Highlights

The fourth quarter of 2021 saw no shortage of concerning headlines, including the emergence of the omicron variant, political issues globally, and more persistent elevated inflation readings. On the positive side, employment conditions continue to improve, corporate earnings look strong and overall economic data continues to show strength. As long-term investors, we try to focus beyond the short-term headlines and instead recognize that markets have rewarded a patient and disciplined investment approach.

While short-term market results can be very random and will certainly not always coincide with our philosophy, this quarter the markets appeared to be looking past the short-term noise and focused on the longer-term trend of positive developments. The US stock market generated strong returns during the fourth quarter, contributing to an exceptionally strong 2021. International developed markets also appreciated for both the quarter and year, while emerging markets were down slightly for both periods.

Q4 Market Summary

Overall monetary policy remains accommodative while central banks appear focused on inflation trends and the potential economic impacts of the omicron variant as they chart their course forward. During the quarter, the Federal Reserve began tightening these conditions by slowing the pace of their asset purchase program, citing the continued strengthening of the economic and employment environment. Markets are pricing in expectations that the asset purchase program will be tapered down by March and that the Federal Reserve is likely to raise rates several times during the course of 2022.

Each quarter we provide transparency and seek to clearly communicate what is driving performance for portfolios. However, as long-term investors we believe it is important to note that any single period (especially a period as short as a quarter) can be skewed or limited in informational value and stress the importance of the longer-term perspective on portfolio positions.

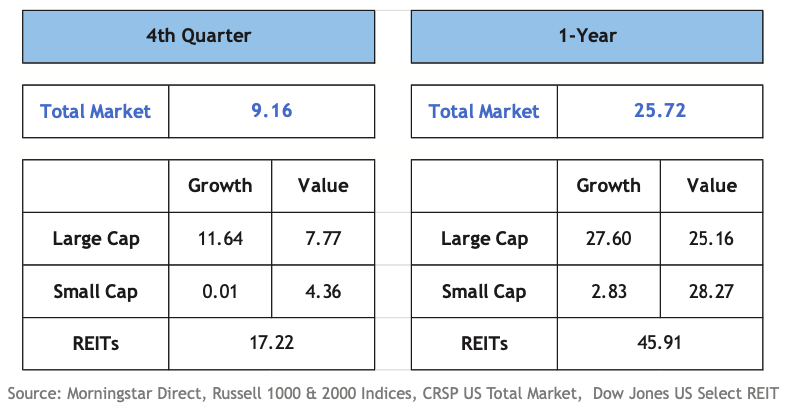

US Stocks

The US stock market experienced a strong fourth quarter, with nearly double digit returns for the broad market. This contributed to solid results for the entire year, with the market returning 25%. Among styles, large cap growth resumed the lead for the quarter resulting in more parity over the course of the entire year. For both the quarter and the past year, the largest difference among styles was seen in the large underperformance faced by small cap growth stocks. REITS performed well during the quarter and after several years of lagging have outpaced the broader market for the past year.

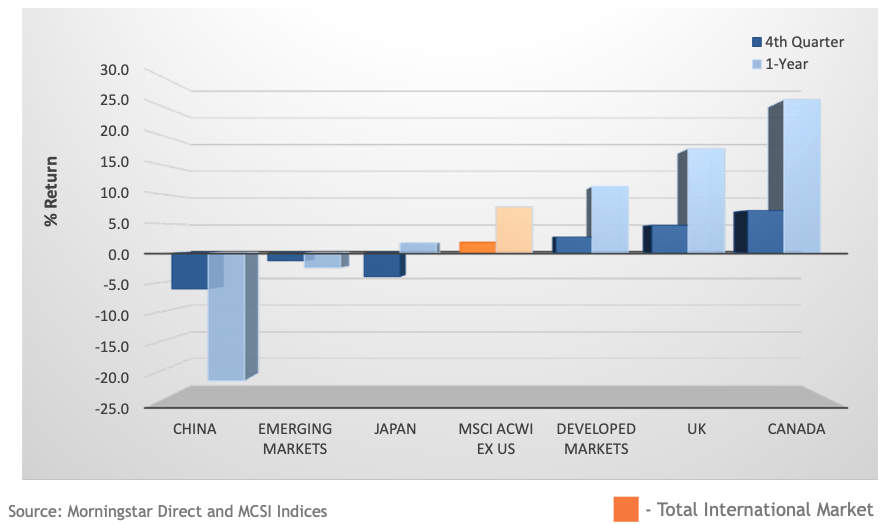

International Stocks

Internationally, developed markets also posted positive returns for the quarter and the year. Particular areas of strength included Canada and the UK. Emerging markets finished the year slightly down, which was driven in large part by weakness in China. Chinese stocks faced several challenges during the year, including regulatory changes, major financial issues in their property development sector, and more aggressive government policies in response to COVID than many other countries.

