I hope you had a great February.

I wanted to share a few interesting facts and articles I came across over the past month.

Financial News Roundup

- I Bond Tax Forms: If you sold Inflation Bonds in 2023, make sure to source your 1099 for tax purposes. It is not mailed to you automatically. Here is how:

- Log into your TreasuryDirect account. Click on “Manage Direct.” Under “Manage my taxes,” select “Year 2023.” Then click on “View your 1099 for tax year 2023.” Print directly from your browser save it as a PDF. If you have trouble, see this video.

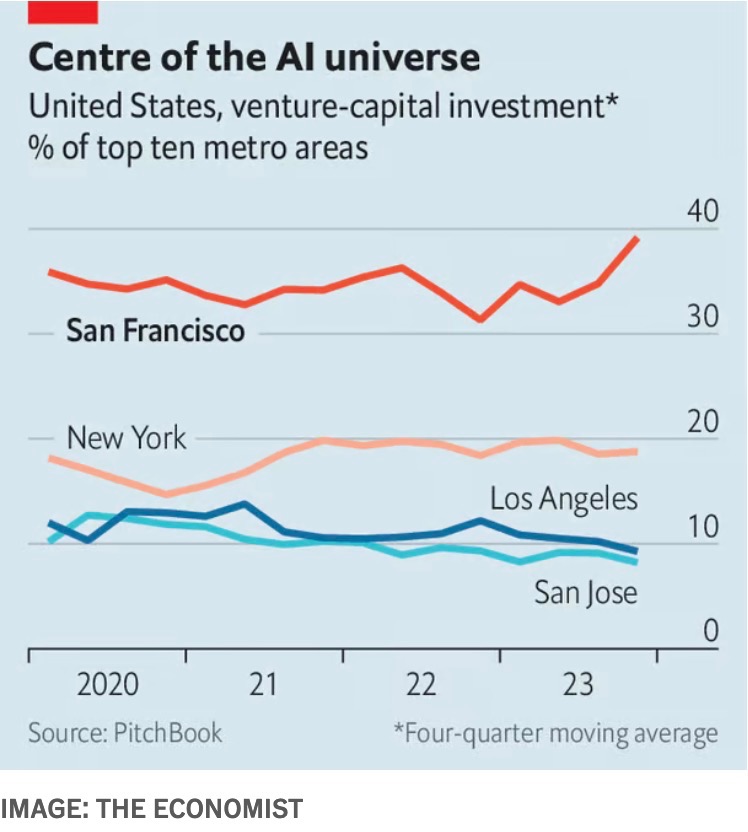

- AI + Real Estate: High mortgage rates are not slowing down the local real estate market. In fact, listings in San Jose area are selling at fastest pace in the US. Many locals feel wealthy, especially with the influx of investment into AI and the stock market at all-time highs. In addition, the majority of AI venture capital investment — about 50% — occurs in San Francisco + San Jose. Certainly a benefit to the Bay Area.

