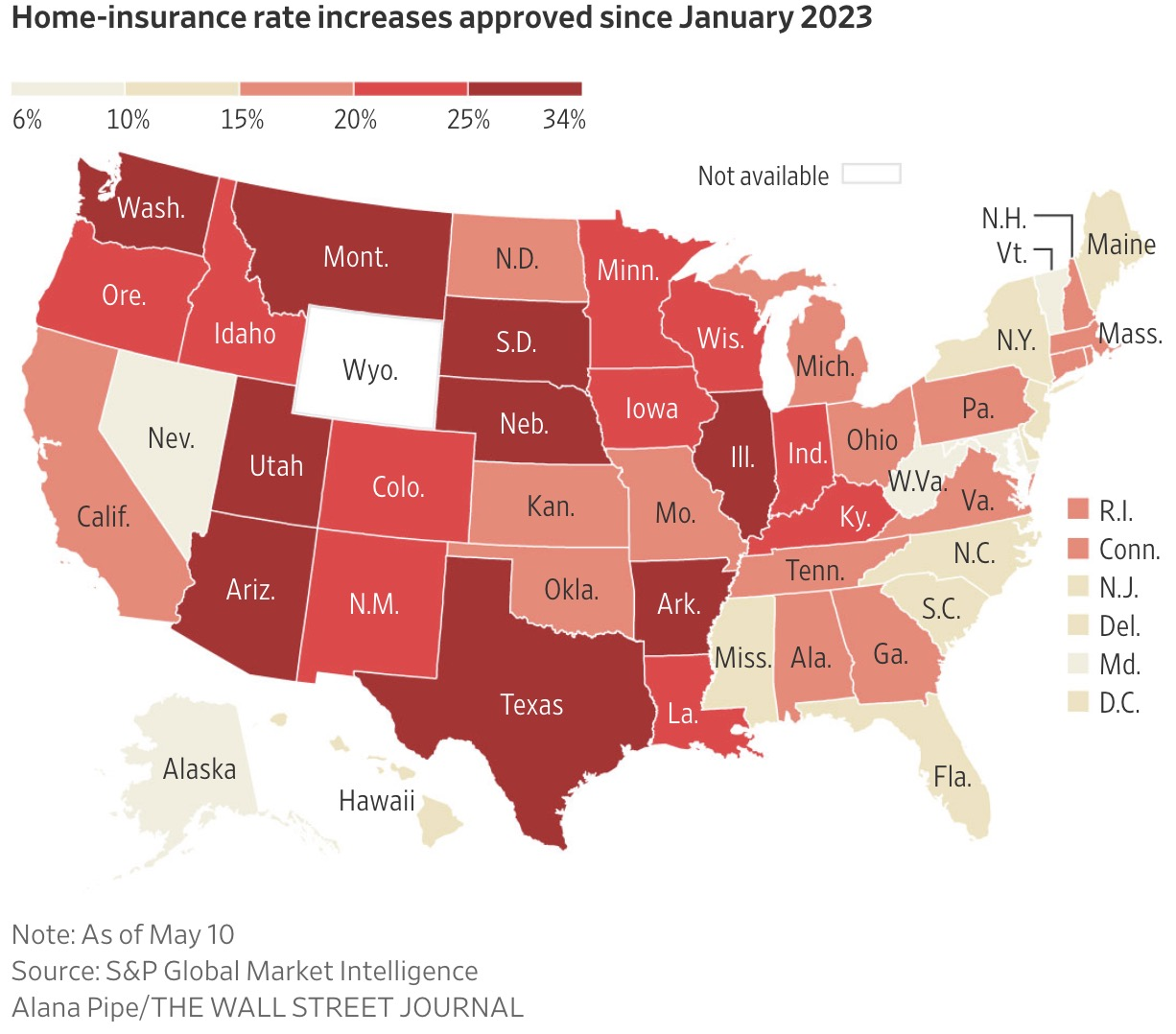

- Inflation in…Homeowner’s Insurance? – Over the past 18 months there have been enormous increases to home insurance costs.

- How to Save – Tips to save on your homeowners and auto insurance policy.

