2024 was a great year for most investors, with the S&P 500 up 25%.

Fun Fact: Some of the worst-performing investments in 2024 were the “fancier” investments: Art (-16%), Fine Wine (-11%), and Diamonds (-20%).

But for those invested in more traditional assets – stocks, bonds, and real estate – most people are richer than ever.

In my experience, it’s during these good times when people become comfortable with risk. The US stock market just had its best consecutive years since 1997-98, and anecdotally I’m seeing a lot of “risk on” behavior.

I’m a long-term optimist for the stock market, but in the near term it’s impossible to predict. Recessions or economic shocks can occur out of left field, and we typically get in trouble when people don’t fear risk.

I recently read a memo from Howard Marks, who seems to share my cautionary stance. Below is a quote that resonated:

- “The three stages of the bull market:

1. The first stage usually comes on the heels of a market decline or crash that has left most investors licking their wounds and highly dispirited. At this point, only a few unusually insightful people are capable of imagining that there could be improvement ahead.

2. In the second stage, the economy, companies, and markets are doing well, and most people accept that improvement is actually taking place.

3. In the third stage, after a period in which the economic news has been great, companies have reported soaring earnings, and stocks have appreciated wildly, everyone concludes that things can only get better forever.“

It feels like we’re in the third stage. One example: A record-high share of investors think there is less than a 10% chance of a stock market crash.

To be clear: I am not predicting a stock market crash, calling a top, or saying the market is in a bubble. I’m simply acknowledging that the past 2 years have been very good from a returns perspective, and I would not expect the next two years to be as good.

Michael Cembalest’s Eye on the Market from JPMorgan summarized this point well: “The S&P 500 just registered two 20%+ years in a row, something which occurred just ten times since 1871. Only during the 1990’s bull market and the Roaring Twenties [1920s, that is] did the good times continue for another two years. I expect a 10%-15% correction at some point in 2025…Plan accordingly: US equity markets should end the year higher than they began but be sure to have plenty of liquidity to take advantage of what might be a volatile year.”

In the Stock Market section below I’ll highlight a few reasons why we might see more muted returns this year or in the near future. I may be wrong (and I sort of hope I am, since it’s nicer when the stock market does well), but as the quote at the end of this newsletter says, you always need to be prepared for “horrifying short-term losses” if you invest in stocks.

