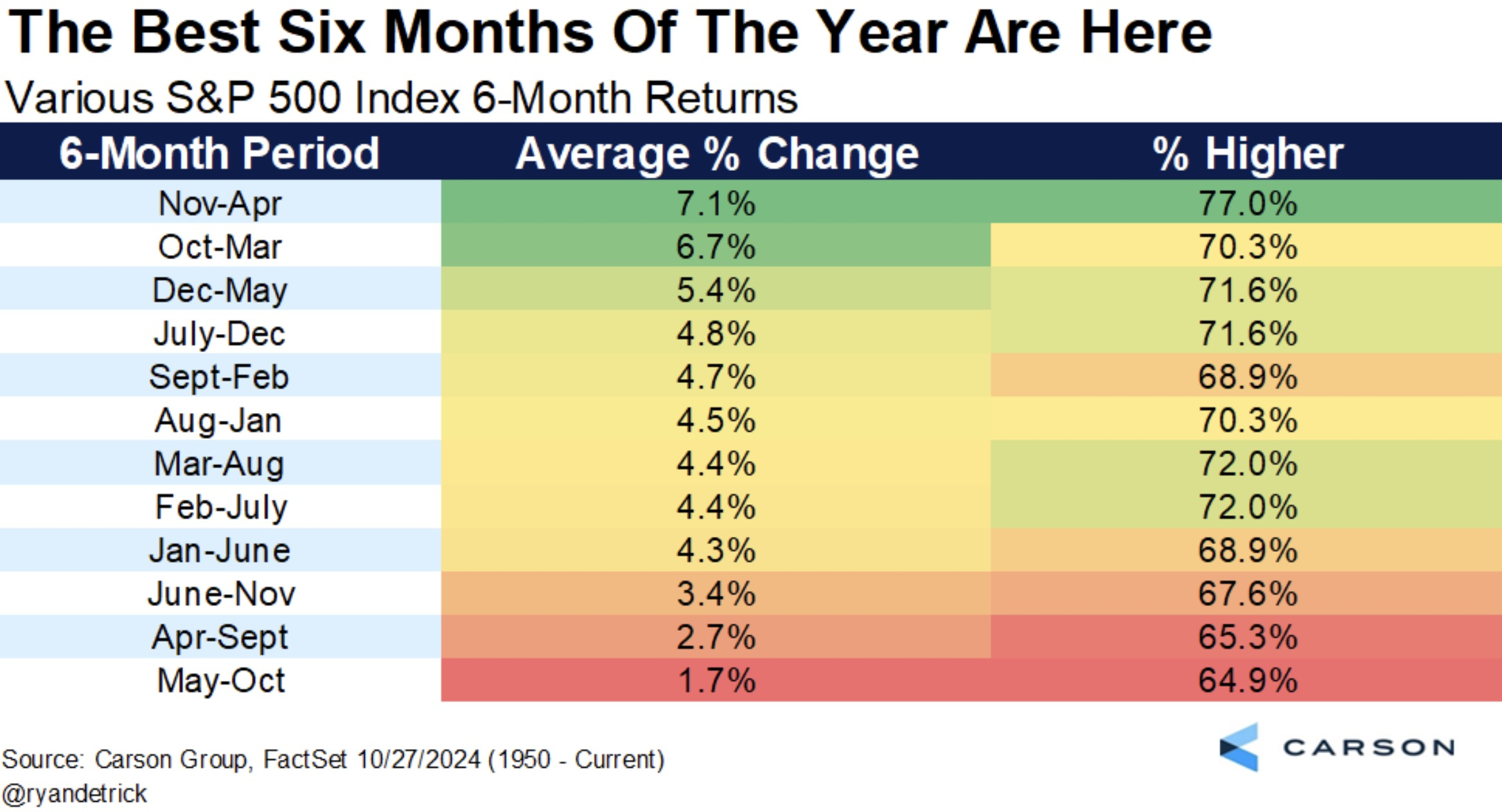

- 📈 The Best 6 Months – November through April has historically been the best six-month stretch for the US stock market, rising 77% of the time for an average gain of +7.1%.

- 📉 If You’re Worried About a Stock Market Decline – This article covers 5 questions to think through.

