Lately, many financial commentators are bringing up the topic of an “AI Bubble.”

Andrew Ross Sorkin had this to say (emphasis mine):

“Are we in an A.I. bubble? I’ve heard that question multiple times in one day.

The answer is that we are — we just don’t know when it will end. When the dot-com bubble popped, it wasn’t the end of the internet. It just meant that the weakest companies didn’t survive. And that’s probably what will happen again.”

What we see today are tech companies competing and spending massive amounts on what they believe is needed to build and scale their AI strategy.

Scott Galloway put it well:

“Big Tech’s business model is flipping from asset-light to asset-heavy. Apple, Amazon, Alphabet, Microsoft, and Meta are on track to spend over $350 billion in capex this year — roughly $100 billion more than last year.

These companies spent the last decade building high-margin, high-free-cash-flow businesses in software, ads, and cloud. Now they’re redeploying those profits into the physical infrastructure of AI…The open question is whether Big Tech’s premium valuations — justified by years of asset-light growth — still hold up as they become asset-heavy.“

From an investment perspective here’s what’s important: You don’t need to time the market to make money and be successful. It reminds me of the following quote from Jack Bogle, the founder of Vanguard:

“The idea that a bell rings to signal when investors should get into or out of the market is simply not credible. After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

And remember, stocks don’t need an AI bubble to fall. They can decline for any number of reasons: cycles turn, liquidity tightens, there’s an oil shock, or something else unpredictable happens. The catalyst rarely looks like the one people are talking about ahead of time.

You don’t prepare by predicting the exact cause or moment of a downturn. It’s not possible. You prepare by building a portfolio designed to survive one.

That means diversifying, not just across the big household tech names, but across small, medium, and large companies, across industries, and across the globe.

Above all, know your risk tolerance. Markets have crashed 50% before, and they probably will again someday. The timing and reason is unknowable in advance, but you should have that expectation in mind.

Control what you can, and let markets do what they’ve always done: surprise us in the short run, and reward patience in the long run.

The goal isn’t to call the top. Finding the right portfolio and risk level, and sticking with that through good times and bad, is the best way to sleep well and earn good returns.

Thanks for reading.

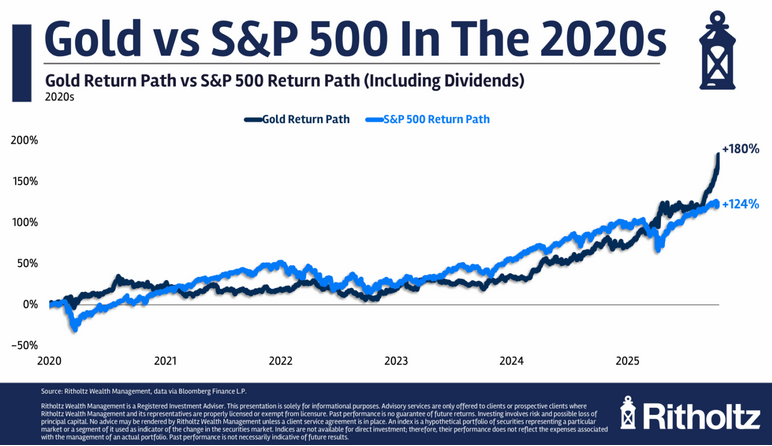

- Why I don’t Own Any Gold – “I just don’t have the stomach for an asset that has the ability to experience 3 lost decades out of 4.” — Ben Carlson, Director of Institutional Asset Management, Ritholtz Wealth Management.

- How Do You Invest During a Bubble? – The options: diversify, hedge, go all in, or do nothing.

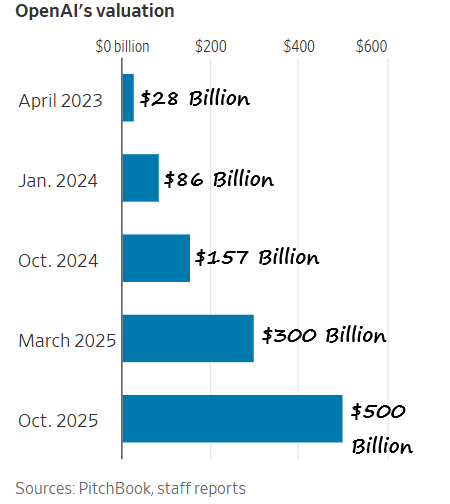

- 💸 OpenAI’s Value – “If OpenAI was public, it would now be the 16th largest company in the S&P 500.” — Charlie Bilello, Chief Market Strategist, Creative Planning

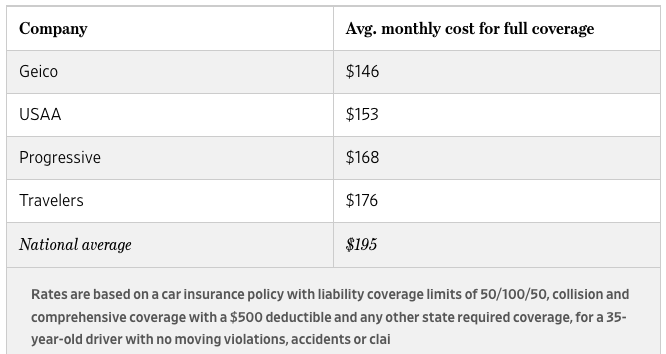

- 🚘 Cheapest Car Insurance – Frustrated by high car insurance costss?

- Here are the cheapest car insurance companies according to The Wall Street Journal:

Life

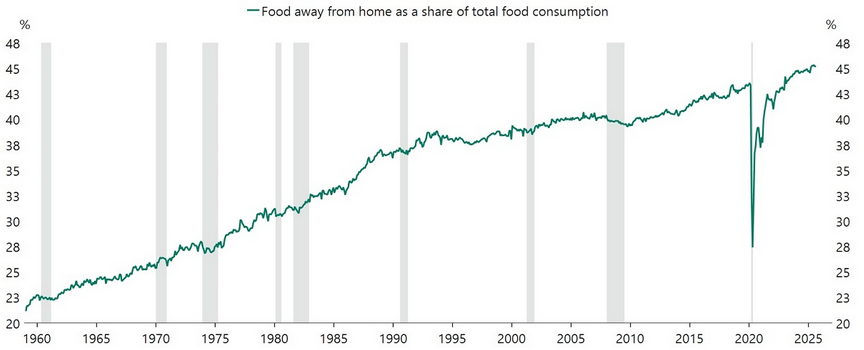

- 🍔 Food Outside the Home – “Households now spend almost as much on restaurants, takeout and delivery as on groceries eaten at home.”

Quote of the Month

“Pause for a moment and ask yourself, how many of the things you have now are the things that you wished for a decade ago?”

– Trevor Noah

As always, please reach out if you have any questions or would like to connect.