Investing / Stock Market

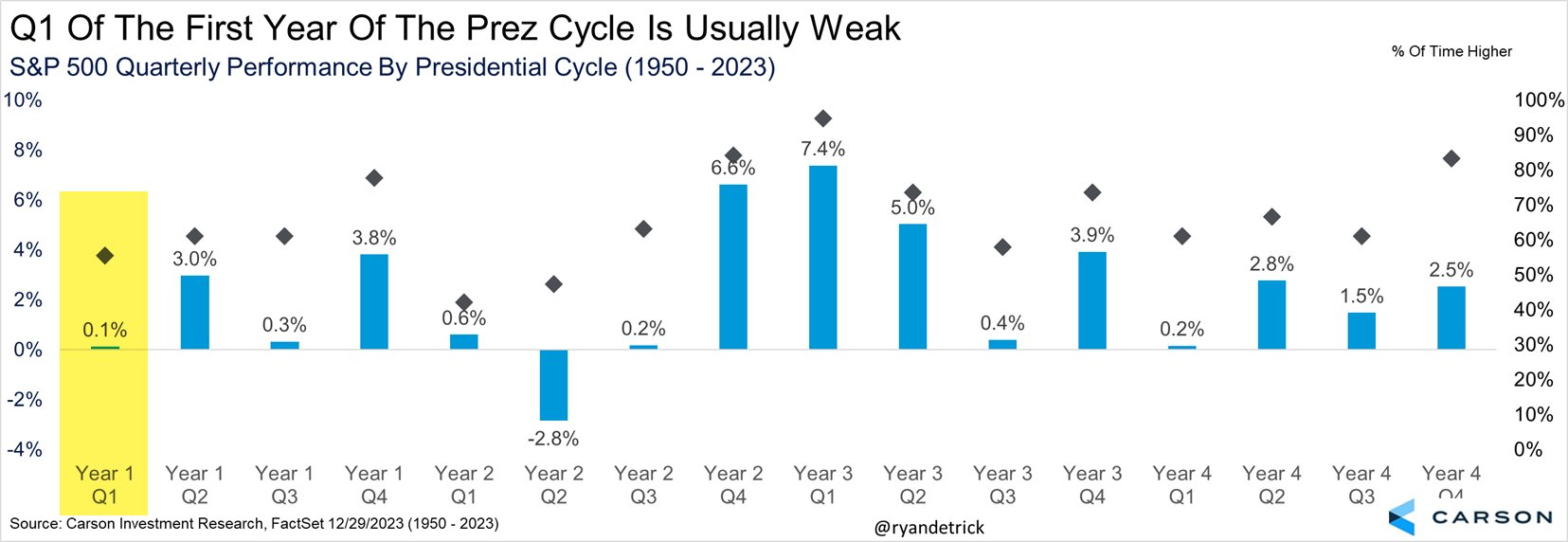

- 📊 New President, Q1, Year 1 – “One of the worst quarters during the four-year Presidential Cycle starts tomorrow [01/01/25].”

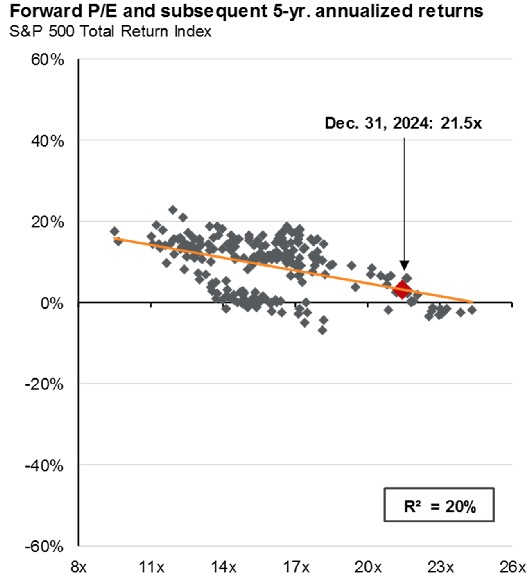

- 📉 Lower Future Returns? – The S&P 500, which represents large stocks within the US, is highly valued. A 21.5 “forward price-to-earnings multiple” simply means that investors are willing to pay $21.50 for every $1 of expected earnings per share over the next 12 months. A high number indicates high growth expectations, which is exactly what’s happening in the AI space.

- Interestingly, these valuations measures are not predictive over a 1-year time horizon. They are, however, more relevant for a 5-year window:

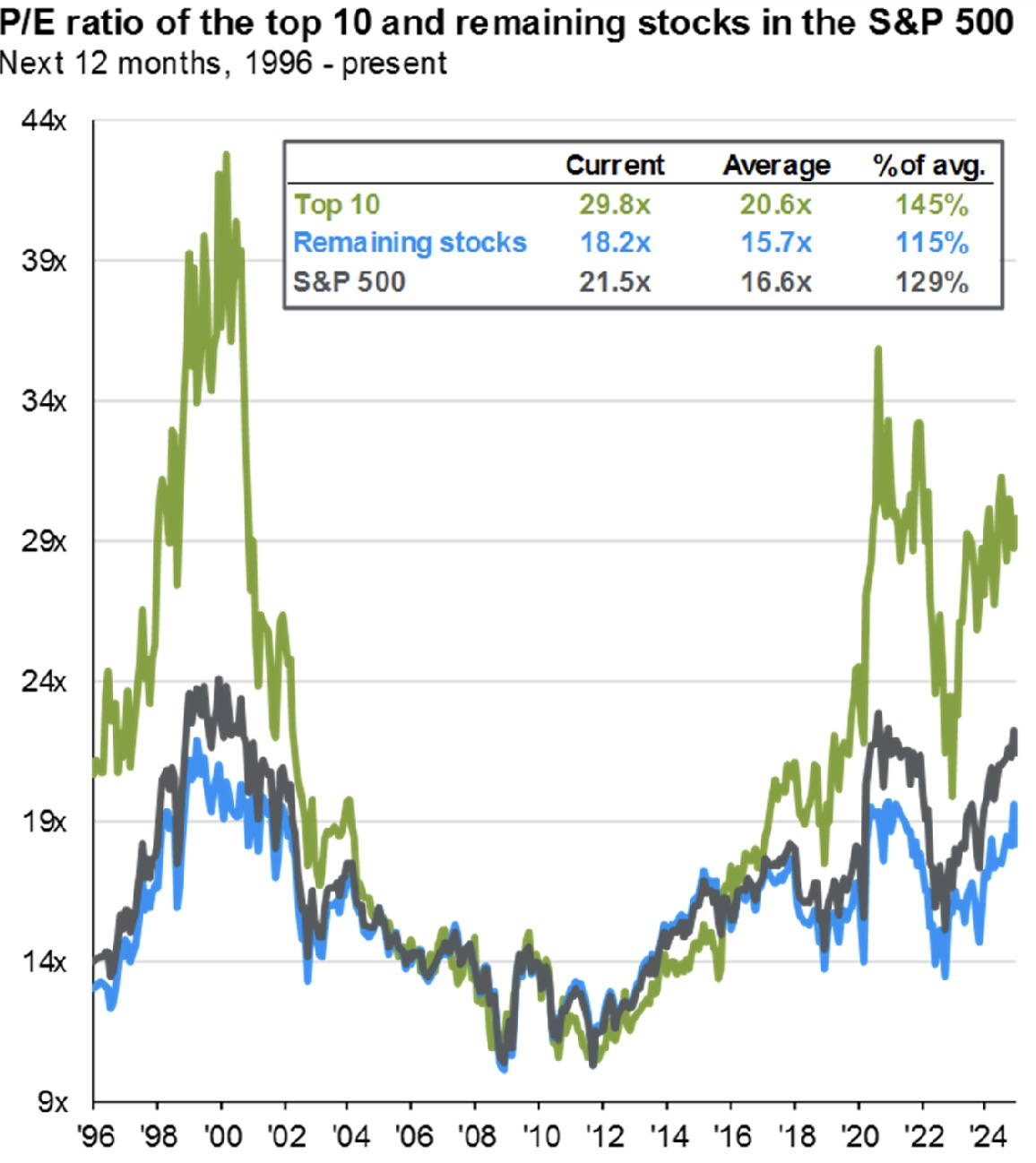

- 🔟 The Top 10 Companies are more Richly Valued – It’s important to point out that the top 10 largest stocks in the index (9 out of 10 being tech companies) are valued at much higher levels than the remaining 490 companies:

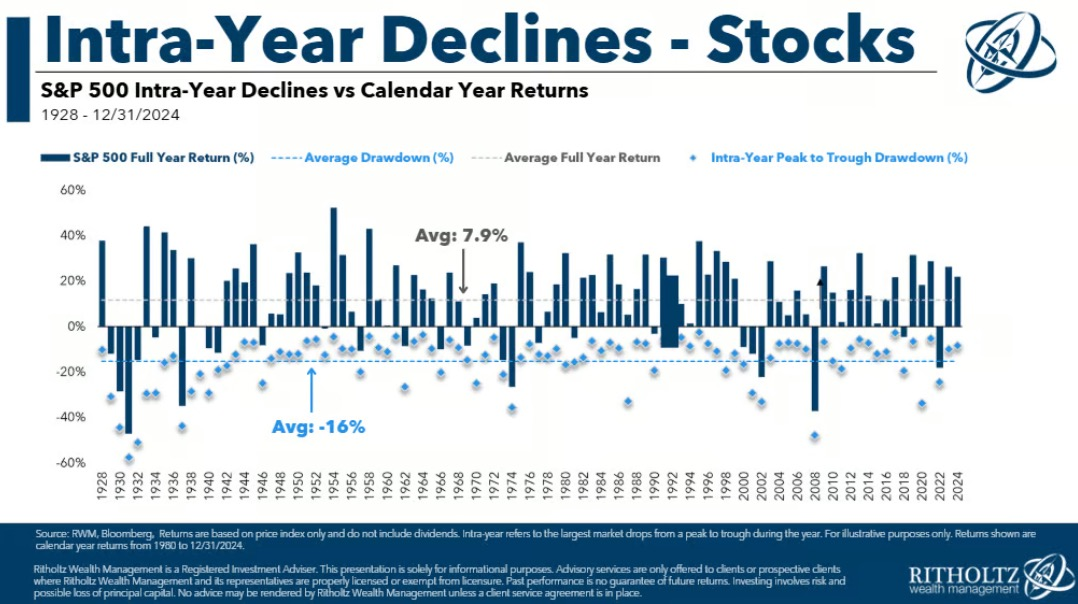

- 📉 Intra-Year Declines – While the S&P 500 has averaged a 7.9% annual return since 1928, the average intra-year decline (peak-to-trough drop) is 16%.

- In 2024, the stock market’s biggest declined was 9.7%.

