Here are a few interesting personal finance pieces from the past month:

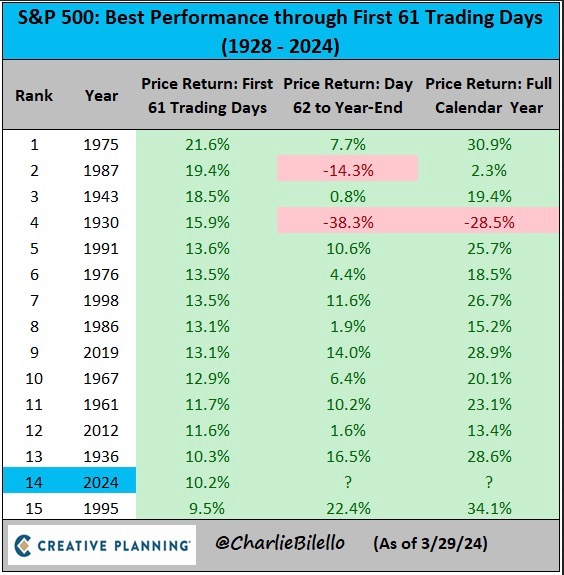

- Great Market Returns – The stock market got off to a great start this year, finishing up 10% in the first quarter. That’s the 14th-best start to the year going all the way back to 1928:

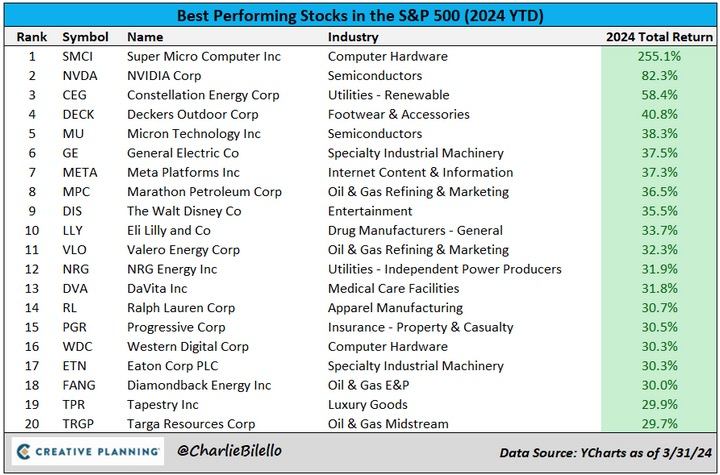

- Best-Performing Stocks year-to-date:

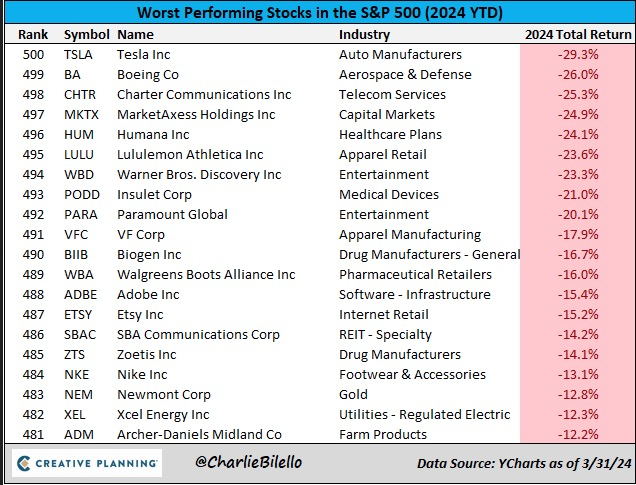

- Worst-Performing Stocks year-to-date:

- Tech Layoffs: Within the technology sector, 2023 was the second-biggest year of job cuts on record, with about 260,000. This is behind only the dot-com crash in 2001.

- With so many recently laid-off employees looking for work, it’s led to an “employer’s market.”

- Extreme College Costs: Some colleges now costs more than $90,000 per year. Examples include: Yale ($91k), Tufts ($96k), and Wellesley ($92k).

- One important caveat: “60% of its students receive financial aid and the average financial aid award is $67,469,” according to Wellesley.

