Below are a few interesting personal finance pieces from August, plus a quick note about September so far:

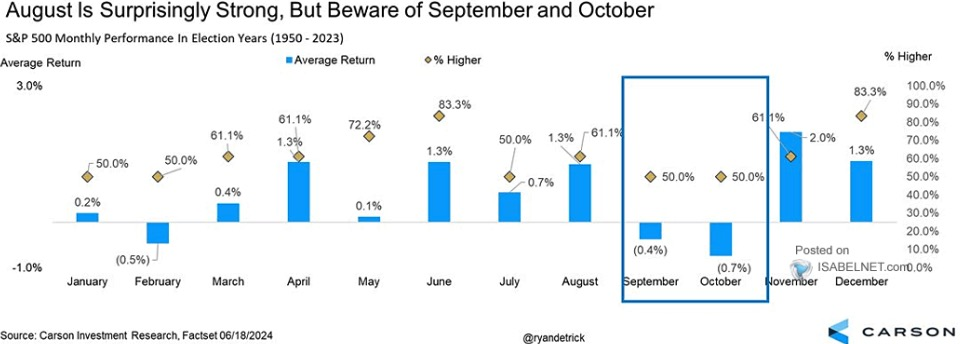

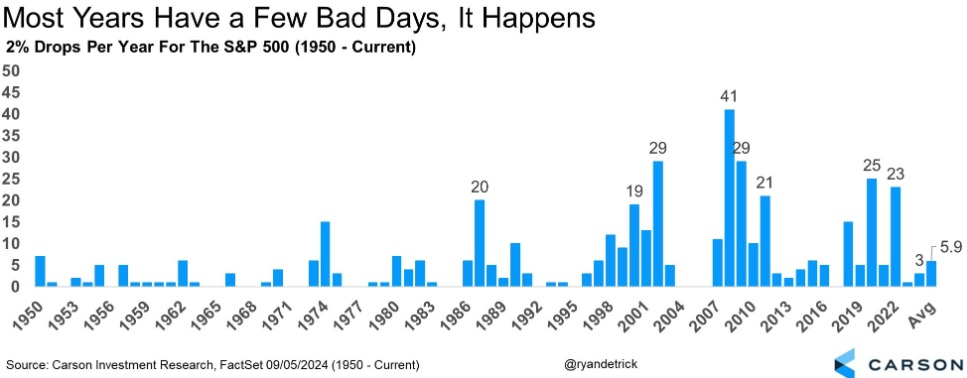

The S&P 500 is down about 4% just a few days into September. From an investor perspective, September and October are on average the worst months (but still up 50% of the time).

If you’re investing for the long term, there is nothing to worry about these short-term declines.

Here are a couple charts to help put it in perspective:

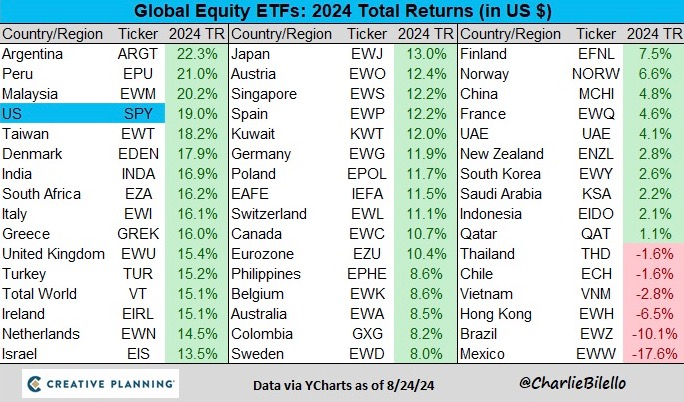

- Global Returns – So far this year the US and international markets have done well:

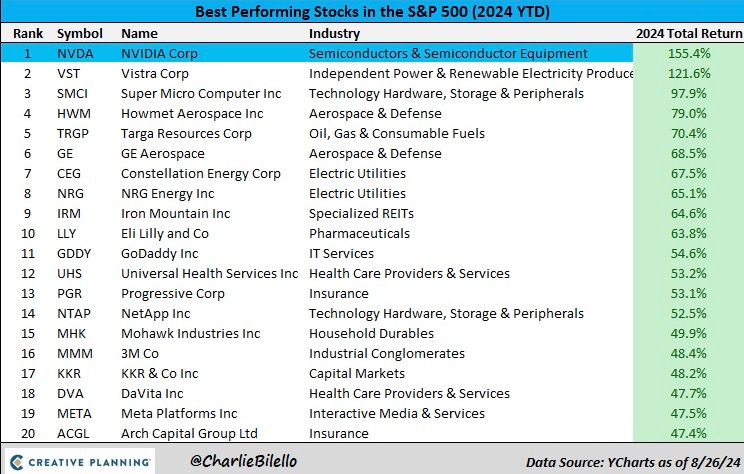

- Best Performing Stocks – Within the US, NVIDIA is the best performer this year (more on NVIDIA below):

