Summary1

- Stock markets finished the quarter strong, as the S&P 500 returned 5.9% and set its 43rd all-time high for the year.

- The Federal Open Market Committee (FOMC) cut interest rates for the first time since the rate increases began in March of 2022. The lending rate was reduced by 0.50%, to a range of 4.75% – 5.00%.

- Investors welcomed the FOMC’s larger-than-anticipated cut, and “risk-on sentiment” took hold in the final weeks of September. However, the upcoming U.S. election in November may add uncertainty and volatility to the markets as investors weigh the outcomes of differing policy positions.

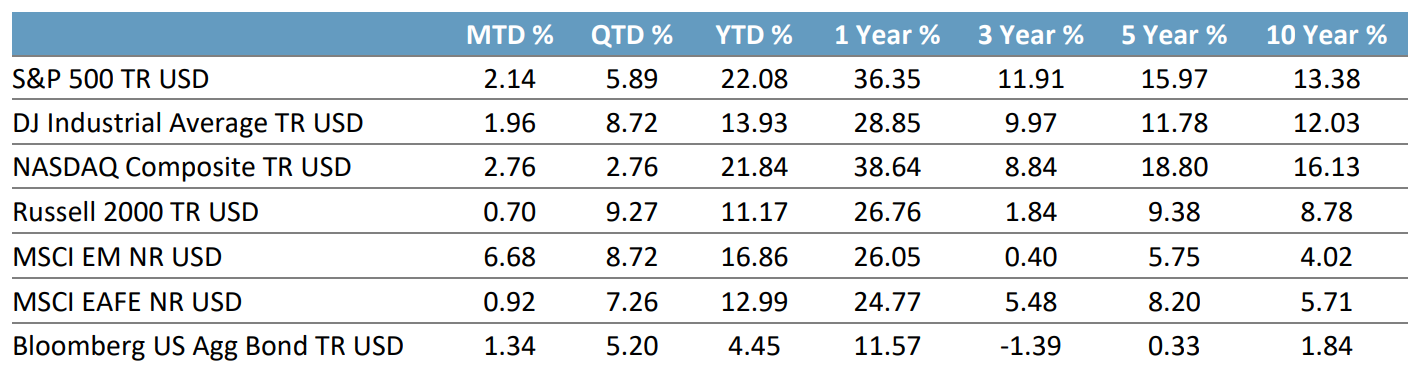

Market Returns1

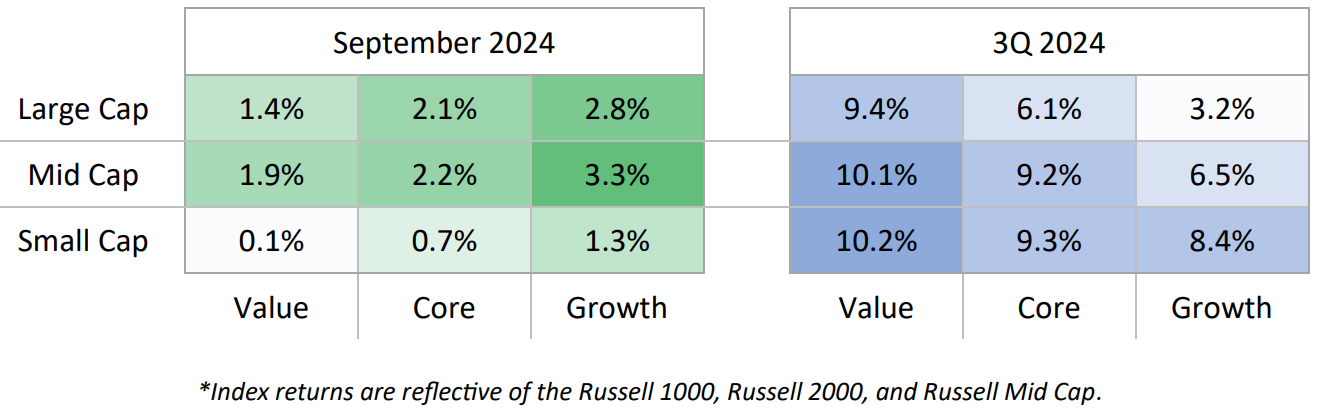

US Stocks

The U.S. stock market performed well in the third quarter, rising by 5.89%. Early in the quarter, many investors shifted their focus to smaller and value-oriented stocks, anticipating that these companies could benefit from a potential cycle of interest rate cuts.

The interest rate reduction suggests that inflation may be easing, raising hopes for a “soft landing” for the economy. This move sparked optimism, leading to increased confidence and risk-taking by investors for the rest of the month.

Size and Style Boxes

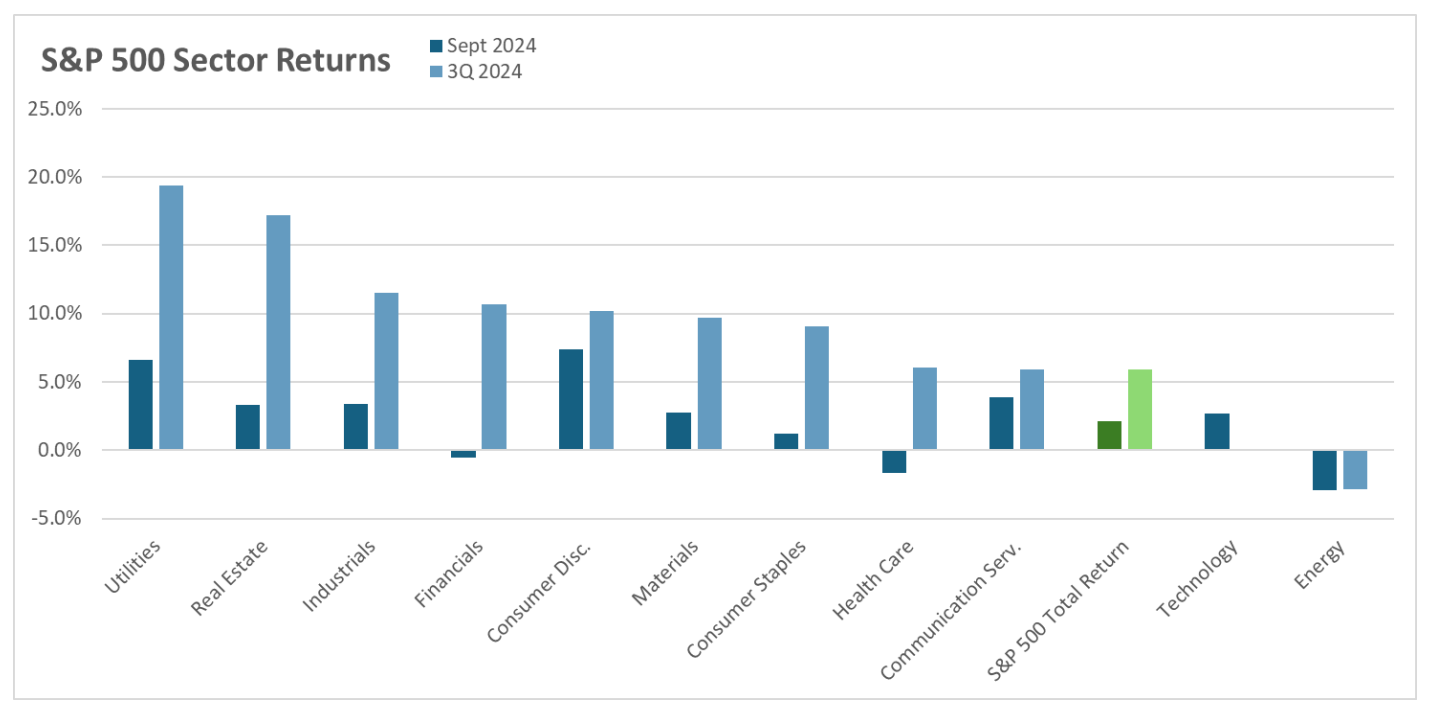

The best-performing sectors in the third quarter were Utilities, Real Estate, and Industrials, while Energy was the only sector to post a negative return. Crude oil prices declined for much of the quarter, with a slight rebound at the end. The International Energy Agency (IEA) recently projected slower demand growth, largely due to China’s economic slowdown.

