Thanks for reading.

- 📊 What to Do When the Entire Market Looks Expensive – “NYU professor Aswath Damodaran [someone I respect and trust]…said that for the first time ever, he’s thinking about moving [some of] his money into cash and collectibles — saying there’s no place to hide in the stock market.

- He’s not alone. Goldman Sachs strategists predicted last week that U.S. equities will likely underperform global peers for the next decade. They recommended that investors ‘Diversify beyond the U.S., with a tilt toward emerging markets.’

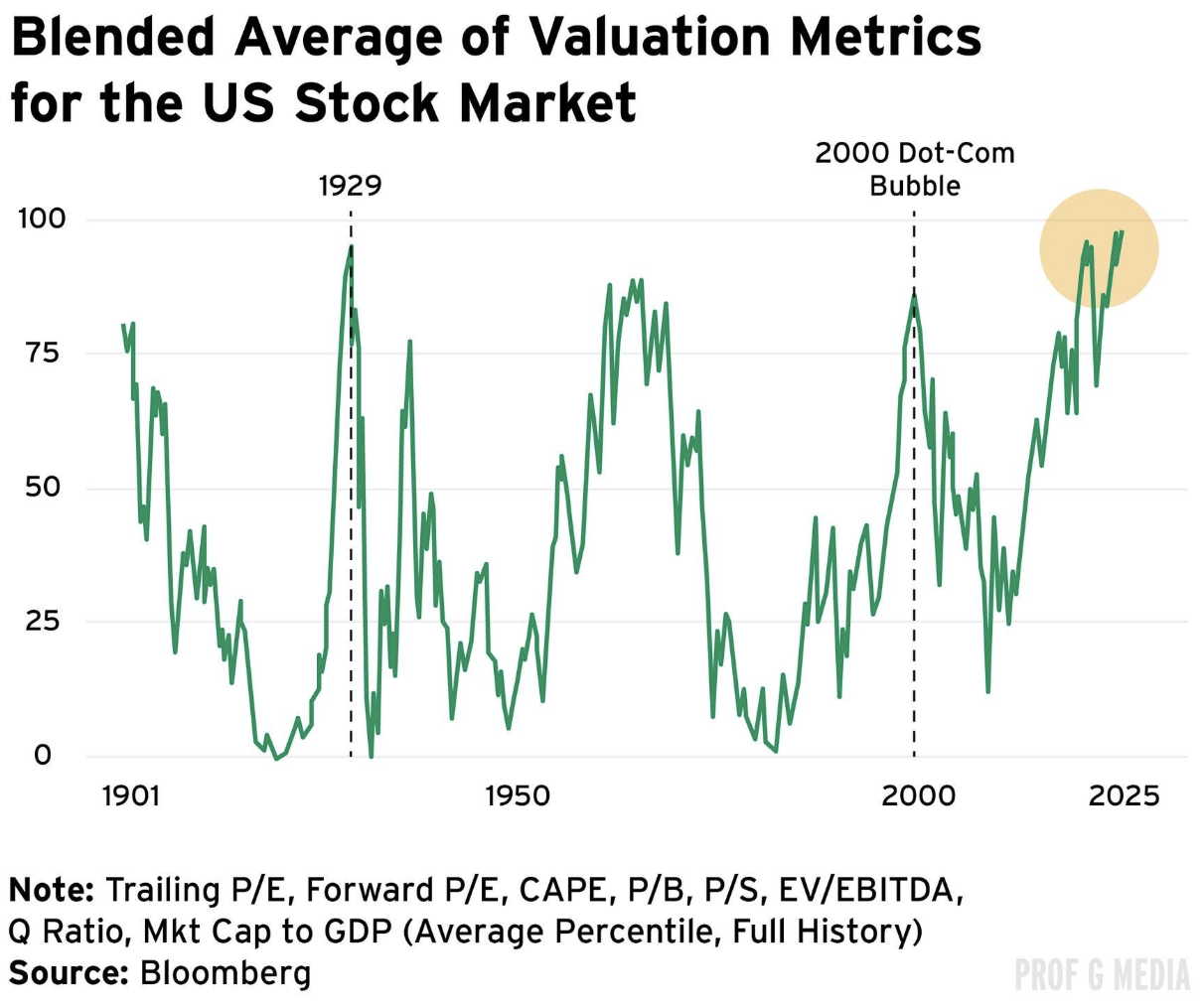

- The S&P 500’s forward P/E [price-to-earnings] ratio is 22x, above its historical average of 17x.