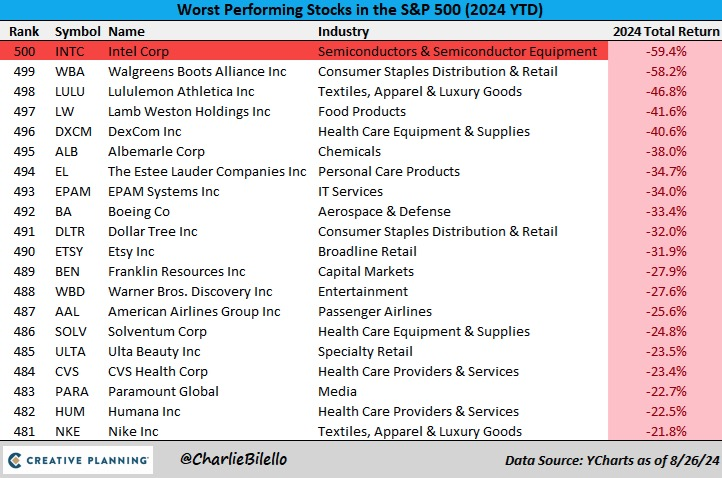

- Worst Performing Stocks – On the flip side, Intel (which is in the same industry as our best performer NVIDIA) is the worst performer this year:

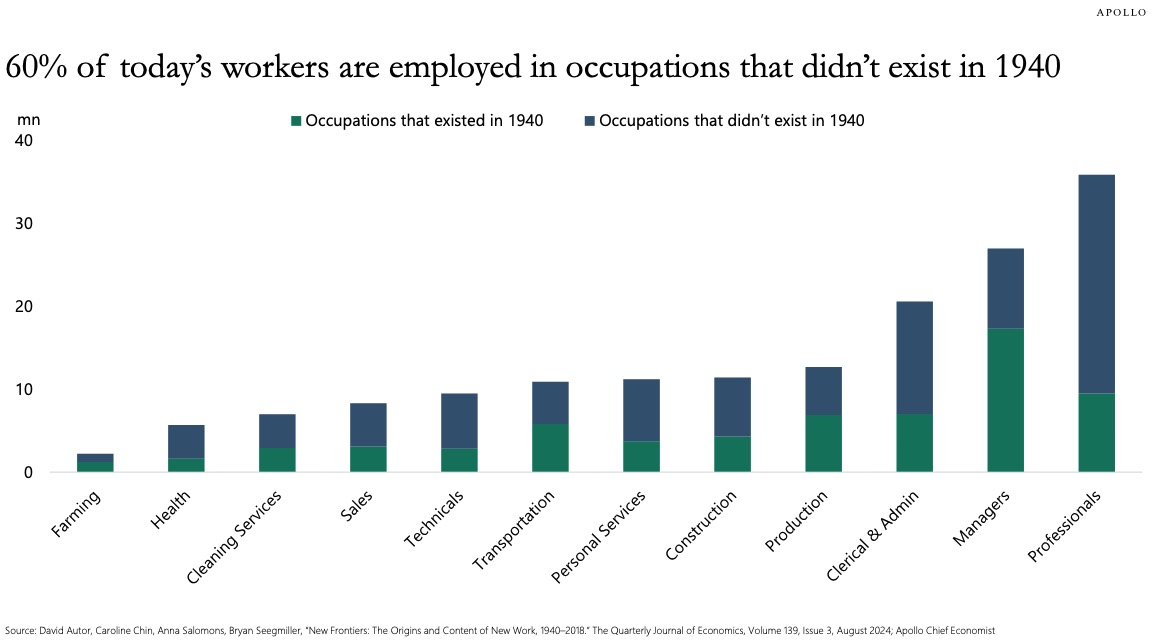

- New Jobs – Most people are working in jobs that didn’t exist in 1940.

