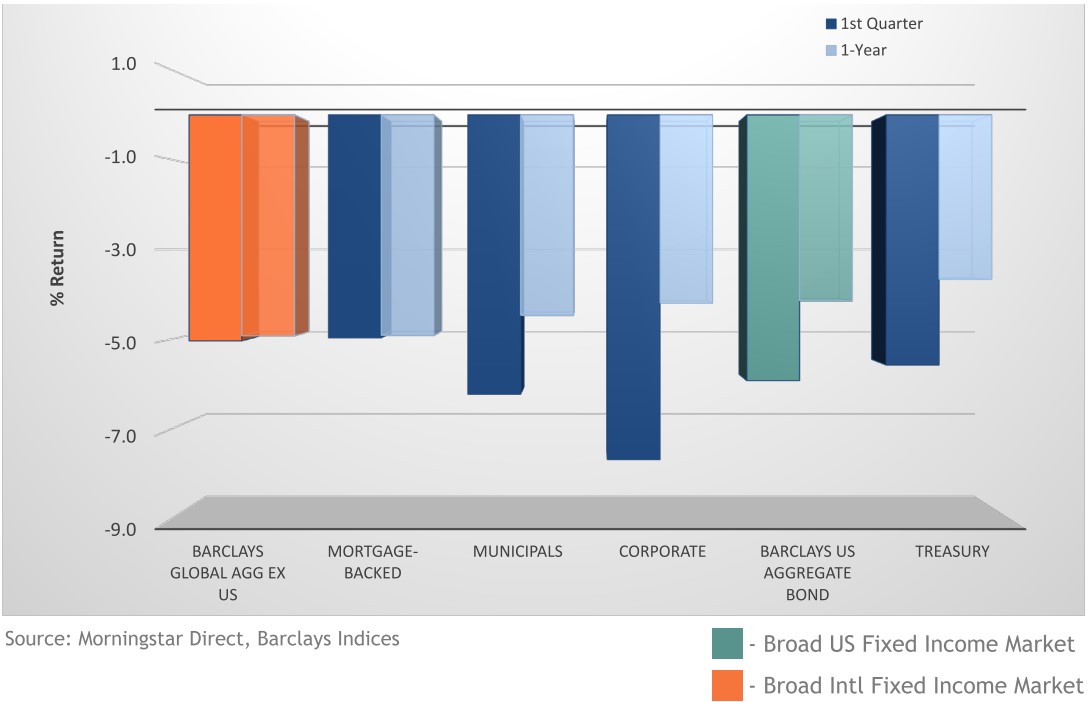

Q1 Investment Commentary Highlights

The biggest event during the first quarter of 2022 was the beginning of the war between Ukraine and Russia, which caused an increase in volatility across stock and bond markets. US and international stocks ended down for the quarter, as did US and international bonds.

Apart from the tragic humanitarian impact, the effects of the war exacerbated concerns over supply chain disruptions and higher inflation, which pushed interest rates higher. Against these inflationary pressures, and with employment and economic data continuing to strengthen, the Federal Reserve increased the federal funds rate for the first time since before the Coronavirus pandemic.

As seen by the meaningful change in interest rates during the quarter, investor expectations shifted quickly to now include more aggressive tightening of monetary policy than was anticipated coming into the year. Current expectations are that the Federal Reserve will continue to raise rates throughout the year in seeking to balance their goals of stable inflation and maximum employment.

Each quarter we provide transparency and seek to clearly communicate what is driving performance for portfolios. However, as long-term investors we believe it is important to note that any single period (especially a period as short as a quarter) can be skewed or limited in informational value and stress the importance of the longer-term perspective on portfolio positions.

