Most people estimate the price of a financial advisor to cost 1% per year. To investigate this assumption, Bob Veres surveyed nearly 1,000 advisors about their fees.

The main takeaway is that financial advisors’ fees are made up of two components.

Number one is the advisor’s fee, which is typically charged as a percent of the money that is managed, known as “assets under management” or AUM. This is the 1% fee most people have in mind.

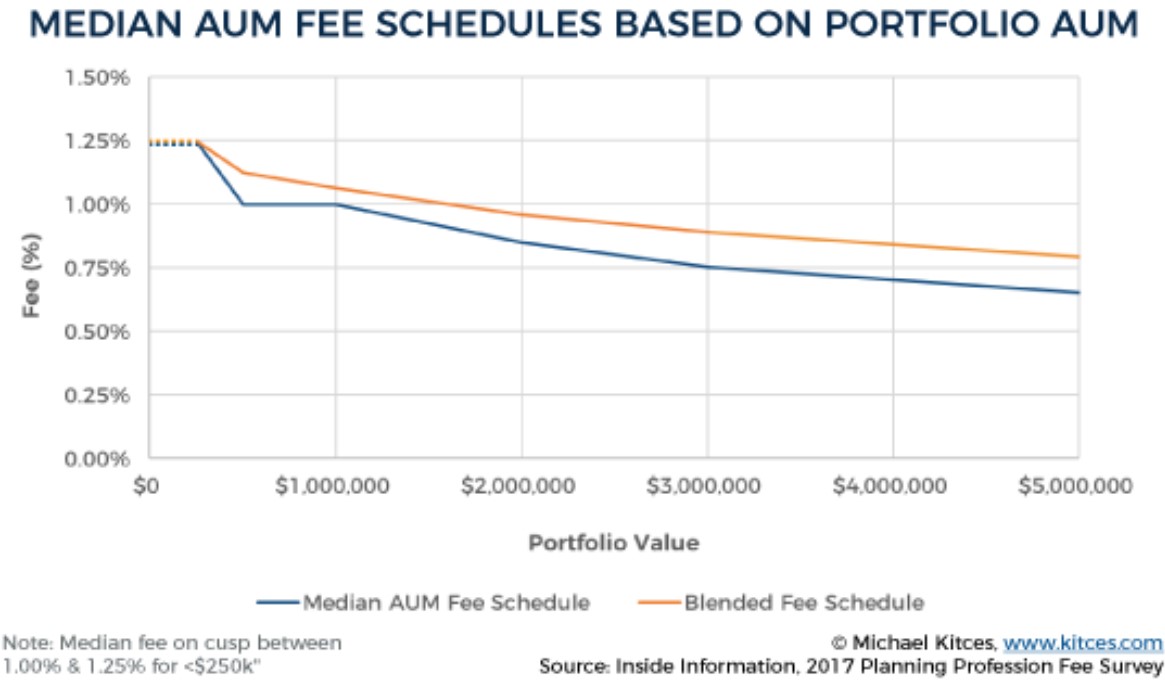

AUM fees typically decline as more assets are managed. For instance, the fee on might be 1.0% on the first $1M and 0.75% on the next $1M. This leads to an overall “blended fee schedule,” shown below in orange:

Source: Financial Advisor Fees Comparison, Michael Kitces, Nerd’s Eye View

As you can see in the chart above, until you have $1.5M you will likely pay above 1%.

It’s also noteworthy these fees do not decrease dramatically. Even for clients with $5M the fee is approximately 0.80%, or $40,000 per year.

The second notable cost is the expense ratio. This often overlooked fee is the price of the mutual funds, exchange-traded funds, or other investment products used. Across all firms, the median cost was 0.50% per year. Importantly, these fees do not decrease as more money is invested, making them that much more impactful.

Total Costs

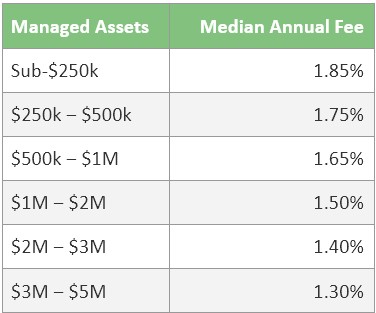

Adding the advisor fee and the expense ratio, the all-in cost of a financial advisor varies by asset level, but remains well above 1.0%:

Conclusion

Keeping fees low is an important component to successful long-term investing.

Those evaluating financial planning professionals should question the value of asset-based fees, and make sure to understand the total overall fee. Then, ask the prospective advisor, “How much time do you expect to spend working with me on an annual basis.” From there, calculate the fees as an average hourly rate.

As a flat-fee financial planner I believe charging an annual retainer is a fairer, more transparent compensation method. It does not cost more to manage a $5,000,000 portfolio versus a $500,000 portfolio. Why should a client pay tens of thousands more to receive the same service and investment portfolio?

This is also not how other established service professionals charge. Would an accountant charge based on your income? Would an estate planner charge based on the size of their estate? No. But this, unfortunately, is the norm in financial planning and investment management.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.