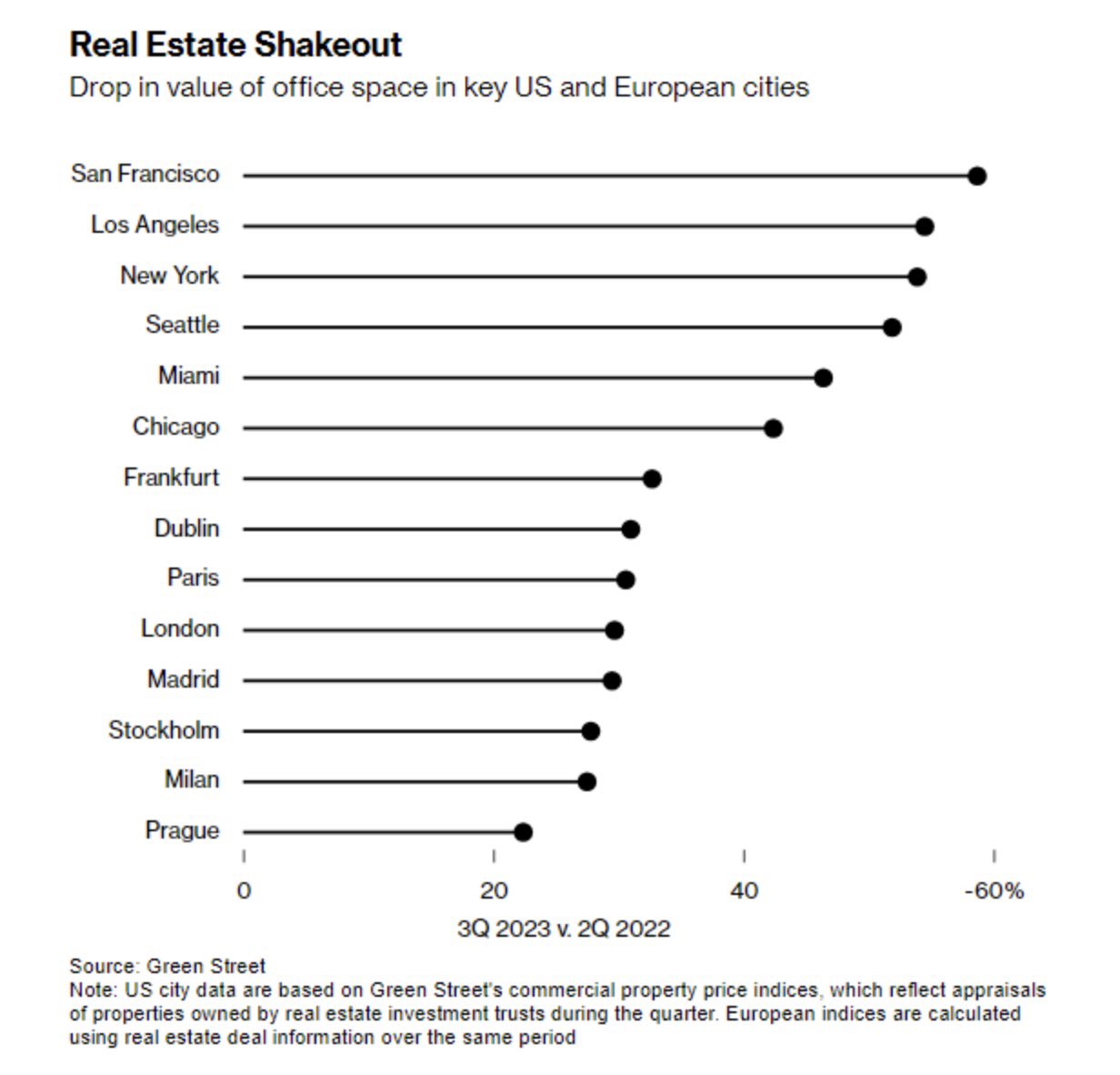

- Commercial Real Estate: In 2023 the value of office buildings fell 23%. Other commercial sectors did poorly too, but none quite as bad as offices.

