As we enter the last month of the year, I’d like to share some personal news, a few year-end financial planning tips, and an interesting observation about the US economy.

First off, the exciting personal news: I’m happy to announce that my wife is pregnant! This is our first child, and we’ll be having a baby girl. The due date is March 22nd. We’re looking forward to her arrival!

Year-End Financial Planning Tips:

- I Bonds: If you have extra cash, I recommend looking into I bonds. The “I” stands for Inflation, so if inflation moves up, the interest rate will too. They currently pay 7.12%, a rate that is unmatched in any bank account. You buy them directly from the Treasury, and are capped at buying $10,000 per person per calendar year. One idea is to allocate $10,000 in 2021 and another $10,000 in early 2022. The interest is exempt from state and local tax, but you will still be subject to federal tax. To learn more and set up an account, visit the Treasury’s website.

- FSA Accounts: The IRS has informed employers that for 2022, workers can carry over the full amount of their FSA savings from 2021. If you have a FSA it’s a good idea to ask your employer if they opted into this change.

- Required Minimum Distributions: If you have not taken your required minimum distribution from your IRA or Inherited IRA, make sure to do so by the end of the year.

- Charitable Giving: For 2021 you can deduct up to $300 even if you don’t itemize deductions (up to $600 for a married couple). These must be cash donations. Or if you itemize your deductions you should consider gifting taxable investments with unrealized capital gains (such as company stock) instead of cash. Not only can you avoid the capital gains tax, but you can take a deduction for the amount you give.

Lastly, I wanted to share an article that I found interesting:

Americans Are Flush With Cash and Jobs. They Also Think the Economy Is Awful.

The New York Times, Neil Irwin

The takeaway is: “Americans are, by many measures, in a better financial position than they have been in many years. They also believe the economy is in terrible shape.”

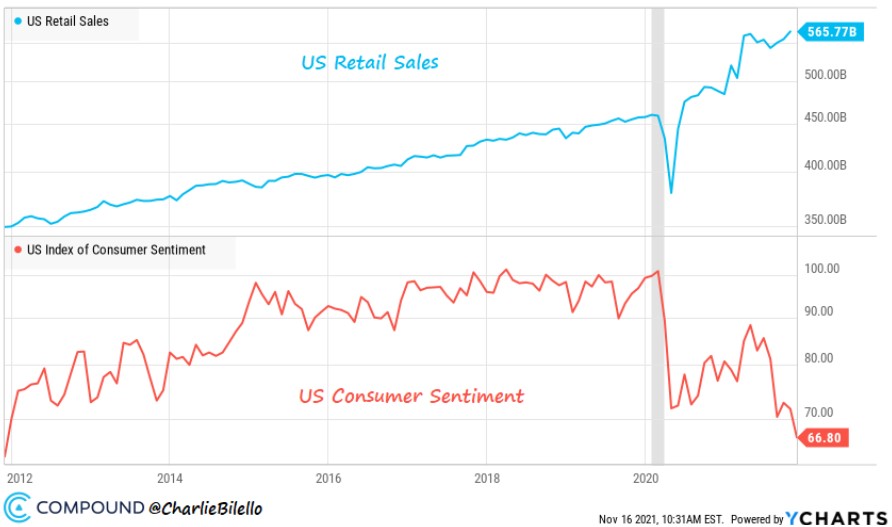

We’re seeing positive economic news almost everywhere. The following have all recently hit all-time highs: US stock markets, home prices, hourly wages, job openings, and household net worth.

Yet despite these encouraging indicators, people don’t feel that the US economy is performing well. This contradiction is summarized well in the chart below. We’re spending more than ever, but sentiment is at a level not seen since 2012:

I hope you found this content enjoyable. If you have any questions or would like to speak about a year-end topic, or anything else, please let me know.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.