Overview

The US stock market is down 23% since the start of the year. Almost every investment around the world is negative: international stocks (-22%), US bonds (-15%), and international bonds (-12%). Less diversified investments, such as the technology-heavy NASDAQ index (-30%), are down even more (source).

You may be wondering if these declines should cause you to rethink your investment approach. For a properly diversified investor with a long time horizon, the answer is no. Let me explain why through the following topics: the stock market, the bond market, investing during a potential recession, and the pitfalls of market timing.

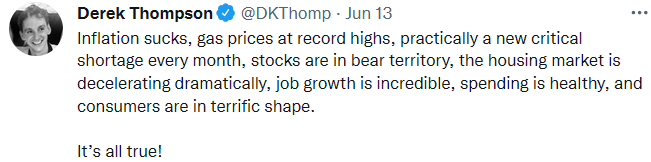

But first, a tweet that summarizes the good and the bad:

The Stock Market

As highlighted above, there are many worrying developments around the world: inflation, supply chain issues, the Russia-Ukraine war, gas prices, rising interest rates, and a potential recession.

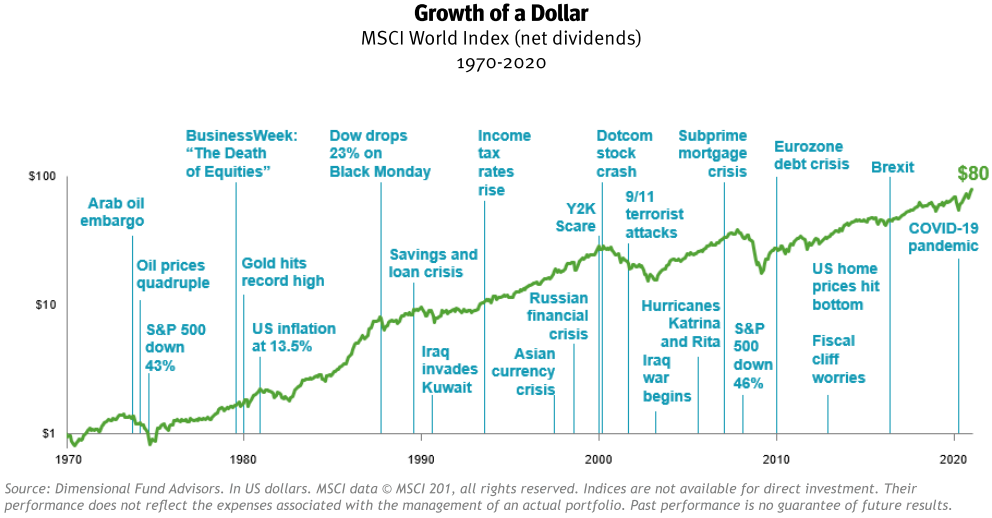

The chart below helps put things in perspective. It summarizes some of the worst headlines over the past 50 years as compared to the return of a global stock index.

Since 1970 there have been seven recessions. As you’d expect, there was lots of awful news: 9/11, Black Monday (in which the Dow dropped 23% in one day), the Great Financial Crisis of 2008-09 (stocks dropped ~50%), and the Arab oil embargo of the 1970s, just to name a few. However, during these 50 years the stock market increased 80-fold, or about 9% per year:

“We will never be without problems, and some of them will be extremely serious problems. The point that this chart cries out to us – this endless chain of permanent advance punctuated by temporary decline – is that we bend, but we never break. And when we recover, we are more flexible, more resilient, more transparent, and more entrepreneurial than ever. The world does not end; it only appears to be ending from time to time…all previous crises – many far worse than today’s – have been successfully resolved.”

– Nick Murray

Unfortunately, the ride for investors isn’t smooth. If there was no risk to investing there’d be no return. With a “buy and hold” investment strategy, holding is the hardest part. That’s why an asset allocation that matches your risk tolerance is so important.

There will continue to be ups and downs, but over time the market should be expected to rise, as it has in the past.