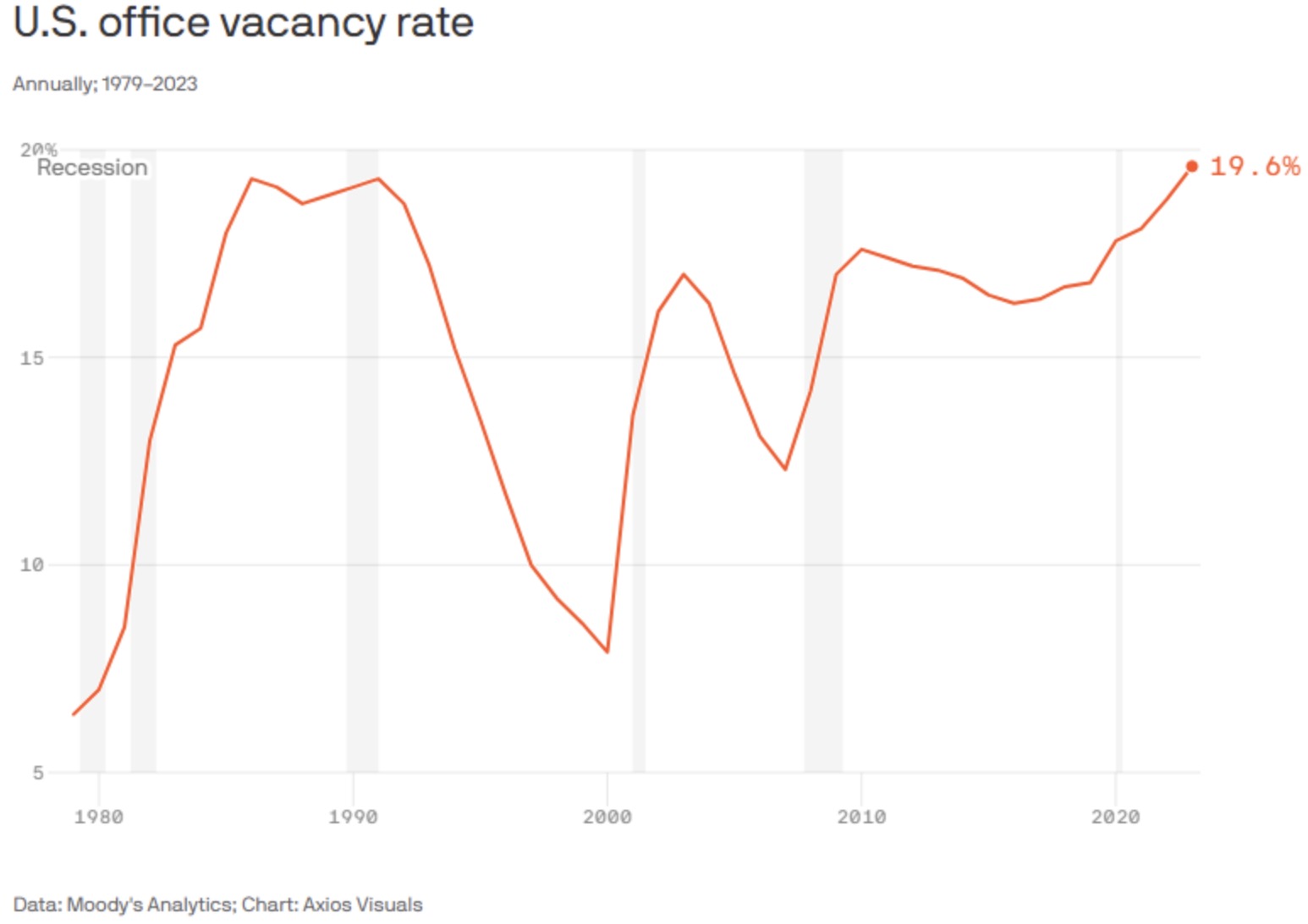

- Office Vacancy Rate: The root cause for the decline in the value of office buildings is obvious: Not as many people work in them. The office vacancy rate is 19.6%, higher than the previous peak from the late 1980s/early 1990s.

- More on Offices: In certain cities, the value of office space has fallen a lot more. In San Francisco, office values are down nearly 60%. It’s hard to believe.

