The third quarter usually provides the worst returns of the year. This year, it lived up to its reputation, with stocks and bonds both down modestly.

These negative returns followed one of the strongest starts ever for the stock market. In the first two quarters, the S&P 500, representing the 500 largest stocks in the US, experienced its 13th best start to a calendar year on record.

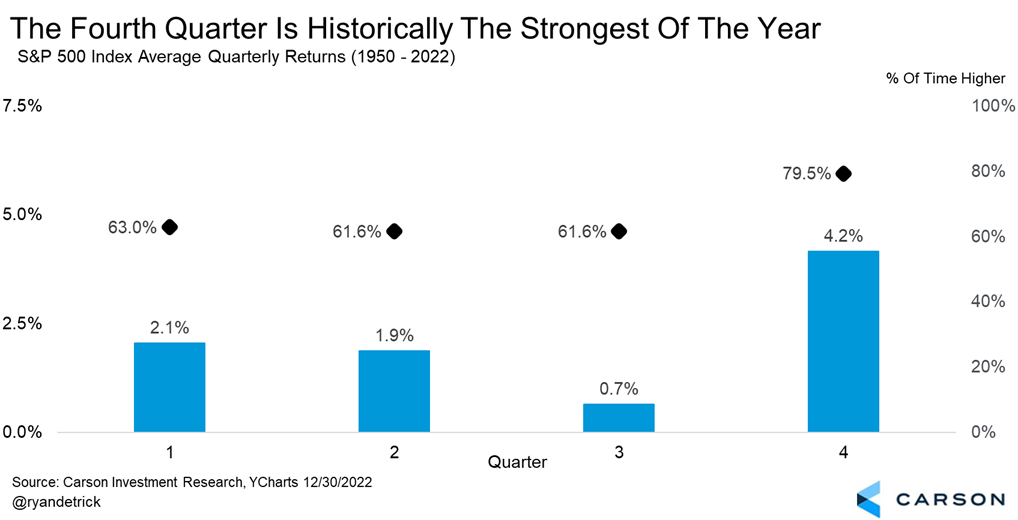

After what felt like a long Q3, most investors are probably looking forward to winter. Historically, the fourth quarter has been the best performing, up 4.2% on average, and positive 79.5% of the time:

Economic Summary

Looking at the economy, we’ll start off with the good news: the economy remains in surprisingly great shape. So much so that The Economist recently compared it to the Energizer Bunny. It just keeps going and going:

“…a steady stream of better-than-expected data has left analysts scrambling to lift their forecasts. New orders for manufacturing firms reached their highest in nine months in July. Retail sales were perky last month, too, with consumers splurging on everything from restaurant meals to online shopping and clothing to sporting goods. The construction industry has also been buoyant, supported by a rebound in homebuilding. Underpinning all this is the labor market, which has remained hot, making it relatively easy for people to find work at decent wages. The total number of jobs in America has been growing faster than the working-age population, helping to keep the unemployment rate at 3.5% [now 3.8%], just shy of a five-decade low…America’s economy is not just holding up but steaming ahead.” (emphasis added)

To add to this impressive list:

- GDP growth for Q3 is projected to be 5.1%. This would be the highest GDP reading since Q4, 2021.

- On the labor market front, September’s nonfarm payroll numbers, which encompasses employment data for approximately 80% of the US workforce, rose by 336,000. This surpassed economists’ expectations by double and exceeded the average monthly gain of 267,000 over the past 12 months. Moreover, employment data for July and August saw upward revisions, totaling 119,000 more jobs than previously reported.

These positive outcomes occurred despite the Federal Reserve’s interest rate hikes, a move that typically slows the economy.

The concern now is that, with the economy remaining resilient and generally doing well, inflation may persist if consumer spending remains high. That could prompt the Federal Reserve to keep interest rates elevate for longer than was originally planned.

Oddly enough, good economic news can end up being viewed as bad news. Positive results end up causing concern about the future.