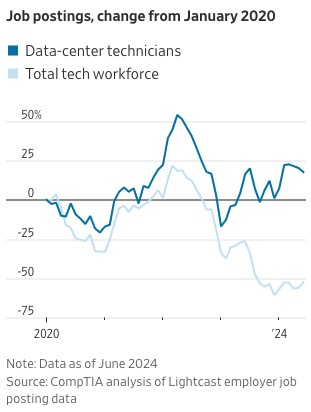

- Tech Job Postings – Tech job postings are down ~50% since 2020:

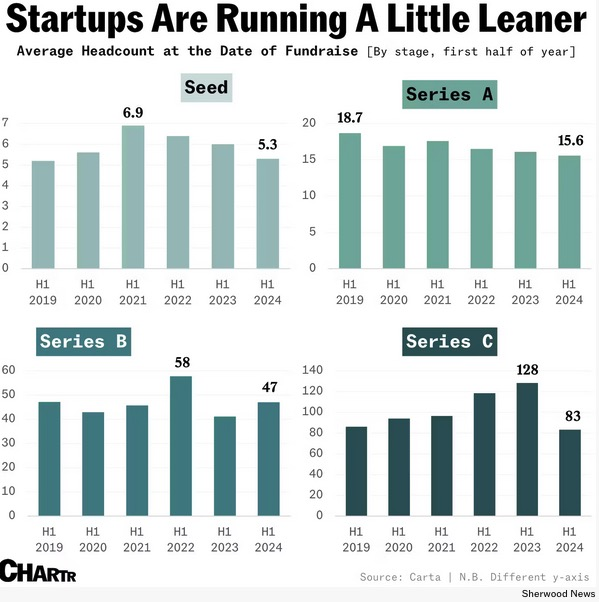

- Headcount is Down – With interest rates up, venture capital funding is harder to raise. As a result, startups are running leaner across all stages.

- A couple takeaways:

-

-

- These reductions appear to be driven more by hiring freezes than outright layoffs.

- “The number of fledgling companies closing shop has surged by 60%.”

-

-

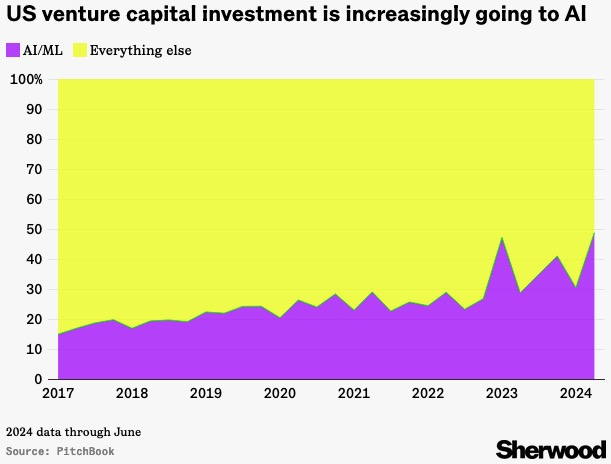

- VCs Love AI – “AI and machine learning startups made up nearly half of all investment, up from 15% in 2017.”

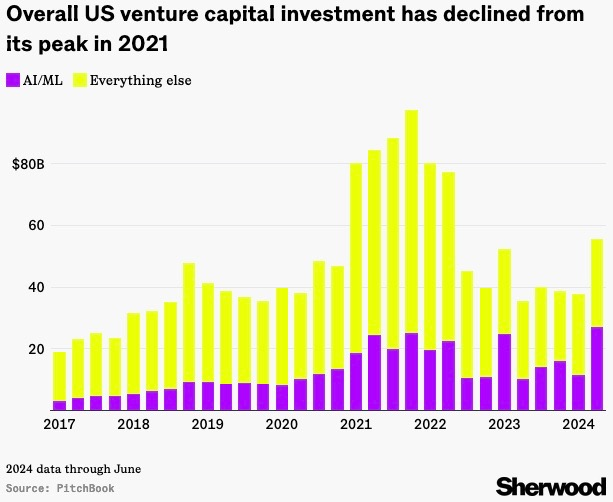

- VC Funding – Venture Capital investment peaked back in 2021.