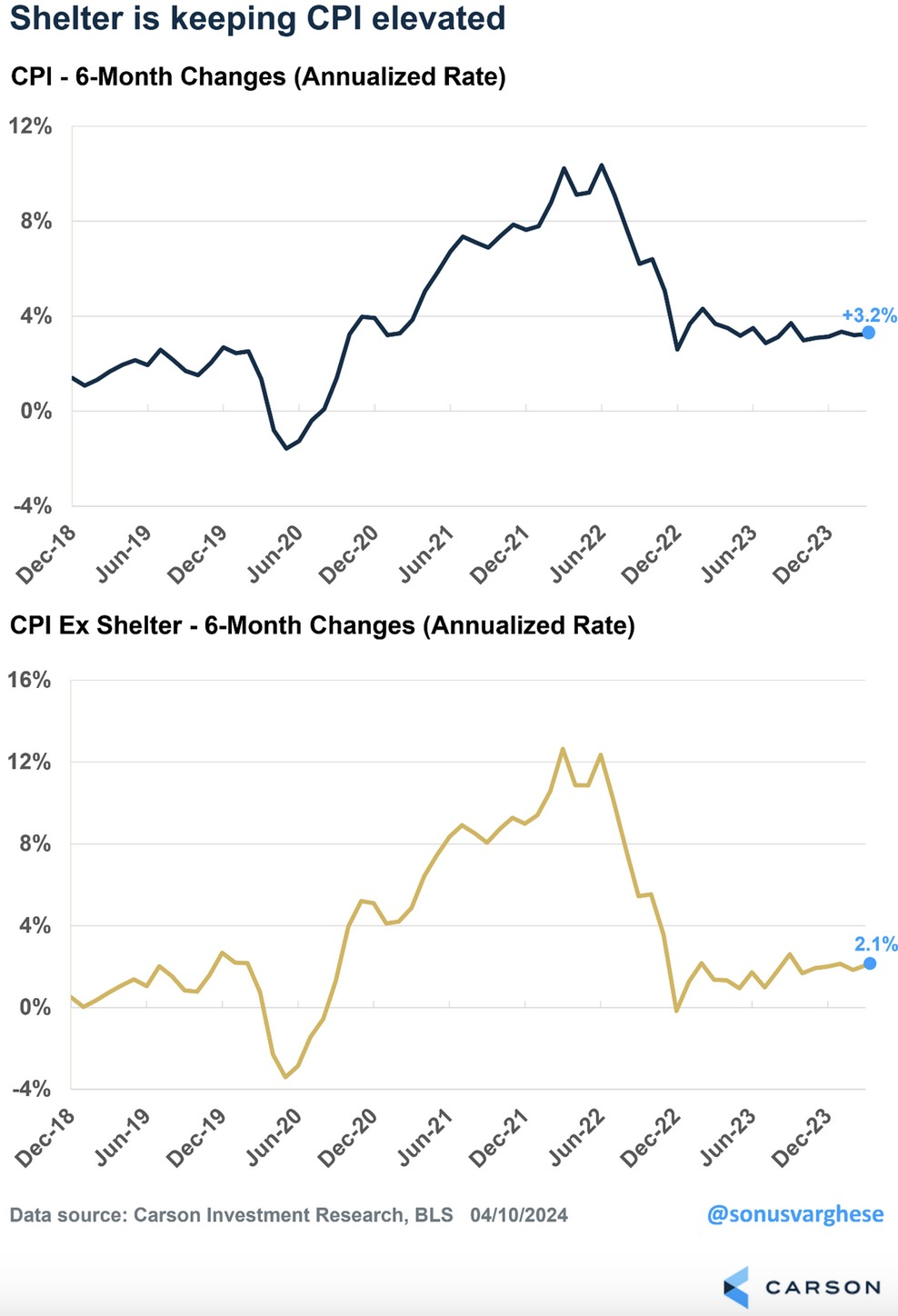

- Shelter’s Effect on Inflation – Shelter makes up more than 40% of the core Consumer Price Index (CPI). Not everyone is affected by the change in home-price affordability, or rent increases.

- Given that, if you exclude shelter from the index, the inflation rate is just above the 2% level that the Fed is targeting:

- Stock Markets Are on a Record-Hitting Spree Around the World – Of the 20 biggest stock markets worldwide, 14 are at or near record highs.

- Expected interest rate cuts, healthy economies, and positive company earnings are driving these results.

- There’s also plenty of potential drivers to keep the momentum going, such as the $6 trillion sitting in money market funds..