The primary worry is that if high interest rates remain they could dampen consumer spending through high rates on mortgages (currently 7.6%), auto loans (currently 8.3%), and credit cards (currently 21.1%).

Additionally, there are several other potential risks to keep in mind:

- Inflation has declined and is now under 4%, a decrease from last year’s high of 9%. However, this is still higher than the Fed’s target of 2%. In simpler terms, prices are still rising, but the rate at which they’re going up has slowed. This can be seen at the gas pump, where prices have increased 12.9% over the last two months.

- There remains a looming threat of a government shutdown.

- Student loan payments just resumed, and it’s unclear how much that will affect overall spending.

- Last but not least, the two wars between Russia-Ukraine and Israel-Palestine seem to be intensifying, each with their own unique geopolitical risks.

Risk is an ever-present part of investing (more on that at the end of this newsletter). But it’s usually the risks that nobody sees that end up causing the most damage.

Housing Market

Before diving into the stock and bond market returns, I wanted to touch on housing.

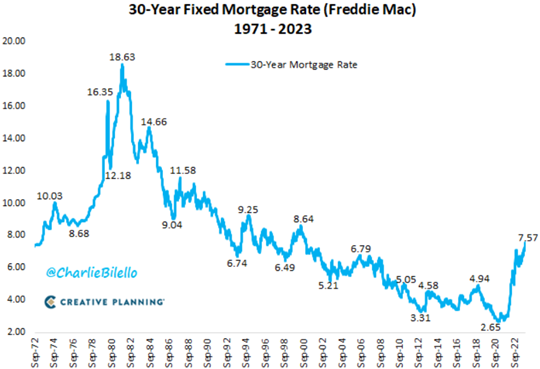

With interest rates at 7.6%, the cost to purchase a home is high. In fact, interest rates haven’t been this high since 2000:

As a result, the housing market has stopped booming, which feels odd given all the activity in recent years.

House prices rose dramatically during Covid, as many white-collar workers moved while interest rates were low. Then inflation rose, interest rates followed, and home prices stopped going up (but they’re still currently at all-time highs).

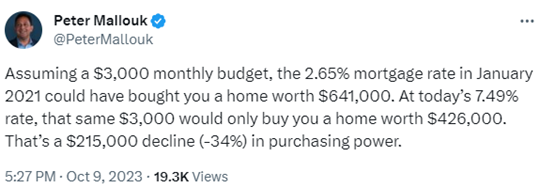

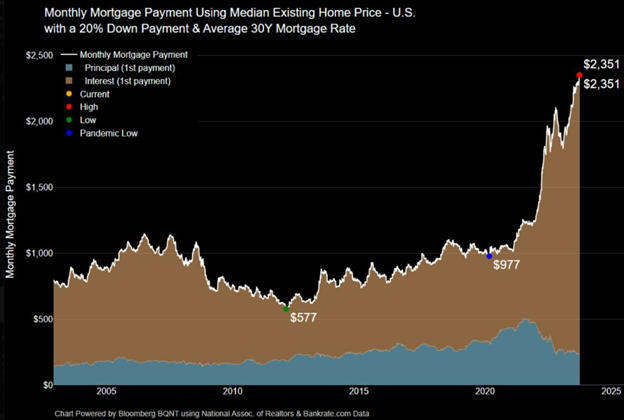

As a result of the run up in home prices and interest rates, home affordability is at an all-time low, as demonstrated by the following screenshots:

However, housing is unique because most people aren’t affected by it. Over the past few years, many people moved or refinanced, and are content sitting still for a while. As a result, there aren’t many sellers, which is limiting supply.

All in all, the market has slowed dramatically, with very few people refinancing, selling, or buying.

Economic textbooks would show that an increase in interest rates would lead to a decrease in home prices, but it’s not always that easy. Just another example of how predicting the future is hard.

