What are Restricted Stock Units (RSUs)?

RSUs are a form of compensation provided by publicly-traded companies to reward their employees. An easy way to think about RSUs is as a bonus, but instead of being paid in cash you’re paid in company stock.

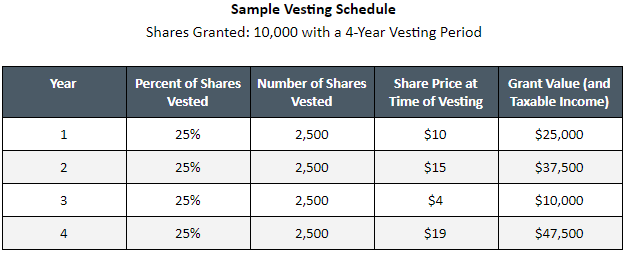

They’re typically distributed on a pre-set schedule, a process known as “vesting.” For example, your shares may vest over a four-year period. In that case, you may receive 25% of the shares each year (assuming you remain employed with the company).

Since the shares are distributed over time, it incentives the employee to stay with the company.

Once the shares vest and are officially yours, you can sell them immediately or continue to hold them. The benefit of holding them is that they may appreciate in value, making them more valuable. This, of course, is not guaranteed. The benefit of selling them is that you convert those shares into cash and use the money for anything you’d like.

What Are the Taxes?

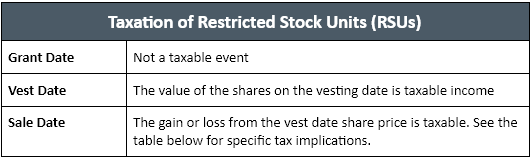

Just like your salary, the value of restricted stock units are subject to federal and state taxes, including Social Security and Medicare taxes. And similar to a paycheck, the taxes are withheld automatically. This taxation occurs when the shares vest and officially become yours.

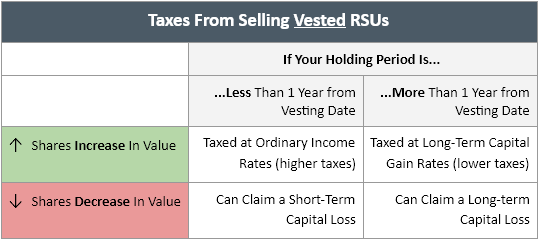

When you sell shares, you will pay either short or long-term capital gains tax on any appreciation above the price of the shares on the vesting date. If you sell the shares at a loss, you can claim that loss against gains made elsewhere in your portfolio.

Conclusion

RSUs can be a sizable source of income for employees of publicly-traded companies. As of a result of their unique tax structure (taxed both when the shares vest and when you sell) it may help to talk with an accountant or financial planner to discuss how RSUs fit into your overall financial and tax-planning strategy.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.