- The index has traded above 22x only twice since 1985: during the dot-com bubble and the COVID-19 pandemic. The market fell sharply both times.”

- Below is blended measure of stock market valuations. Across essentially every metric the U.S. market is expensive. That doesn’t mean it can’t or won’t go higher. It’s just that, expensive.

- So What?

- If you’re concerned that the U.S. stock market is overvalued, here are your options:

1. Do Nothing. As long as you have an investment plan in place that suits your risk profile and time horizon, the best move might be to just follow your plan.

2. Hold or build cash.Keep your allocation largely the same but directnewcontributions, or perhaps proceeds from overpriced or concentrated assets, into cash.

3. Change your asset allocation/diversify. Adjust your stock/bond mix, increasing exposure to what you believe is undervalued and reducing what you see as overpriced.

- Within stocks, diversify globally: Roughly one-third internationally is a good starting point.

4. Buy protection. Use derivatives like puts or futures to hedge your portfolio without altering your core holdings.

5. Make leveraged bets. Take aggressive, leveraged positions, such as buying puts or shorting stocks, to profit from a potential market correction.

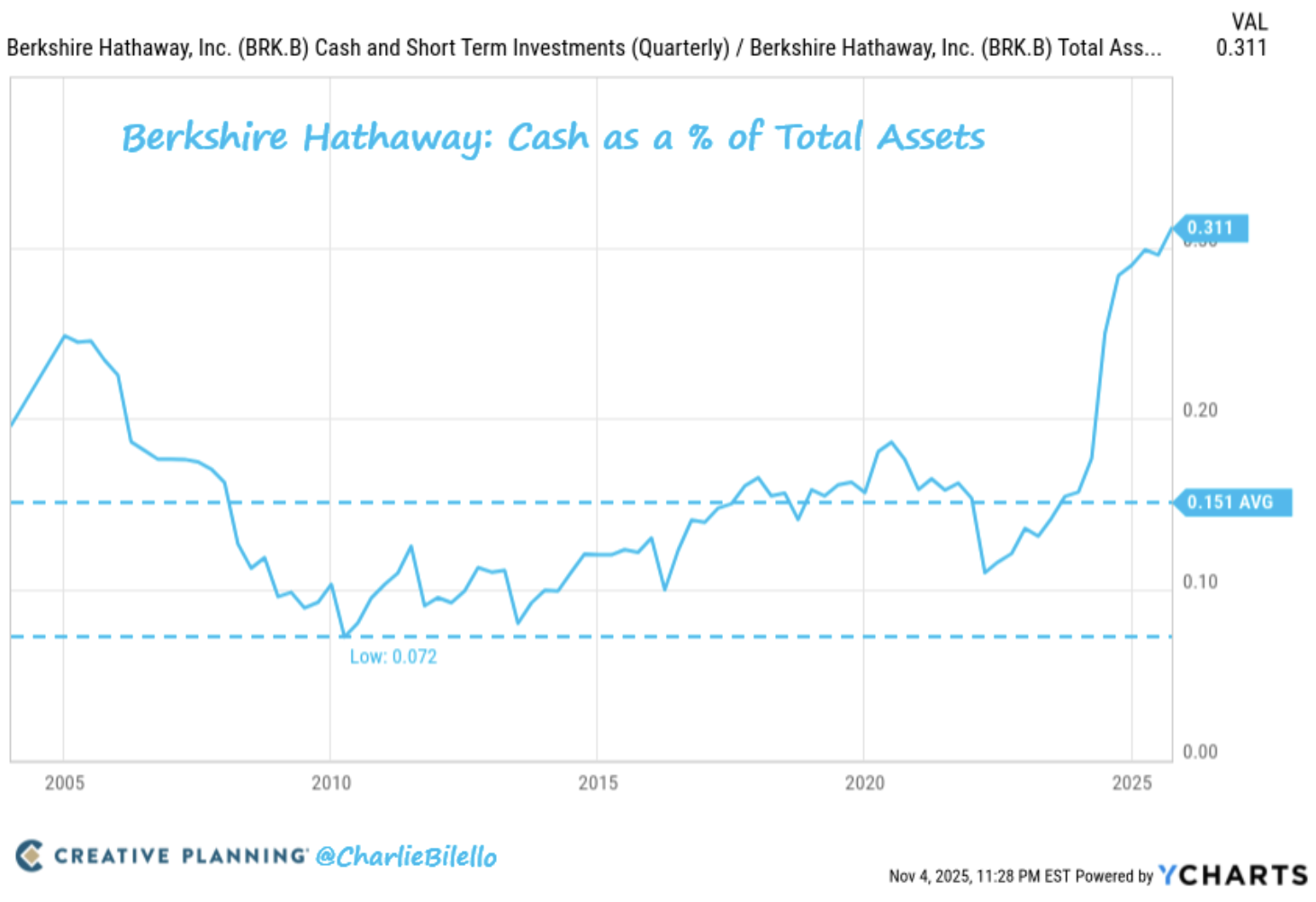

- 💸 Warren Buffett is Holding Tons of Cash – “Berkshire Hathaway is now holding over 31% of their assets in cash [$382 billion], their highest percentage on record.”

- Warren said this recently about this topic:

- “We’d love to spend it [cash]…It’s just that things aren’t attractive.” For now, it seems, Berkshire is positioned very defensively.

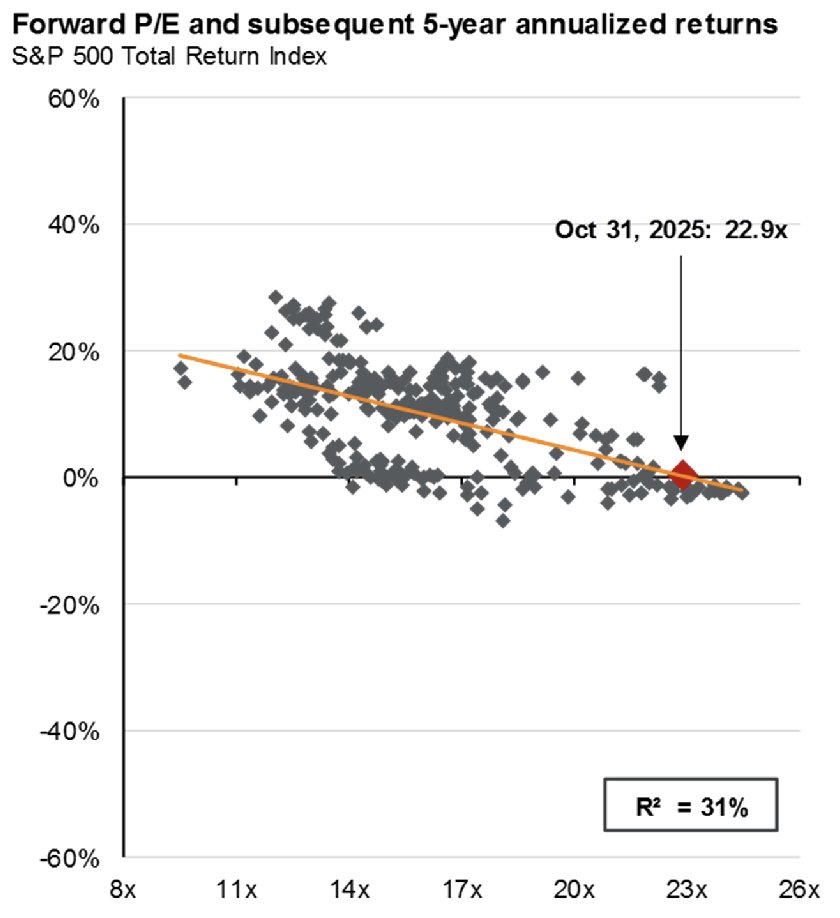

- Valuations vs. Returns – Stock market valuations, shown on the x-axis below, have historically offered reasonable insight into five-year returns.

