Monthly Financial News – June 2024

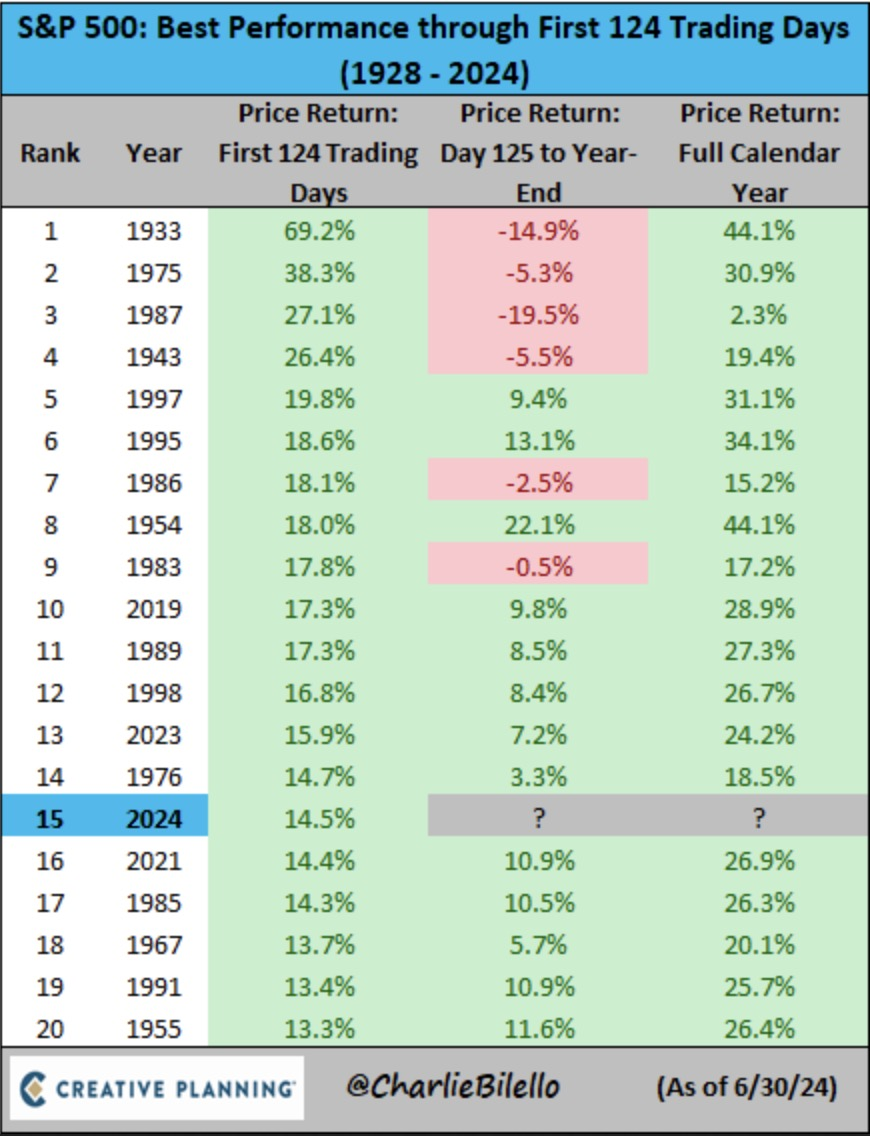

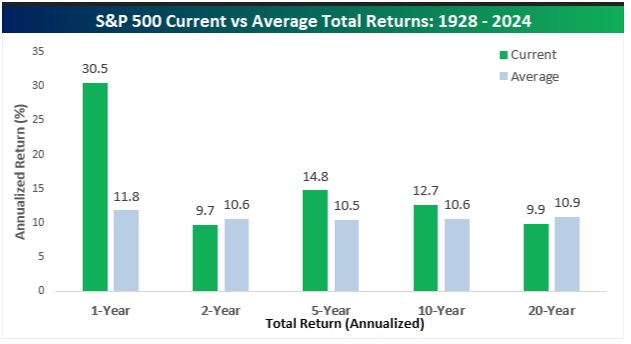

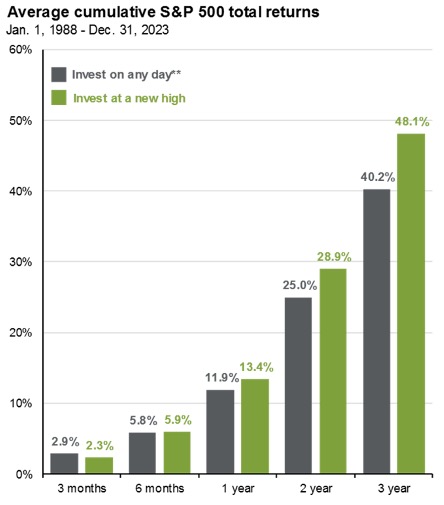

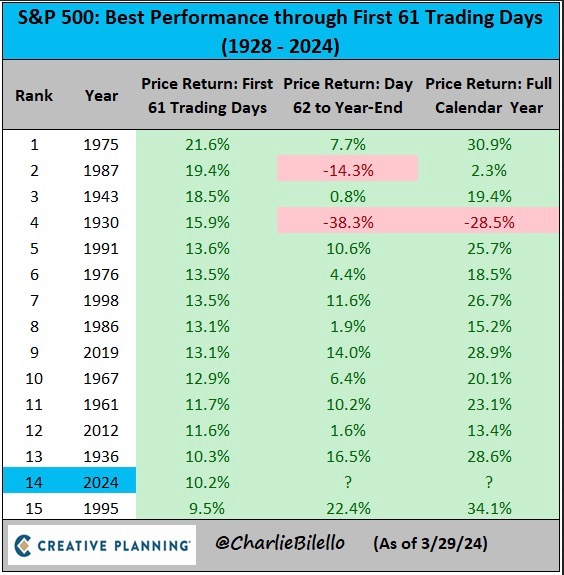

- All Time Highs – The stock market started the year well, rising 14.5% and ending June at an all-time high.

- This was the 15th best start to a calendar year since 1928:

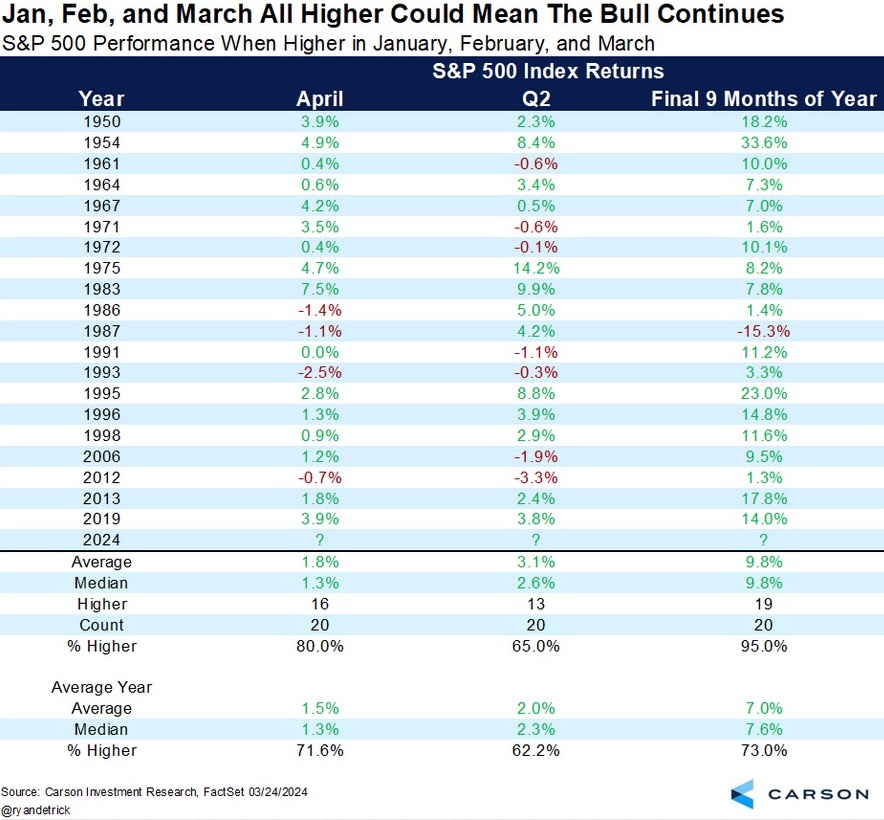

- Slow & Steady – One thing interesting about this market: How slow, steady, and almost boring the upward movement has been.

- This year there have been zero days when the S&P 500 has declined by more than 2%, and just seven days with performance of -1% or worse.

- In times like these when the markets are performing well, it’s good to remember the concept of loss aversion. That is, the pain of losing is felt more intensely than the joy of gaining something equivalent.

- Said another way, losing $100,000 feels much, much worse than the joy of gaining $100,000.