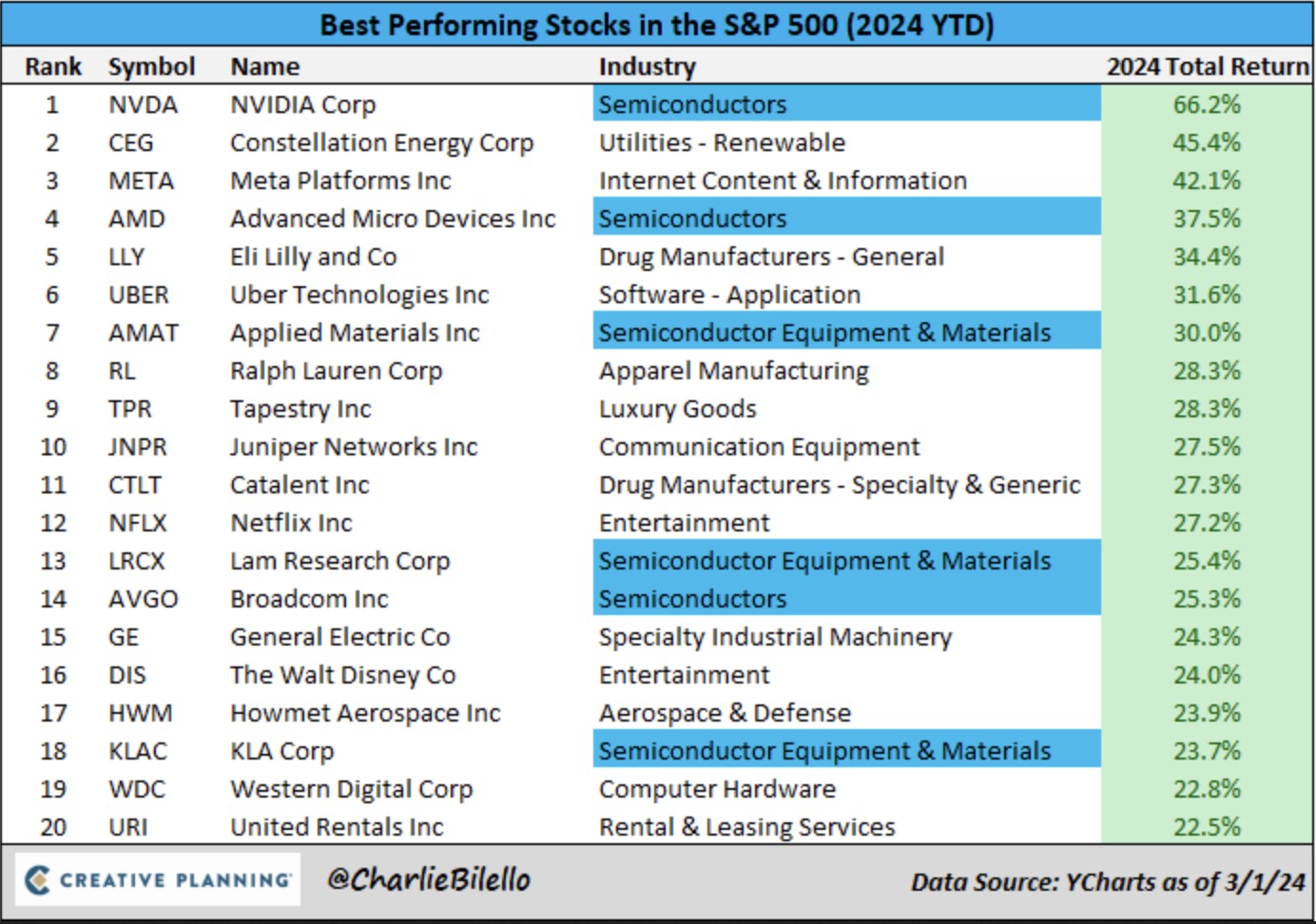

- Best Stocks This Year: Many tech stocks, especially those in the semiconductor industry, are performing well so far this year (as of 3/1).