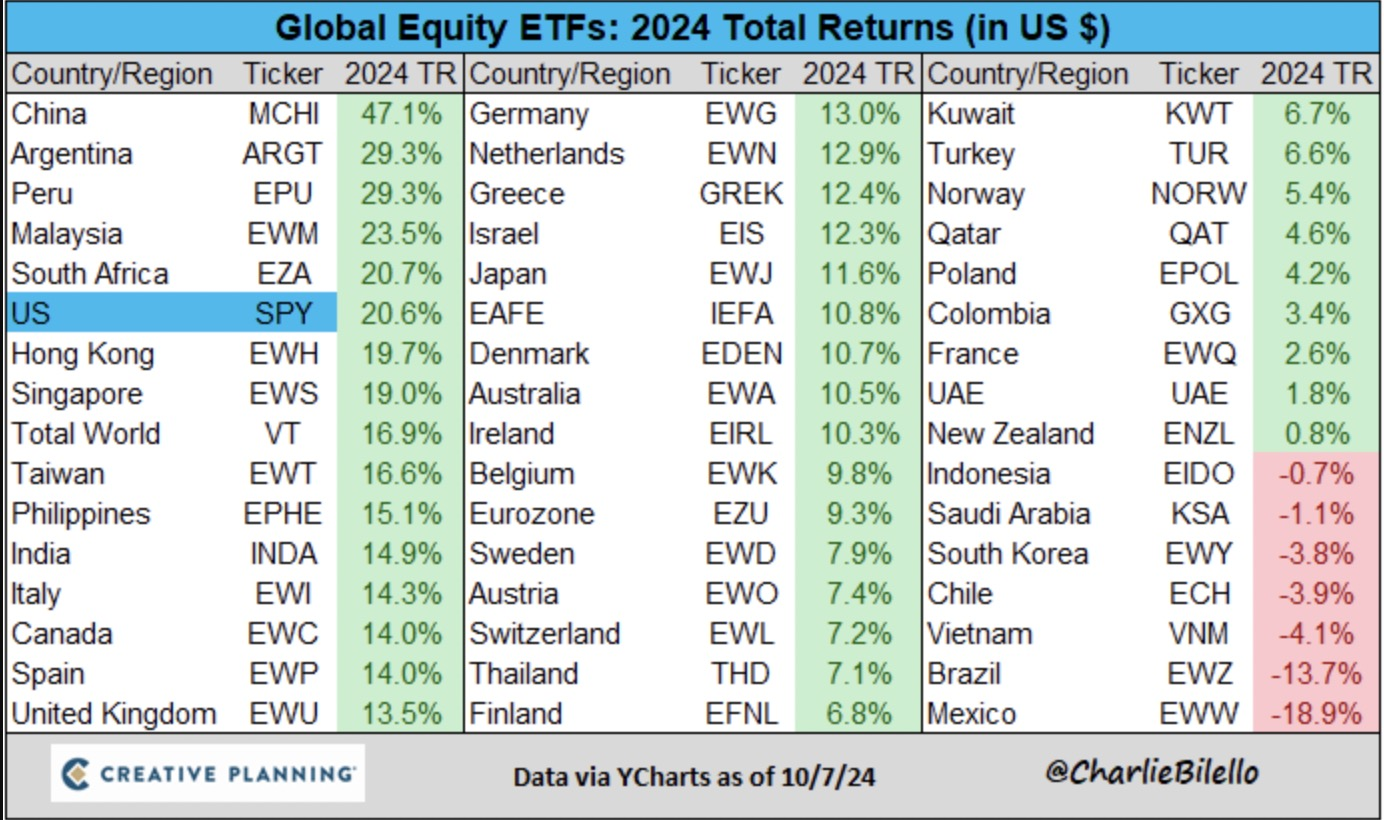

- 🇨🇳 China Rally – From Charlie Bilello, “In the span of a few weeks, China went from being one of the worst performing stock markets in 2024 to #1.”

- The catalyst has been the immense amount of stimulus the Chinese government has been put towards shoring up their economy and stock market.