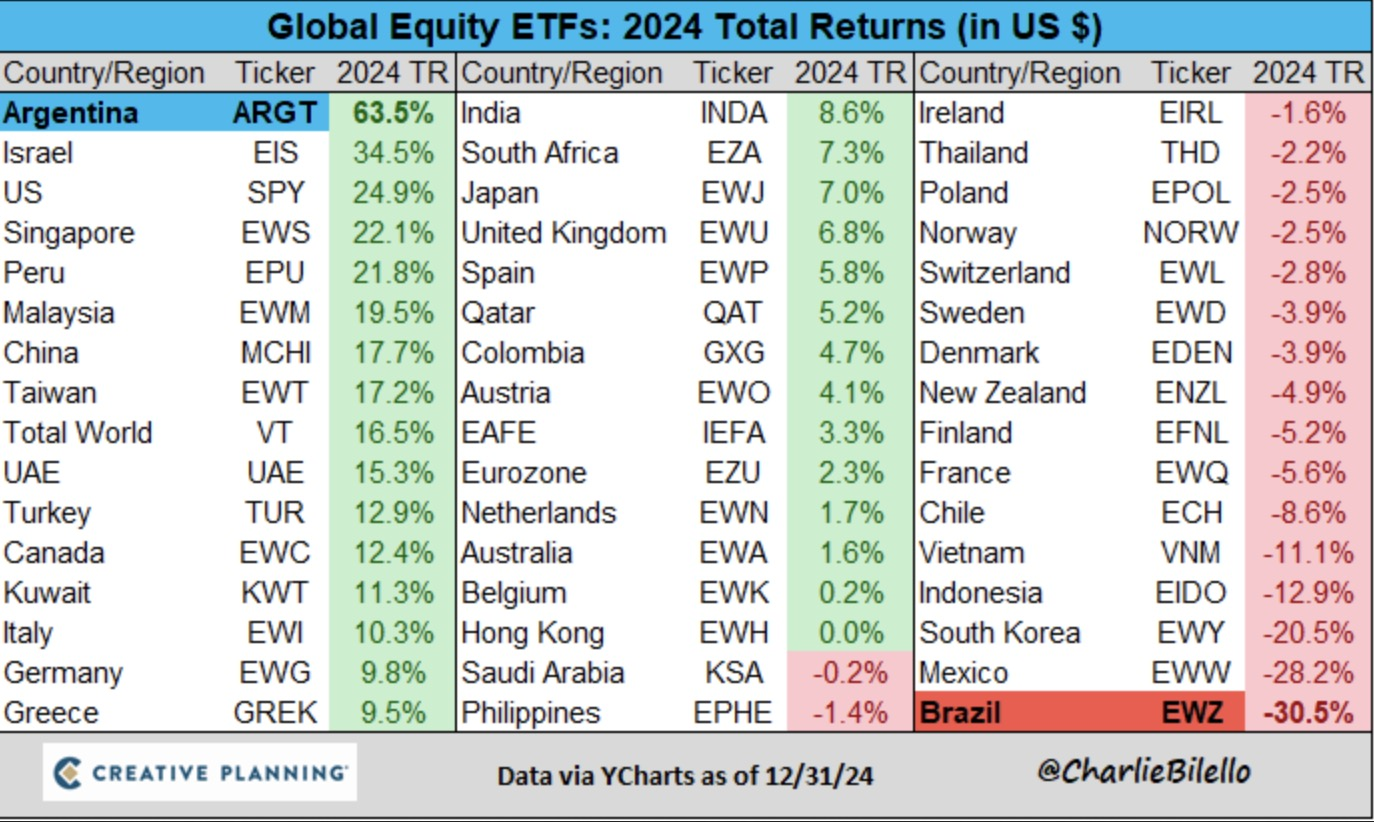

- 🌎 Global Stock Returns – How many people predicted that Argentina and Israel would be the top performers in 2024?

