Below are a few interesting personal finance pieces from the past month, starting off the with volatility piece.

- Low Volatility? – Through most of 2024 there had been very little movement in the stock market. That changed around the middle of July.

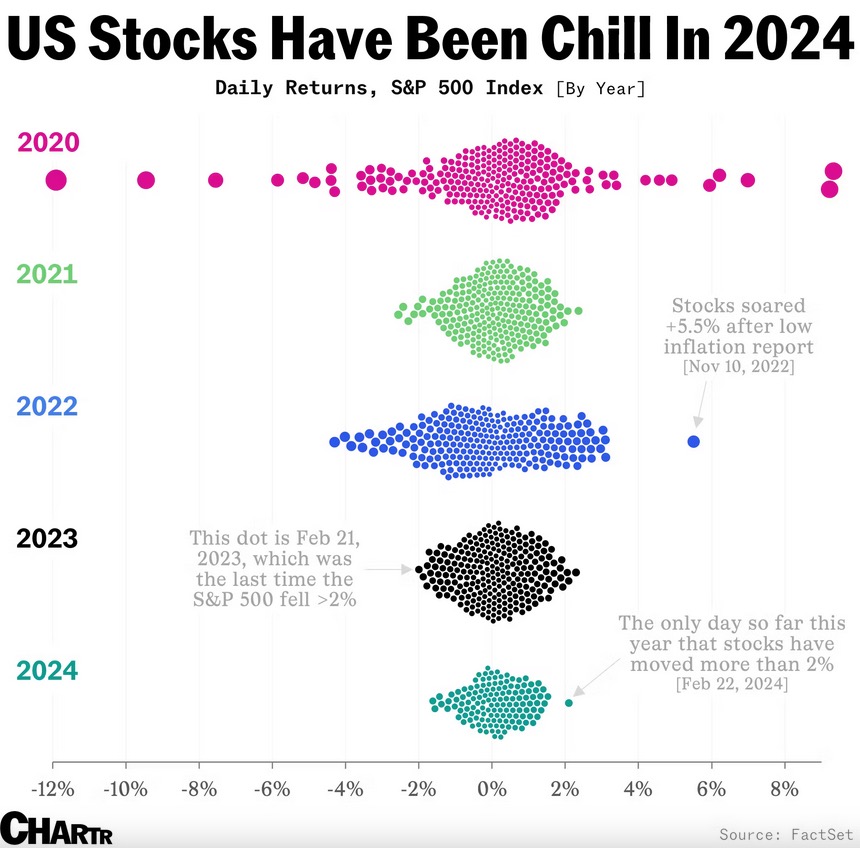

- Below is a dot plot showing the daily returns of the S&P 500. Compared to previous years, 2024 had been especially quiet (until the past couple of weeks):

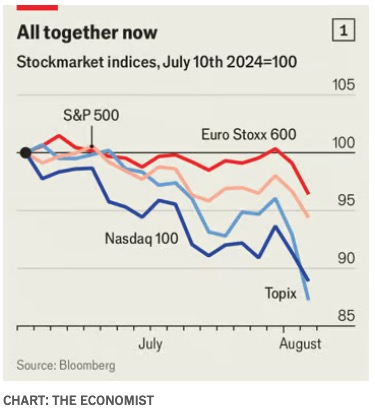

- But since July 10th, the Nasdaq 100 – an index of large tech companies – has decreased by ~13%, while the S&P 500 is down about 8%. It appears volatility has returned:

- What was A Great Run – As of July 16th, the S&P 500 had risen during 28 of the past 37 weeks.