Economy & Jobs

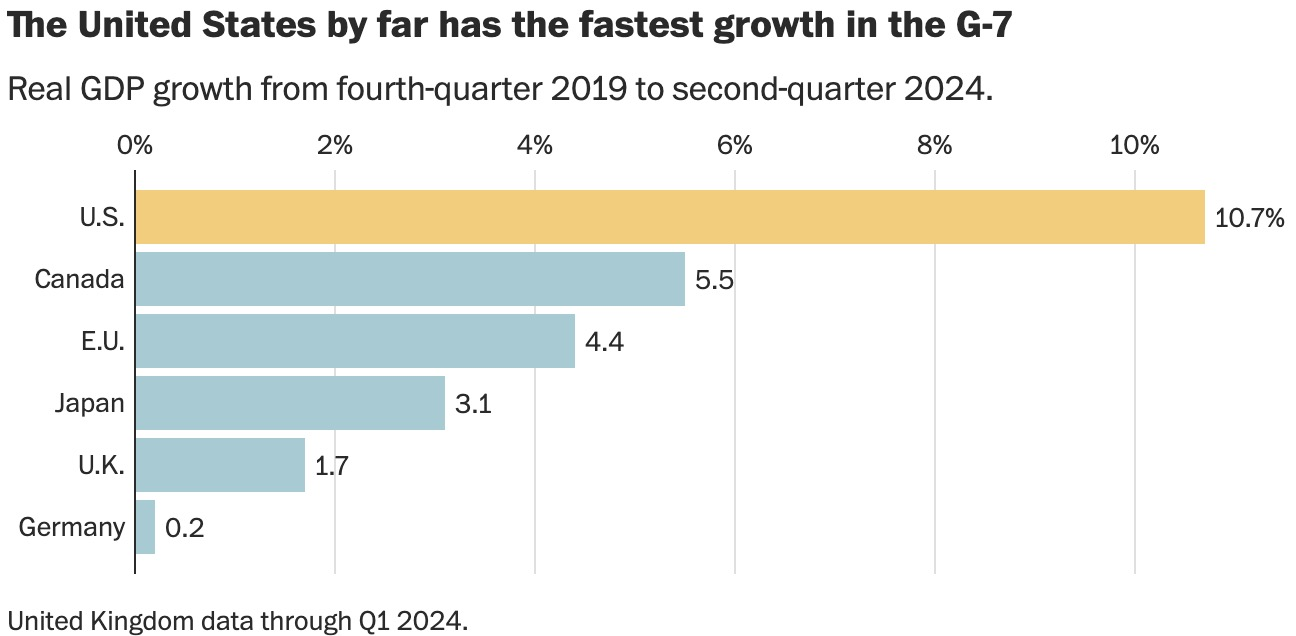

- 💵 American Exceptionalism – Some good data points from an excellent piece in The Washington Post, This is a great economy. Why can’t we celebrate it?

- The US has had the most growth among developed nations since the pandemic:

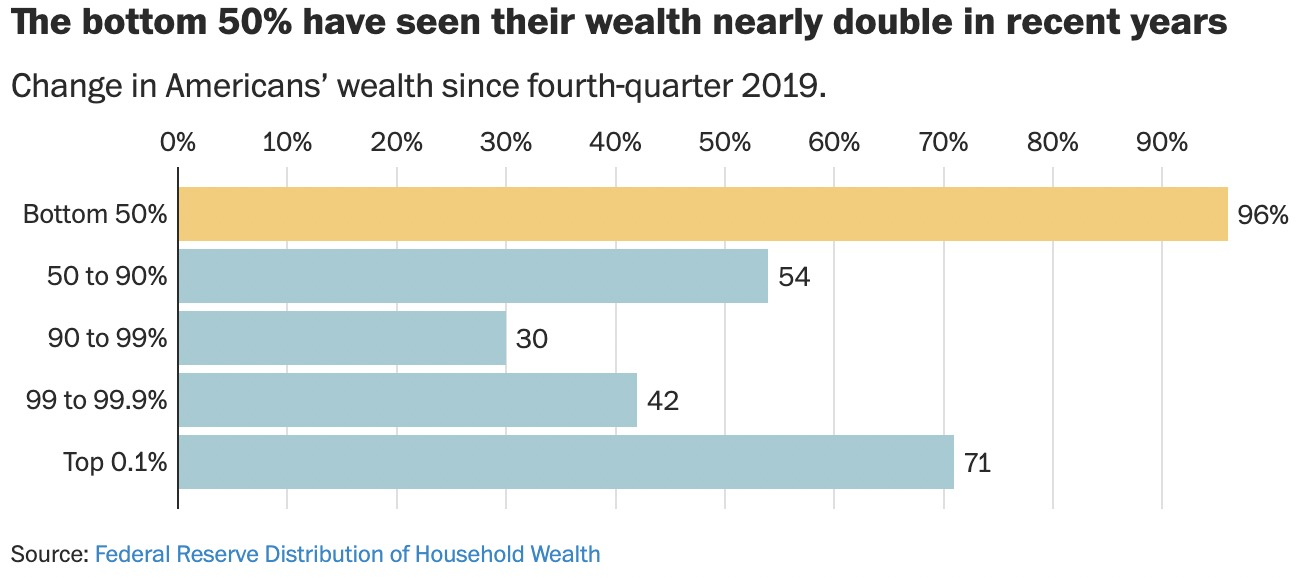

- 🏡 The Poor Get Richer – In more good news, the poorest half of Americans have basically doubled their wealth since 2019:

- 🇺🇸 America’s Economy is Doing Great (But Most People Don’t Feel That Way) – For more great stats about how well the American economy is doing, I suggest this article from Ben Carlson, The New Normal of Negativity.

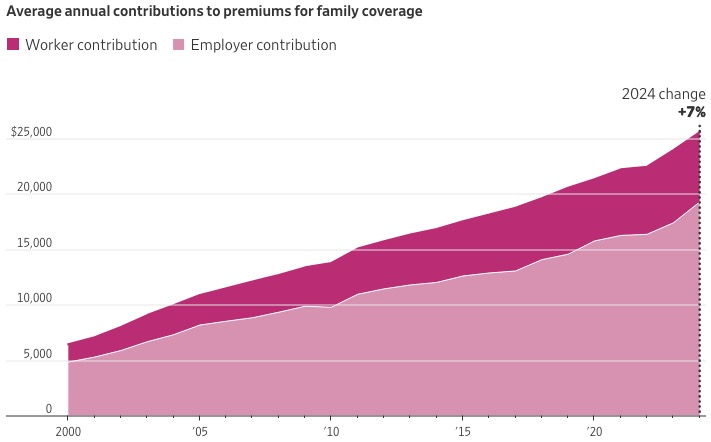

- 🏥 Healthcare Costs – Some unfortunate news about healthcare inflation: “The cost of employer health insurance rose 7% for a second straight year.”

- 🤔 App to Help You Choose a Healthcare Plan – Speaking of healthcare, it’s open enrollment season. If you have questions about which healthcare plan is the right fit, Sheer Health will help you analyze and select a health insurance plan.

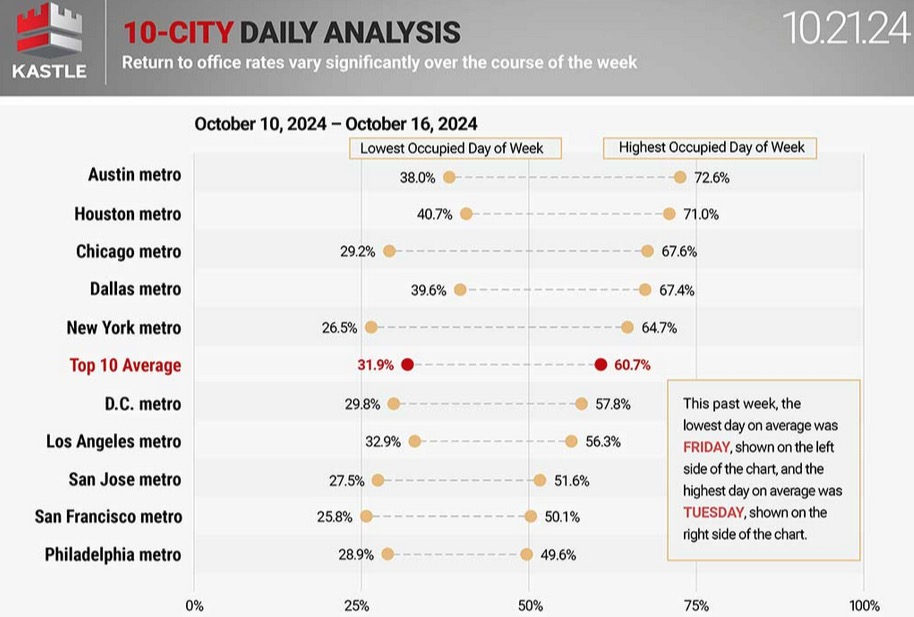

- 🏢 Return to Office Rates – About two-thirds of office workers work from home on Friday’s. Tuesday is the most popular in-office day.