- The chart below summarizes the performance of the global stock market this year:

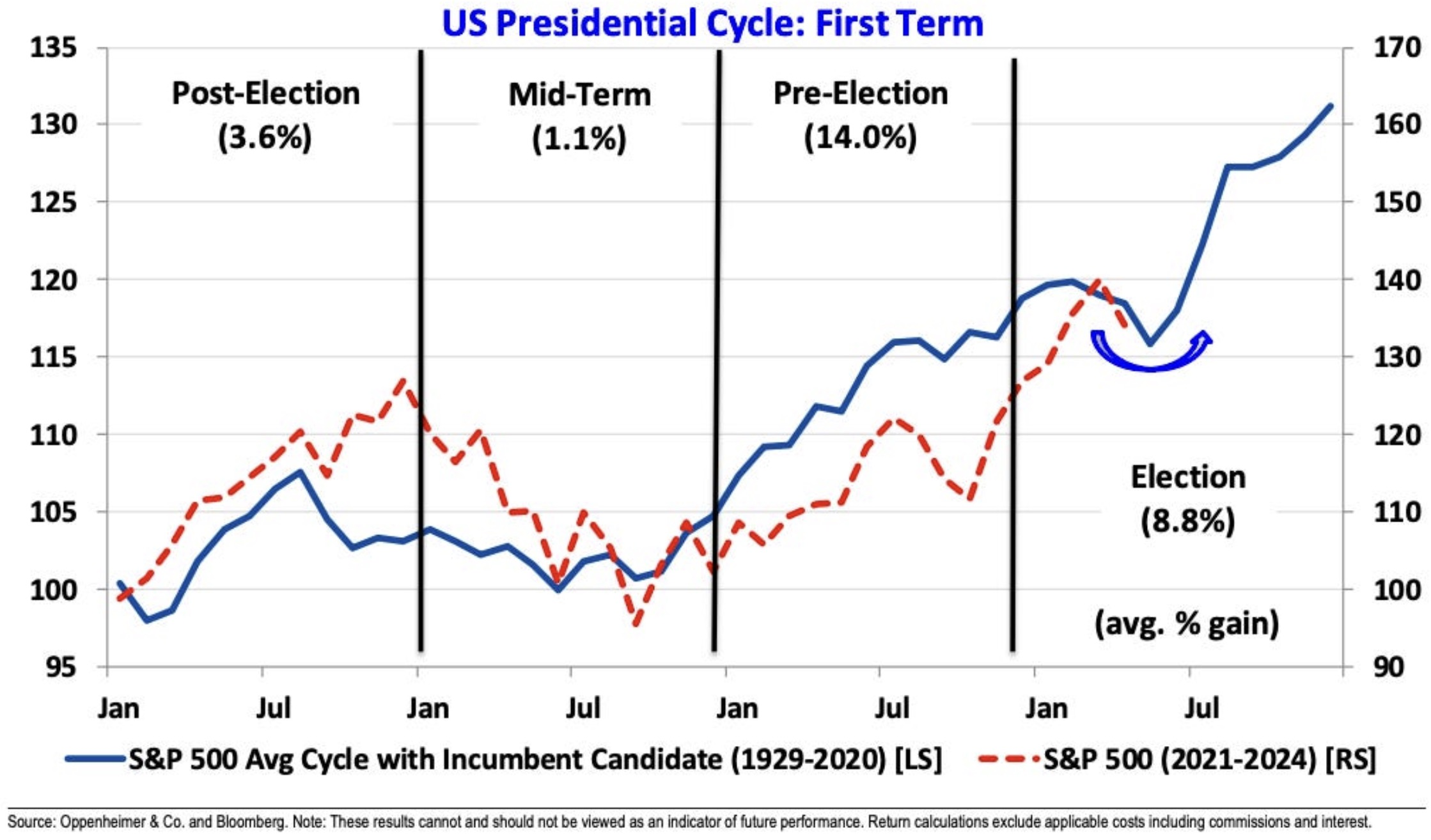

- Stocks in an Election Year – The stock market averages an 8.8% gain in an election year for an incumbent president.