- While it’s a relatively small sample size, if that pattern holds, U.S. market returns over the next five years could be flat or even negative.

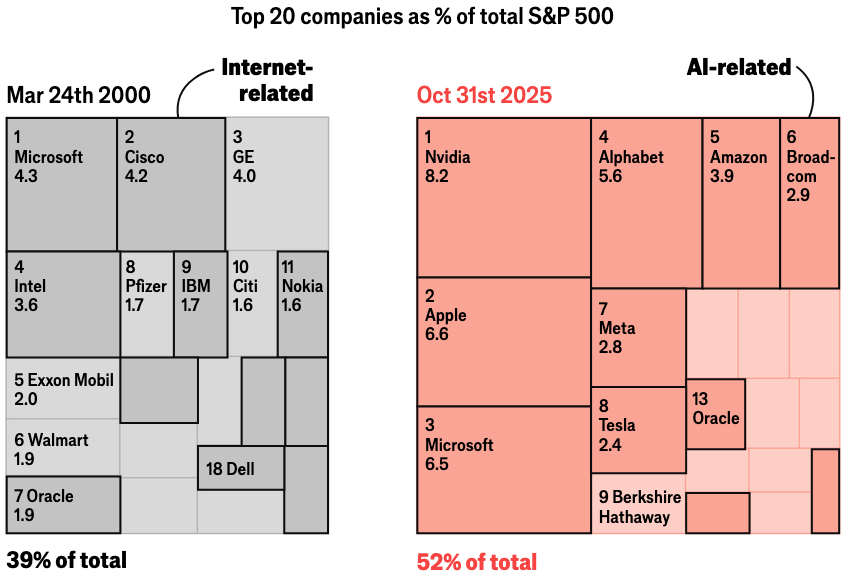

- AI is Huge – “In 2000 the 20 biggest firms on the S&P 500 made up 39% of its total value. Eleven of those were internet-related companies.

- Today the top 20 account for 52%, with the same number deeply invested in AI.

- If the tech fails to deliver juicy returns they would all be hit hard.” — The Economist

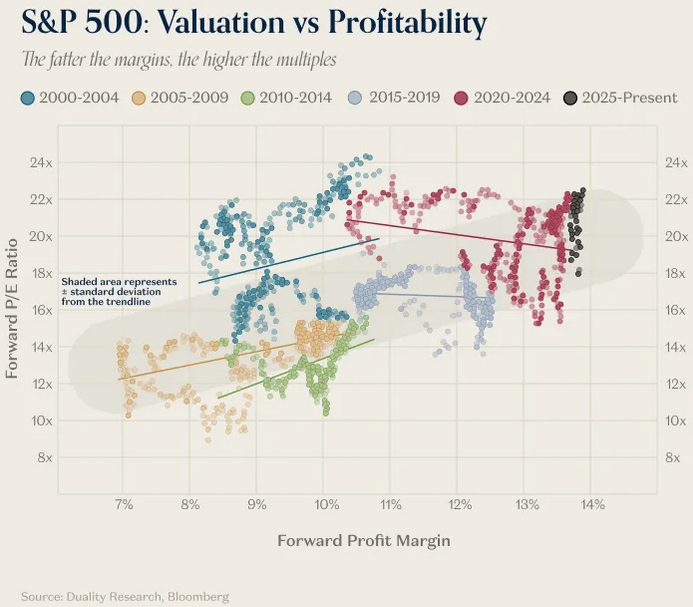

- % Higher Profits = Higher Valuations? – On the other hand, here’s a good chart and point from A16Z:

- “It’s true that multiples on earnings are historically high, but it’s also true that companies are historically profitable–and valuations have scaled accordingly.

- The point here is that for all the histrionics, investors aren’t dumb. There’s a clear method to the madness, and it’s all about profitability. Fat margins and growing profits lead to high stock prices, and fat margins and growing profits is exactly what PublicCos keep doing.