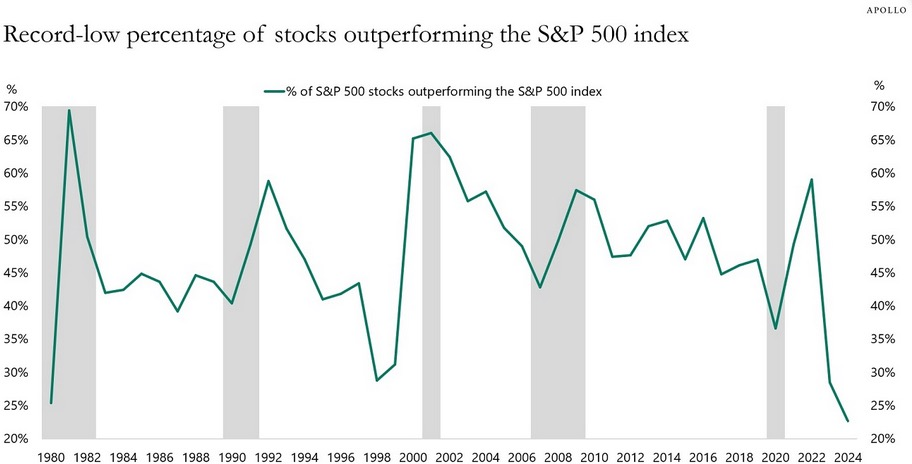

- Stock Picking is Hard – Over this time, only about 20% of individual stocks have outperformed the S&P 500 index:

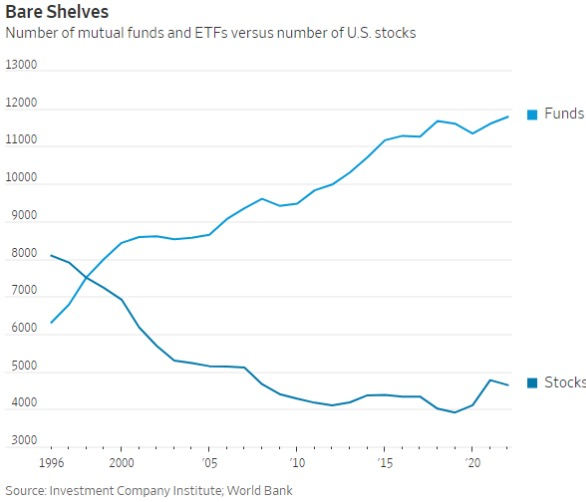

- Tons of Funds – Despite the difficulty of being an active investor, many try.

- There are about 5,000 US stocks to invest in, but there are around 12,000 funds (and growing)!

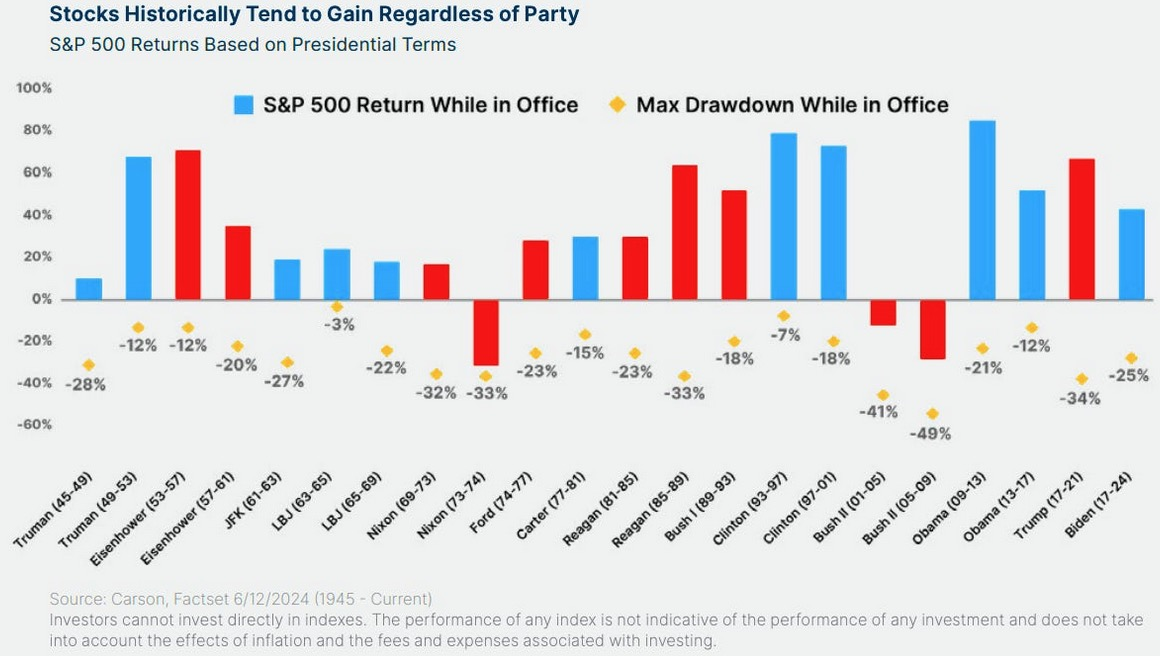

- President vs. Stock Market – With the presidential election coming up, I wanted to share the chart below. The way I interpret it is that the stock market tends to go up over time, regardless of who is in power.