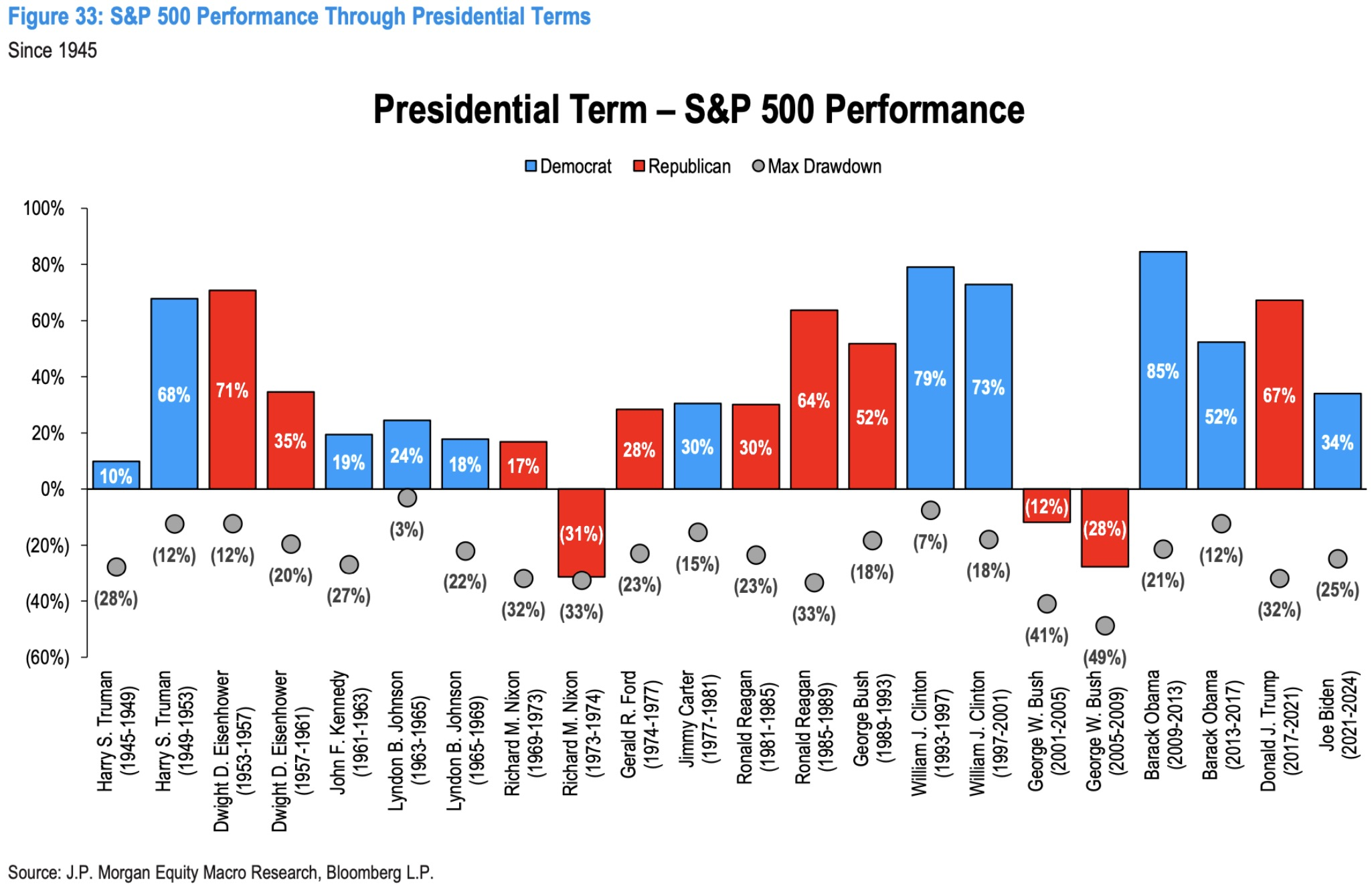

- Stocks vs. The President – The market has trended higher during most president’s time in office:

- Utility Stocks Are Hot? – “These dullest of all stocks have suddenly become a bet on the single flashiest area of the market: artificial intelligence. AI requires a lot of computing power, and computers use a lot of electricity.

- Three of this year’s five best-performing stocks in the S&P 500 are utilities: Vistra, Constellation Energy and NRG Energy. Vistra, up 143%, has even outperformed the king of AI itself, Nvidia; Constellation, up 85%, is barely behind it.”.