- San Francisco and San Jose remain below the national average.

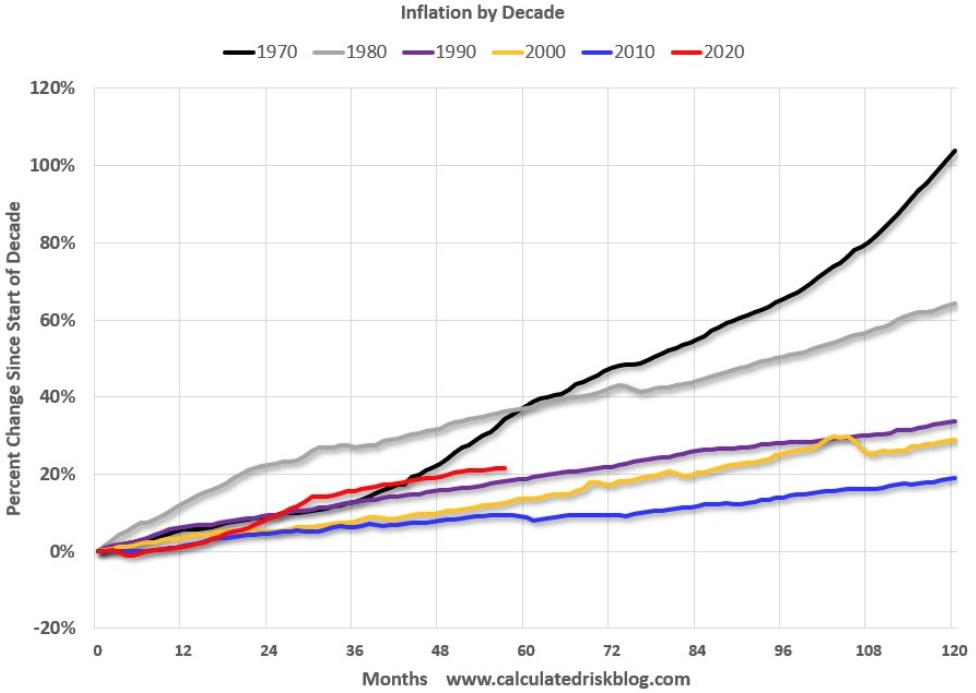

- 🛫 Inflation by Decade – The 2010s (in blue) had extremely low inflation.

- That makes today’s inflation feel much higher, when in reality it’s much less than the terrible inflation of the 1970s or 1980s.

Housing

- 💡 Thinking About Energy-Efficient House Improvements? – Check out this link to see what you qualify for.

- 🏠 Save on Property Taxes! – File this simple form, the Homeowner’s Exemption, to reduce your homes assessed value by $7,000. This should save you about $75 per year for only a few minutes of work:

- San Mateo County

- San Francisco County

- Santa Clara County

- If your county isn’t listed, just search “(county name) + homeowner’s exemption”

- Homeowner’s Insurance Tips – With Hurricane Helene ruining many homes and lives, there’s renewed interest in home insurance. Here are some helpful tips from The Wall Street Journal:

- “If your policy won’t pay enough to rebuild your home from the ground up—at today’s costs—as well as to replace your personal property, such as furniture and clothing, then you are underinsured.”

- “While most homeowner insurance policies include replacement-cost coverage for personal property, that may not apply to the home itself.”

- “For condos: Be sure to review the governing documents of the association to determine the extent of your responsibility to rebuild if there is a casualty loss. Typically, unit owners are responsible for rebuilding the interior of their units, while the condominium association will rebuild the structure of the building.”

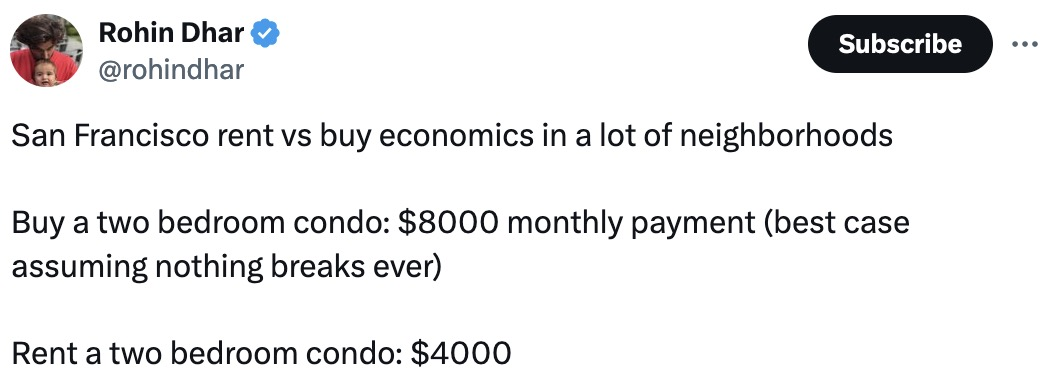

- Rent vs. Buy – I’ve noticed the same math across California:

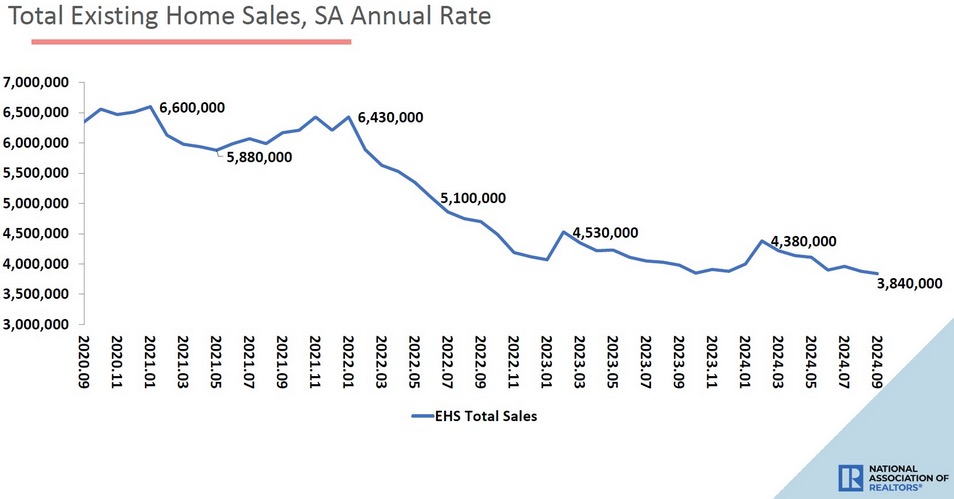

- 🔑 Few Home Sales – The number of existing-home sales dropped 1.0% from August to September, to a seasonally adjusted annual rate of 3.84 million:

Life

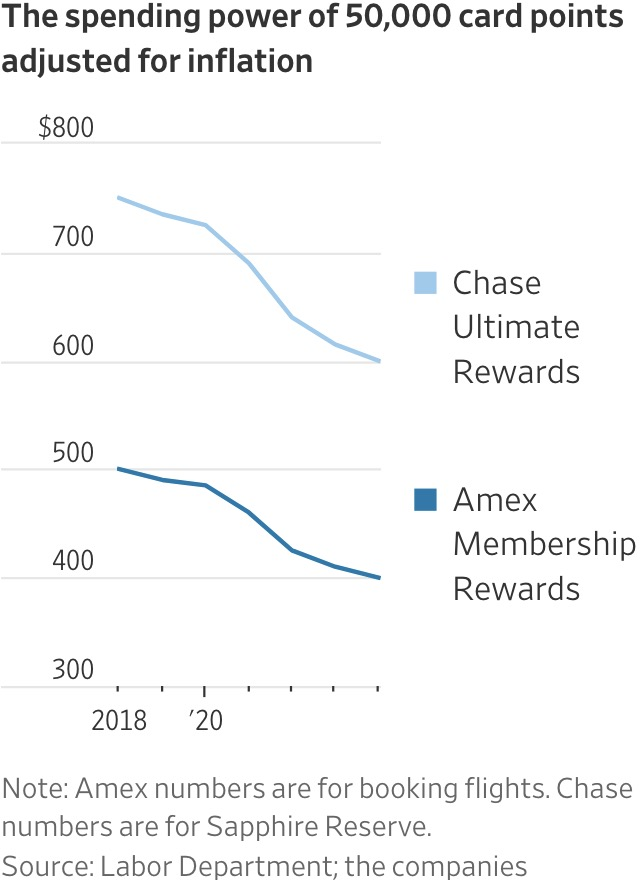

- 💳 The Buying Power of Your Credit-Card Points Is Tanking – From The Wall Street Journal, “A point redeemed in a portal has long been worth about 1 cent, according to the credit-card issuers, and a penny has lost about 20% of its purchasing power since 2018….Practically, this means that if you accumulated 50,000 Capital One points in 2020 and still haven’t spent them, they are now worth about 41,300 points within the bank’s portal.”

