Investment returns during the first quarter were positive across the board: stocks and bonds, both domestically and abroad, were all up.

Q1 Investment Commentary – Overview

- Q1 Economic Overview

- The Value of Diversification

- Labor Market Update

- Inflation Trending Down

- Q1 Stock & Bond Performance

- Looking Ahead – Encouraging News on Inflation

Q1 Economic Overview

The first quarter gains occurred despite turmoil in the banking sector. With both the failure of Silicon Valley Bank and the collapse of Credit Suisse, it’s understandable that many were pessimistic and/or worried.

These events are a great reminder for why diversification is critical. Below is a screenshot showing the performance of Silicon Valley bank’s stock (in red) versus a diversified US benchmark, the S&P 500 (in blue):

At times, SVB stock was outperforming the US benchmark by more than 4x. Silicon Valley Bank employees receiving company stock must have been happy with these results, but unfortunately anyone that did not sell before the quick collapse lost all their money.

This is why diversification is the #1 rule in investing. It is also a good reminder to reassess how much of your own company stock you are comfortable holding.

Elsewhere in the economy, the labor market remained tight: The US added more than one million jobs, and the unemployment rate remains low at 3.5%:

In other good news, the biggest economic headwind from 2022, inflation, has also been trending down:

5% inflation is higher than we’d like – the target is 2% – but the downward trend is encouraging (more on that at the end of this article). This trend is also occurring around the world.

Taken together, these positive indicators point to momentum in the economy.

US Stocks

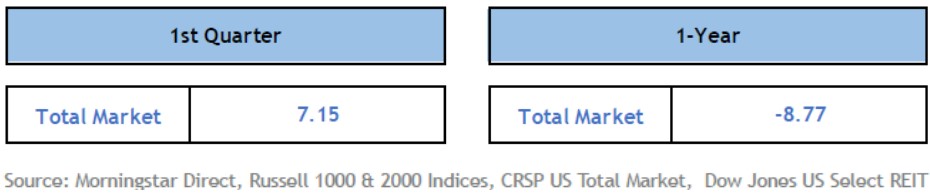

The US stock market returned 7.15% in Q1.

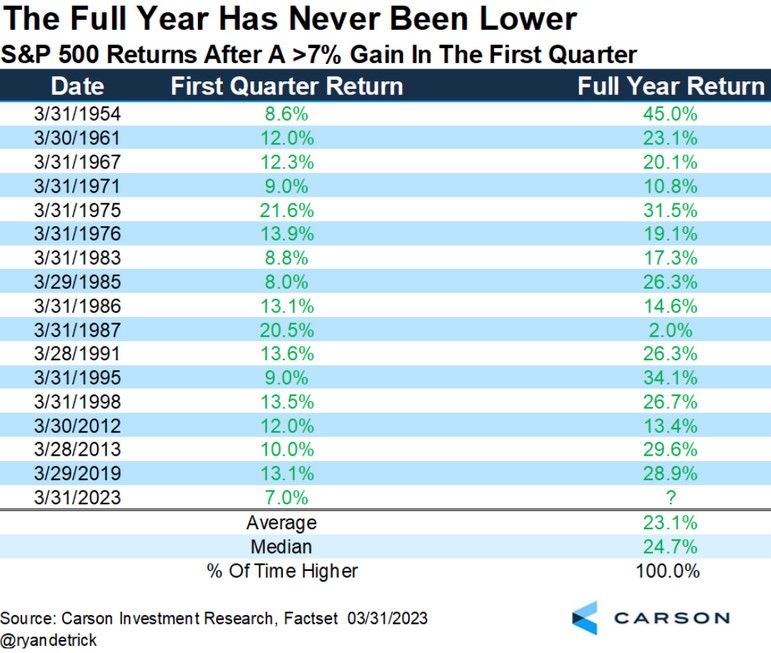

One interesting data point: When the S&P 500 has gained 7% or more during the first quarter (which has happened 16 times since WWII), the year has never been negative:

International Stocks

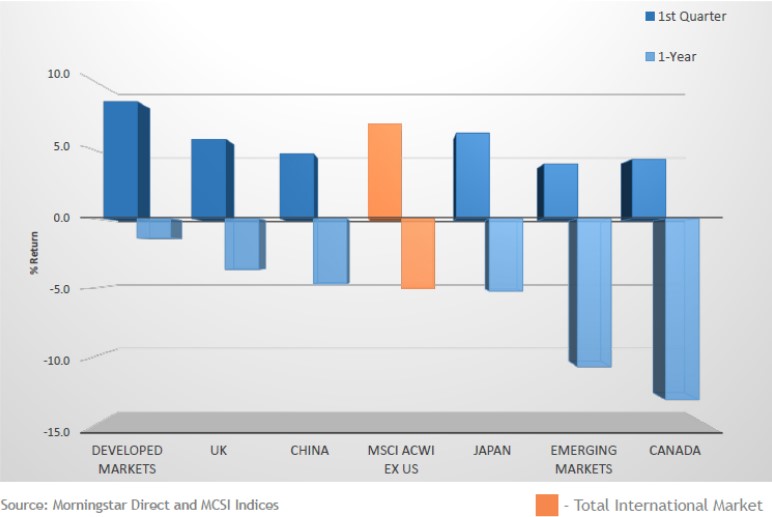

Developed International stocks (countries like Canada, Germany, and Japan) outperformed the US market, up 8.5%.

Emerging Markets (countries like Brazil, India, and Mexico) were up 4%:

If you go back to September 1st, 2022, Developed International stocks are up even more: 28% versus America’s 15%. This is another reminder on the benefit of diversification.

Bonds

Positive returns were seen across nearly all bond categories. US and international bonds both appreciated roughly 3%.

Looking Ahead – Encouraging News on Inflation

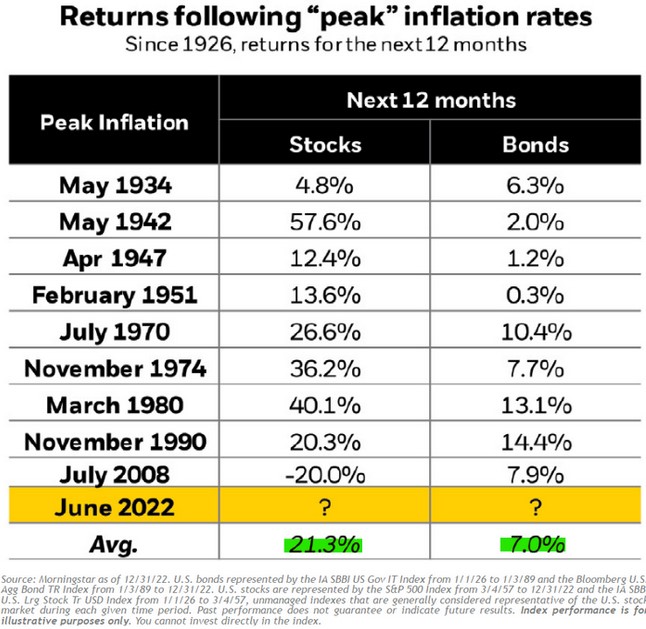

The illustration below shows that returns for stocks and bonds tend to be quite strong after inflation has peaked.

It appears that the US hit that peak back in June of 2022. Since then, the US Stock Market is up about 10% and Bonds are roughly flat:

The message here is about the forward-looking nature of markets. Positive returns tend to arrive well in advance of the data hitting the desired levels.

As always, please reach out if you have any questions or would like to connect.