Q2 Investment Commentary Highlights

Stocks and bonds, both in the US and abroad, experienced further volatility and declines during the second quarter of 2022. It is times like these that test us as investors. Look at a long-term chart of the stock market and you’ll see that it moves up and to the right. But in order to get those long-term results, you have to be able to survive the short- and medium-term declines like we’re in now.

The major factors driving the markets centered around inflation, strong policy responses from the Federal Reserve and other central banks, and the ongoing war in Ukraine. While stocks and bonds are often influenced by different factors and exhibit a low correlation to each other, the macro trends this year have presented headwinds for nearly all asset classes.

A variety of issues have contributed to inflation: the aforementioned war in Ukraine, COVID lockdowns in China, and continued supply chain challenges around the world. The Federal Reserve raised the Fed Funds rate 1.25% during Q2. Markets have also priced in expectations for further increases at the Fed’s next several meetings. The Federal Reserve remains committed to bringing inflation under control, which has led investors to also consider the probability of an increased risk of recession. However, on the positive side, the employment and job opening data remain very strong.

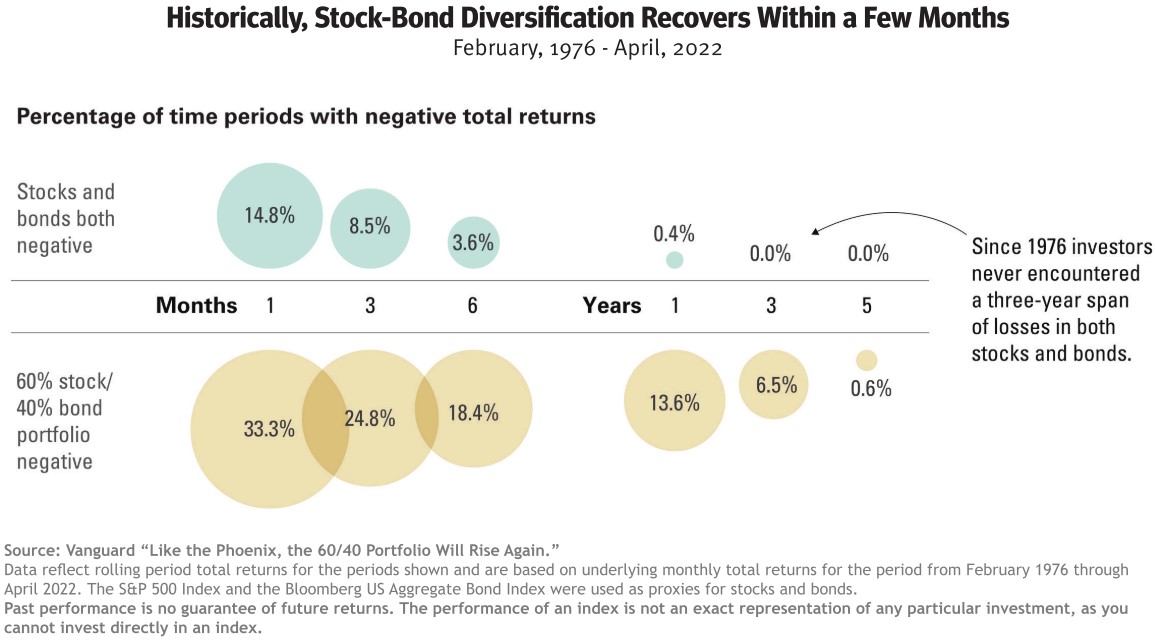

A little historical context on the current environment might be useful. While stocks and bonds are broadly considered to offer correlation and diversification benefits for investors over time, the first six months of 2022 have clearly highlighted, especially over the short-term, that it does not always hold true. The following illustration highlights that historically stocks and bonds have both fallen in about 15% of months (roughly 1 in 7 months). While not unprecedented, having stocks and bonds both down over a 6-month period is certainly a rarer event:

Over longer periods, the historical probability of negative outcomes for both stocks and bonds becomes significantly lower. In fact, Vanguard notes that since 1976, stocks and bonds have never both been negative over a 3-year time period.

While we know past performance does not guarantee us anything about the future, it is informative to understand the unique situation that investors have endured to start 2022. It is also important to consider the longer-term benefits of holding diversified, risk-appropriate portfolios for achieving investment goals.

Markets have shown their resilience through many business cycles, interest rate increases and decreases, expansions and recessions, and even periodic “black-swan” events like wars and pandemics. Although the current environment offers many short-term reasons for pessimism, and turbulent markets can certainly test our resolve, history has shown that long-term investors who stick to their plan and remain disciplined ultimately will be rewarded for their patience.

US Stocks

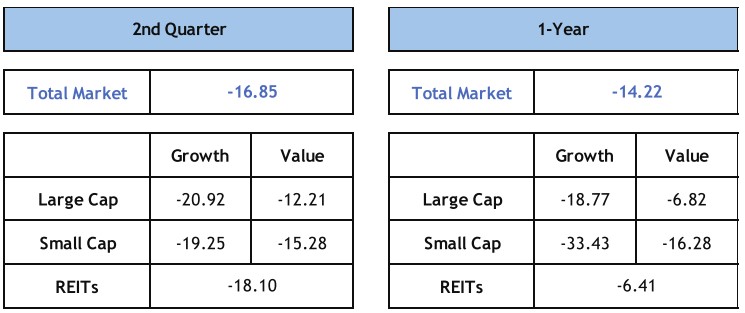

US stocks fell during the second quarter by -16.9%, and are down -14.2% over the past year. While in absolute terms it is certainly a meaningful decline, we must remember this has come following a very strong period for investors. Looking at the S&P 500, for example, prices are back to levels where they were roughly at the beginning of last year.