Jobs

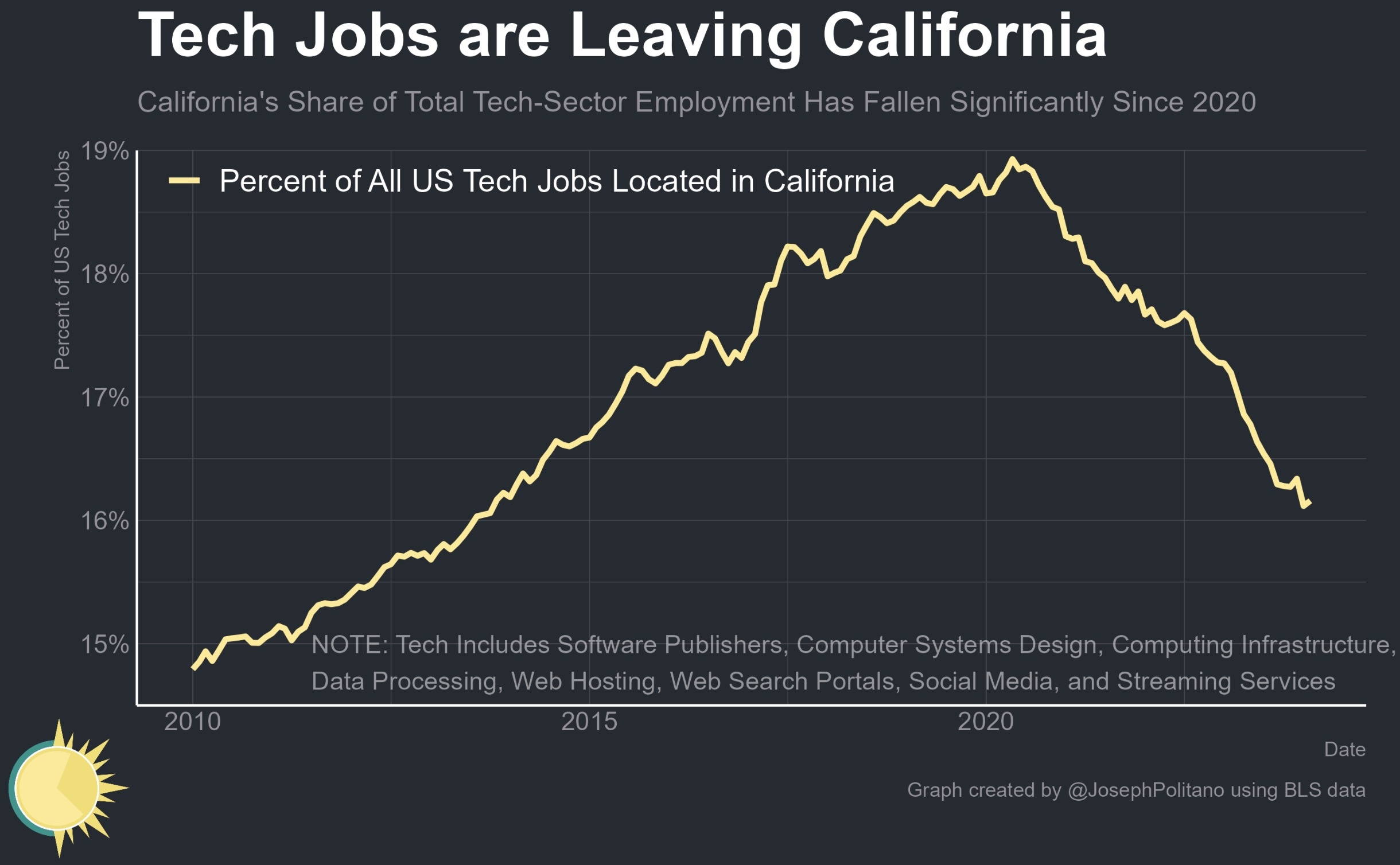

- 💻 California is Losing Tech Jobs – “Since the beginning of COVID, California has added a sum total of only 6k jobs in the tech industry—compared to roughly 570k across the rest of the United States.”

- 💰 For Public-Sector Workers, Increased Social Security Benefits – Great news for anyone with a pension from the public sector:

“Police officers, firefighters, nurses, postal workers, public school teachers and government employees are among the nearly 3 million public sector workers affected by the provisions.”

“Before Biden signed the bill, the Windfall Elimination Provision reduced Social Security for those who earned ‘non-covered’ pension income (which includes pensions from state and local governments, as well as non-U.S. employers) from their jobs, while the Government Pension Offset reduced spousal or survivor benefits when an individual’s pension is non-covered.”

Real Estate

- 🏠 Weekly Home Maintenance Email – WeeklyHomeCheck is a helpful resource that sends a once-per-week email about one simple home maintenance task. Their recommendation last week was particularly timely given the fires in Southern California:

“Walk through your home and record everything. Having proof of all the items and details in your home would be crucial if anything were to happen, like a natural disaster.”

