In most areas of life, the more you spend on a product the better it is. Take cars, for example: A $90,000 Tesla is undeniably nicer than a $30,000 Toyota.

Many people apply the same logic to investing: the more you pay for an investment manager, the better they must be.

But with investments, that rule does not apply. In fact, the funds that charge the most tend to perform the worst. (source)

Investing Choices

When choosing to invest you have two high-level options:

Actively Managed Funds: These rely on the skill and expertise of a team of investment professionals to choose which companies to own in order to generate superior returns (i.e., beat the market).

Actively managed funds cost ~1% per year (source), a fee known as the “expense ratio.” But, the thinking goes, the managers’ stock-picking skills will provide outperformance, thus justifying the cost.

Passively Managed Funds: Instead of trying to beat the index (for example, the S&P 500), these funds simply own all the stocks that make up the S&P 500, mirroring its performance.

Since no managers are employed to research which stocks to own, these funds cost less. The typical expense ratio is ~0.20% but can be as low as 0.02% (source)

What’s The Evidence?

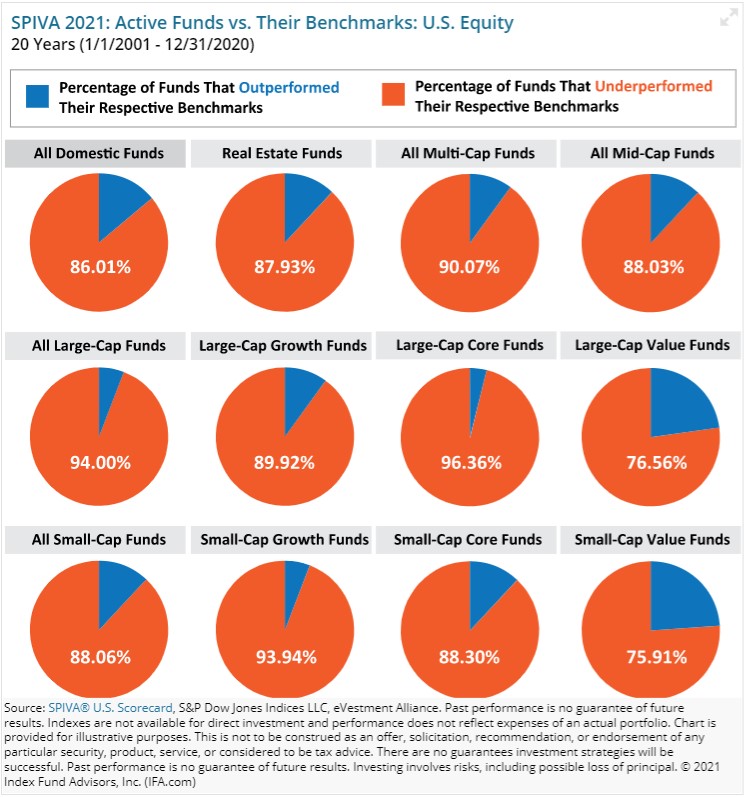

The vast majority of actively managed funds do not beat their benchmark:

Across the US, over the past 20 years 86% of active funds have failed to beat their benchmark. (source)

The same pattern is also evident within international stock markets and the bond market. (source)

What Should Investors Do?

Instead of picking funds that aim to outperform (but typically do not), investors should utilize passive funds. This advice is not only supported by empirical evidence but also many well-known investors:

- Warren Buffett, CEO, Berkshire Hathaway

- Jack Bogle, Founder, Vanguard

- Charles Schwab, Founder, Schwab

- Ray Dalio, Co-Chief Investment Officer, Bridgewater Associates (the largest hedge fund in the world)

- Eugene Fama, Nobel Prize Winner and Finance Professor at the University of Chicago

Purchasing an investment is not like buying a car.

“In investing, you get what you don’t pay for. Costs matter…intelligent investors will use low-cost index funds to build a diversified portfolio of stocks and bonds.”

– Jack Bogle

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.