Jobs & Economy

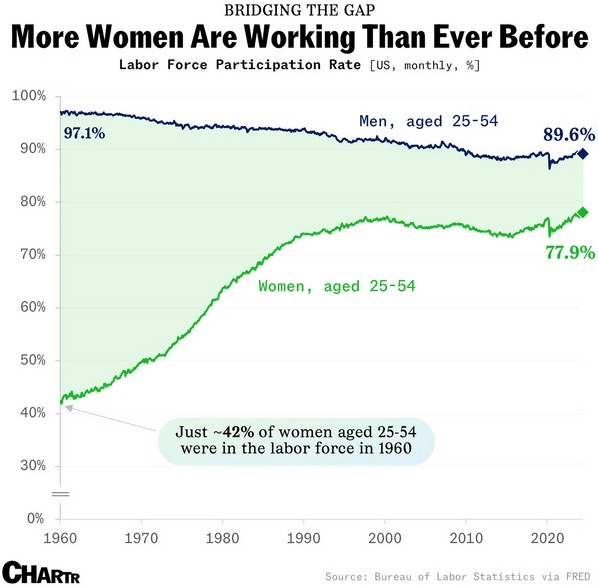

- America’s Female Workforce is Expanding – “The share of women aged 25-54 that are working or looking for work reached an all-time high of 78.1% in May…meaning that women now hold a record 79 million jobs across the US.”

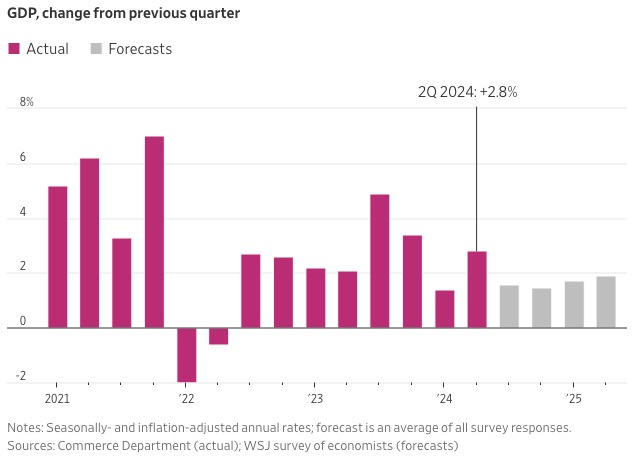

- Q2 GDP – In good news for the US economy, “Gross domestic product — the value of all goods and services produced in the US…rose at an annual rate of 2.8% for April through June.

- That was faster than the 1.4% pace in the first quarter, and well above the 2.1% rate economists had expected.

