This article covers three topics related to your personal finances: Your taxes, your 401(k), and a few updates from the SECURE 2.0 legislation.

Taxes

- The tax deadline for the vast majority of Californians has been extended to May 15 (originally April 18).*

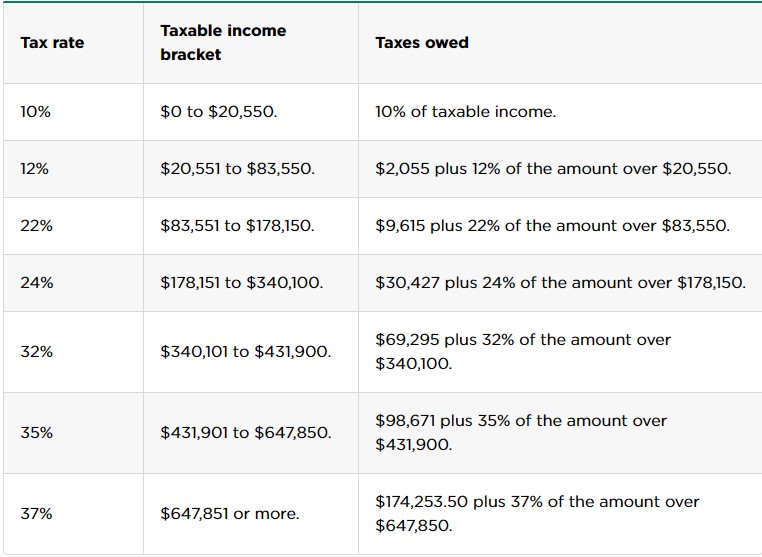

- How income tax works: I thought it might help to review how the American income tax system works. Below is a screenshot showing the federal tax brackets for a married couple filing together (California and many other states have their own additional tax brackets):

For example, if a married couple earned $200,000 of taxable income they would pay:

- 10% tax on the income between $0 to $20,550 ($2,055)

- Plus 12% tax on the income from $20,551 – $83,550 ($7,560)

- Plus 22% tax on the income from $83,551 – $178,150 ($20,812)

- Plus 24% tax on the income from $178,151 – $200,000 ($5,244)

- Total: $35,671

Their overall tax rate, AKA their “effective tax rate,” is 17.8% ($35,671 divided by $200,000).

401(k)

- The maximum annual 401(k) contribution increased this year to $22,500 (previously $20,500). If you plan on maxing out your 401(k) you may need to increase your savings rate.

- Those aged 50 and over can contribute up to $27,000.

- Employer matching to retirement plans can now be made to a Roth 401(k). Previously, employer contributions had to be made with pre-tax dollars. If directed to a Roth 401(k), contributions are taxable to the employee.

- Beginning in 2024, participants in retirement plans who are 50 or over and paid more than $145,000 will be required to make catch-up contributions on a Roth basis.

Required Minimum Distributions

The required minimum distribution age increased to 73 for those born between 1951 and 1959 and pushed back to 75 for those born in 1960 and later.

529 College Savings Accounts to Roth Conversion

Beginning in 2024, the SECURE Act 2.0 will allow a tax and penalty-free rollover from a 529 account to a Roth IRA account under certain conditions. This will allow money that was earmarked for educational purposes to be repurposed as retirement savings in the event those funds are not needed for education. The following requirements need to be met:

- The 529 plan must have been open for at least 15 years.

- The lifetime maximum rollover amount is $35,000.

- The rollovers would be subject to the Roth IRA annual contribution limits.

- No income limitation would apply.

Please contact us if you have questions about any of the topics above and their implications for your finances.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: Investments are not guaranteed and are subject to investment risk, including possible loss of the principal amount invested. Past performance is no guarantee of future results. All allocations and opinions expressed are as of the date of this presentation and subject to change. The information contained herein does not constitute investment advice or a solicitation. Information obtained from 3rd parties is believed to be accurate, but has not been independently verified.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.