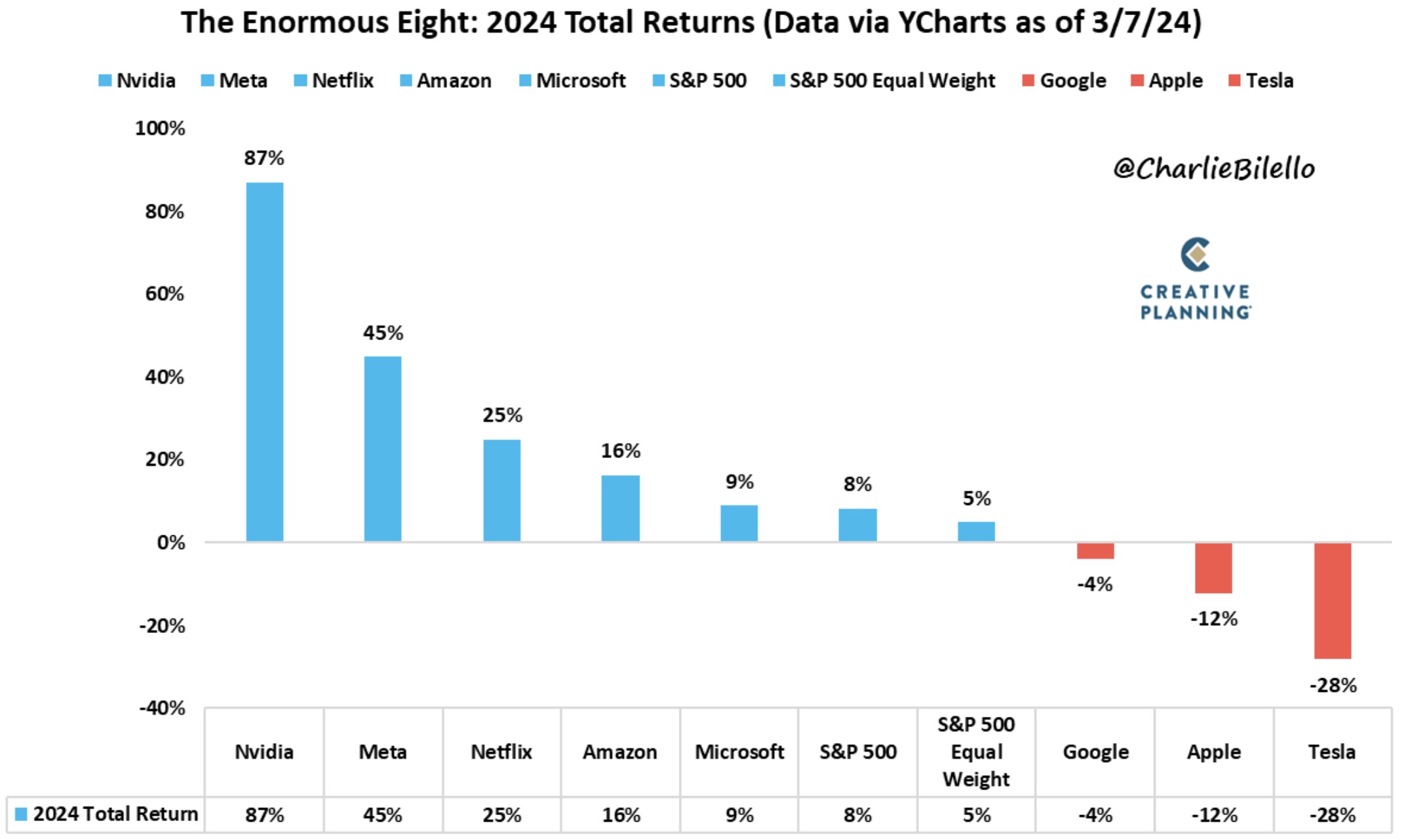

- Tech Performance: Along the same lines, here’s a closer look at how eight of the largest and most popular tech/consumer companies have done this year (as of 3/7).

- Increasing Wealth: As mentioned earlier, many people feel richer today than ever before. The wealth of Americans under 40 grew by 80% between 2019 and 2023. Americans between the ages of 40 and 54 saw their wealth increase just 10%, whereas those over 55 had wealth gains of 30%.

