In 2023, the economy, stock market, and bond market all performed well.

This was a very different year than 2022, which had negative stock returns, bond returns, and high inflation. Many economists predicted those bad times would continue, with a recession in 2023.

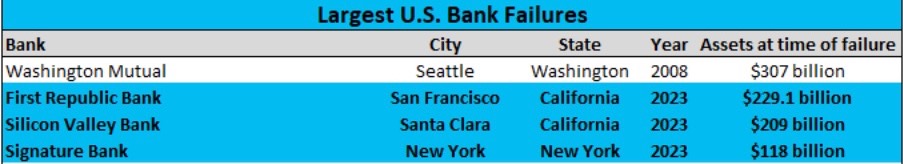

Luckily, that did not happen. The year did get off to a rough start, with three big bank failures: Silicon Valley Bank, First Republic, and Signature Bank. These were three of the largest bank failure in US history:

What also served as a headwind was the Federal Reserve raising interest rates. They did so four times in 2023 in order to mitigate the risk of further inflation.

Largely as a result of a declining inflation, resilient consumer demand, and a competitive labor market, no recession occurred. As we’ve seen before, investors who remained disciplined were rewarded with favorable returns.

Tech of the Year: AI

A notable theme of the year was AI, which was highlighted by the launch and popularity of ChatGPT. Despite AI’s decade-plus presence (Siri was launched in 2011), this felt like a catalyst for the industry.

Side bar: It’s interesting to think about what other technology is available today, but not yet at its full potential. 3D printing?

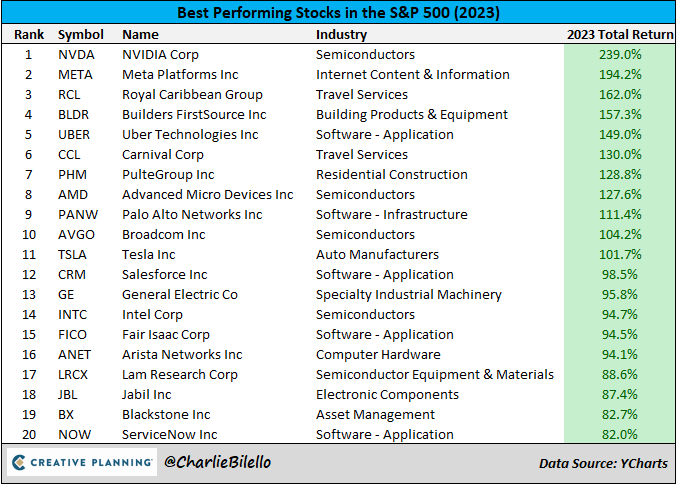

Back to AI, Nvidia showcased the sector’s strength by being the top performer in the S&P 500:

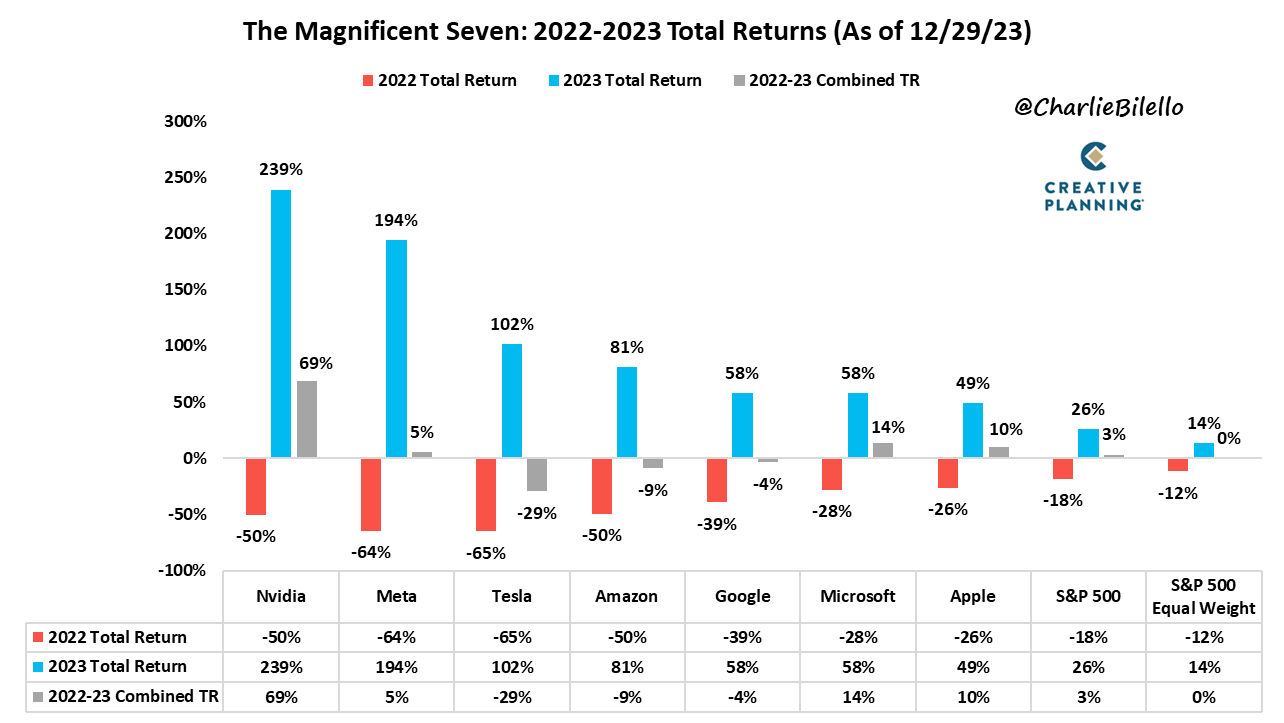

Nvidia’s excellent year also serves to highlight the difference between 2022 and 2023.

Below, we see how “The Magnificent Seven” – the 7 largest stocks in the S&P 500 (all tech) – performed in 2022 (poorly) versus 2023 (very well):

Fourth Quarter Economic Highlights

- Economic Growth: The economy continued its impressive performance, exceeding expectations with GDP growth of approximately 2.5% in the 4th quarter, more than double the analysts’ initial forecast.

- Inflation: The Federal Reserve’s preferred measure of inflation decreased to 2.6% in November, down from 7% in 2022.

- Interest Rates: Due to declining inflation, the expectation is that interest rate hikes are behind us, with potential rate cuts in 2024.

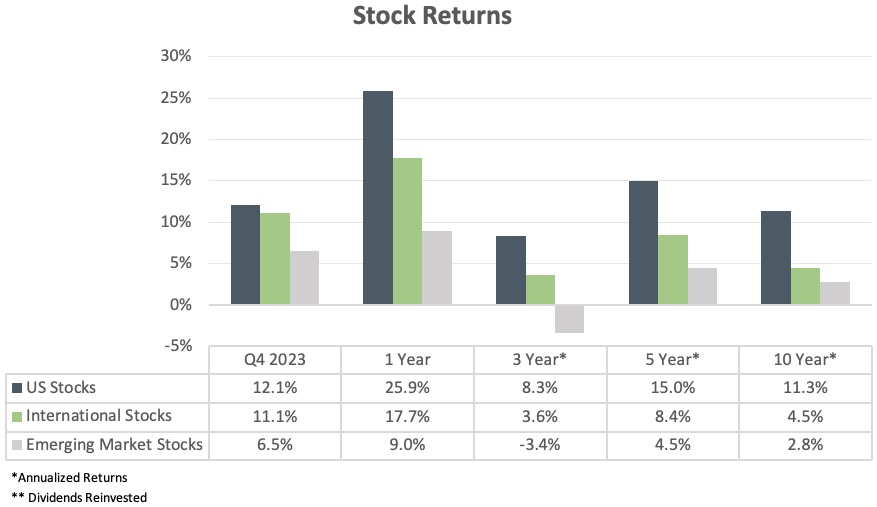

Stocks – Fourth Quarter Results:

- US Stocks: US stocks rose 12.1% during the quarter and 25.9% for the year. November through December was the 12th best two-month period for US stocks since 1950, with a gain of 13.9%. A historically good quarter.