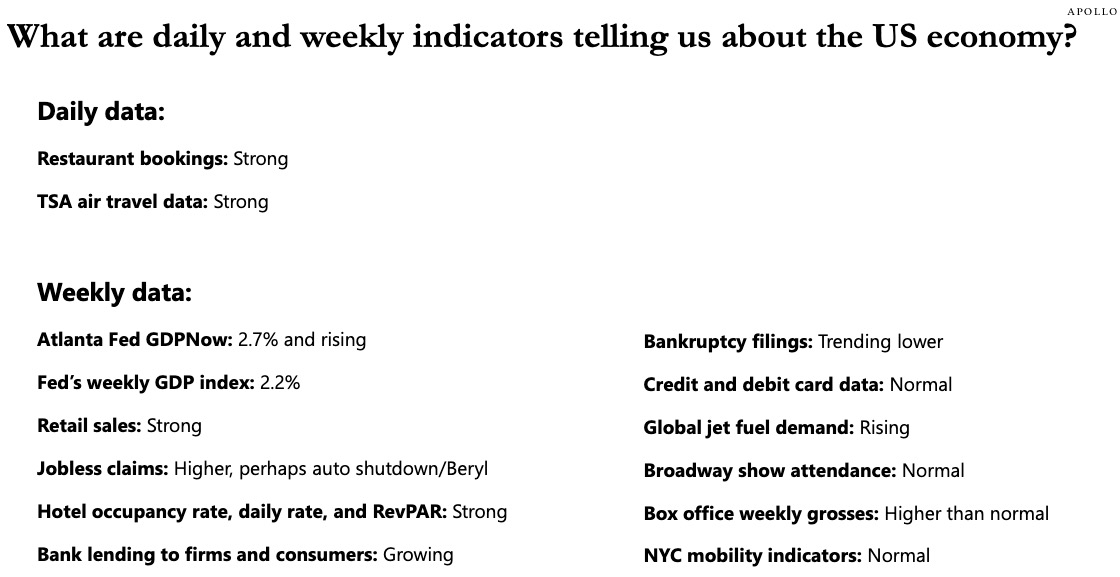

- Strong Economy – Below is a nice snapshot of US economic indicators. These are great results across the board.

- Soft Landing – This is a big deal. Many predicted that bringing down the inflation rate, and bringing up interest rates, would cause a recession.

- As the economy continued to expand from April through June [growing GDP], inflation resumed a downward trend and seems to be on track to slowing further toward the Federal Reserve’s 2% target.

- America’s economy is about to stick what’s called a ‘soft landing,’ which is when inflation returns to the Fed’s target without a recession — a feat that’s only happened once, during the 1990s.”

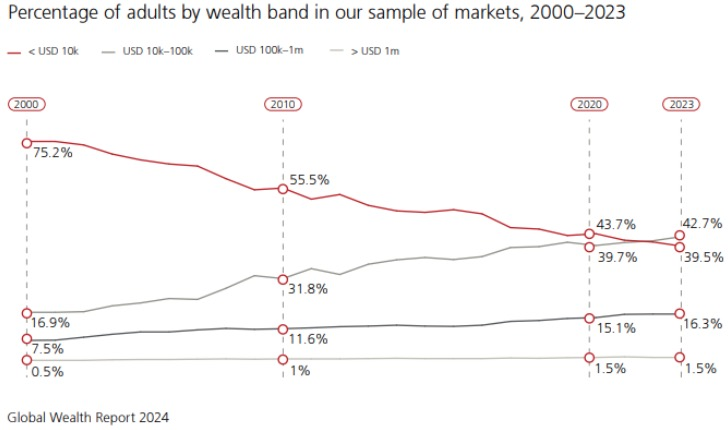

- More Good News – This stat is hard to believe: In 2000, 75% of adults held $10,000 or less in wealth.

- That number is now down to 40%. A great step in the right direction.

- On the other side of the wealth spectrum, 1.5% of Americans have $1M+ (up from 0.5% in 2000).

- Inflation is Down, but Prices Aren’t – “The typical household is spending $925 more a month to purchase the same goods and services as three years ago, according to Moody’s Analytics.”

- Consumer prices increased by 3% year-over-year in July, according to the Bureau of Labor Statistics. That’s an improvement from the 9% rate of inflation in June, 2022. Yet many Americans are not feeling great about that, as prices are still higher than they were last year – they’re just rising at a slower pace.

Housing

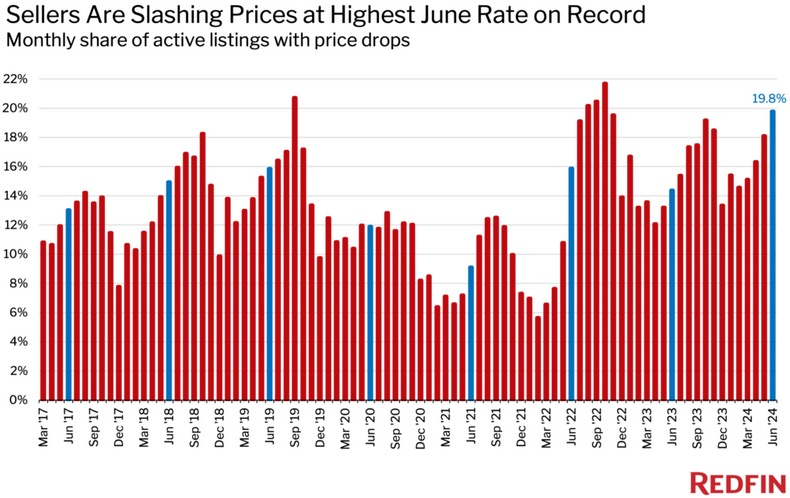

- Price Drops – “Roughly one in five (19.8%) homes for sale in June had a price cut — the highest level of any June on record.”