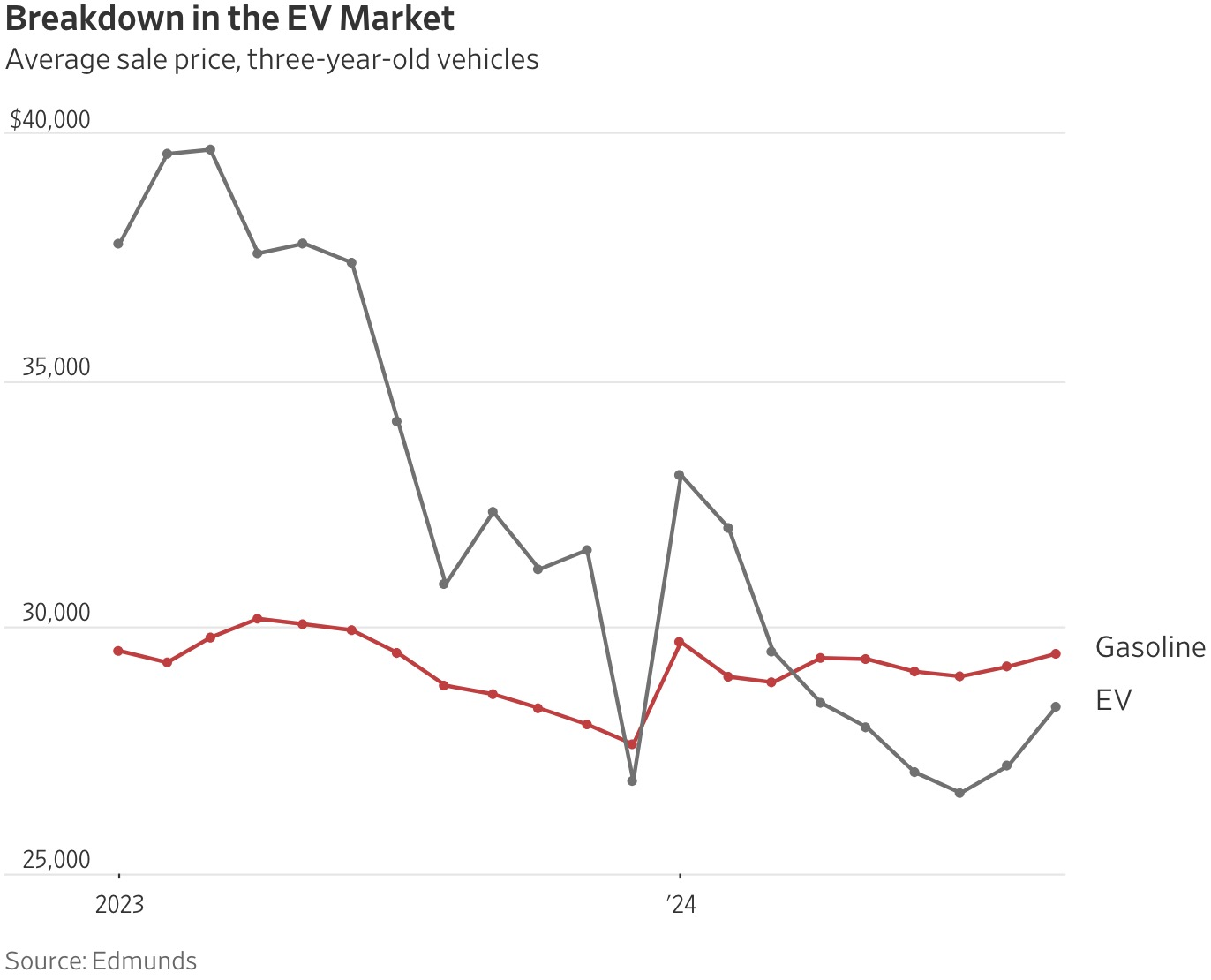

- 🔋 Used Electric Cars are Cheaper than Used Gasoline Cars – There are great deals on both new and used electric cars.

- In addition, “the average monthly payment on a [new] electric-car lease has fallen from $950 at the start of last year to $582 in August, according to Edmunds…77% of EVs from dealerships were leased.”