- Diversification: I speak a lot about the benefit of diversifying. The chart below does a nice job summarizing some of the great brands and companies in Europe:

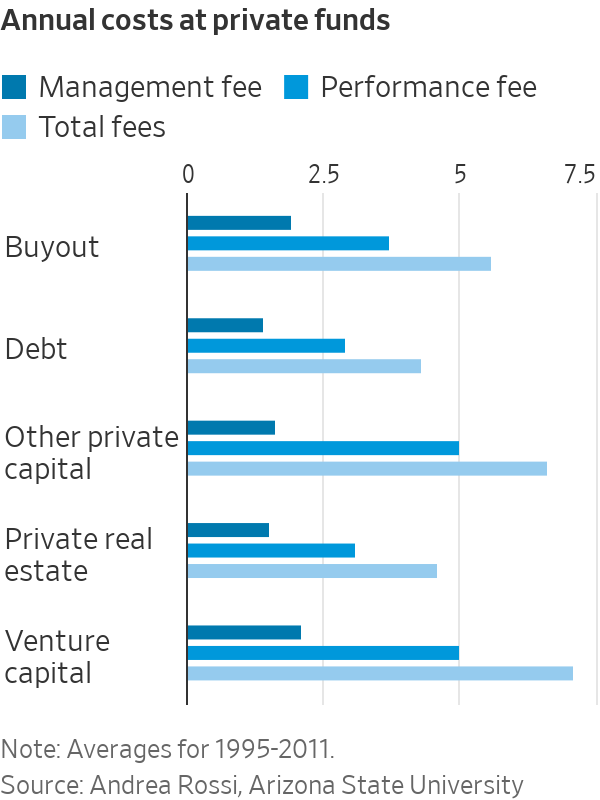

- Fees at Private Funds: Thinking of investing in VC, a hedge fund, private equity, or other private investments? Make sure to know the fees. They can easily reach 5% or 6%, a tremendous hurdle.

“Let’s say you expect the stock market to return an average of 6% annually over the next decade. If you’re considering a private-equity fund that effectively charges 6% in annual fees, do you think its managers can double the return of public markets? Can the managers of a venture-capital fund more than double the return of public markets?

Maybe.

But probably not.

Remember: Future returns are uncertain, while fees are inevitable.”

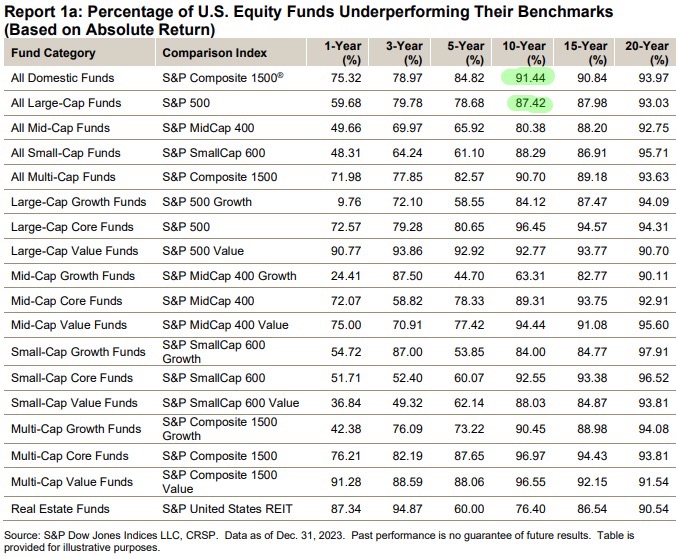

- Index Funds: S&P Global comes out with an annual report summarizing how active fund managers performed against their investment benchmark. For professionals trying to pick stocks, the results are consistently poor. Over a 10-year period, approximately 90% of funds fail to beat their benchmark: