I wanted to share a few pieces of information regarding the recent market volatility.

The Bad News

Succinctly put, it’s been a bad start to the year. The reasons are well known: inflationary worries, the Russia-Ukraine war, high oil prices, Covid shutdowns in China, and supply-chain shortages.

The S&P 500, an index of the 500 largest US stocks, is down 16%. The damage is worse in the technology sector: Nvidia (-49%), Facebook (-47%), Amazon (-41%), Microsoft (-25%), Alphabet (-24%), and Apple (-20%), are a few examples. Smaller companies that were pandemic favorites, such as Peloton (-89%), Shopify (-79%), Zoom (-78%), and PayPal (-75%), are down even more.

Usually when stocks decline, bonds cushion the blow. Unfortunately, with interest rates rising bonds are down about 12%.

The decline in stocks and bonds concurrently has led to an environment where essentially all investors are down.

The Good News

- This is Normal: Since 1980 the S&P 500 index has had positive returns in 33 of the past 41 years. In most years, even the positive ones, there has been a significant decline at some point during the year. The average decline is about 14%, which is not too far off the 16% decline in 2022.

- Higher Interest Rates are Encouraging: Part of the reason interest rates are rising is because the economy is doing well. Higher interest rates, relative to where they’ve been over the past few years, are normal. This will lead to more income in your bank account and higher returns for bonds.

- Home Prices: Nationwide home prices are up 20% over the past year and 40% over the past three years.

- Opportunity to Tax-Loss Harvest: While nobody likes losing money, the current environment is a good opportunity for tax-loss harvesting. This is exactly what we’ve done for managed accounts.

- The Job Market is Strong: All private-sector jobs lost during Covid have been recovered. There are also twice as many job openings as there are people looking for a job.

- Company Earnings: During Q1, earnings-per-share have grown 6.7%, much higher than the long-term average of 4.1%. While this is lower than the Q4 average of 13%, it’s not as if public companies are shrinking.

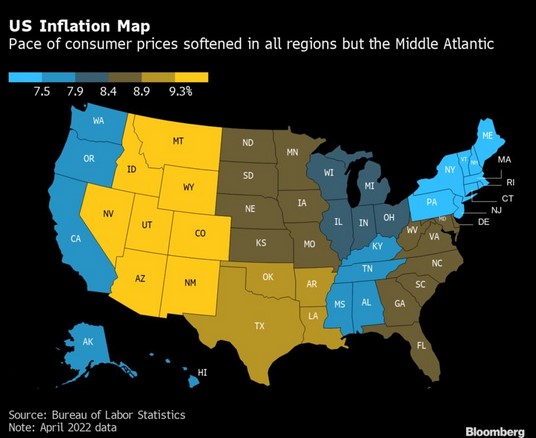

- Inflation: While inflation is higher than it’s been over the past decade, there are signs of deceleration. The inflationary trends also depends where in the country you live (the west coast being lower than elsewhere):

If you’d like to read more, here are a couple articles and excerpts:

- How to Think and Act For the Long Term

Michael Batnick, The Irrelevant Investor

“Look at a chart of the S&P 500. It goes up over time. Why would you want to hop off something that has historically generated 8-10% annual returns?…You were probably expecting a pullback at some point. Well, here it is. You cannot expect a pullback and then freak out when it happens. I mean, you can, but you’re not going to have much success if you do.”

- Some Things I Remind Myself During Market Corrections

Ben Carlson, A Wealth of Common Sense

“If you buy the market [i.e., a diversified portfolio], every sell-off in history has been a buying opportunity.”

“Every time stocks fall it feels like they’re going to fall even further. It’s always much easier to look back at a long-term chart and kick yourself for not buying when stocks were falling in the past. When you know the exact bottom, investing is easy. But when you’re living through it these corrections it always feels like they’re only going to get worse.”

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.