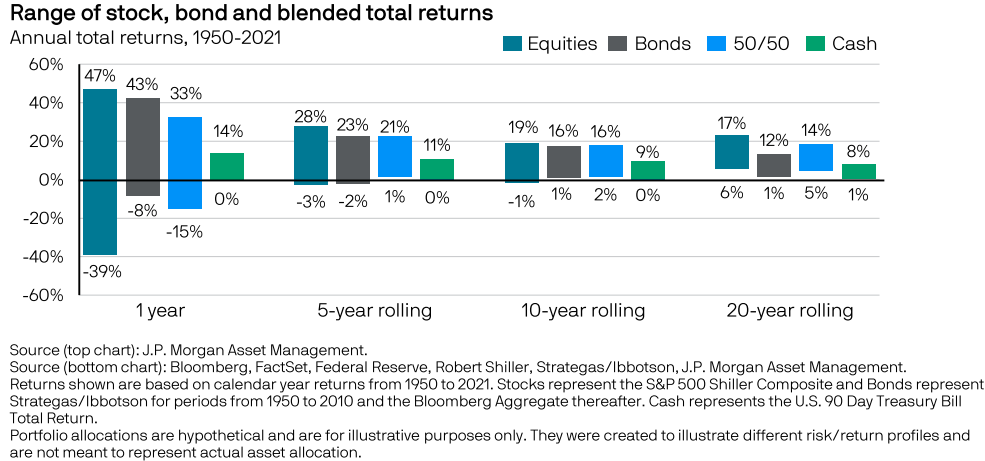

This also highlights the importance of having a long timeframe. The chart below shows how the range of investment returns shrinks over time, and becomes increasingly more positive, as time extends:

It’s cliche but true: investing for the long term is the key to success. The longer you hold any investment, the higher the likelihood of a positive return.

The Bond Market

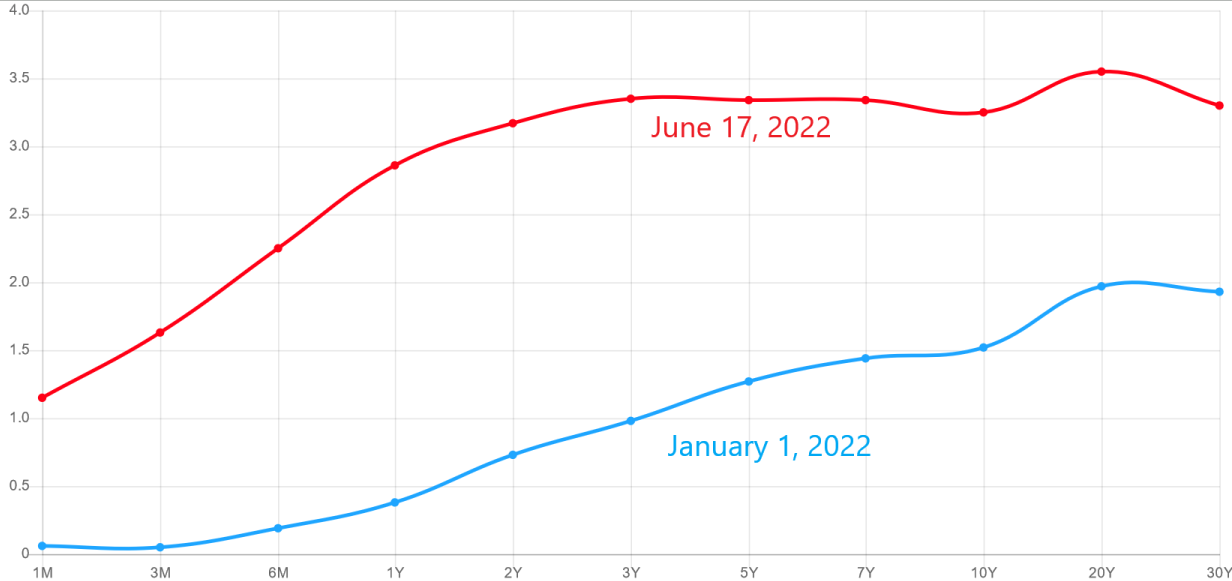

Since the start of the year interest rates have risen dramatically:

The Federal Reserve is raising rates in order to increase the cost of borrowing. For example, mortgage rates have doubled since the start of the year. These higher borrowing costs tend to slow economic activity. Over time, the Federal Reserve hopes lower demand will bring down inflation.

