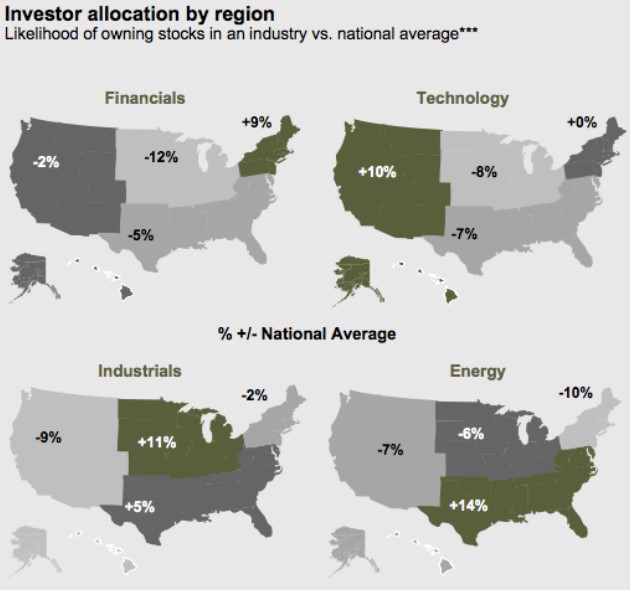

People invest in things they feel comfortable with. That’s why:

- Investors on the west coast are more likely to hold technology stocks

- Investors in the northeast are more likely to hold financial (i.e. bank) stocks

- Investors in the south more likely to hold energy (i.e. oil) stocks

- Investors in the midwest are more likely to hold industrial stocks

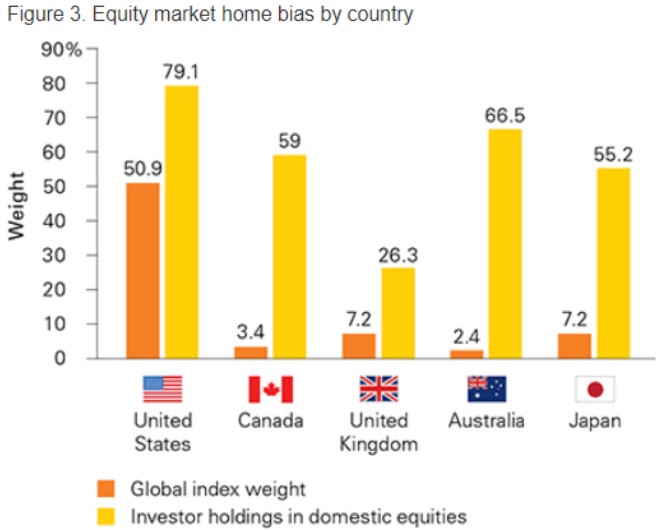

The same pattern emerges at the domestic level. US investors are more comfortable holding US-based stocks. This is called “home country bias,” and it means investors have a tendency to favor companies from their own country as compared to those from other countries.

This is not just a US-based bias. Investors across the world do the same thing:

The average American is ~80% exposed to the US, despite the American stock market being around half the global weight.

The average Canadian is ~60% exposed to the Canadian stock market, despite it being only 3% of the global weight.

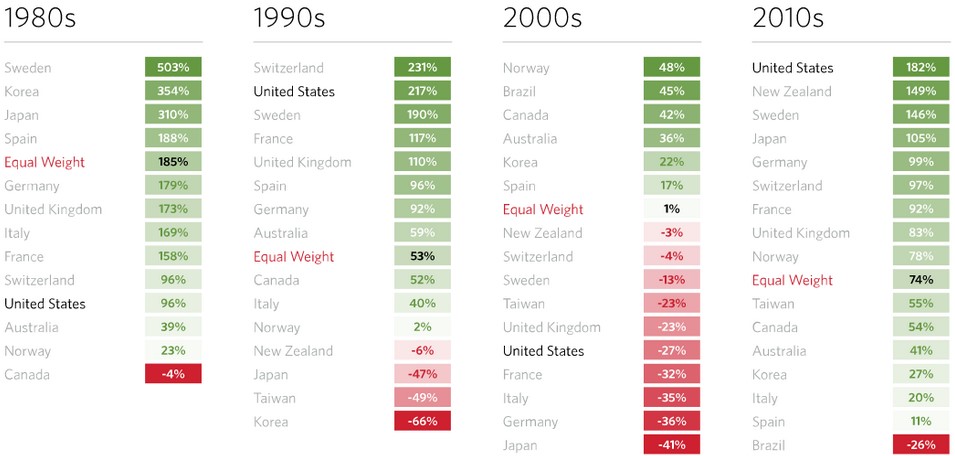

If you are a US-based investor who is overly concentrated in US stocks, this approach has turned out very well over the past decade:

But if you look back over the previous decades, it’s clear that the performance of each country ebbs and flows. Knowing that it’s impossible to predict which sector or stock market will perform the best, we diversify.

While it might feel more comfortable to invest locally, buying international companies provides exposure to great international businesses: Toyota, Nestle, Roche, and many more. In fact, there are about twice as many stocks listed internationally as there are in the US (source #1, source #2)

When setting up your portfolio, be mindful of home country bias, don’t concentrate too much of your investments in your domestic market, and diversify internationally.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.