Investment returns during the second quarter were good once again. This marks the third straight quarter of positive returns for US and International stocks.

Second Quarter Investment Commentary – Overview

- Economic Overview

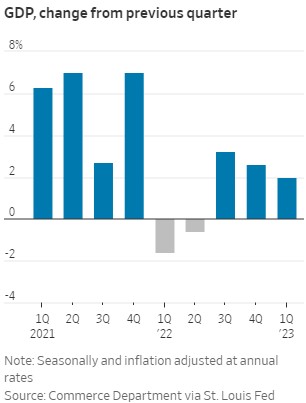

- Gross Domestic Product (GDP) Revised Higher

- Inflation Continues to Trend Down

- Unemployment Rate Remains Low

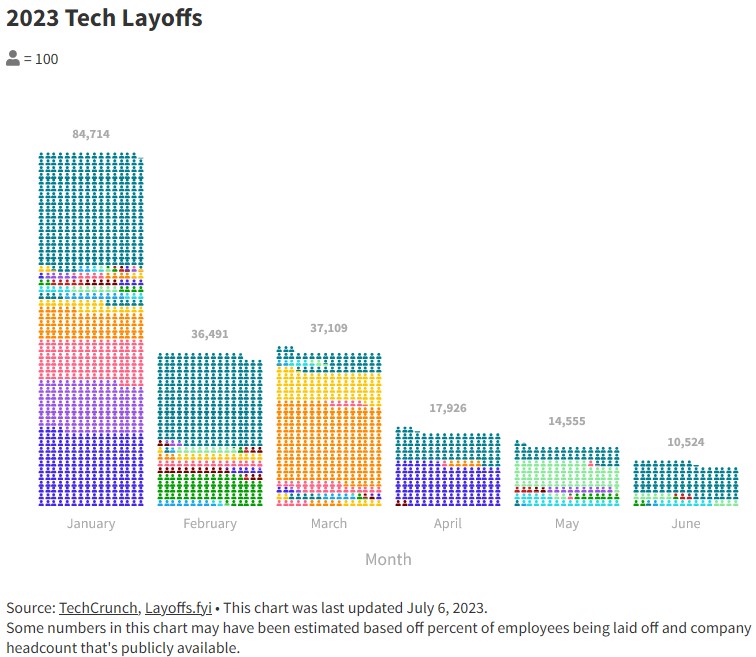

- Tech Layoffs Lessen

- US & International Stock & Bond Performance

- Looking Ahead – Low Volatility This Year

Economic Overview

At the end of last year, many economists forecast a recession in 2023. In fact, 63% of economists surveyed by The Wall Street Journal believe one would happen.

While there is still plenty of time left this year, those predictions seem unlikely, as the US and global economy have done very well:

- US gross domestic product grew at a 2% in Q1 (revised up from 1.3%) (source)

- Inflation has declined 12 consecutive months, from a peak of 9% in June, 2022, to 3% in June, 2023.

- Unemployment remains low, at 3.6%, down from a high of 14.7% during the pandemic.

- Layoffs in tech are on the decline.

Economic risks remain, of course, but investors who stuck with – or added to – their portfolios have been rewarded.

US Stocks

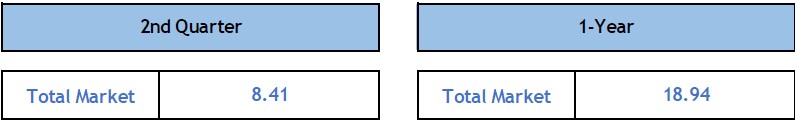

US stocks rose 8.4% during the second quarter, and are up nearly 19% over the past year:

