The fourth quarter ended on a good note, with stocks and bonds posting positive returns. After negative returns in the first three quarters of the year, this was a welcome change and may indicate an improved investing landscape in 2023.

But before looking ahead, we’ll review some of the investing challenges in 2022 and then see how how stocks and bonds performed throughout the quarter and year.

Investing In 2022 – Overview

- Double-digit losses in stocks and bonds

- The highest inflation in four decades, including record high gas prices

- War in Ukraine

- A historic interest rate increase by the Federal Reserve

- Slowing housing activity

Investing in 2022 – Deeper Dive

The biggest economic event from last year was inflation. The sustained rise in inflation resulted from a few factors coming together to create a perfect storm: First, supply chain issues were caused by the pandemic. Then, also as a result of the pandemic, trillions of dollars were provided to many Americans. And lastly, many recipients of those stimulus checks felt like spending after being subject to lockdowns during the pandemic. When more people spend more money while the supply chain is broken, inflation results.

In response, the Federal Reserve felt it was necessary to raise interest rates. The idea was that this would slow economic activity (such as borrowing), which would cool the economy and allow inflation to die down. They raised the Federal Funds rate (the core driver of interest rates used by the Federal Reserve) from 0.07% at the beginning of 2022 to 4.33% by the end.

This quick rise in interest rates negatively affected certain areas of the economy much more than others, notably technology. Many tech companies don’t earn a profit, and that was more accepted by investors when interest rates were low. But when interest rates are high, the interest you can earn on cash is also higher. That means companies that produce profits (i.e. cash) now become more valuable, whereas money-losing companies (that aim for profits in the future) less valuable. This is what led to the stock decline of companies like Wayfair (-83%), Roku (-82%), and Twilio (-81%), among many others.

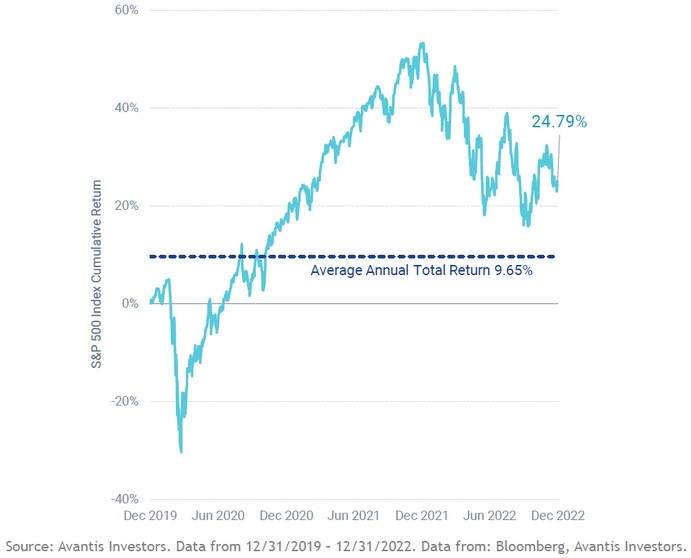

As tough as this year was, when it comes to investing one year is short. If we zoom out and think back 3 years, we see that an investor who held the S&P 500 is up approximately 25%. This, of course, is just one asset class, but most globally diversified portfolios were positive over the past 3 years.

It was a very volatile year, but one that also reminds us of a couple core investing concepts:

- Investing for the long term is the only way to go. The longer your holding period, the higher the chance of earning a positive return.

- Diversification is the #1 rule in investing. In 2022 we saw many individual companies have a steep decline in stock price.

US Stocks

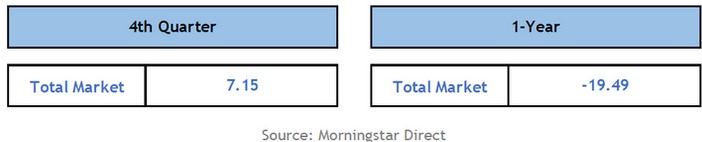

The US stock market gained roughly 7% during the fourth quarter, coming off the lows in September. It finished the year down 19%.

While nobody is happy to be down 19%, that number doesn’t quite tell the full story. Here are a few highlights to show what went on beneath the surface in 2022:

- Energy was the only positive sector in the S&P 500, up 54%

- The Technology sector was down 29%

- The “Consumer Discretionary” sector was the worst performing sector, down 38%. This includes companies like Amazon (-50%), Home Depot (-21%), Tesla (-73%), Nike (-27%), and McDonald’s (+1%)

- Commodities (such as oil, wheat, and corn) were the best performing asset class, up 17%, followed by cash (+1.4%)

- Real estate investment trusts (REITs) were the worst performing asset class, down 26%

- Small- and medium-sized US companies declined less than large companies (that make up the S&P 500). “Small Cap” companies declined 16% and “mid cap” companies declined 13%

International Stocks

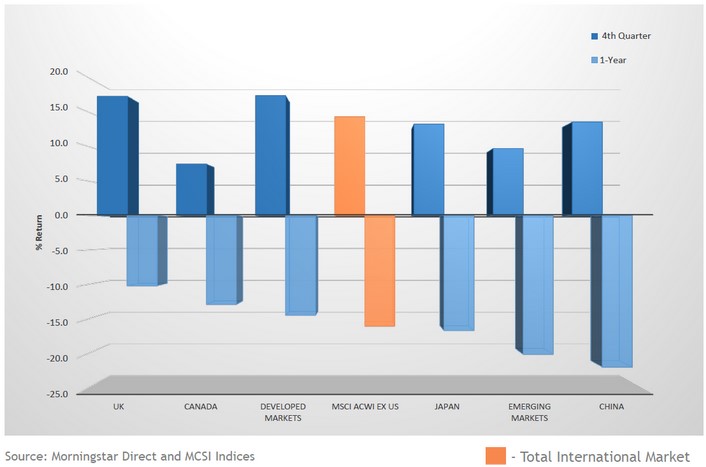

Developed international markets (such as countries like Canada, Germany, and Japan) gained 17% for the quarter, and outperformed the US stock market for the year (-14%). This marks the first year since 2017 that international stocks outperformed US stocks on a relative basis.

