Highlights

The third quarter started with continued strength across equity markets, before backtracking during September. Issues that surfaced as cause for the pull back include: geopolitical concerns, economic impacts from the Delta variant, supply chain disruptions and labor shortages being linked to inflation, and messaging from the Federal Reserve that they may scale down the pace of their current quantitative easing before year end (sooner than expected).

Q3 Market Summary

US equity markets finished roughly flat, international stocks fell about a half a percent, and emerging markets declined 8.1%.

In the bond market, yields ended with little change from the start of the quarter and returns were flat. While central banks around the world remain accommodative, recent comments from the US Federal Reserve have focused on the continued strength of economic and employment conditions. The expectations are that the Fed will begin reducing the pace of quantitative easing before year-end and that they will pursue further tightening of monetary conditions in 2022. This could mean higher interest rates on the horizon.

As long-term investors, we try to look past the headlines of the day and remember that there always exists any number of reasons to have concern. The best approach is to focus on the long term and try to tune out the short-term noise. Markets have shown a tremendous ability to reward patient investors.

US Stocks

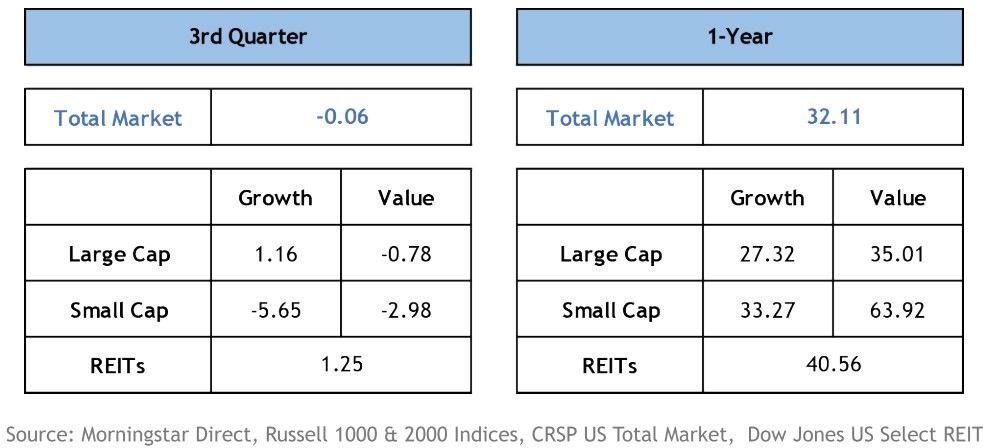

The US stock market finished essentially flat during the third quarter, yet has appreciated over 30% in the past year. While value and smaller cap stocks performed strongly over the prior year, the trend reversed slightly during the quarter as large cap growth led the market. Real estate investment trusts (REITs) performed well during the quarter and over the past year.

International Stocks

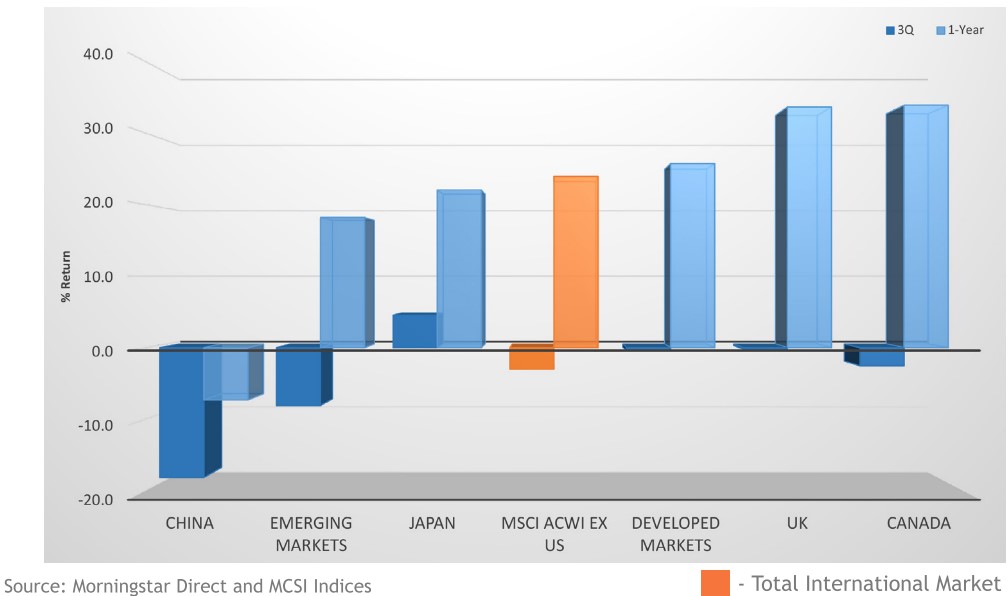

Emerging markets faced the greatest headwinds, driven in large part by weakness in China. Chinese stocks faced several challenges during the quarter, including regulatory changes and major financial issues for the property development company Evergrande, which captured significant headlines during the quarter due to concerns about their viability.

