The House of Representatives is expected to vote soon on the Build Back Better Act. This legislation affects federal taxes, so I wanted to share a preview of what’s to come.

Many expected to pay more tax under a Biden administration. Surprisingly, the bill will likely reduce taxes for many high-earning Californians.

Below are the high-level details from the current draft of legislation. Please note, this bill has not yet been signed into law, and last-minute changes are likely to occur.

First, what will not change:

- Top ordinary income tax rate: 37%

- Top long-term capital gains rate: 20%

- The step-up in cost basis upon death ‒ Under current law, if the owner of an asset dies, the unrealized gains are not subject to tax. When the heir eventually sells the asset, they are only required to pay taxes on the increase in value from the date they inherited it.

- Estate and gift tax exemption: $11.7M ‒ this exemption amount is scheduled to sunset at the end of 2025 and revert to $5 million per person in 2026. With that in mind, you may want to consider your own estate and gift-planning strategy.

- Annual Gift Exclusion: Remains at $15,000 per recipient.

Here are the areas of change:

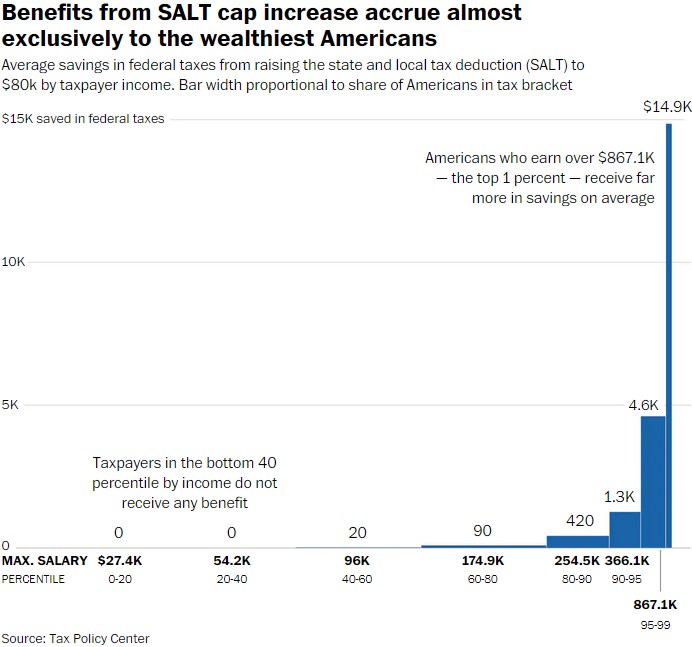

- State and Local Tax (aka SALT) Deduction Increase to $80,000Current law limits state and local taxes (e.g., property taxes) to be capped at $10,000 per year. So if you pay $40,000 of combined state and property tax, you can “only” deduct $10,000 of that amount on your federal tax return.The revised law will allow you to deduct up to $80,000 of state and local taxes, beginning in 2021. This would be a big win for high-income households. A large portion of the benefit from such a change would go to those with earnings between $250,000 – $1 million per year, as illustrated below:

- Changes to Roth accounts

- Backdoor Roth Conversions are set to be eliminated, beginning in 2022.

- No Roth conversions at all for high-income (400,000 single/$450,000 joint) taxpayers, effective 2032.

- Increases to Maximum Retirement

- Account Contributions

401(k)’s and 403(b)’s: $20,500 (increased by $1,000), beginning in 2022. The catch-up contribution for those over age 50 remains unchanged at $6,500 per year. - The overall limit, which includes employer contributions, increases by $3,000 ‒ from $58,000 in 2021 to $61,000 in 2022. If your employer allows after-tax 401(k) contributions, you also get the advantage of the new $61,000 limit for 2022.

- SEP IRA and Solo 401(k): Increased from $58,000 in 2021 to $61,000 in 2022

- Account Contributions

- Additional surtaxes of 5% and 3% for taxpayers with income greater than $10 million and $25 million, respectively (applies to trusts at $200,000/$500,000).

- Enhanced Child Tax Credit ‒ Parents earning less than $400,000 will qualify for a tax credit of $3,600 for children under the age of six and $3,000 for children under the age of 18.

- Net Investment Income Tax (NIIT) ‒ A 3.8% surtax to S corporations or limited partnerships. Begins in 2022.

- Wash Sale Rules ‒ Scope increased to include commodities, foreign currencies, and digital assets (such as Bitcoin). Effective 2022.

I will let you know when the bill is signed into law and inform you of any changes from the current proposals.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.