- Still, the cost of attending a public four-year college rose more than 200% between 1987 – 2017, while general inflation rose 122% over the same period.

Taxes

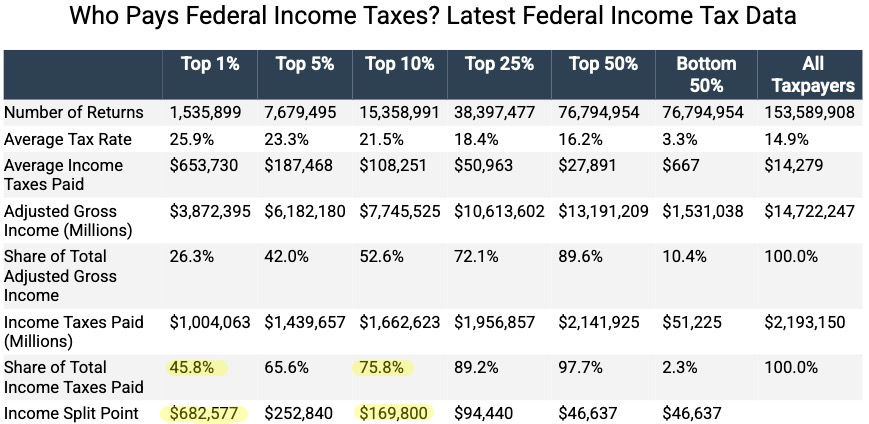

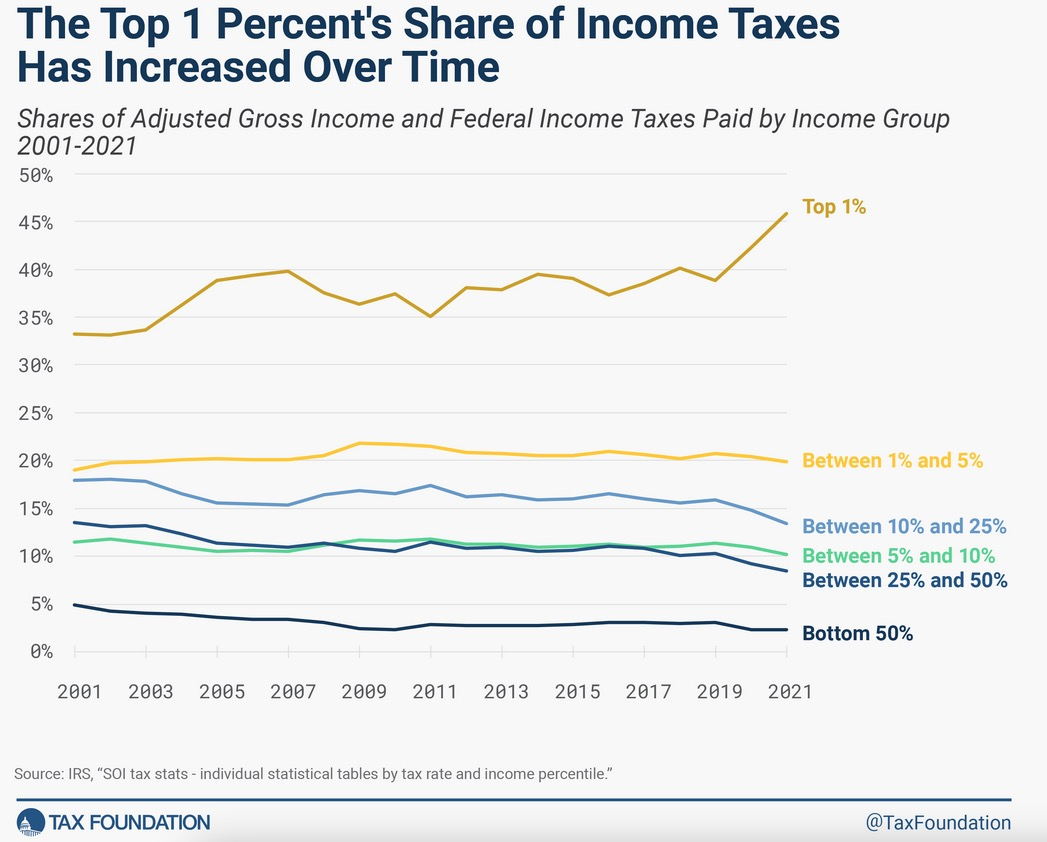

- Who Pays Federal Income Tax: Since it’s tax season, it’s a good time to look at the breakdown of who pays how much federal tax (based on the latest available data from 2021):