- That’s up from 14.4% a year earlier and is just shy of the 21.7% record high set in October 2022.”

- Closed Homes Sales – The number of homes that sold in June increased in just one metro: San Jose, CA (1.8% growth).

- Also in San Jose, 72% of homes sold above their final list price, the highest share among all metros.

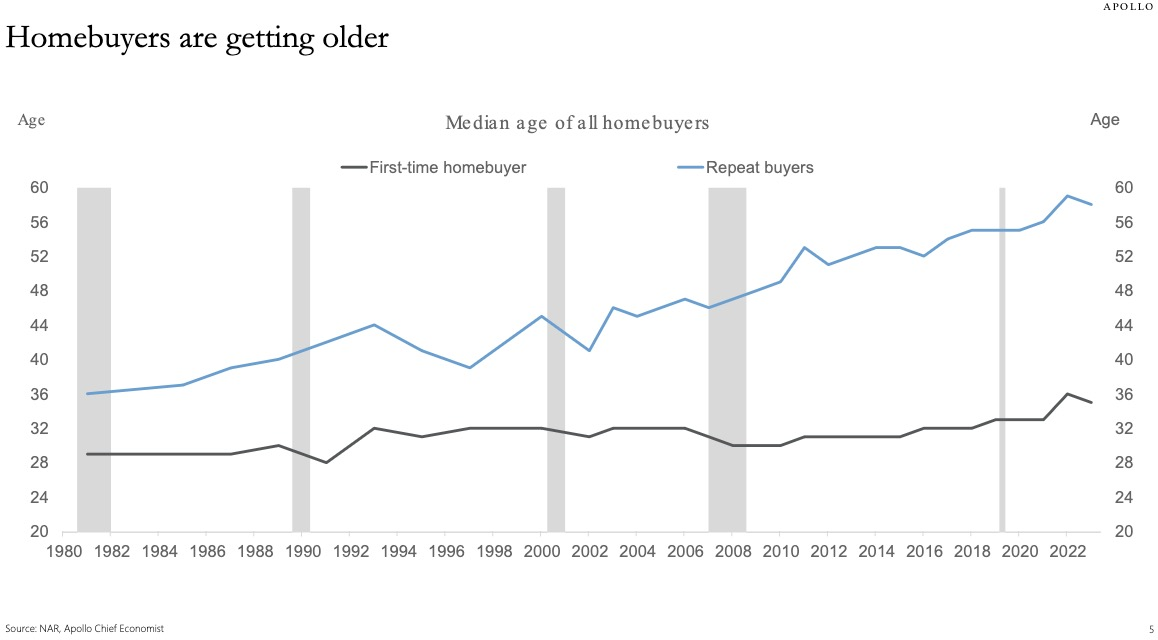

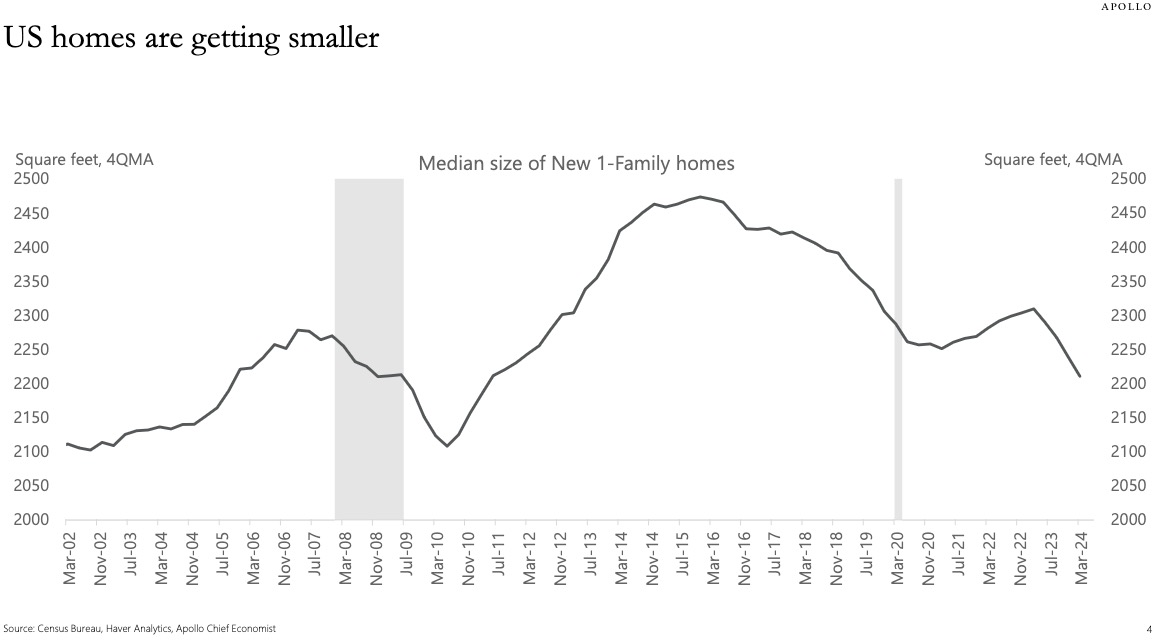

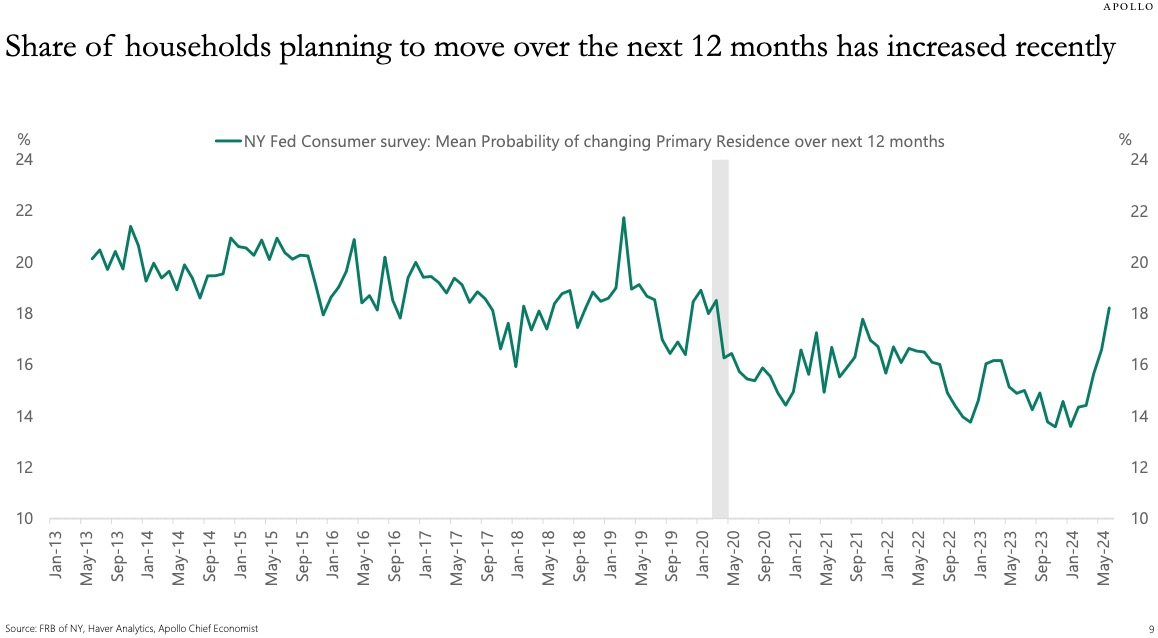

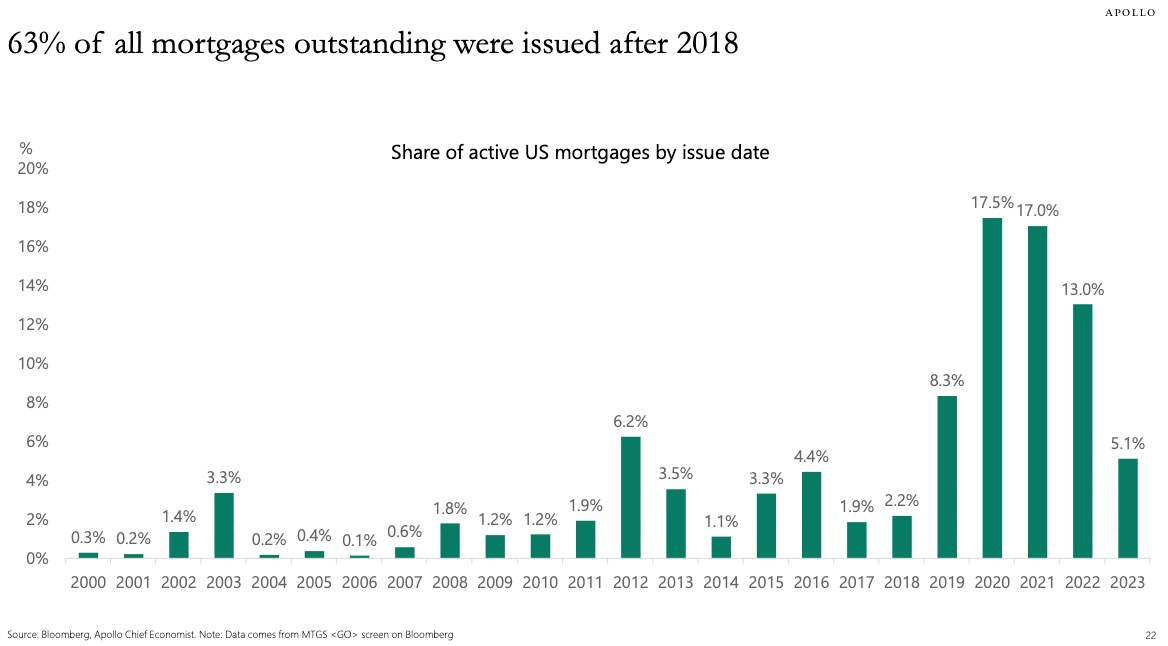

- Interesting Housing Charts – There are a lot of great charts about the housing market in this report from Apollo. If you’re interested in real estate I highly recommend it.