- 🔍 Homeowner’s Insurance Cost – Given the fires in Los Angeles, many are taking a second look at their homeowner’s insurance policy.

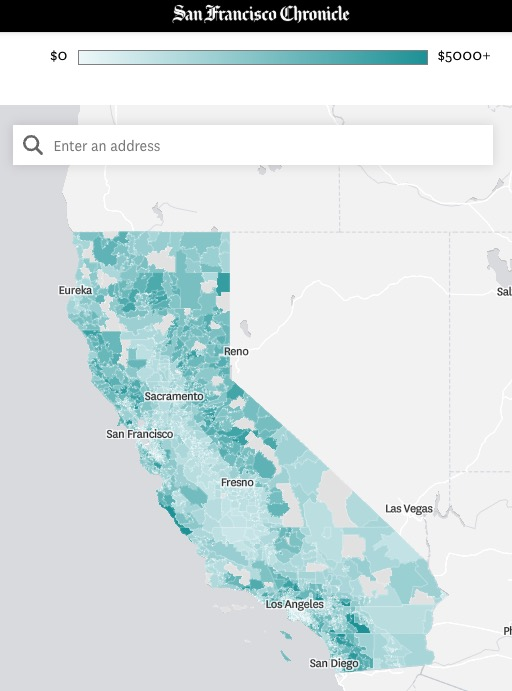

- The San Francisco Chronicle has a helpful resource to analyze ZIP code level data on homeowner’s insurance premium costs. For example, the average annual premium in Redwood City is $1,751.

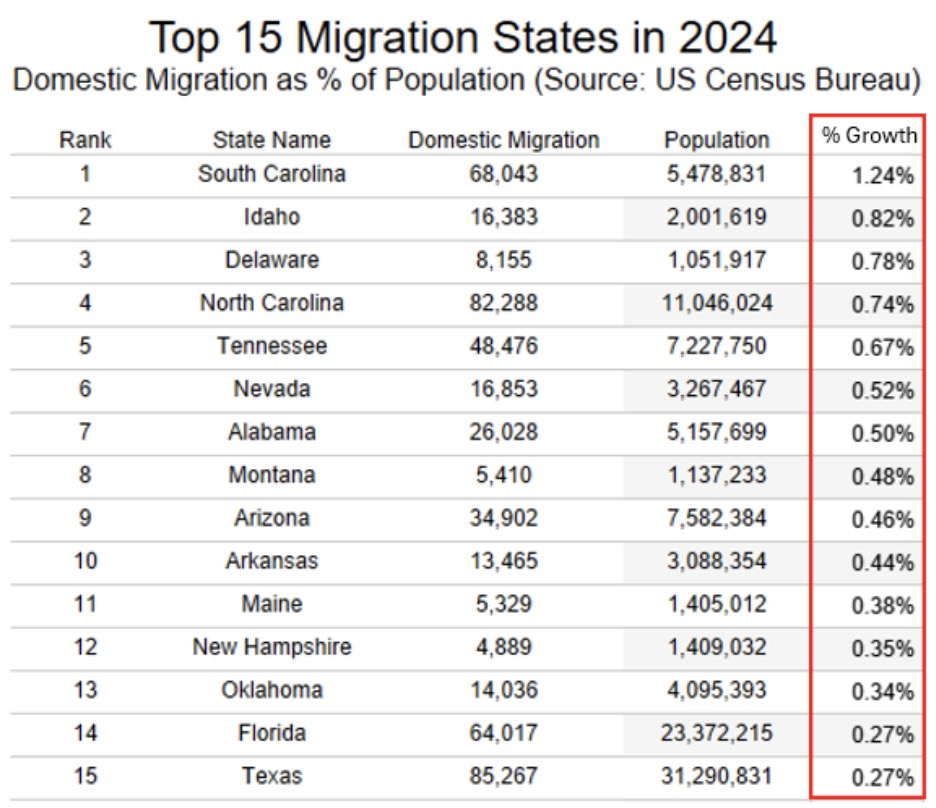

- 🚚 Moving Patterns – The states that had the biggest inflows last year:

Quote of the Month

“In order to capture the potentially higher returns that stocks can offer, you have to reconcile yourself to the certainty of horrifying short-term losses. If you can’t do that, you shouldn’t be in stocks—and shouldn’t feel any shame about it, either.”

As always, please reach out if you have any questions or would like to connect.