US Stocks

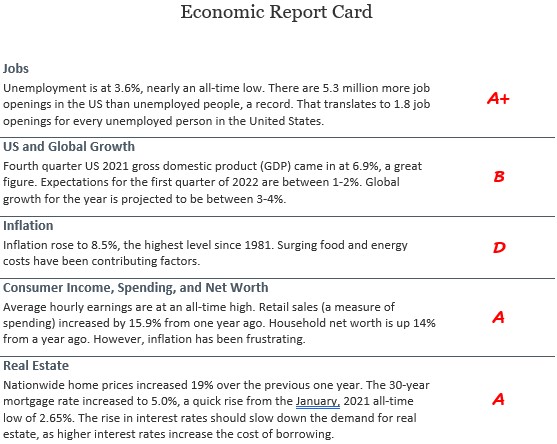

The US stock market declined during the quarter in reaction to these geopolitical events. The market was down by as much as 13% in early March before a strong rebound to finish the quarter. Among investment styles, growth-oriented stocks (including technology stocks) fared worse than the overall market. In addition, larger companies performed better than smaller companies.

After the strong results in 2021, the US market has appreciated 11.7% over the last calendar year, with real estate investment trusts (REITs) and large growth companies exhibiting the best results.

International Stocks

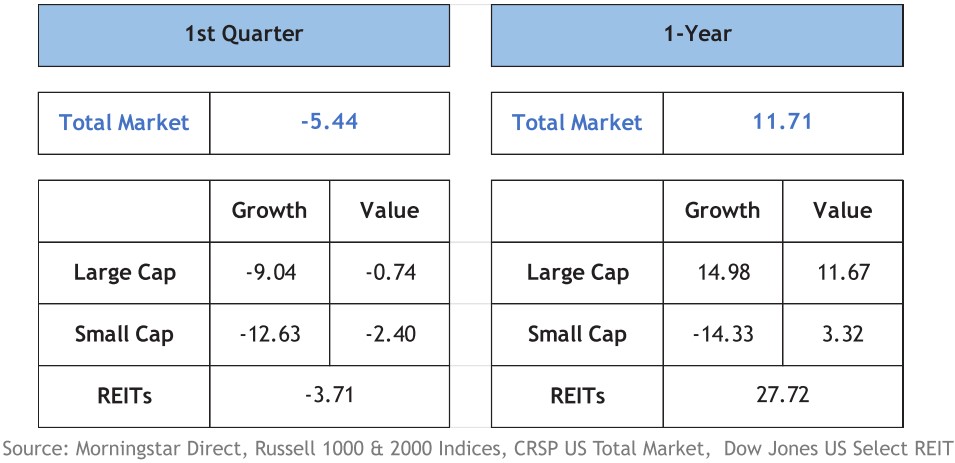

International developed markets finished the quarter down roughly in line with US markets (-5.9%), while emerging market stocks trailed slightly (-7.0%). Results by country varied greatly, as the current events positively impacted some and hurt others. For example, many net-exporting emerging markets countries gained on commodity price increases. Canada also benefited due to its exposure within the financial, energy, and material sectors.

In aggregate, international stocks have trailed the US markets over the last year, with developed markets returning 1.2% and emerging markets declining -11.4%.