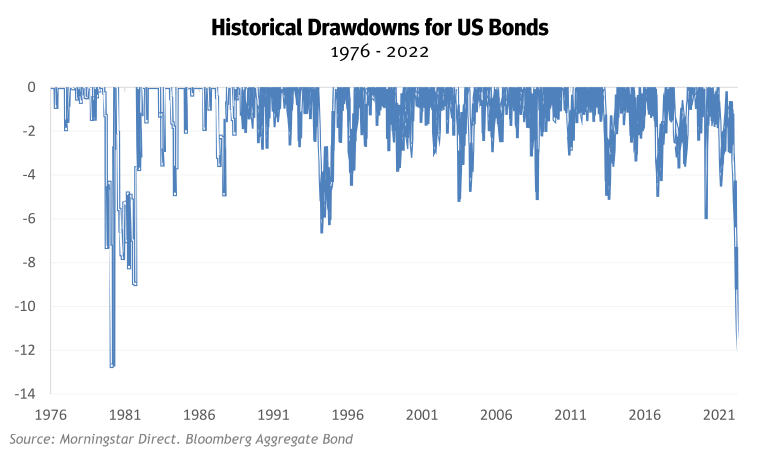

The bad news is that when interest rates rise, bond prices fall. As shown in the chart below, this has resulted in the bond market declining quite substantially:

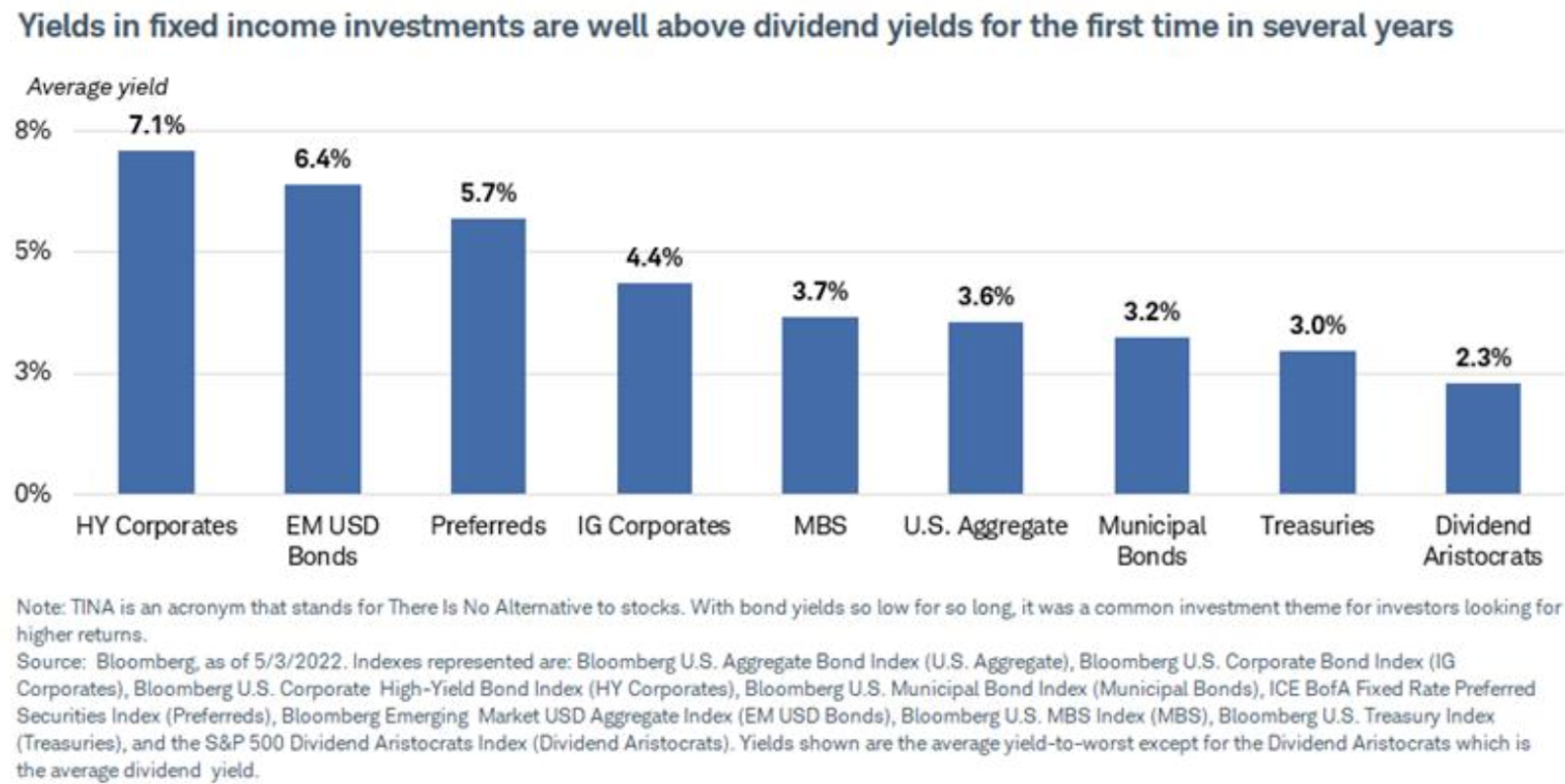

The good news is that higher interest rates increase the expected returns of bonds going forward. Here’s a look at the average yield of various bonds:

The question now is: what to do? When the bond market has losses, does it make sense to get out?

The data shows that rising interest rates and falling bond prices have little predictive value. The fact that rates are rising and bond prices falling in one period tells you nothing about how those bonds will perform in the future.

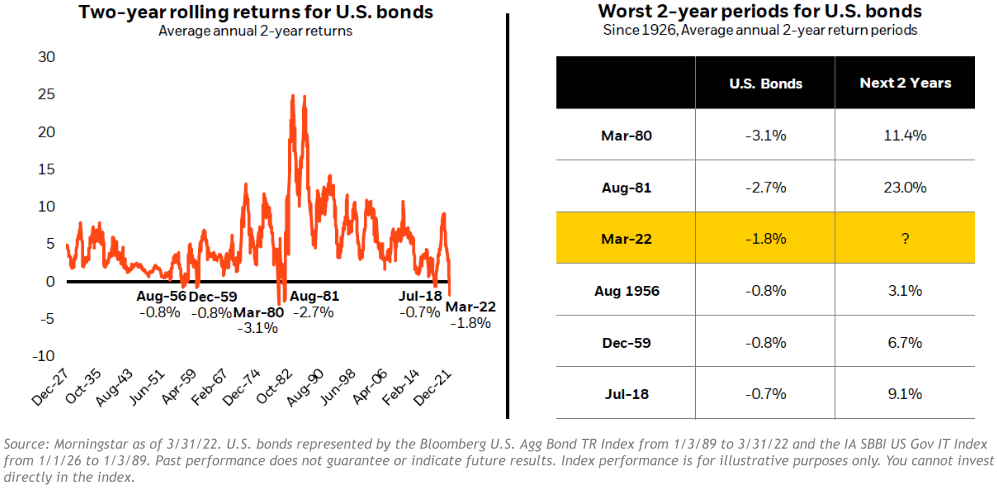

The graphic below shows what happened in other periods where bond performance had been particularly bad. It shows that when bonds had their worst 2-year performance, the subsequent 2 years have usually produced very good returns.

If this pattern holds, we could see a similar pattern emerge in the near future.

Recession?

There’s a lot of discussion and articles about whether or not we’re in a recession. Morgan Housel says it well: “We’re always heading toward a recession, we just have no idea when it’ll begin.”

While it’s unclear whether or not we’re in a recession right now, what is clear is that the stock market is down.