- Now, reasonable minds can disagree about whether forward earnings estimates are correct (and there are of course many other things that affect stock prices), but taking them at face value, there is nothing bubbly at all about current valuations.”

- 🏦 Record Quarterly Results – Given how profitable today’s companies are, the results and numbers from the following tech companies are extraordinarily impressive.

- “It was another record quarter for Big Tech, with:

- Apple revenues growing 8% YoY [year-over-year] to a new Q3 record of $102 billion and net income growing 92% YoY to a new Q3 record of $27 billion.

- Google revenues growing 16% YoY to a new record high of $102 billion and net income growing 33% YoY to a new record high of $35 billion.

- Microsoft revenues growing 18% YoY to a new record high of $78 billion and net income growing 12% YoY to a new record high of $28 billion.

- Amazon revenues growing 13% YoY to a new Q3 record of $180 billion and net income growing 38% YoY to a new record high of $33 billion.”

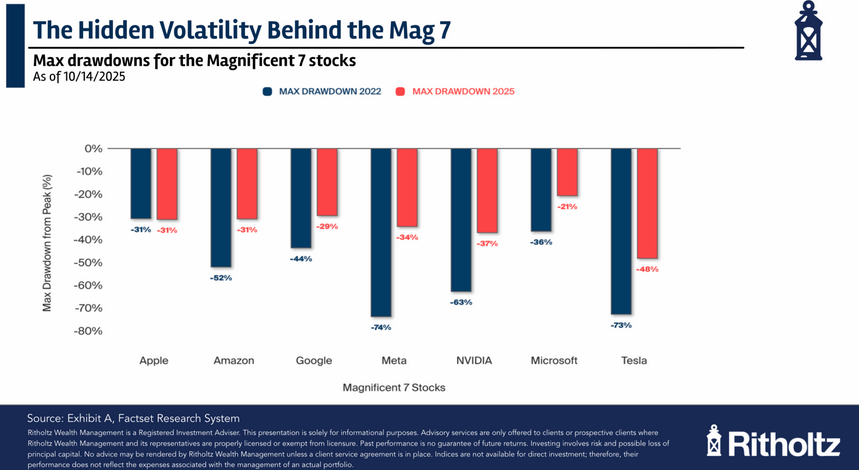

- Despite these amazing results, the declines (AKA “drawdowns”), whenever they may happen, can be intense:

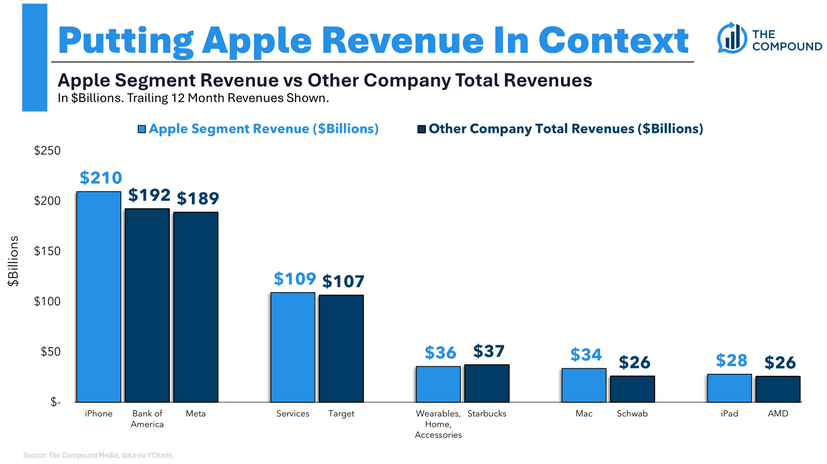

- 📱 Apple’s Revenue by Product Line vs. Other Corporations – “The iPhone produces more revenue than Bank of America or Meta. The iPad makes more money than AMD.” — The Economist

“When people get very excited, as they are today about artificial intelligence, for example…every experiment gets funded, every company gets funded…The good ideas and the bad ideas. And investors have a hard time in the middle of this excitement, distinguishing between the good ideas and bad ideas.”

– Jeff Bezos

As always, please reach out if you have any questions or would like to connect.