- Here are a few favorites:

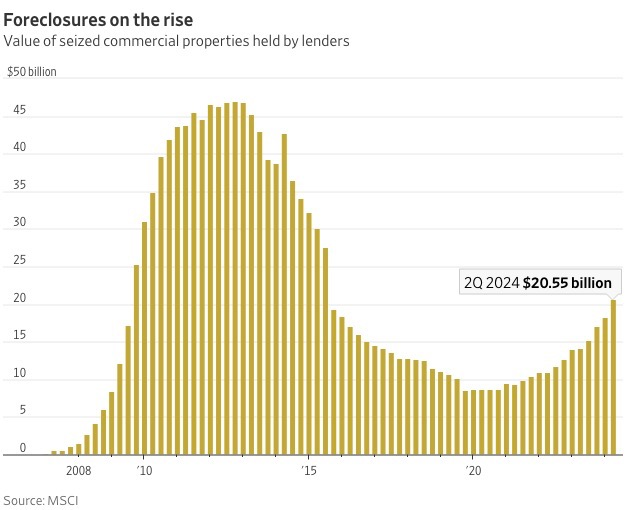

- Commercial Property Foreclosures – A bad sign in the commercial real estate market:

- “Portfolios of foreclosed and seized office buildings, apartments and other commercial property reached $20.5 billion…that is a 13% increase from the first quarter and the highest quarterly figure since 2015.”

Taxes

- Inherited IRA Rules Clarified – If you inherited an IRA from someone who was not your spouse, you may be familiar with the 10-year rule for required distributions. The IRS has clarified those rules to the following:

- “If the person who died was required to take withdrawals, the person who inherits the account must take annual payouts starting the year after death. The law mostly affects children and other inheritors, like grandchildren, siblings and friends.

- Because there has been confusion about the new rules, many people didn’t take distributions in the past several years. The IRS has essentially excused them, saying it won’t penalize people in this situation for failing to take required payouts for the years 2021 through 2024.”