S&P 500 Sector Returns2

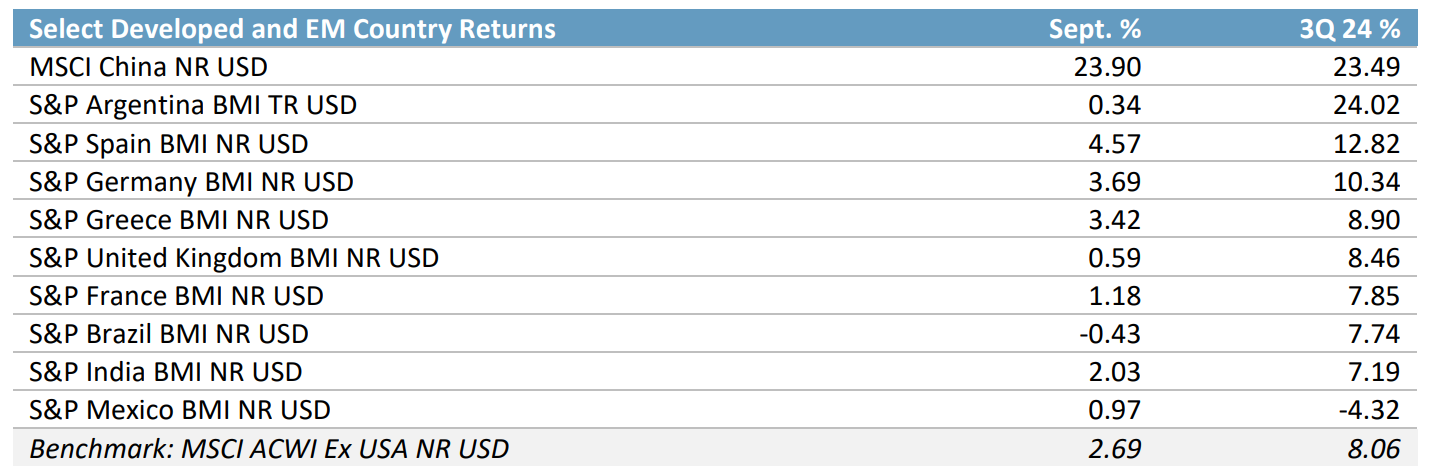

International Stocks

International markets saw mixed performance during the third quarter. Europe showed areas of strength, with countries like France and Italy leading the way. However, Germany’s industrial sector faced challenges due to its dependence on China and slower transition to electric vehicle production. To boost growth, the European Central Bank (ECB) joined the Federal Reserve in cutting interest rates. With inflation on the decline, there’s hope for stronger consumer spending and improved corporate earnings in the region.

Developed & Emerging Market Returns3

China, a key driver for many international markets, is dealing with structural challenges. Despite ongoing stimulus efforts, its property market struggles and weak consumer confidence have yet to be resolved, dampening hopes for a strong rebound. Japan also presents a mixed picture, with rising inflation and household spending under pressure, though corporate sentiment there remains optimistic.

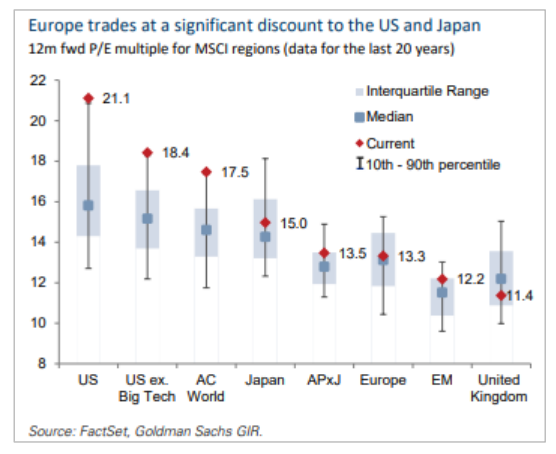

The overall outlook for international equities is mixed. European stocks are attractively valued (see below), especially in countries poised to benefit from recovering consumer confidence and falling inflation. However, uncertainty around China and potential geopolitical disruptions continue to pose significant risks.