-

- The top 1% – those earning more than $682k – accounted for almost half (46%) of all federal income taxes.

- The top 10% – those earning more than $170k – accounted for approximately 75% of all federal income taxes.

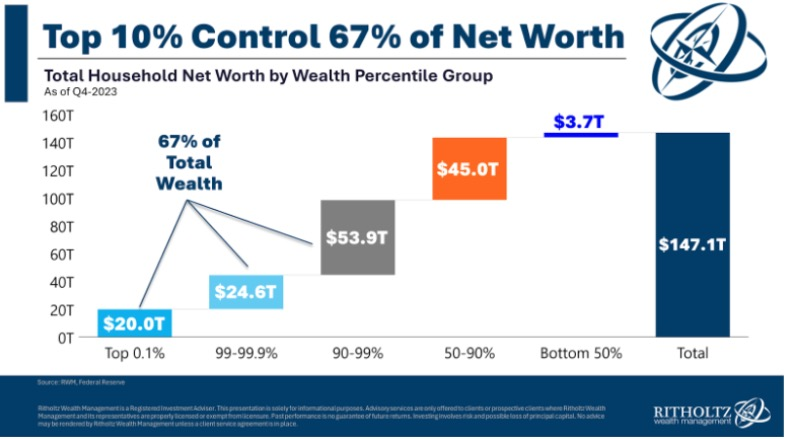

- Another Way to Look At It: The top 10% control two-third’s of the wealth. So for them to pay about three-quarters of the taxes feels somewhat fair?

- Tax Rates over Time: It’s also interesting that the top 1% of income earners have paid a higher share of taxes over time, rising from ~33% of total taxes paid in 2001 to 45% in 2021:

- Home Insurance – Harder to Find & More Expensive: Many people are finding it difficult to find home insurance. And those that do may end up paying much more.

- As catastrophic risks rise, insurance companies are backing out of specific markets. State Farm, the largest home insurer in California, announced it would pause issuing policies in the state due to wildfire risks. In Florida, Farmers Insurance deemed it too risky and pulled out as well.

- Californians without insurance options can look to the California FAIR Plan, a state program for those who can’t obtain insurance through a regular insurance company. In 2021, the FAIR Plan accounted for 3% of the state’s policies, nearly double the share from 2018.