- Stock Market Trivia – Question: What was the best-performing year for the Dow Jones?

- Answer: 1915. The Dow was up 80% that year, on the heels of World War I (which began in 1914). In fact, the market was up 9% per year through all of World War I. Pretty surprising.

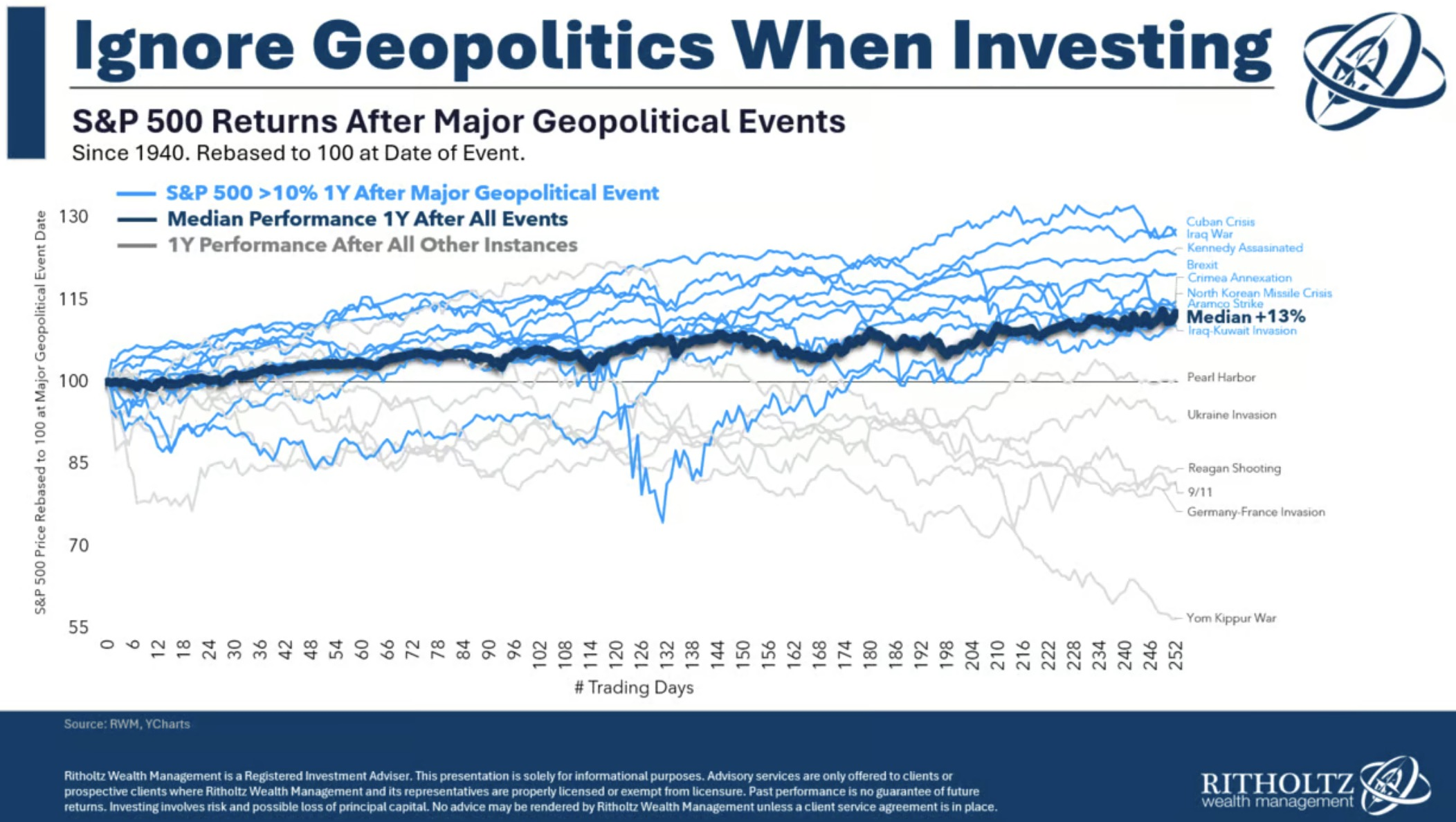

- Investing vs. Geopolitics – Speaking of investing during geopolitical challenges, here’s a chart showing how the stock market did during major events. Generally speaking, it performed well:

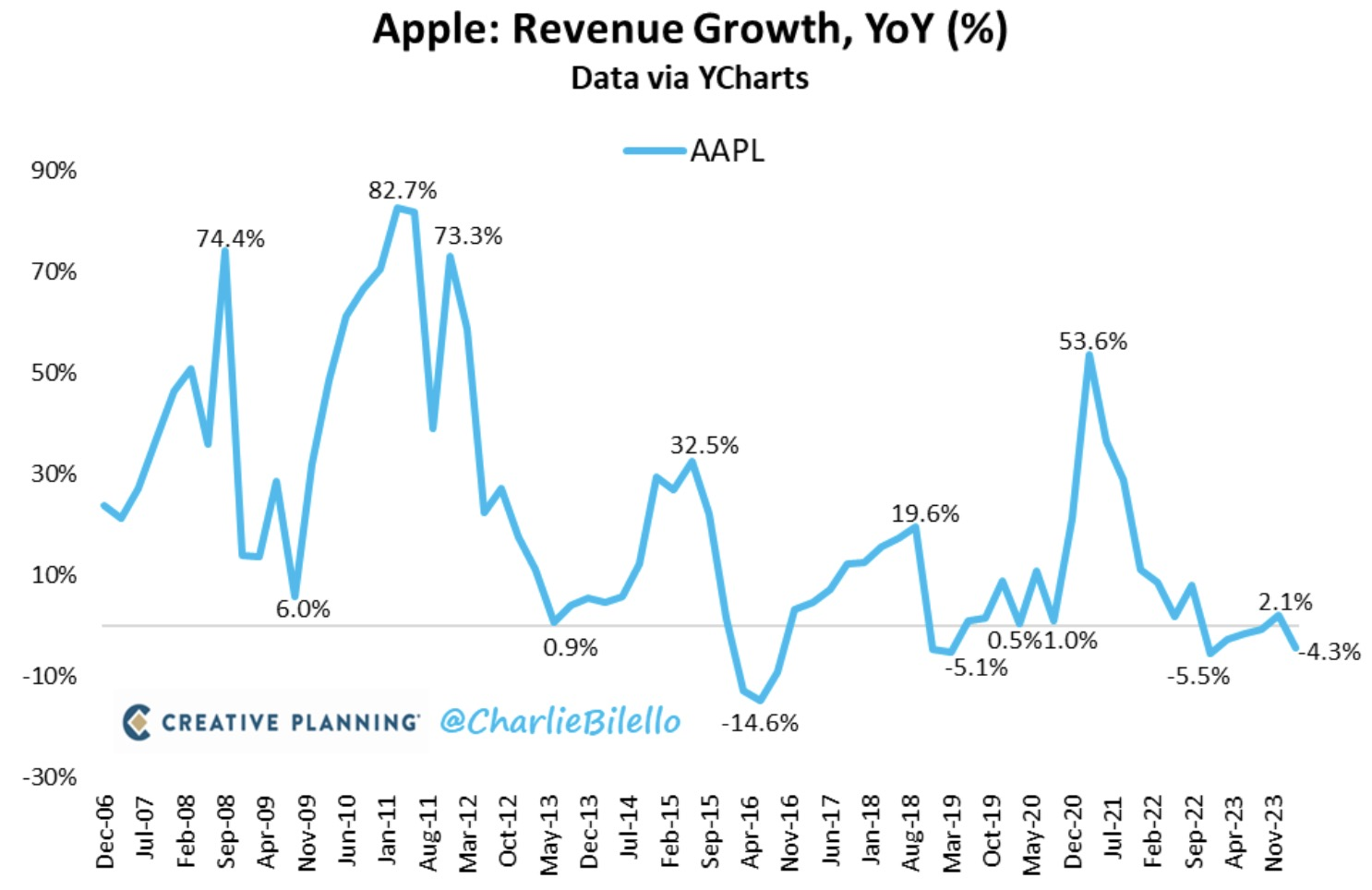

- Revenue Growth – Apple’s revenue fell 4% over the last year. This was the 5th negative year-over-year growth rate in the last 6 quarters.