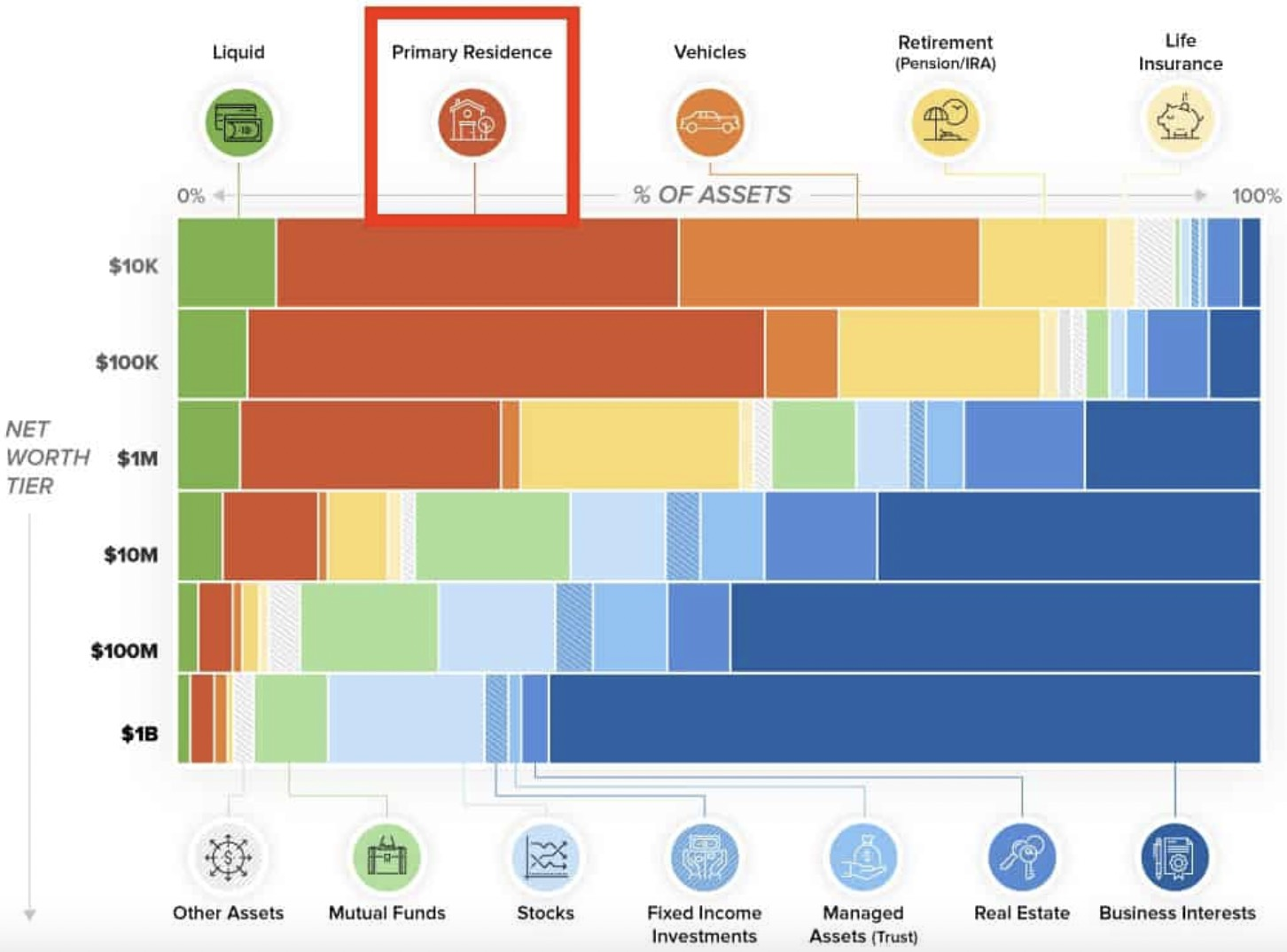

- 💵 How Assets are Distributed Across Wealth Levels – Wealthy people have the majority of their assets in (usually their own) business.

- Stocks and mutual funds also make up a sizable portion of their net worth:

Quote of the Month

“Get out of ‘save a nickel’ mode. Get into ‘make a buck’ mode.”

– Adam Carolla

As always, please reach out if you have any questions or would like to connect.