Global Equity Valutions4

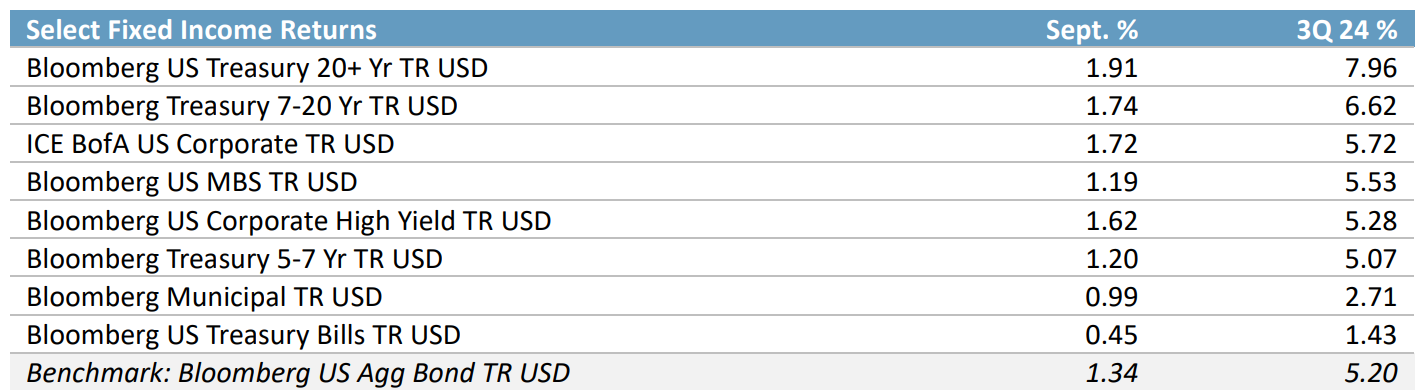

Bonds

Bonds had a solid third quarter thanks to the Fed’s rate cut, which pushed yields (i.e. interest rates) down across the board. With inflation cooling off, particularly in the U.S., and slower global growth expectations, bonds found more love from investors.

Within bonds, U.S. Treasuries were the standout, with the 10-year yield dropping as markets started pricing in more rate cuts. Emerging market bonds also got a nice boost, helped by lower inflation and more attractive yields versus U.S. Treasuries. For investors looking to balance out stock market volatility, fixed income continues to offer a strong case.