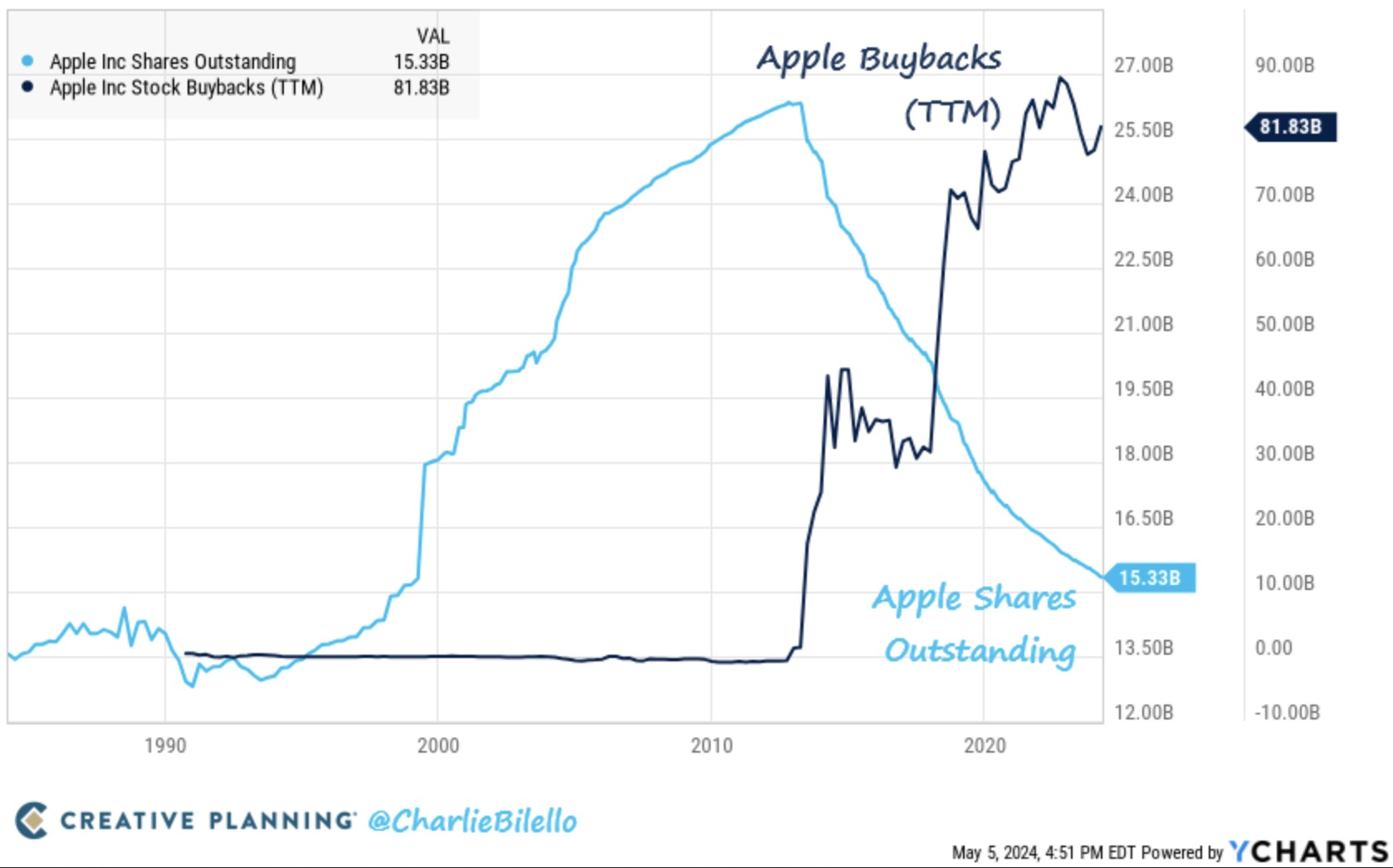

- Stock Buybacks – From Charlie Bilello, “Apple is the undisputed king of buybacks. Over the past decade, it has bought back $625 billion in stock. That’s greater than the market capitalization of 492 companies in the S&P 500.”

- A stock buyback is when a company uses its cash to buy its own shares. That reduces the number of shares available for purchase by the general public. Apple is essentially taking those shares off the market. That move increases certain key metrics, like earnings per share.

“Two people who make the same income today will likely end up in distinctly different places over the years based on their approach to career and money.”

Scott Galloway

The Algebra of Wealth

As always, please reach out if you have any questions or would like to connect.