- 2024 is on pace for more investment than 2023, up by a projected 12%:

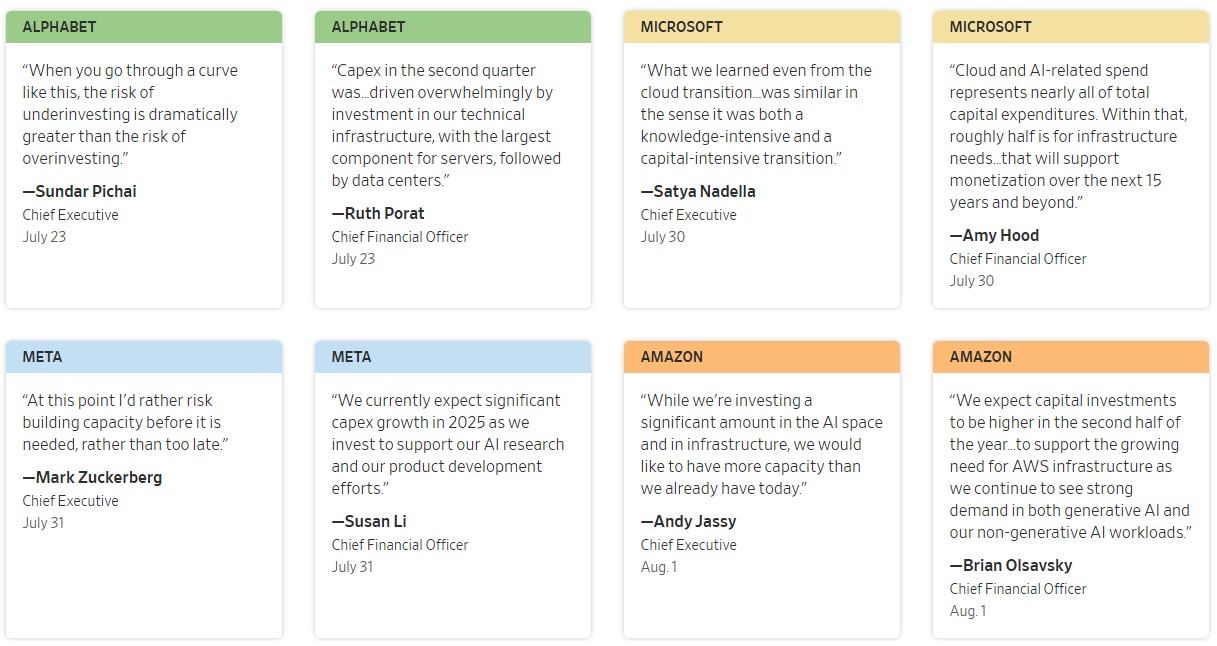

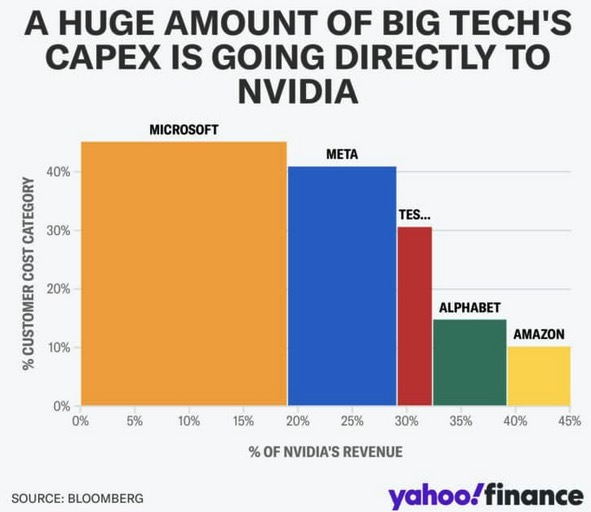

- Large Companies on AI – Speaking of AI investment, it’s interesting to read what the big companies are saying about that expense:

Housing

- Interest Rates – have dropped to a 15-month low.

- An interest rate cut this month by The Federal Reserve could indirectly put more downward pressure on mortgage interest rates.

- Revised Home Buying/Selling Rules – Starting August 17, new rules were rolled out that slightly changed the way Realtors get paid. Here’s an overview:

-

-

- How It Worked Before: A 5%–6% fee was typically paid by the home seller and split between the seller’s agent and the buyer’s agent.

-

- For example, if a home sold for $1,000,000 the seller would be responsible for paying $60,000 (6%) to both agents.

-

-

-

- How It Works Now: As a buyer, you have to sign a contract with the agent representing you before they show you a property.

-

- The contract outlines the compensation your agent will receive, and is designed to inform buyers that they are responsible for paying their realtor if the seller chooses not to cover the cost.