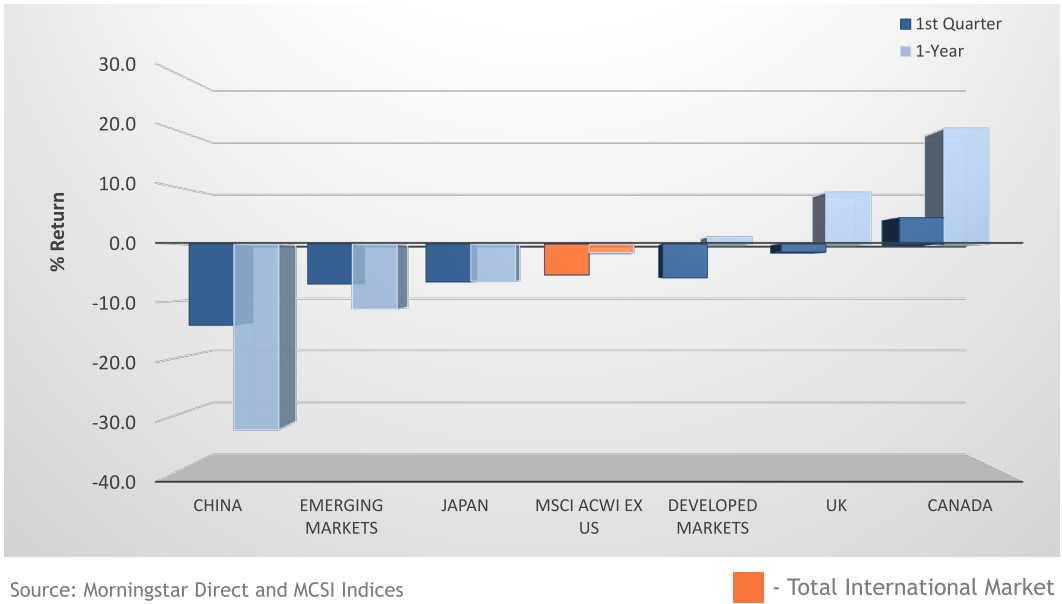

Bonds

Bonds declined during the quarter, reflecting a repricing of expectations for interest rates. Coming into the year, the expectations were for a gradual interest rate increase by the Federal Reserve (and other central banks around the world). However, due to many factors in the first quarter, such as the inflation readings, added pressures from the war in Ukraine, and strengthening employment and economic data, the markets priced in more aggressive interest rate hikes.

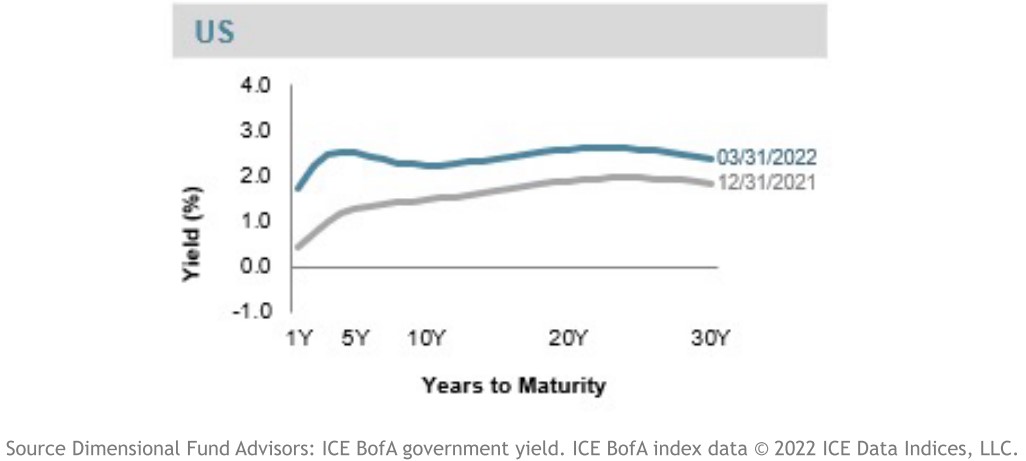

As shown below, the yield curve shifted higher over all maturities during the quarter, with shorter maturities (which are more closely tied to central bank actions) rising the most in anticipation of more and faster increases than previously expected. As bond prices move inversely to interest rates, the negative performance of fixed income investments reflected these changes in expectations.

Predicting short-term interest rate movements is as futile as predicting short-term stock market returns. We believe that markets are very efficient at pricing in new information and that the current levels broadly reflect the new most likely path forward.

Parting Thoughts

Fixed Income In Perspective

This quarter was bad for fixed income, or bond, investments. As new information came to light, markets adjusted rapidly to reflect the new reality and anticipated path forward related to interest rates. In order to stave off sustained inflation threats, central banks will have to move more aggressively to tighten monetary conditions (e.g., increase interest rates) faster than previously anticipated.

As noted earlier, while we don’t believe we can predict short-term fixed income market movements any more than we can predict equity market results, our view based on our research and conversations with many asset managers indicate that this resetting of expectations is now mostly, if not fully, priced into the markets.