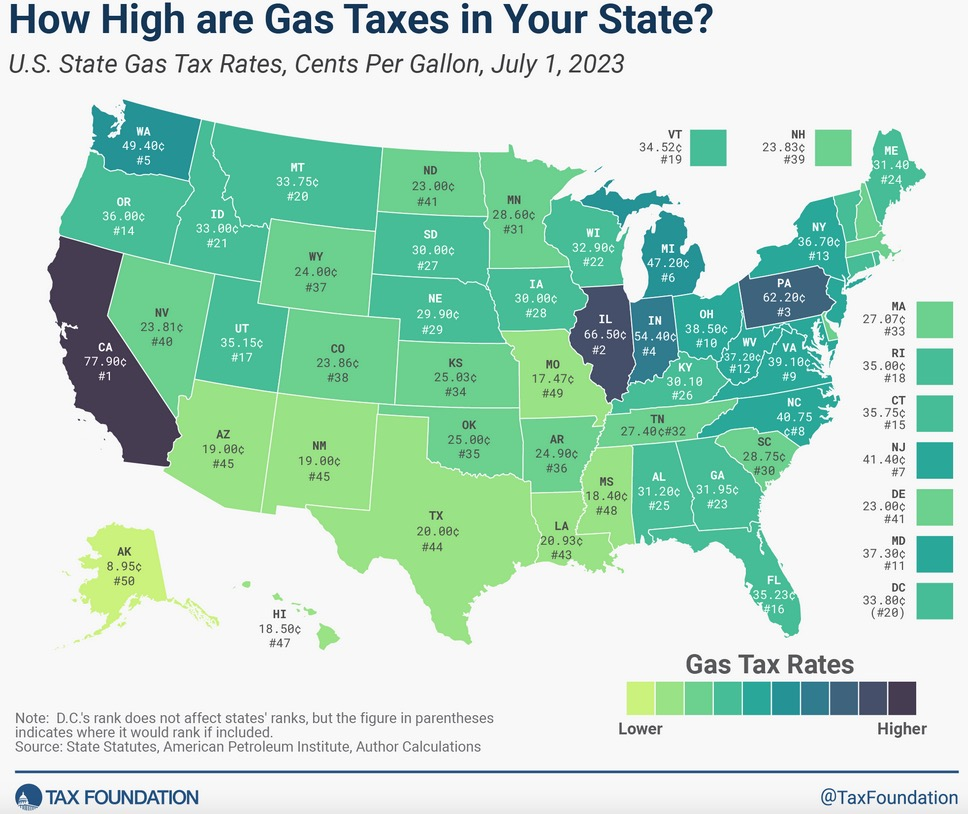

- Gas Tax – “California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

- The lowest state gas tax rates can be found in Alaska at 9.0 cents per gallon, followed by Missouri (17.5 cpg) and Mississippi (18.4 cpg)”

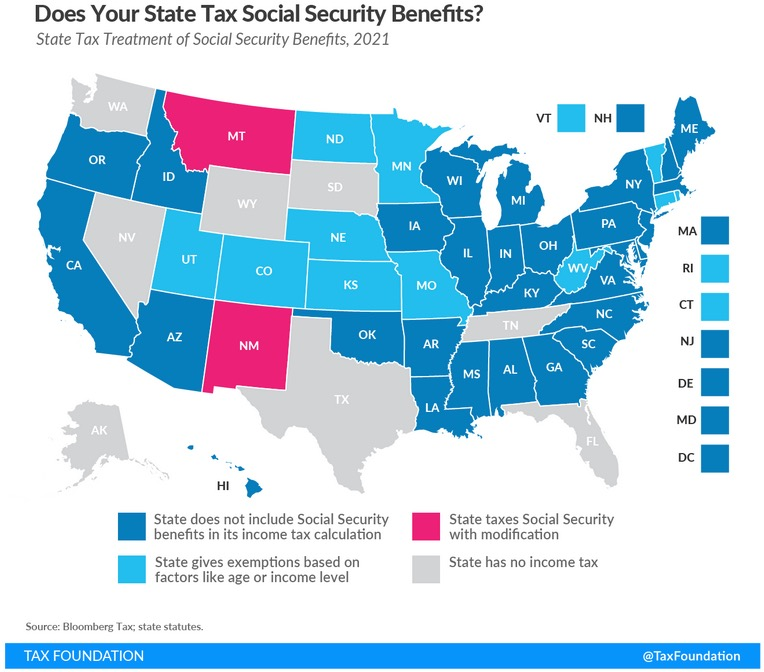

- Does Your State Tax Social Security? – While Californians pay a lot of tax on their gasoline, at least the state does not tax Social Security:

“Wealth is like seawater: the more we drink, the thirstier we become.”

– Arthur Schopenhauer

As always, please reach out if you have any questions or would like to connect.