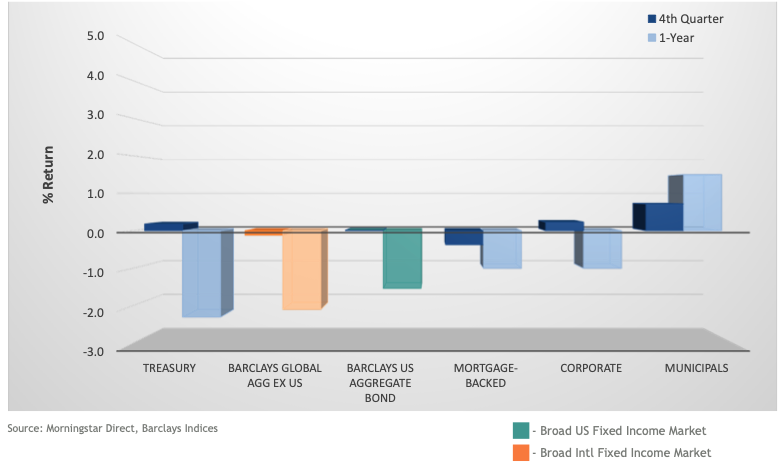

Fixed Income

Returns were effectively flat across the major fixed income sectors during the fourth quarter, with the exception of municipal bonds. Municipal bonds outperformed other sectors over the last year, driven in part by strong demand and a reduction in concern that the pandemic would impact the credit worthiness of some municipal issuers.

After a strong 2020, when the Barclays Aggregate Bond Index appreciated nearly 8%, 2021 saw interest rates broadly rise in anticipation of tighter monetary policy. This led to modest declines for bonds in the US (Barclays Aggregate: -1.5%) and internationally (Global Aggregate ex-US: -2.1%).

Parting Thoughts

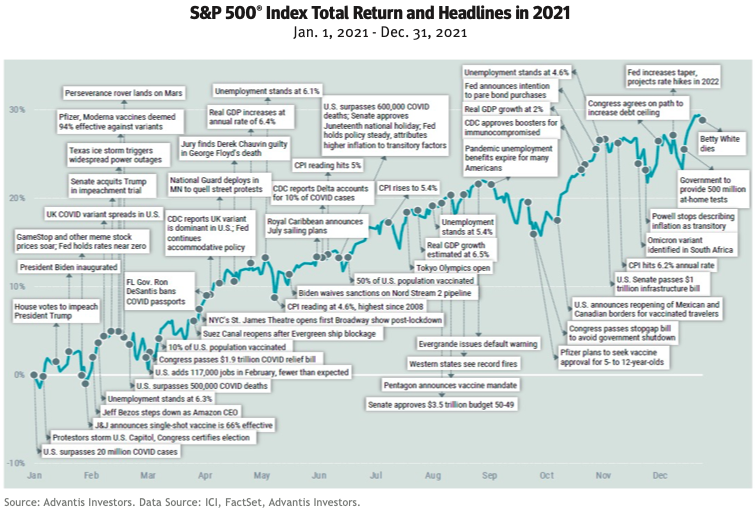

The above illustration, created by Avantis Investors, highlights a critical message we regularly discuss with investors. We have cited several similar charts over the years, often highlighting longer periods of time, but this one specifically focuses on 2021 and we felt it was appropriate for a year-end summary.

The chart shows many of the key headlines and issues that occurred throughout 2021, starting with the political unrest and impeachment vote that occurred back in January. Headlines throughout the year included the rise of the delta variant and the omicron variant. They include high unemployment readings and high inflation readings. Yet, there were many positive notes as well. Those include broad access to COVID-19 vaccinations and subsequent boosters for many, improved employment numbers and a world trying to get back to “normal.”

In many regards, it is a worthwhile exercise to reflect upon the past year and the many issues we have encountered, overcome, and learned from. A chart like this can help remind us of how far we have come.

We also think charts like this help us to see that making investment decisions based on current events or news is ultimately a futile effort. With the geopolitical unrest, constant uncertainty regarding COVID and all of the other headlines and issues we encountered in 2021, it would have been easy and seemingly justifiable to stay conservative. Believing that it would be better to wait it out until there is some clarity on these major issues. However, this illustration helps highlight the fact, as evidenced by the return pattern for the S&P 500, that the linkage between the market and the news cycle is essentially non-existent. Unfortunately, there never exists an “all-clear” signal for investors to rely on.

The market certainly can react to short-term news at times, but history has shown that following a disciplined investment plan and sticking to it through good times and bad has historically rewarded long-term investors. While the quarter-to-quarter and even year-to-year movements in the market are hugely unpredictable, the long-term compounding benefits of being invested is critical for investors seeking to reach their goals.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: Investments are not guaranteed and are subject to investment risk, including possible loss of the principal amount invested. Past performance is no guarantee of future results. All allocations and opinions expressed are as of the date of this presentation and subject to change. The information contained herein does not constitute investment advice or a solicitation. Information obtained from 3rd parties is believed to be accurate, but has not been independently verified.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.