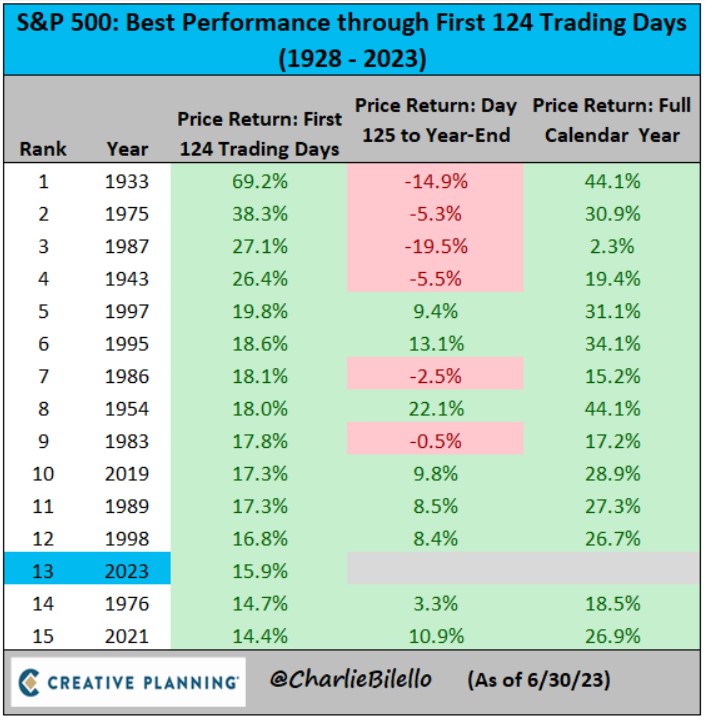

Looking at the S&P 500 (the largest 500 stocks in the US), that index had the 13th best start to a calendar year on record (source):

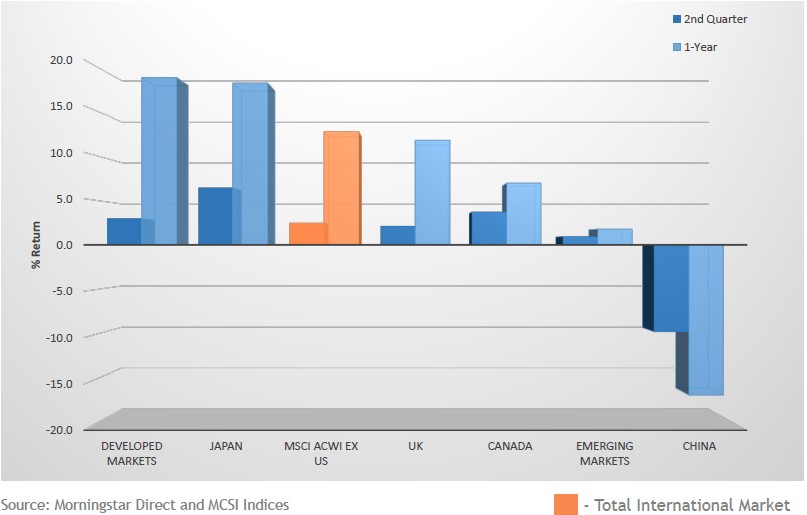

International Stocks

International stocks were up during the quarter, but not as much as the US market.

Over the past year, returns for developed international stocks (countries like Canada, Germany, and Japan) and US stocks have been virtually identical.

Emerging Markets (countries like Brazil, India, and Mexico), weighed heavily by weakness in Chinese stocks, were modestly positive over the quarter and year.