US Stocks

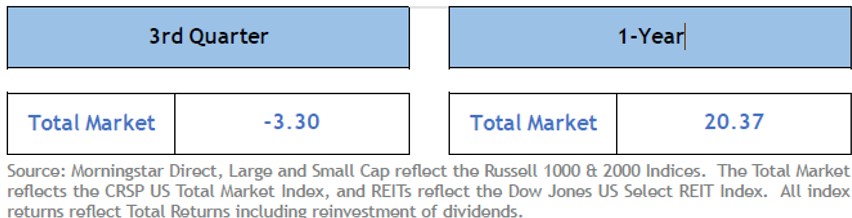

After a strong run for the prior three quarters, US stocks fell modestly during the third quarter, down 3.3%, while they are up 20.37% over the past 1 year:

During the quarter, energy was the best-performing sector, up 11.4%, as the result of higher energy prices.

The worst-performing sectors were utilities (think of companies like PG&E and Duke Energy), and real estate, down 10% and 9.7%, respectively.

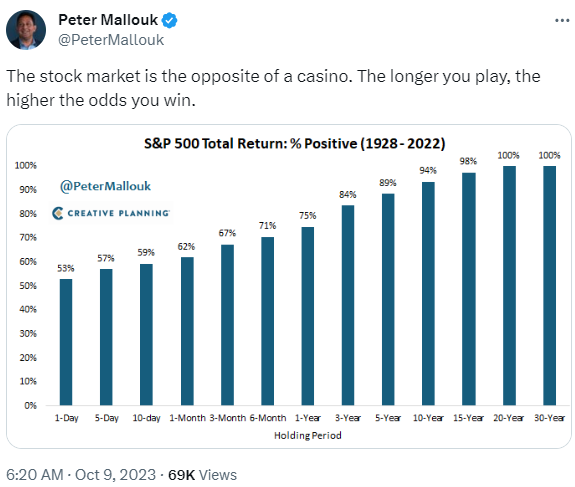

As mentioned at the beginning of this post, it’s the long-term investing outcome that matters. As shown below, the longer your investing time horizon, the higher the likelihood of achieving a positive return:

International Stocks

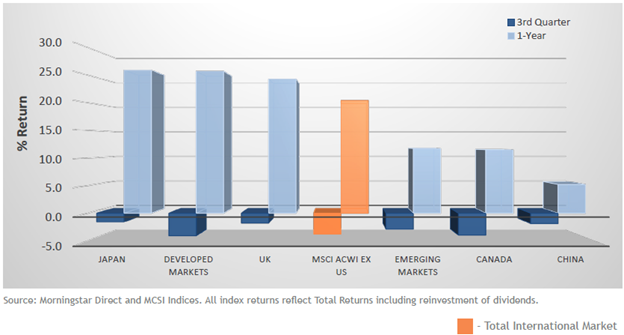

Developed international and emerging markets stocks performed similarly to US markets for the quarter, with developed markets down 4.1% (as measured by the MSCI EAFE) and emerging markets down 3.0% (MSCI EM).

Over the past year, developed international markets (think of companies located in countries like Germany, Japan, and Canada) outpaced the US, gaining 25%. Emerging markets (think of companies located in countries like India, Mexico, and Taiwan) gained 11.7%.

Bonds

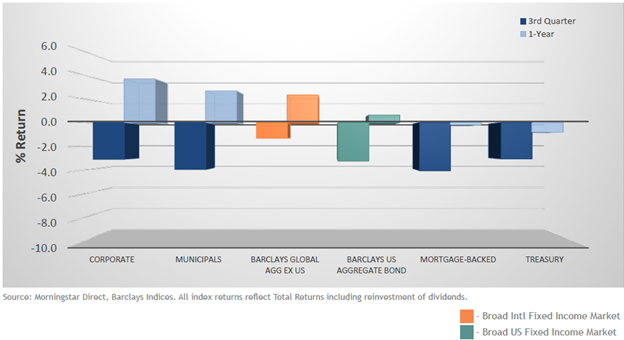

Bond performance was negative across all sectors during the quarter. This was largely attributable to investors weighing recent economic data and Federal Reserve guidance. During the quarter, investors appear to have priced in a higher probability that the Fed may hold rates at higher levels throughout much of 2024.