Real Estate

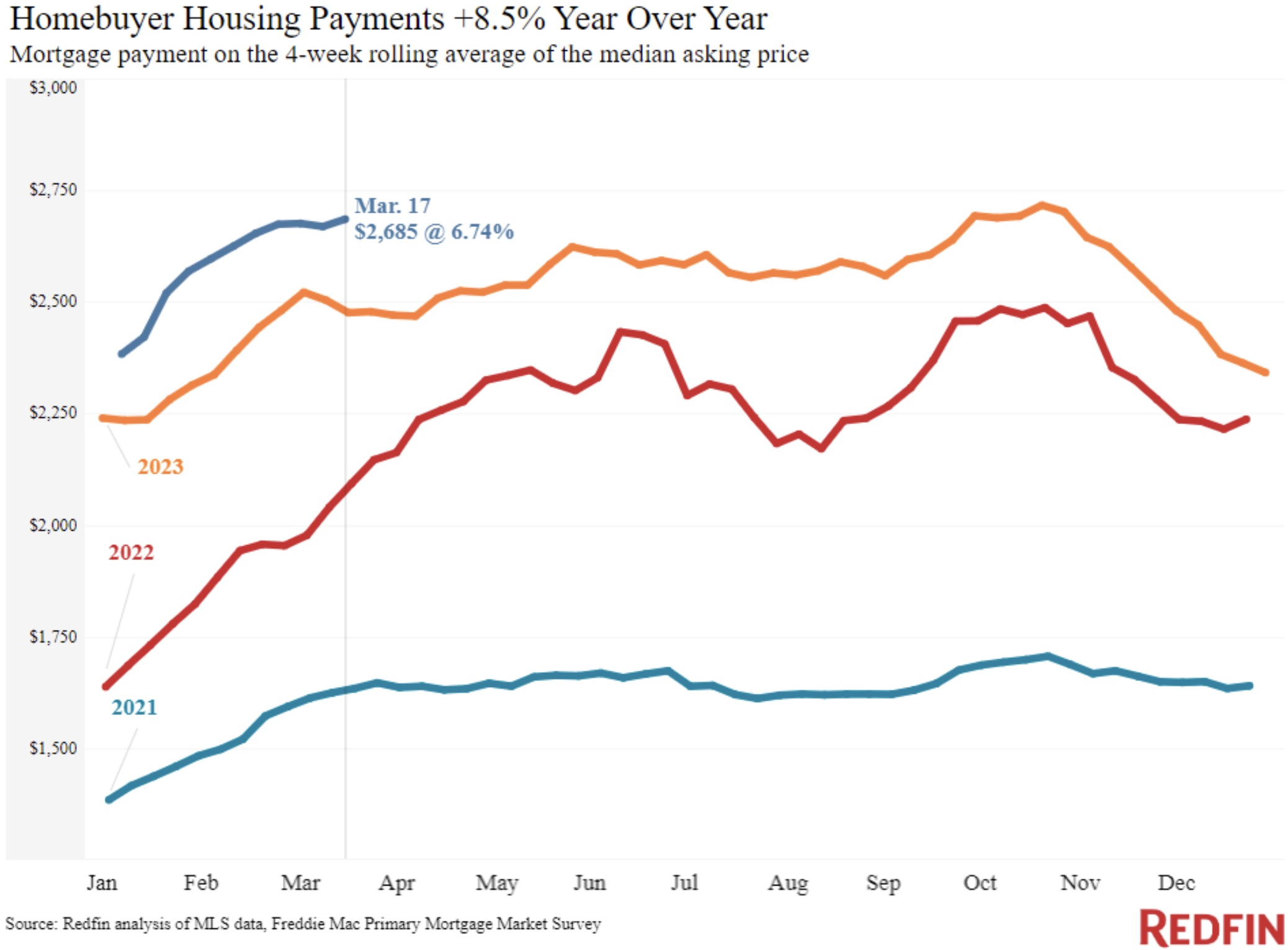

- Expensive Housing: The monthly mortgage payment on the median-priced home in America is up 80% over the past four years, from approximately $1,500/month to $2,700/month:

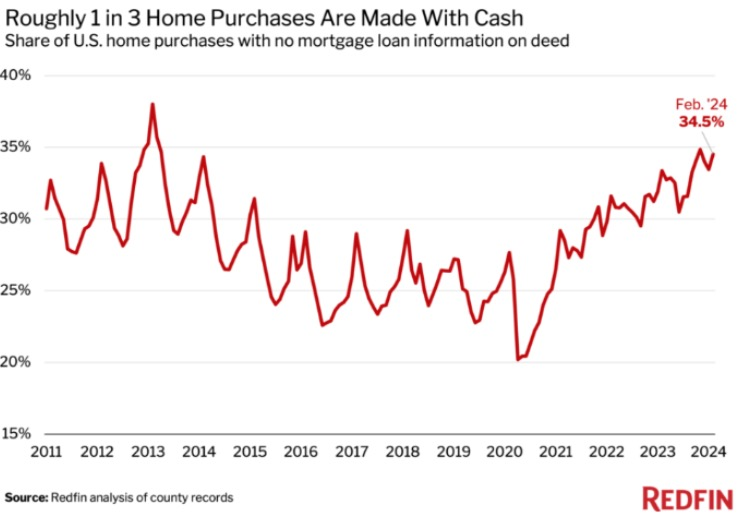

- Cash Purchases: About one-third of homes these days are bought with cash, likely as a result of high mortgage rates and stock markets hitting all-time-highs:

- Rent vs. Buy: If you’re considering renting versus buying a home, here is a good article on the topic.