- International Stocks: Developed international stocks (e.g., Japan, Germany, Australia) rose 11.1% during the quarter and 17.7% for the year.

- Emerging Markets: Emerging market stocks (e.g., India, Philippines, Brazil) rose 6.5% during the quarter (largely pulled down by China’s weaker performance) and 9.0% for the year.

With a year of 20%+ returns behind us, I found this stat interesting:

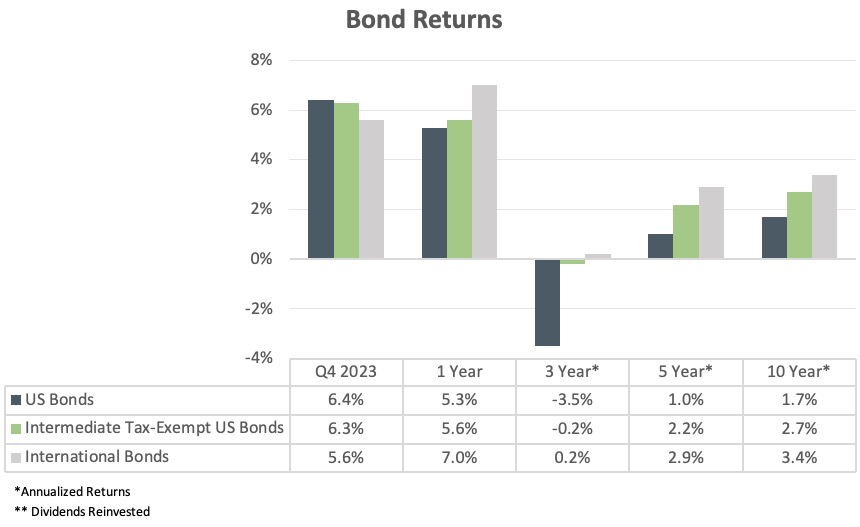

Bonds

After a volatile year for interest rates, the US 10-Year Treasury – an important benchmark for lending – ended 2023 almost exactly where it started. Despite briefly reaching 5%, the 10-Year yield started and finished the year just under 4%.

This decline in interest rates drove the rally in bonds during the quarter.

Over the past year, hedged international bonds showed the benefits of global diversification, as they outperformed US bonds.

For investors in tax-sensitive portfolios, municipal bonds have been one of the strongest sectors over the last year, with even better relative results when compared on an after-tax basis.

Parting Thoughts – Large Tech Stock Valuations

With all the fanfare around AI, I thought this analysis from Larry Swedroe was informative:

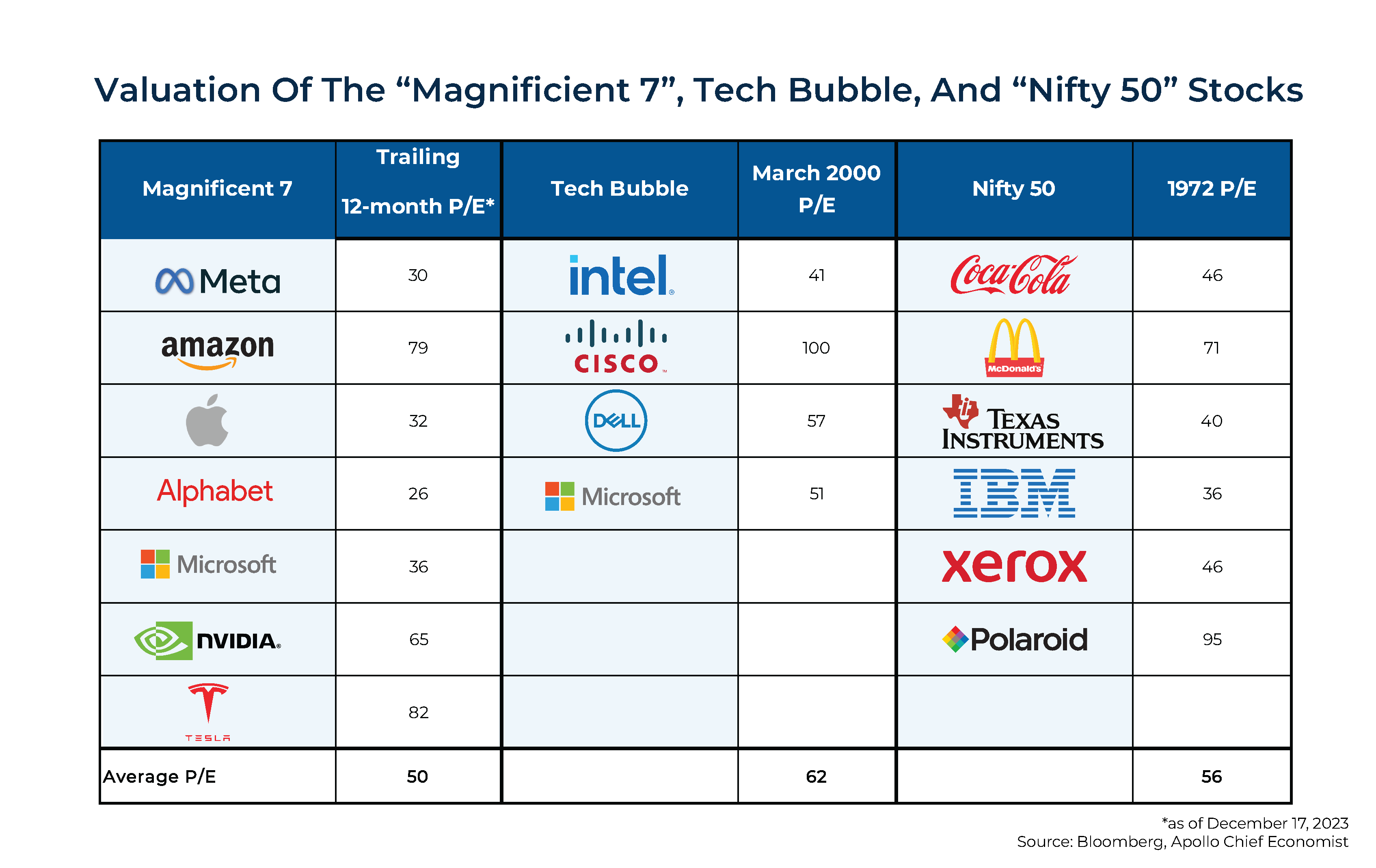

With an average P/E [price-to-earnings ratio] of 50, the valuations of the Magnificent 7 [the largest 7 companies in the US] are reminiscent of the high valuations of the Nifty 50 and the dotcom stocks just prior to their crashing.

While not a forecast of a crash, it is a warning that, at the very least, these stocks…are at historically extreme valuations.”

“For example, Vanguard’s U.S. Total Stock Market ETF (VTI) had a P/E ratio of 22.1, about its average over the last 40 years.

In contrast, Vanguard’s Total International ETF (VXUS) had a P/E of 12.5, well below its historical average. Similarly, the Emerging Markets Stock Index ETF (VWO) had a P/E of just 11.2.

Don’t let recency bias keep you from investing in asset classes that have performed relatively poorly, such as international stocks (relative to U.S. stocks) and U.S. small and value stocks (relative to U.S. large and growth stocks). Their valuations are now trading at historically large discounts, increasing the odds that they will outperform going forward.”

As always, please reach out if you have any questions or would like to connect.