I hope you had a great January.

I wanted to share a few interesting facts and articles I came across over the past month.

Financial News Roundup

- California Quietly Raises State Income Tax Rate to 14.4%. Starting this year, California workers earning more than $145,600 will pay an additional 1.1%.

- 529-to-Roth Conversions. I’ve had a few questions about converting college-savings accounts to retirement accounts, which became an option in 2024. If you’re curious about the rules, here is a good article on the topic.

- The Four Phases of Retirement. An interesting and entertaining Ted Talk (13:23).

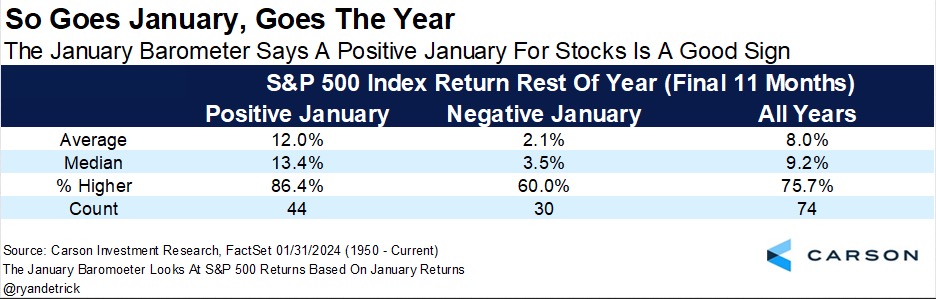

- January Effect. This is more of a fun stat, so take it with a grain of salt. When stocks are positive in January, the remaining 11 months of the year are up 12% on average, and positive 86% of the time. Given that we just finished with a positive January, let’s hope this holds true!

- 49ers: If you’re looking for another reason to root for the 49ers to win the Super Bowl, know this: stocks have done better when the NFC team wins. In addition, the S&P 500 is up 19% on average the past 5 years the Niners won!

-

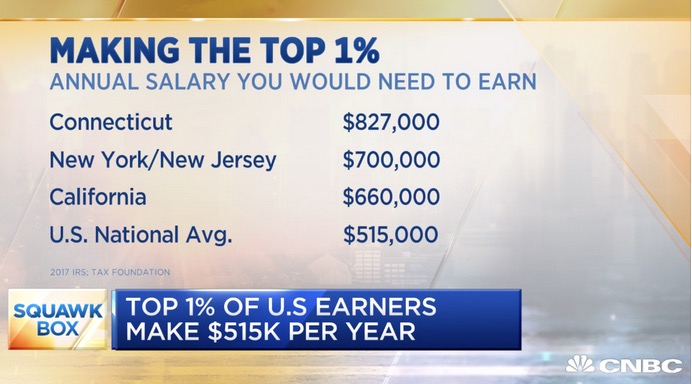

Top 1%: How much you need to earn to be in the top 1%:

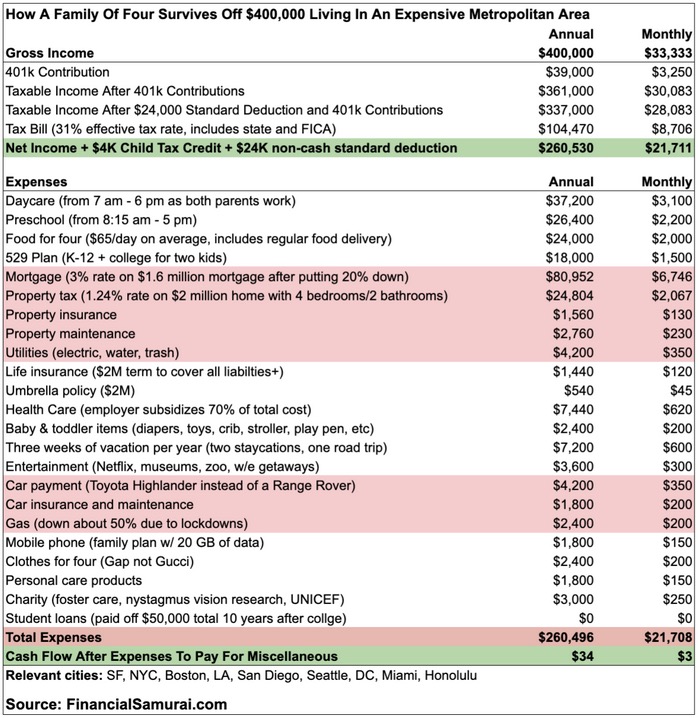

- Budgeting: I look at how people spend their money all the time. Most people don’t, so I thought sharing this sample budget from a family of four (two working parents, two young kids) earning $400,000 pre-tax could be interesting:

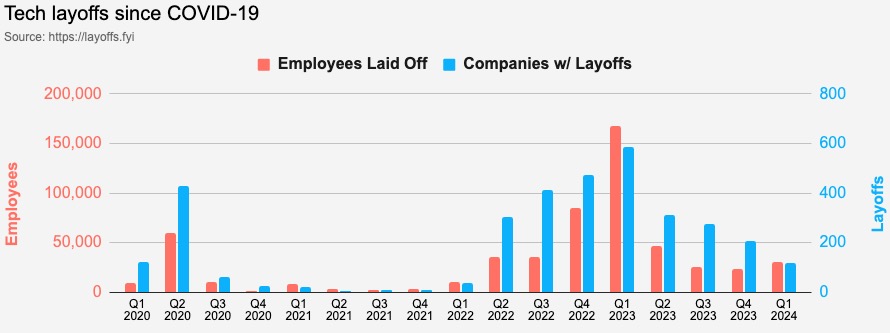

- Tech Layoffs: Layoffs nationwide remain flat, but there have been headlines recently about layoffs in tech. For a detailed view, head to layoffs.fyi. Here’s the high-level overview:

Monthly Economic & Market Summary for January 2024

- Jerome Powell, Chairman of The Federal Reserve, said it best (and succinctly) this week when he said, “This is a good economy.”

- US GDP grew 3.3% in the fourth quarter of 2023. Expectations were for 2.0% growth, so this was surprisingly good outperformance. For 2023 as a whole, US GDP grew at 2.5%, which is great.

- All-Time Highs: The S&P 500, an index for large US companies, hit an all-time high in January. This was its first all-time high in two years. Certainly something to celebrate!

- US and global inflation is on the decline. This is a very welcome change. Of the G10 countries, prices are rising by 5.4% per year, down from a peak of 10.7% in October, 2022. In America, the inflation rate is lower, at 3.3%.

- Gas prices remain low. The national average of $3.15 is four cents more than a month ago, but 35 cents less than a year ago.

- The job market remains strong, In January the US added 353,000 jobs, nearly double what was forecast. Unemployment remains below 4%.

- Incomes are rising, especially among low-income earners.

- Sentiment Improving: People across the country are slowly coming around to an optimistic view of the economy. An important survey of consumer sentiment among U.S. consumers climbed in January to its highest level since July, 2021.

As always, please reach out if you have any questions or would like to connect.