At this point, it’s important to revisit why we hold fixed income in portfolios to begin with. We believe there are three primary roles:

- Capital Preservation

- Diversification (in particular, against equity risks)

- Generate Returns and Income

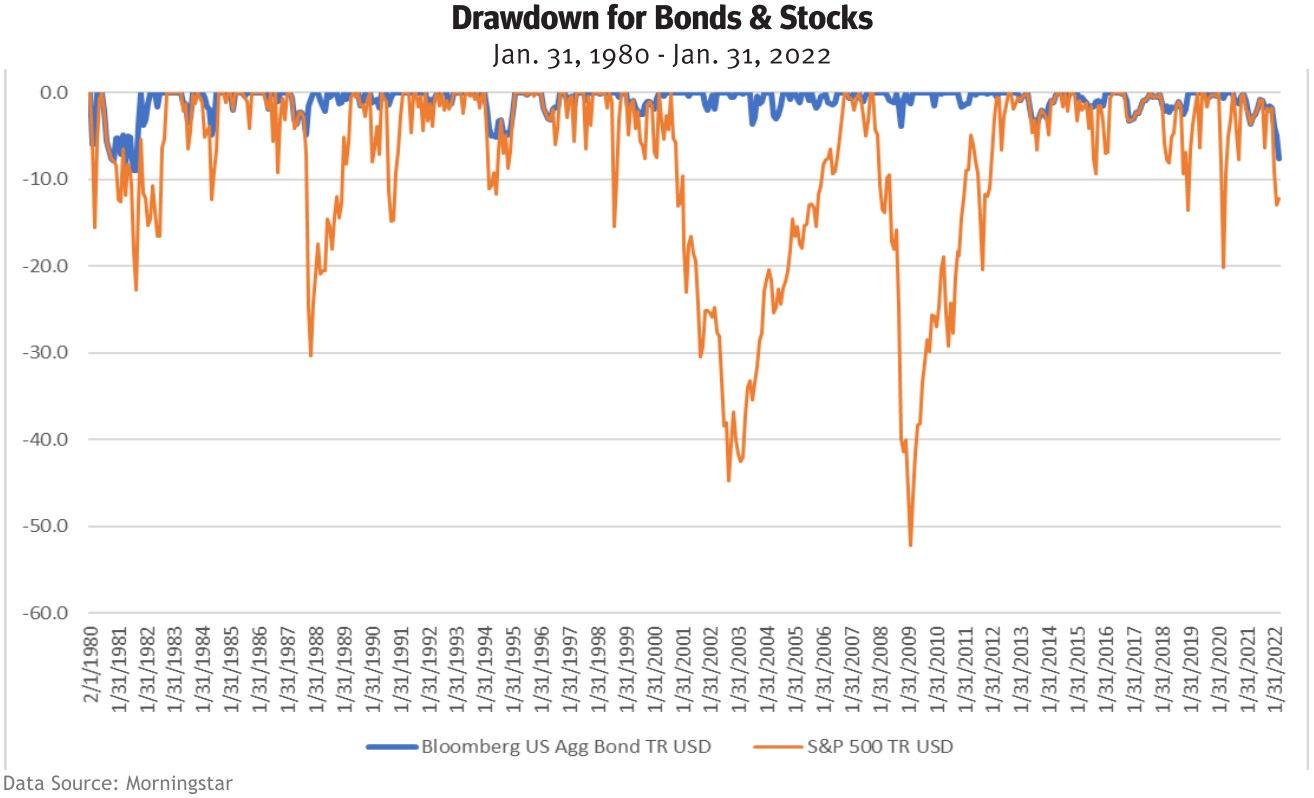

Capital Preservation. While the current decline in bonds is meaningful, it pales in comparison to the downside potential of risk assets, like stocks. As an example, the below chart shows historical drawdowns (e.g., decline) for stocks and bonds. While bonds are not immune to periodic drawdowns, over time they have performed as the ballast we expect.

Diversification. Bonds often shine brightest during times of economic difficulty, such as recessions or market crises like the Global Financial Crisis or the Covid Pandemic decline in 2020.

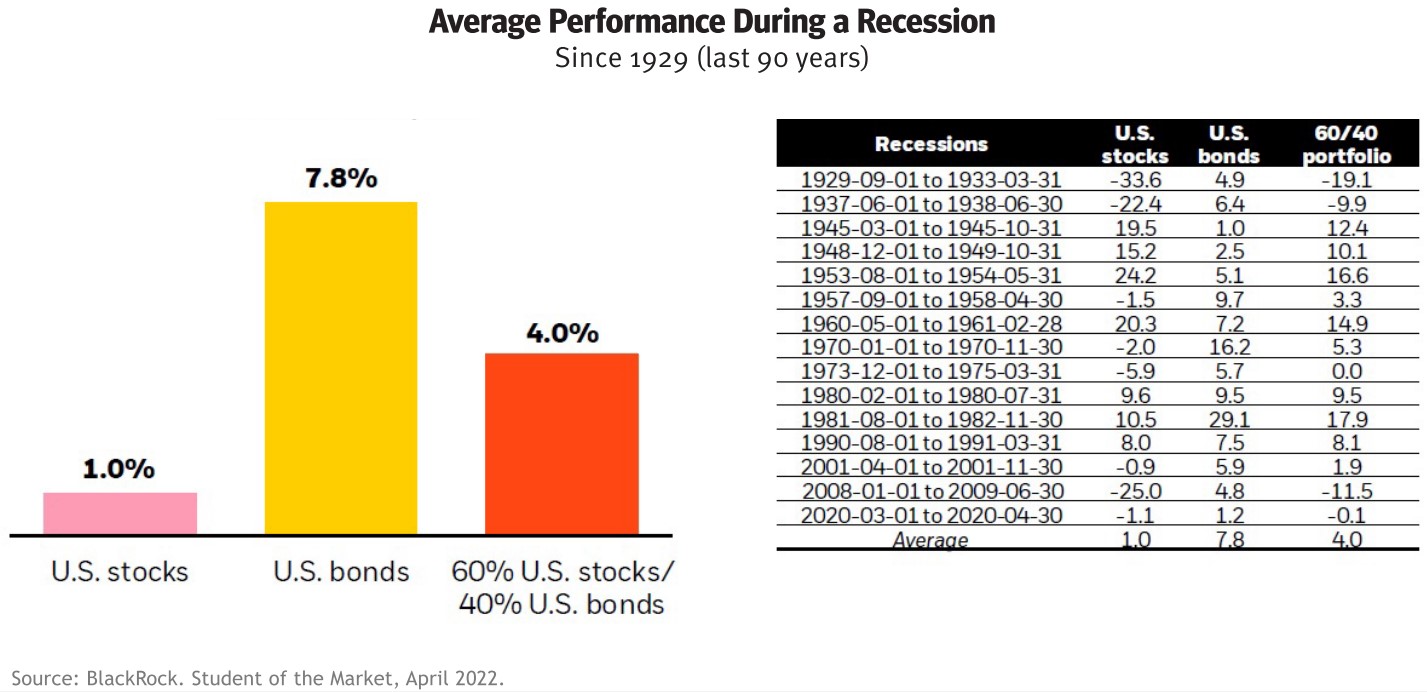

The illustration below highlights the performance of stocks and bonds during recessionary periods going back to the great depression. On average, bonds have held up better and offset weakness inequity holdings during these periods and have generated positive returns in every period.