Bond Returns5

Election Influence and Portfolio Strategy

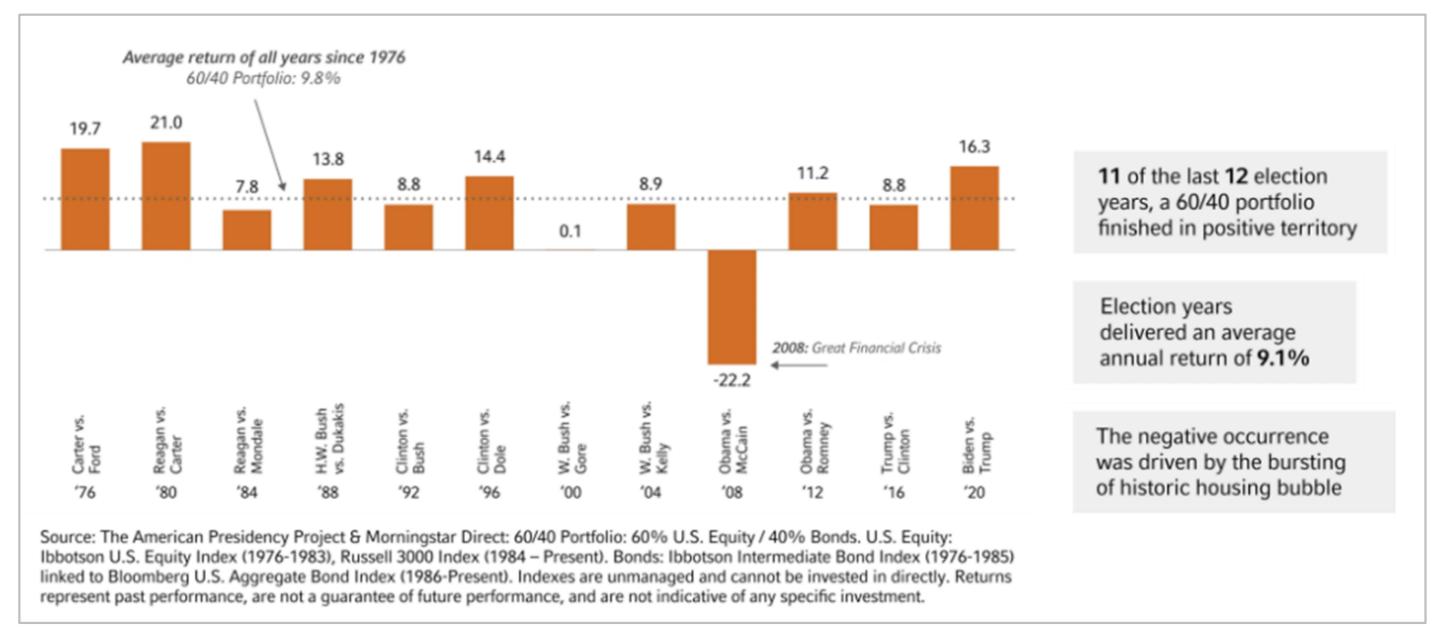

As we head into another presidential election cycle, it’s a good time to remind long-term investors to stay focused on their strategy rather than getting caught up in the political noise. Historically, markets have tended to shrug off elections over the long haul, and U.S. stocks have moved higher regardless of which party is in charge. If you’re invested in a balanced 60/40 portfolio, you’ve typically done well in election years—and 2024 is shaping up to be no different. Politics may stir up short-term volatility, but sticking to your plan always wins in the end.

Impact of U.S. Presidential Elections on Markets6

U.S. markets have weathered all kinds of political environments, and there’s little evidence that election outcomes have much to do with long-term stock performance. The smart move for investors is to stay diversified and keep their eye on asset classes and sectors that fit their long-term goals. Trying to time the market based on election results is a fool’s errand—sticking to your plan is what pays off in the long run.

The fourth quarter brings a mix of opportunities and challenges. With the Fed and other central banks starting to cut rates, the backdrop looks favorable for both stocks and bonds. That said, we could still see some volatility with geopolitical and political events in play. It’s a good reminder to stay focused on the big picture and not get distracted by short-term noise. Here are some things to keep in mind:

- Market Cap Diversification is key when it comes to balancing risk and opportunity. The mega-cap tech stocks have done a lot of the heavy lifting in recent years, but leaning too heavily on them comes with its own risks. The third quarter reminded us of that, with a rotation into small- and mid-cap stocks, along with value sectors. This is why keeping a diversified portfolio across different market caps and styles is so important—it helps you capture opportunities when the market shifts.

- Global Diversification is crucial for investors looking to reduce concentration risk and tap into different economic cycles around the world. While the U.S. has been a growth leader, Europe and Asia have their own opportunities that can help balance out a portfolio. As monetary policies and economic conditions shift globally, these regions can offer potential gains and a more well-rounded approach to investing. It’s all about capturing those international opportunities while keeping your risk in check.

- Bonds are a crucial piece of the puzzle in balanced portfolios, especially when markets get shaky. With central banks starting to cut rates, bonds stand to gain from falling yields, making them an attractive option for generating income. Plus, their lower correlation to equities means they can help smooth out the bumps in your overall portfolio. In uncertain times, having that stability from fixed income can make all the difference.

Sources

-

- Data from Morningstar. Returns over one year are annualized

- Data from Morningstar.

- Data from Morningstar.

- Data from Morningstar.

- FactSet, Goldman Sachs, GIR

- Russell Investments