-

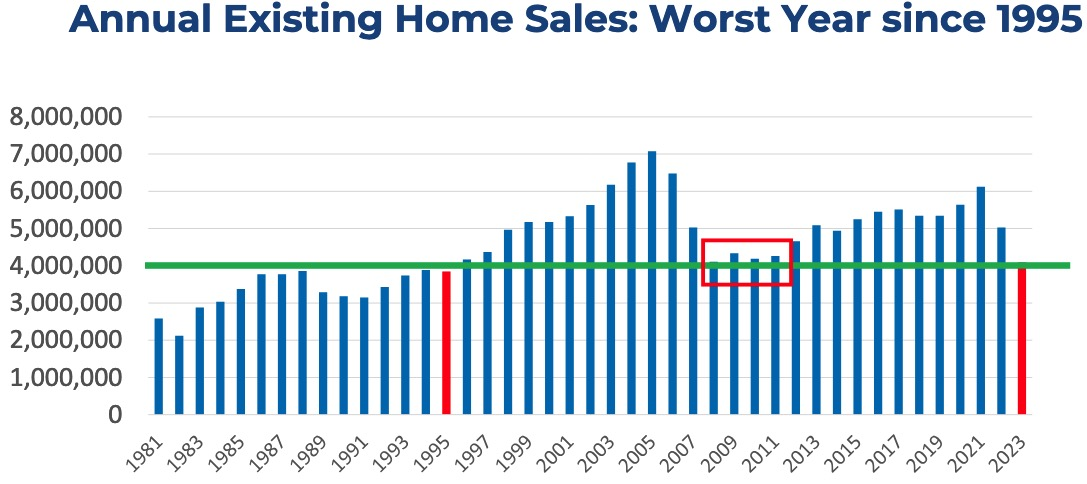

- Home Sales Are Down – Housing activity is at a low.

- Due to high interest rates and relatively low inventory, the number of homes sold is at the lowest level since 1995:

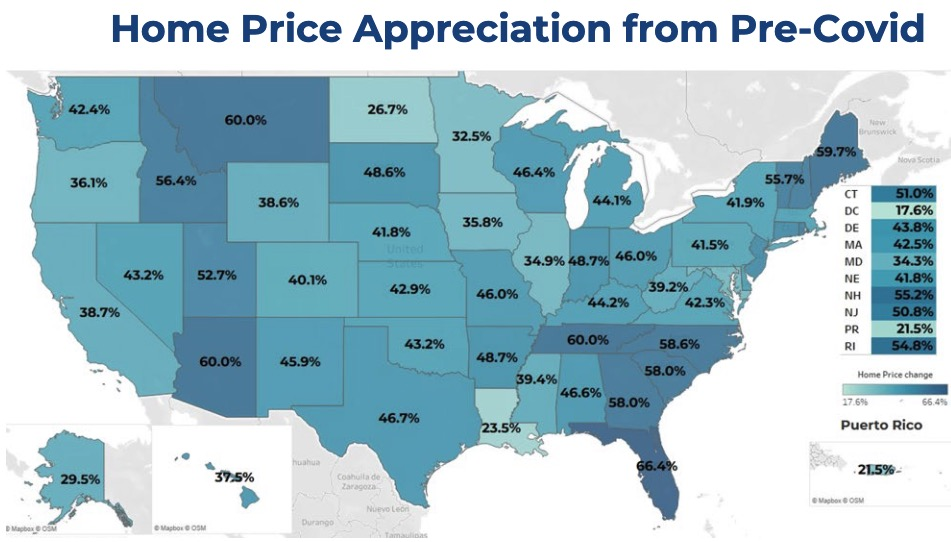

- Home Price Appreciation – Prices are up across the country. The Southeast looks to have done the best:

- Is NVIDIA Overvalued? – If you’re interested in the share price of NVIDIA, I highly recommend this article.

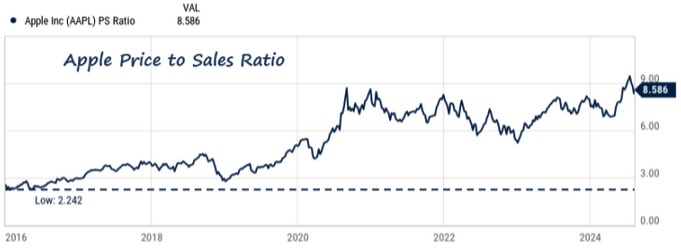

- Apple’s Valuation – Apple’s price to sales ratio is quite high.

- To understand this metric, imagine a company that sells $1M of goods per year. If the company is valued at 3x sales, it’d be worth at $3M.

- Right now, investors are valuing Apple at approximately 8.5 times its annual sales, up from 2.2 in 2016:

Quote of the Month

“Rather than spend time trying to add more years to our lives, what we should be doing is adding more life to our years…by doing that, I think it will have the surprising effect of helping us live longer.”

As always, please reach out if you have any questions or would like to connect.