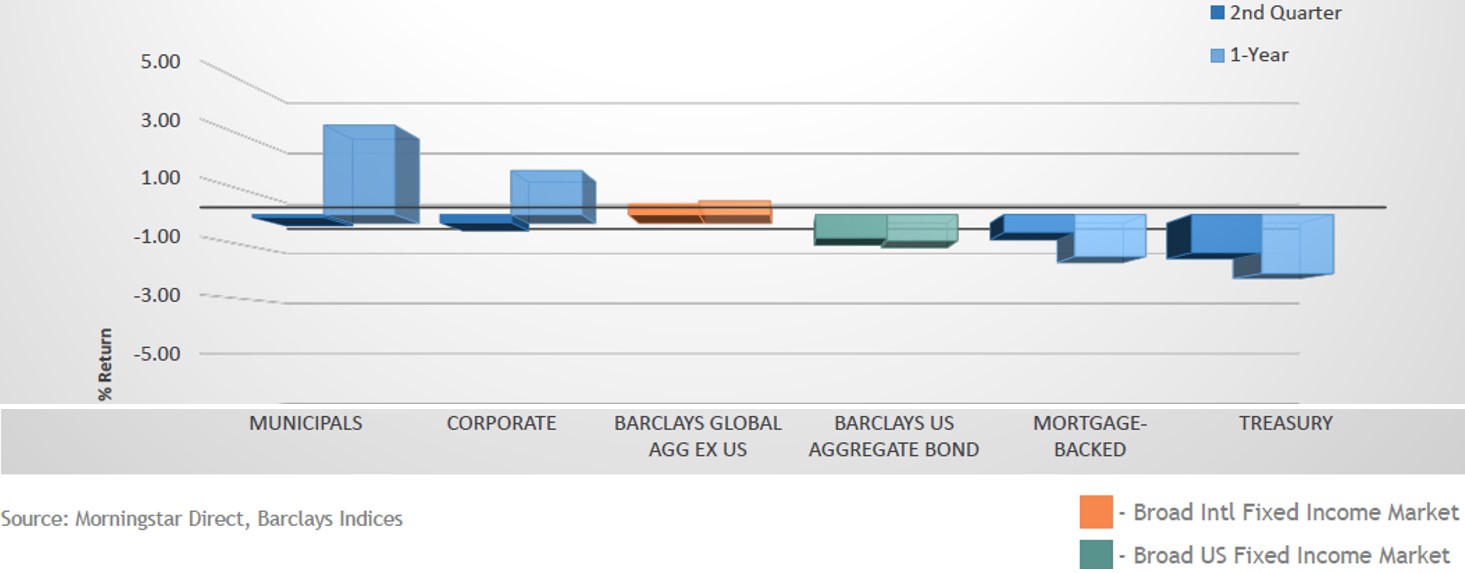

Bonds

The bond markets were flat to modestly negative for the quarter.

The US bond index, the Bloomberg Barclays Aggregate Bond Index, was down just under 1%.

Overseas, international bonds eked out a small gain.

For investors holding municipal bonds, those have been one of the strongest sectors over the last year.

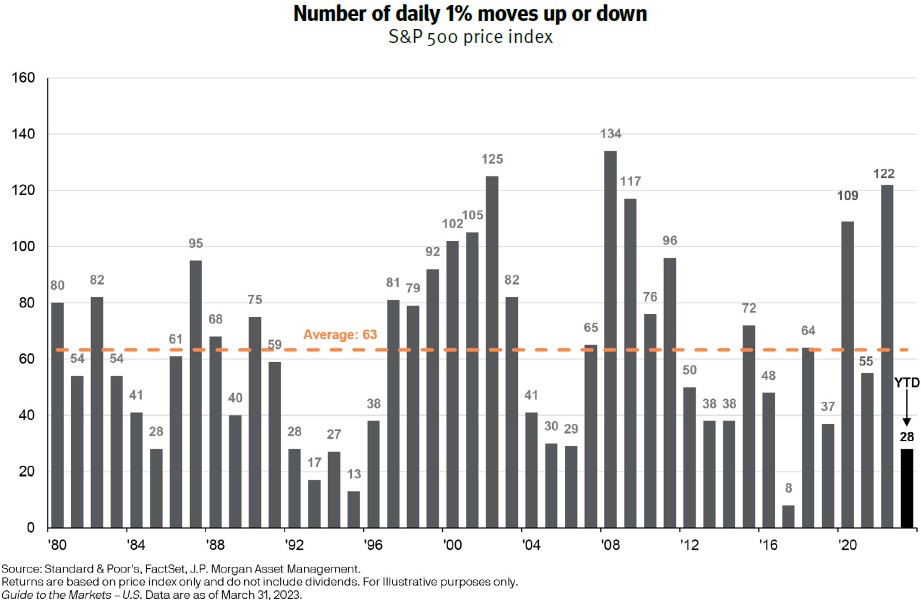

Looking In The Rear View – Low Volatility in 2023

Despite major geopolitical headlines, bank failures, debt ceiling tensions and more throughout this year, if you feel like things have settled down a little bit and volatility has declined, you’d be right.

The illustration below shows how many days the S&P 500 has moved up or down more than 1% each year:

We’re on pace to experience less than half of the number of big daily moves that occurred last year.

Given that we have roughly 250 trading days in a year, in 2022 the market moved by more than 1% nearly every other day.

As always, please reach out if you have any questions or would like to connect.