There are two ways a stock can earn you money.

1. Capital Appreciation: This is the increase in share price. For example, when you hear about a stock being “up” a certain amount, that’s capital appreciation

2. Dividends: Many companies will pay their shareholders a percent of their profits as a dividend. For example, if you own $1,000 of a stock that pays a 2% dividend, you would receive $20 per year simply for being a shareholder. Think of it as the company saying “thank you” for being an investor.

But which one of these is more important?

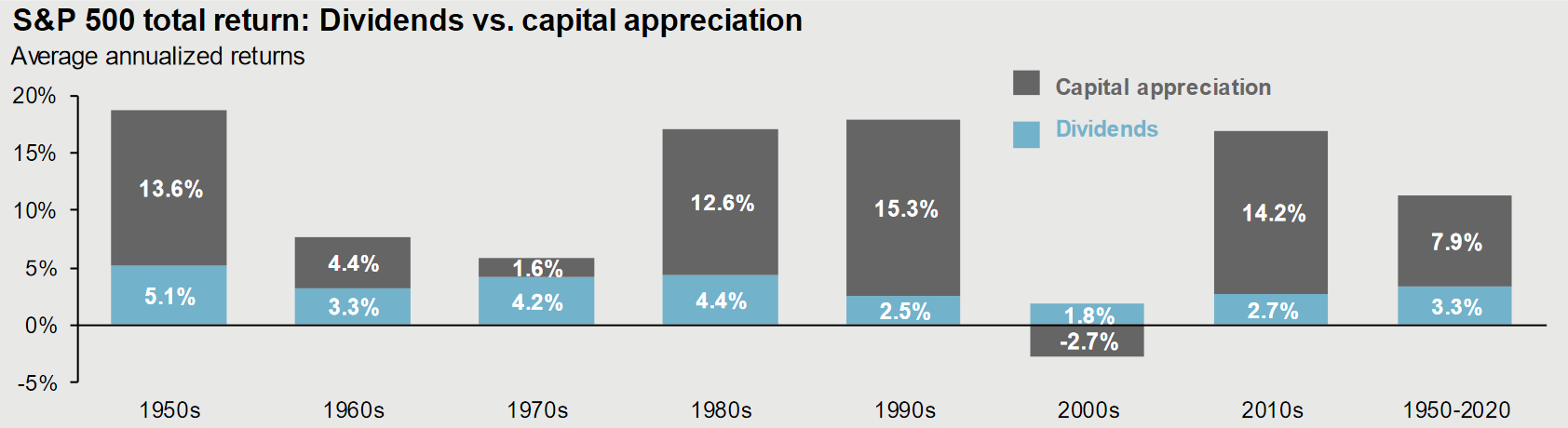

The chart below shows the S&P 500’s return per decade, breaking out the amount produced by capital appreciation and dividends:

Dividends were a positive contributor every decade. They accumulate over time and can be reinvested to earn more. Capital appreciation, on the other hand, was much more volatile. While there were some great decades for capital appreciation (e.g., 2010s, 1990s, 1980s, and 1950s) there were also decade-long droughts (e.g., 2000s, 1970s).

From 1950-2020, the “total return” (capital appreciation + dividends) from the S&P 500 was 11.2%. Dividends provided 3.3% of that return (~30%) and capital appreciation provided 7.9% (~70%).

Capital appreciation has driven the majority of the return, but dividends were helpful too, especially in the decades where capital appreciation was low or negative.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.