Developed international markets outperformed emerging markets by a wide margin, declining a modest 0.5% for the quarter.

Over the past year, emerging and developed markets have appreciated considerably, gaining 18% and 26%, respectively. Progress in the recovery from COVID continues across the globe and many major economies are rebounding along with the United States. Absolute returns have generally been strong over the last year, with Canada and the UK standing out as particular areas of strength.

Bonds

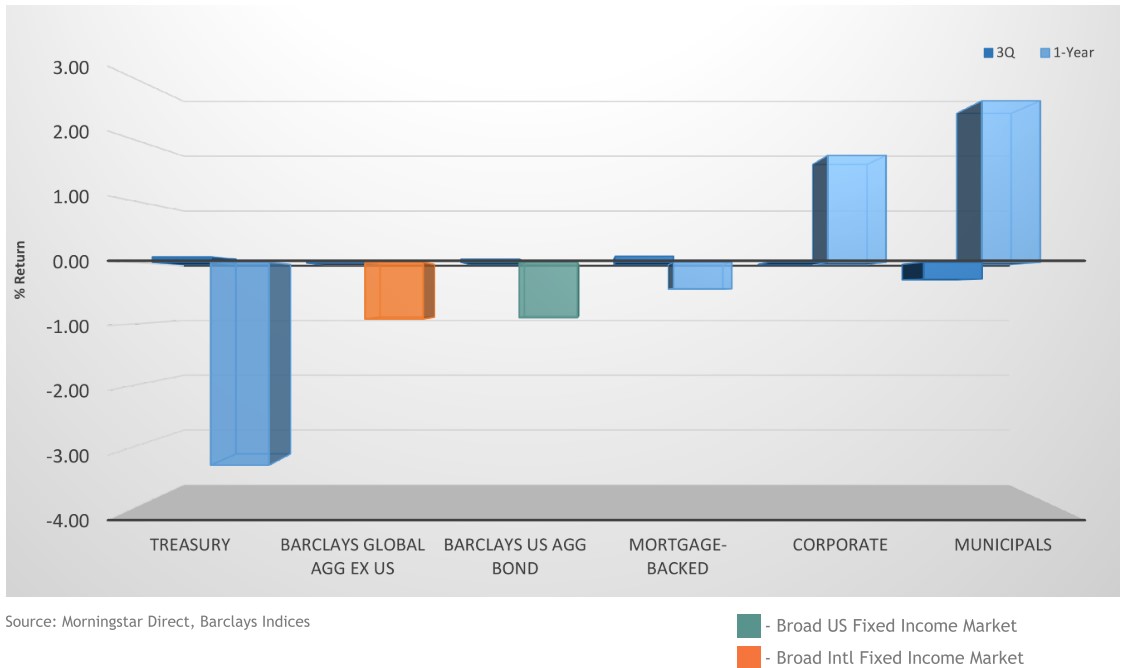

Yields were little changed from the beginning of the quarter, with returns effectively flat across the major fixed income sectors. After being bid up in the early stages of the COVID crisis, Treasuries (US government bonds) have been the weakest area over the last year.

A general increase in rates over the prior year has resulted in modest declines in the US (Barclays Aggregate: -0.90%) and internationally (Global Aggregate ex-US: -0.92%). Corporate and municipal bonds have held up better than other sectors as strong demand and tightening spreads have contributed to positive performance over the last year.

Parting Thoughts

A common question that arises during times of turmoil or high levels of negative news is, “wouldn’t we better sitting this out and waiting to invest until things are calmer/clearer?”