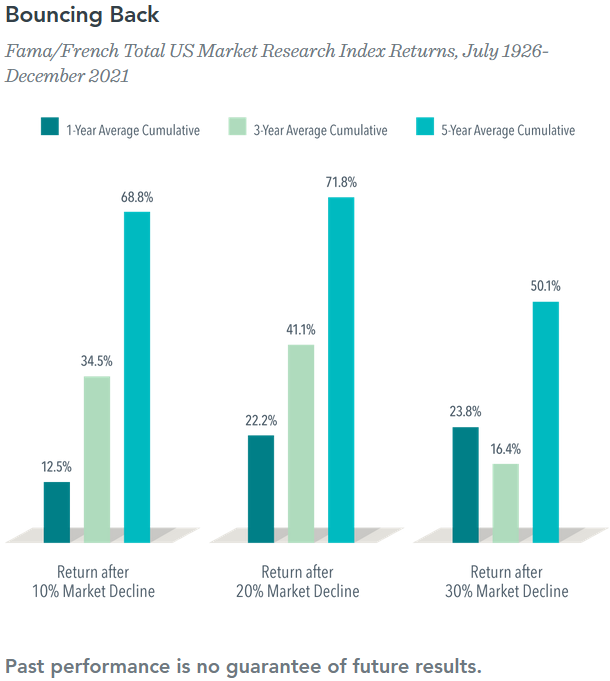

Below is a very informative chart. It shows the average 1-, 3-, and 5-year returns after the stock market declines 10%, 20%, and 30%. After a 20% decline (like we’re in now), the average 1-year return is 22%. And again, the longer the time frame the higher the return:

Market Timing

“The idea that a bell rings to signal when investors should get into or out of the market is simply not credible. After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has done it successfully and consistently.”

– John Bogle, Founder, Vanguard

Some investors may be tempted to cash in their chips and head to the sidelines until things look brighter. Or they may want to reduce exposure to a particular investment that isn’t doing well, then jump back in when the performance improves.

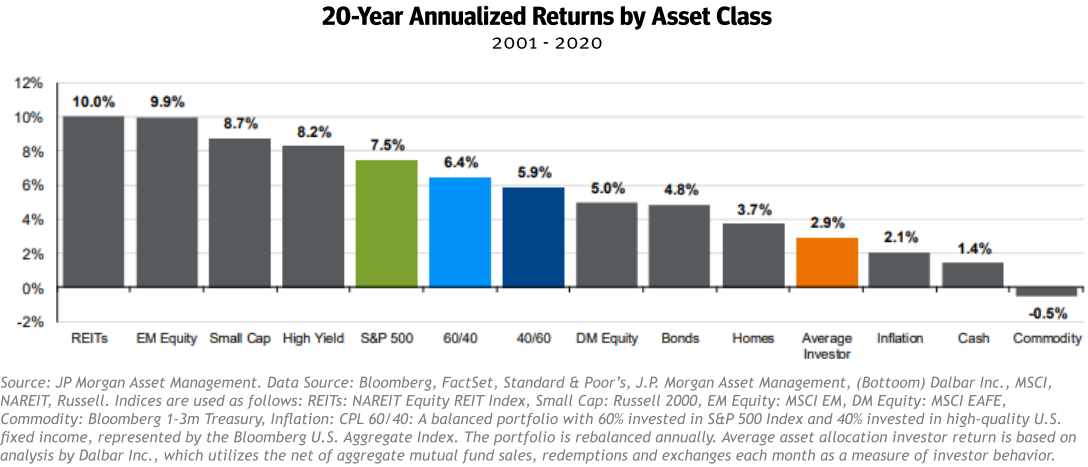

This is known as market timing, and it doesn’t always work. The graphic below shows just how damaging it can be. It shows the returns of various asset classes from 2001 through 2020. It also shows the return for the average investor (in orange):

The average investor generated 2.9% per year during a period when almost every asset class, including stocks (+7.5%) and bonds (+4.8%), were up much more. How? It’s because many investors try to time the market, and they almost always get it wrong.

You don’t have to predict the future to be a successful investor. Look at the two blue bars representing the 60% stock and 40% bond portfolio and the 40% stock 60% bond portfolio. If you had invested in one of those and simply stayed put, you would have done over twice as well as the average investor.

Summary

Successful investors have patience, discipline, and conviction in their portfolios. While it’s not comfortable or easy to sit tight during difficult periods, better times have always come.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.