- Credit Card Interest Rates have spiked these days (20%+). Avoid them if you can.

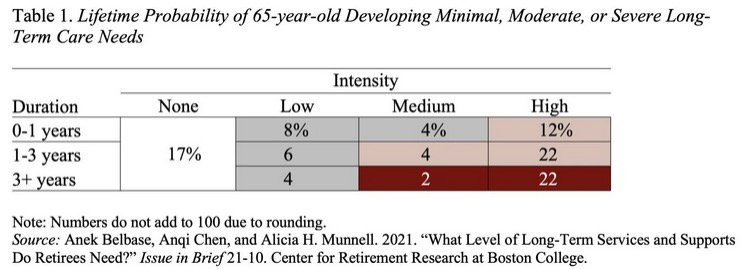

- Long-Term Care: If you’ve considered long-term care, already have a policy in place, or are just curious about the topic, I recommend this short article from the Center for Retirement Research at Boston College.

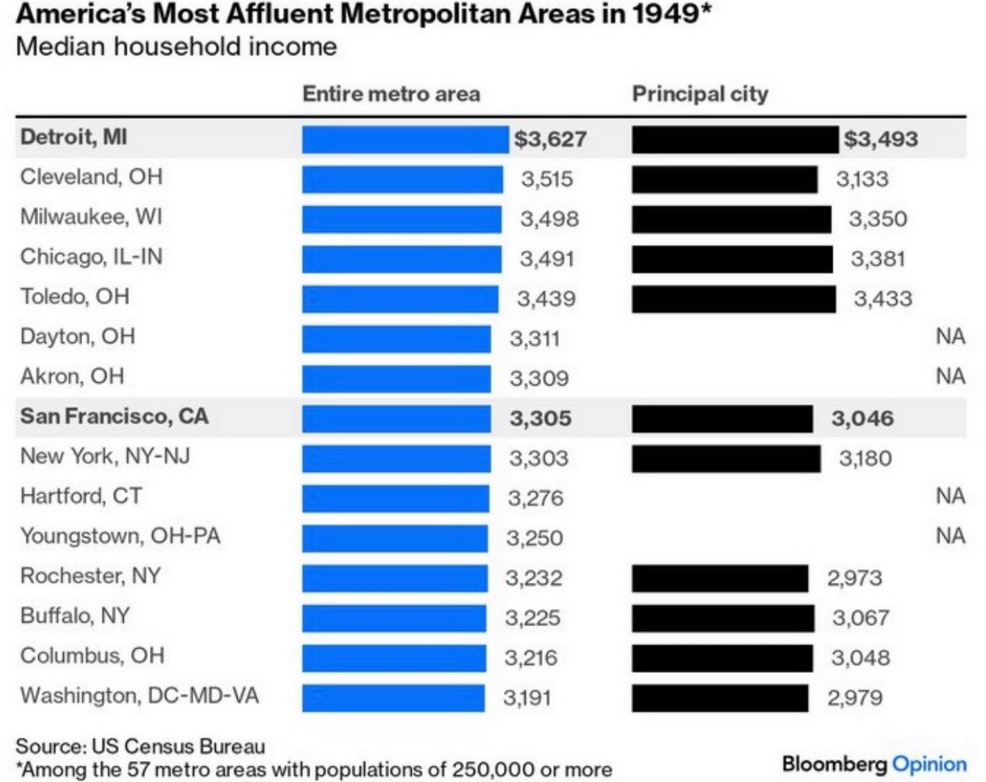

- Affluence in America, 1949: For the econ history buffs, it’s interesting how wealthy the Midwest was in 1949:

I hope you found these interesting.

As always, please reach out if you have any questions or would like to connect.