I hope you’ve had a great week.

Please see this week’s personal finance articles, chart, and quote below, along with a bonus blog post written by me.

3 Articles

How to Buy Happiness (Responsibly)

Ron Lieber, The New York Times

The great reopening offers ample opportunity to lift your spirits if you have some money to spare. Here’s how to do it right.

Why You Should Wait Out the Wild Housing Market

Derek Thompson, The Atlantic

Pick a housing statistic at random, and it’s probably setting an all-time record. Home prices: record high. Inventory: record low. Percentage of homes selling above asking price: record high. Average time on market: record low.

Is $1 Million Still Worth $1 Million

Nick Maggiulli, Of Dollars and Data

There are around 32 million millionaires living in the United States. Based on data from the Survey of Consumer Finances, having $1 million in 2019 would have put you in the top 12% of U.S. households. However, having $1 million in 2001 would have put you in the top 7% of households.

1 Chart

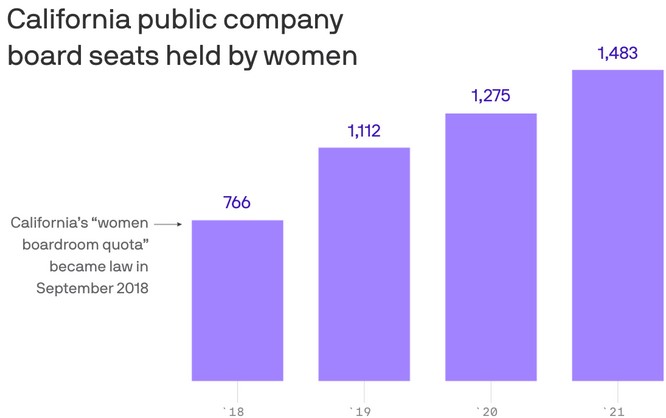

26% of board seats there are now held by women — twice as many as before the law passed.

Source: California’s “Boardroom Quota” Impact, Axios

1 Quote

“The trouble with retirement is you never get a day off.”

– Abe Lemons

Bonus Content | Written by Will This Week

Investing Where it’s Comfortable

US investors are more comfortable holding US-based stocks. The same is true with Canadian, British, and Australian investors. This article describes this “home country bias,” including where it stems from and why it’s to be avoided.

Subscribe

Join Our Newsletter

Sign up to receive an email when new articles are posted.