Summary

- Markets continued to rally in March, with the S&P 500 marking its fifth consecutive month of positive returns.

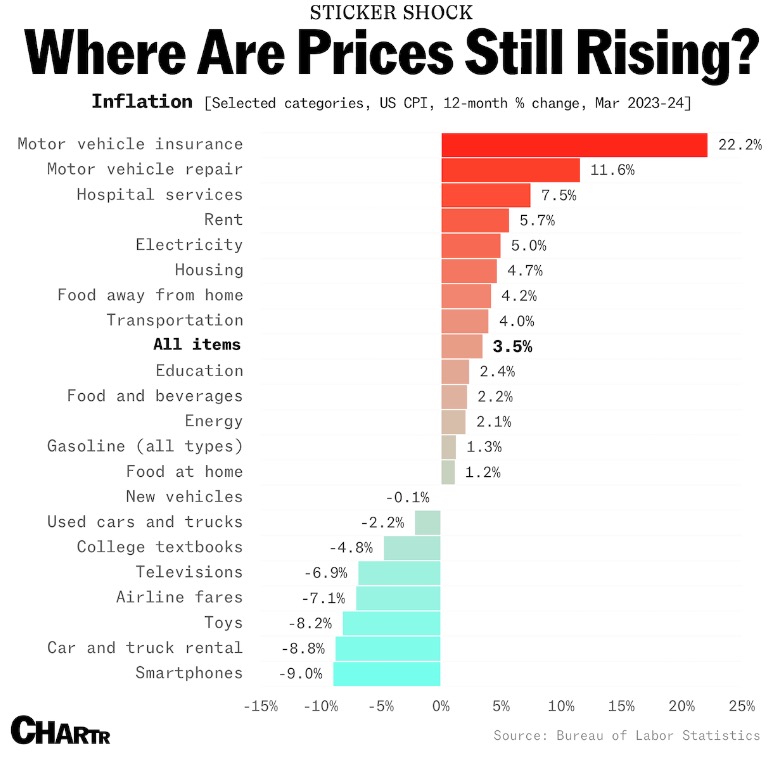

- Inflation remained higher than preferred, but overall continued in the right (downward) direction.

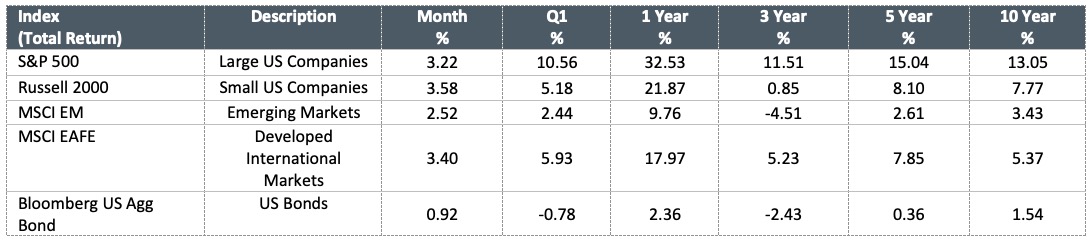

Market Returns

Market Overview

Stock markets performed well in March, building on prior strength.

For the quarter:

- US Stocks gained over 10%. The S&P 500 Index finished with the most record closes in a first quarter since the first three months of 1998, according to Dow Jones Market Data.

- Developed International Markets gained approximately 6%.

- Emerging Markets stocks lagged, but were still up 2.4%.

- Bonds were flat to slightly negative.

The Federal Reserve & Interest Rates

Expectations from The Federal Reserve indicate that while inflation will likely cool through the year, it may not decline be as quickly as previously anticipated. The Federal Reserve’s preferred inflation measure showed that prices rose as expected in February, putting a spotlight on whether price growth will decline enough to justify an interest rate cut by midyear.

The Federal Reserve left its key interest rate unchanged during the quarter and the Federal Open Market Committee (FOMC) maintained its outlook for three rate cuts in 2024.

Parting Thoughts

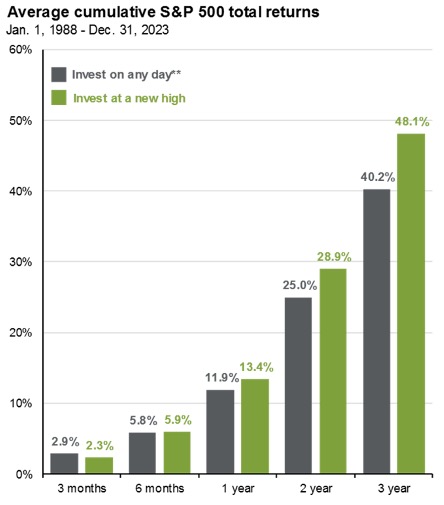

Many major indexes hit all-time highs during the quarter.

While all-time highs can often result in investors wondering if they have missed the gains of the market, and consider waiting for a pullback to invest further, the data shows that is unlikely to be a successful strategy.

In fact, according to J.P. Morgan, investors are just as well off – or sometimes better – by putting money to work on days that hit all-time highs vs other days.