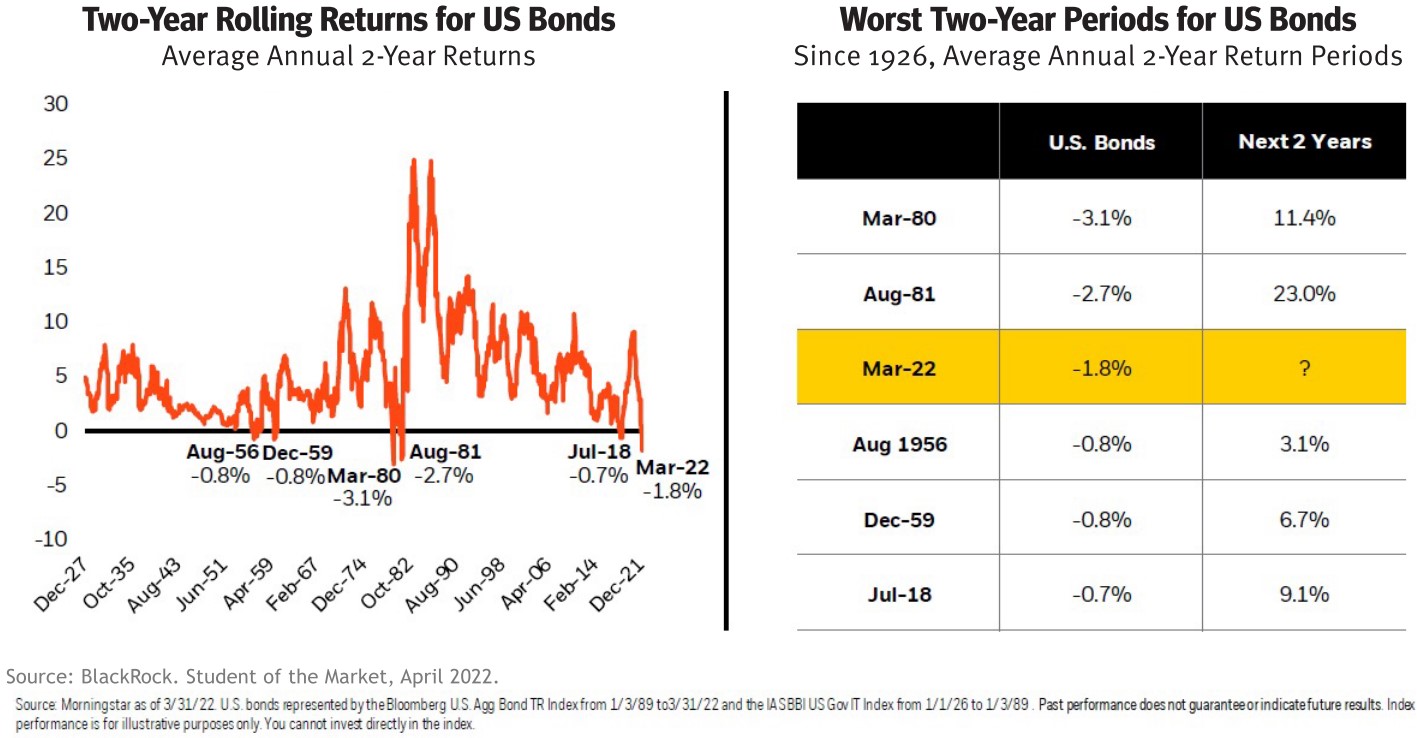

Generate Returns and Income. As shown in the illustration below, bonds have historically generated positive returns over the vast majority of 2-year periods. While the current period ranks among the worst historical periods for bonds, much like equities, periods of poor performance are often followed by better results.

One benefit of the increase in rates is that coupon payments and proceeds from maturing bonds can be reinvested at the new higher rates. This increases the expected returns of bonds going forward.

While the recent short-term bonds results have been a letdown, the long-term fundamental benefits from allocating to bonds in a diversified portfolio remain in place.

To read more about the bond market’s first quarter results and outlook, I highly suggest the following article from Schwab’s Chief Fixed Income Strategist, Kathy Jones. At Last – Income in the Fixed Income Market.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: Investments are not guaranteed and are subject to investment risk, including possible loss of the principal amount invested. Past performance is no guarantee of future results. All allocations and opinions expressed are as of the date of this presentation and subject to change. The information contained herein does not constitute investment advice or a solicitation. Information obtained from 3rd parties is believed to be accurate, but has not been independently verified.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.