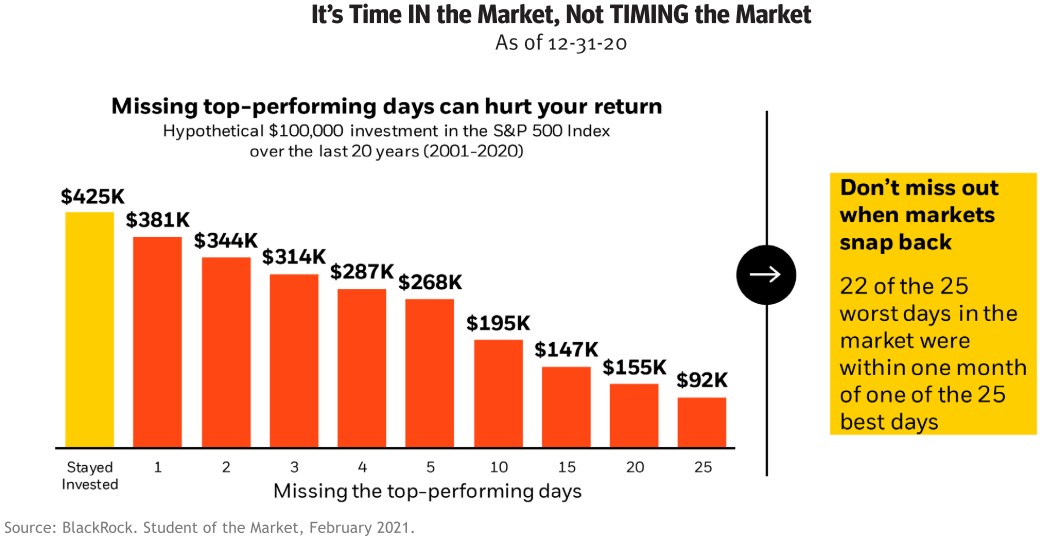

Unfortunately, the research and our experience indicate this is a futile endeavor. The below illustration highlights one of the primary reasons why. The stock market can move quickly, and being out of the market for as few as the five best days over the last 20 years would have cut an investor’s return by nearly 40%. Over 20 years, that is about 5,000 trading days, so missing the just 1/10 of 1% of those days has a drastic impact. Missing the 10 best days would result in a return less than half of that of staying fully invested.

Further, it is often after a market decline that these questions tend to become more prominent. However, the data shows that very often the best days occur within one month of the worst days. Thus, being out of the market for even a small fraction of the days can have a major negative impact on a portfolio’s return.

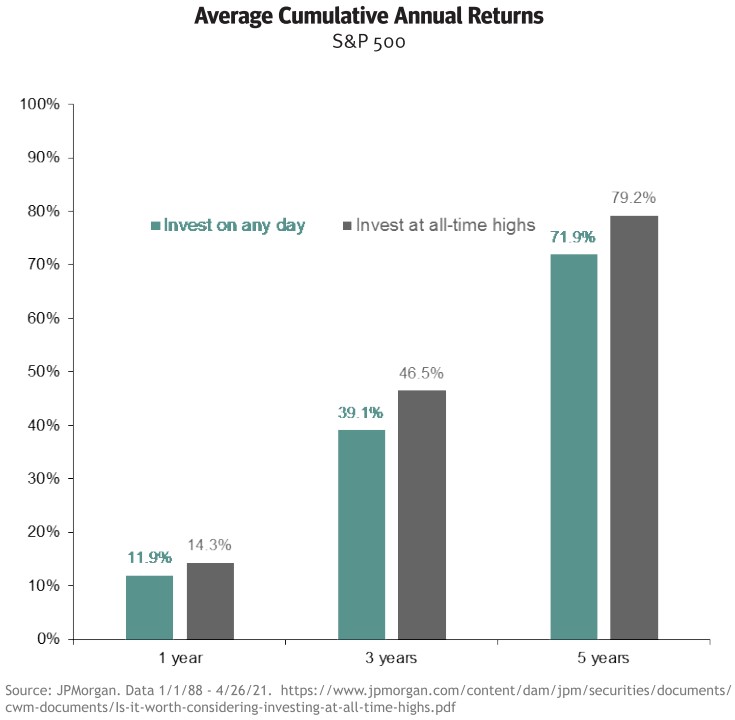

History shows that market highs are very often followed by further market highs and using this in attempting to time market entry points can actually lead to lower results. JPMorgan looked at all the days that one could have invested over the last 30 years and separated out the results from investing on days when the S&P closed at all high time highs from all the others.

Interestingly, investing on days when the S&P closed at all-time highs actually resulted in slightly higher returns over the subsequent one, three, and five-year periods. While it seems intuitive to wait for a pull back before investing, the general long-term rise in equity markets can make the opportunity cost meaningful.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: Investments are not guaranteed and are subject to investment risk, including possible loss of the principal amount invested. Past performance is no guarantee of future results. All allocations and opinions expressed are as of the date of this presentation and subject to change. The information contained herein does not constitute investment advice or a solicitation. Information obtained from 3rd parties is believed to be accurate, but has not been independently verified.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.