There has also been a distinct shift among investment styles, with value stocks outperforming more growth-oriented stocks (which tend to be more tech heavy). Growth stocks over the past year have been among the weakest areas.

International Stocks

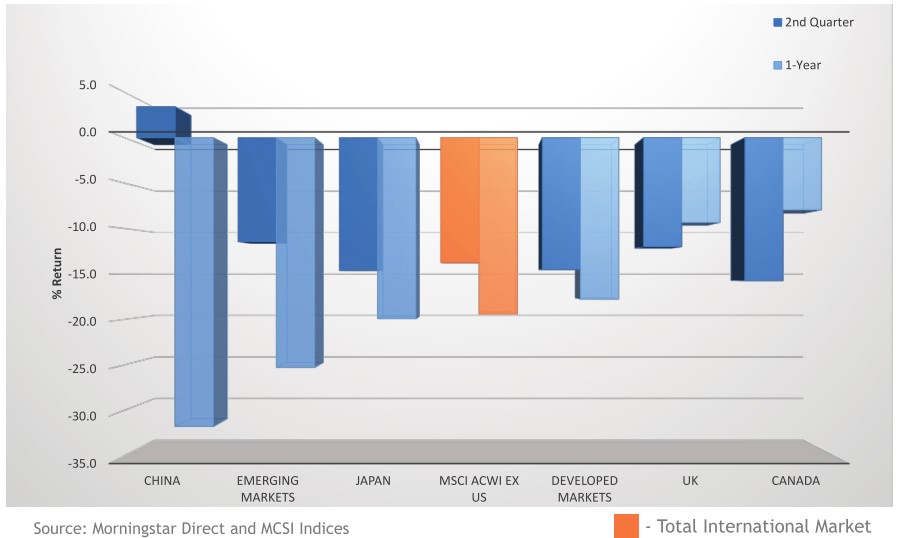

International developed markets finished the quarter down slightly less than US markets (-14.5%), while emerging market stocks held up relatively better than either (-11.5%).

While the current environment has provided very few places for shelter, after a strong sell-off earlier, one area of positive returns during the quarter came from China as many lockdowns were lifted and increased economic activity resumed. International stocks have trailed the US markets over the last year, with developed markets returning -17.8% and emerging markets declining -25.4%.

Bonds

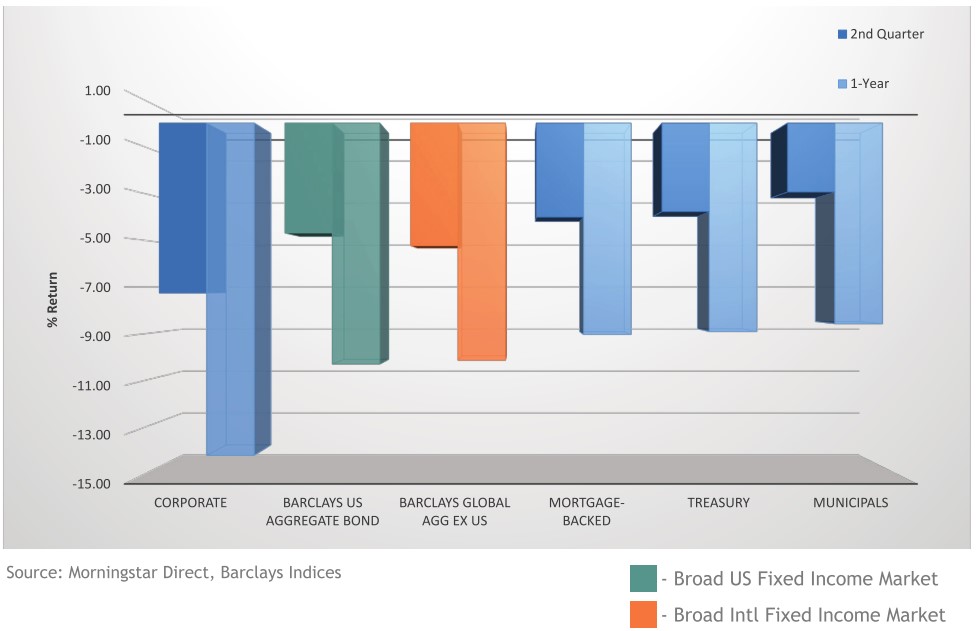

Bonds fell during the quarter, reflecting the repricing of expectations for interest rates and inflation. In addition to the impact of higher rates, credit spreads widened as investors demanded more compensation for the higher risk of corporate bonds relative to Treasuries. The result was that corporate bonds were among the weakest performers for the quarter and the last year.

One silver lining of the rise in interest rates is that going forward, fixed income investments offer a much more attractive return opportunity than has been available for quite some time. As bonds mature and coupon payments are received, they can be reinvested at higher rates. While challenging currently, over the longer term investors have the opportunity to benefit from higher returns than if rates had not moved at all and simply stayed at pre-2022 levels.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.

Disclaimer: Investments are not guaranteed and are subject to investment risk, including possible loss of the principal amount invested. Past performance is no guarantee of future results. All allocations and opinions expressed are as of the date of this presentation and subject to change. The information contained herein does not constitute investment advice or a solicitation. Information obtained from 3rd parties is believed to be accurate, but has not been independently verified.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material is presented solely for information purposes and has been gathered from sources believed to be reliable, however Think Different Financial Planning cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Think Different Financial Planning does not provide tax or legal advice, and nothing contained in these materials should be taken as such. As always please remember investing involves risk and possible loss of principal capital. Advisory services are only offered to clients or prospective clients where Think Different Financial Planning and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Think Different Financial Planning unless a client service agreement is in place.Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.