Over the past year, returns for fixed income investments have been modestly positive. More credit-sensitive sectors, like corporate bonds, have generated the highest results for the period.

For investors in tax-sensitive portfolios, municipal bonds have been one of the strongest sectors over the last year, with even stronger relative results when compared on an after-tax basis.

Parting Thoughts – Investing During Major Geopolitical Events

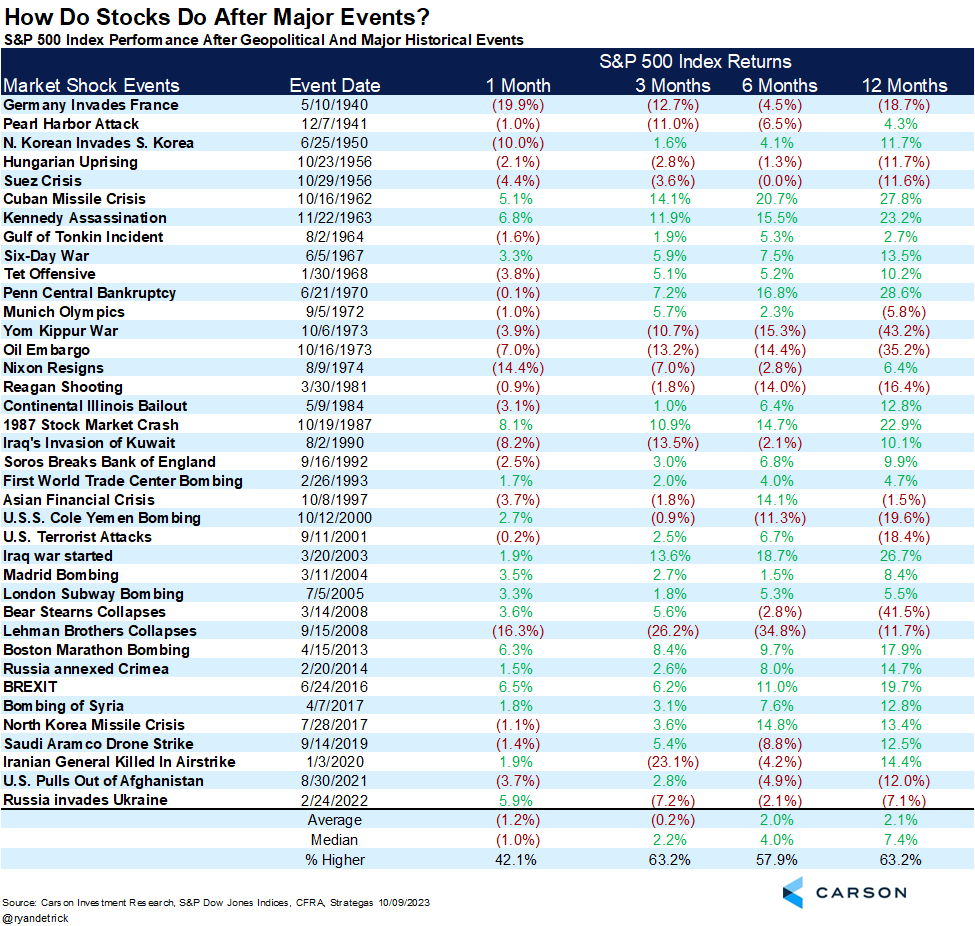

Ryan Detrick from The Carson Group recently provided a table depicting the performance of the S&P 500 in response to geopolitical events.

Looking at this extensive list, we see everything from the Pearl Harbor Attack to the Cuban Missile Crisis to the Kennedy Assasination, 9/11, and much more.

The lesson I take is that market sell offs have generally been limited. And while some extended periods of weakness have occurred, the market typically recovers swiftly.

This is because stocks reflect earnings over time, and companies persist in pursuing growth.

If history is any guide to the future, we can learn that despite terrible and tragic news, the stock market consistently bounces back and rewards patient investors.

As always, please reach out if you have any questions or would like to connect.