Emerging markets (such as countries like India and Mexico), also rebounded in the fourth quarter (+9.7%), trailed developed international markets for the year (-20%).

Bonds

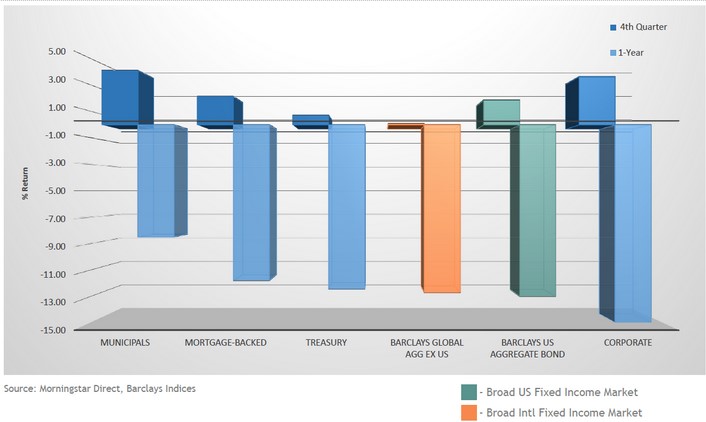

Bonds across the board were positive for the quarter. For clients investing in our tax-sensitive portfolios (that utilize municipal bonds), those holdings outperformed other areas of the market.

The decline in bonds was exceedingly painful this year. Typically, bonds act as the buffer when stocks decline. But when interest rates rise, the price of outstanding bonds decline. And since interest rates rose so much (and so unexpectedly), bond prices suffered their biggest decline on record.

The silver lining is that a) the worst should be behind us, and b) the new interest rates paid by bonds is much higher than before. Bonds are paying approximately 4%, as compared to about 1% in January of 2022.

This should also be true for your bank account. If your cash is held at a competitive financial institution, you should be earning about 3% on your cash.

Looking Ahead and Parting Thoughts

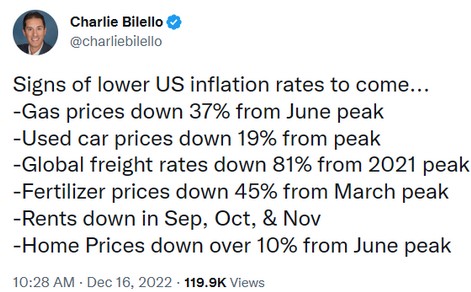

As for looking forward, there are a couple of green shoots. The first pertains to inflation, which seems to be trending lower (source):

The official inflation rate in America is 6.5%. That’s higher than usual – the target is 2% – but six months ago it was 9.1% (source). As a result of the slowdown, the Federal Reserve is expected to decrease the pace of their interest rate increases this year, which many consider to be an encouraging sign.

In addition, the labor market remains strong, with “the highest job shortages in the post-war era, the lowest ‘job fill’ rate, the largest premium for job switchers vs job remainers. (source)” But again, we see that the technology sector is in focus, as there were more than 90,000 layoffs of tech-sector employees in 2022 (source).

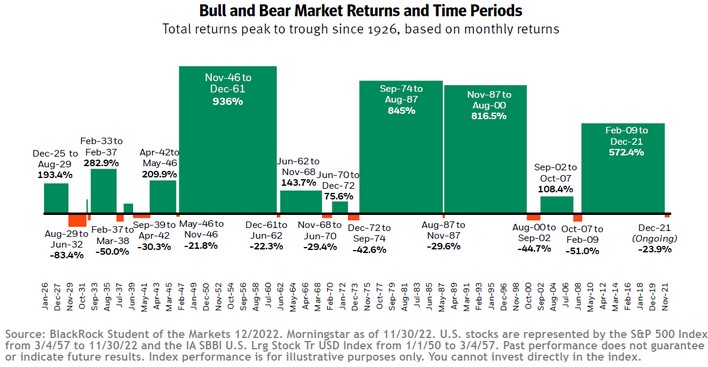

Bear markets (declines of 20% or more) come with the territory of investing in stocks. Over time they’ve provided a nice return, but risk and return go hand-in-hand.

For long-term investors, it’s important to recognize that declines like we saw in 2022 are never pleasant, but historically they have been relatively short lived. According to Forbes, the average bear market lasts less than a year.

When combined with the nearly constant flow of negative news, it can feel like there is no hope or light at the end of the tunnel. The below illustration provides some helpful perspective, as it illustrates the dramatic difference in the length of bull and bear markets:

Bear markets tend to be quick, but painful. Taken as a whole, the message to be gleaned is that there is light at the end of the tunnel, and it often comes faster than investors expect.

As always, please reach out if you have any questions or would like to connect. Here’s to a positive (pun intended) 2023!

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: Investments are not guaranteed and are subject to investment risk, including possible loss of the principal amount invested. Past performance is no guarantee of future results. All allocations and opinions expressed are as of the date of this presentation and subject to change. The information contained herein does not constitute investment advice or a solicitation. Information obtained from 3rd parties is believed to be accurate, but has not been independently verified.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.