- This year, most people are seeing that their portfolio is performing well, but they don’t necessarily feel great about it. If, on the other hand, they were down the equivalent amount that they are up, they’d be worried, upset, etc.

- Just a reminder to be thankful for and enjoy the good times!.

- Active Managers Underperform – “In the first half of 2024, according to Morningstar, only 18.2% of actively managed mutual funds and exchange-traded funds that compare themselves to the S&P 500 managed to outperform it.”

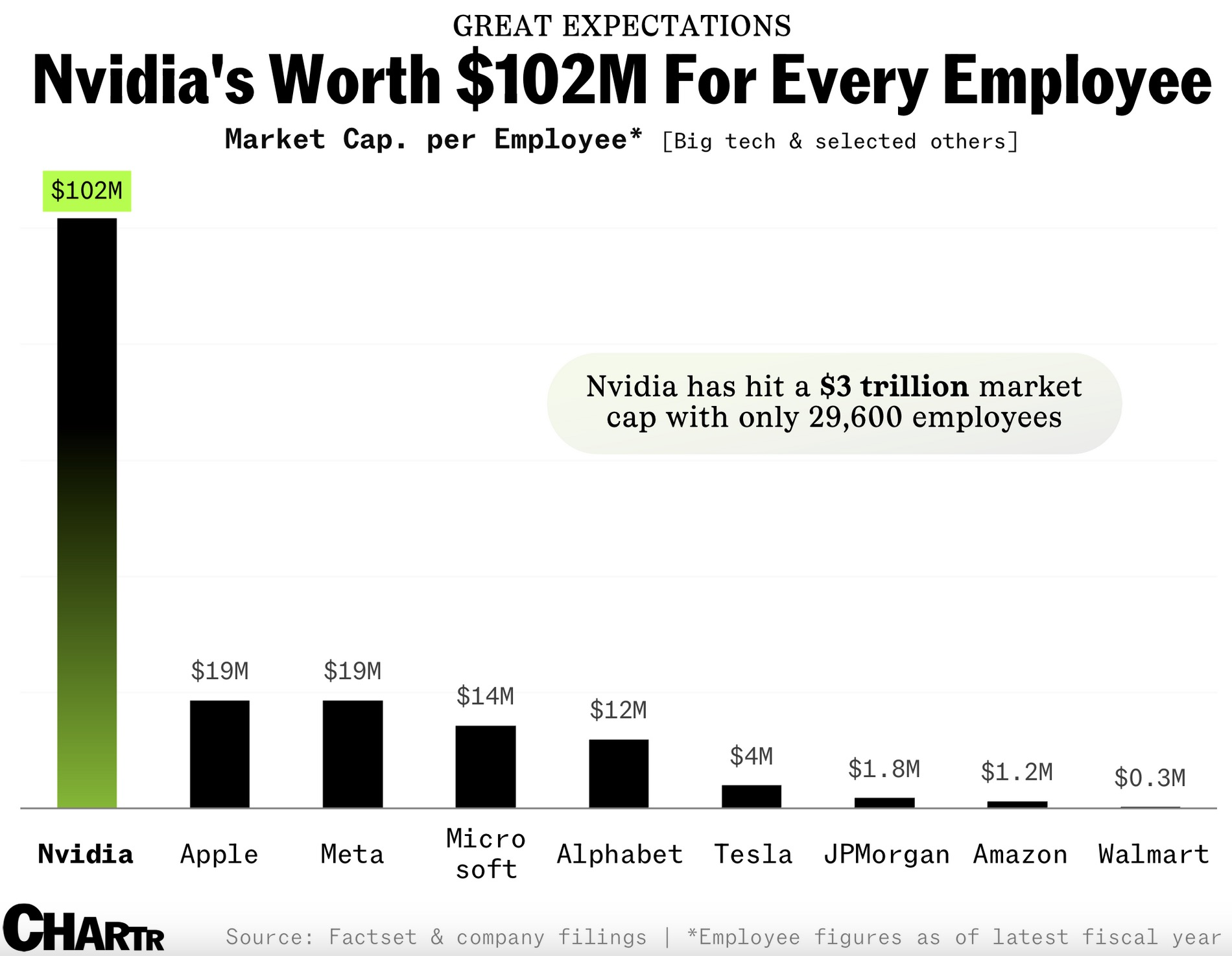

- Market Cap per Employee – Nvidia stands out in this wild chart. It looks at how much a company is worth (market capitalization) divided by how many people they employ:

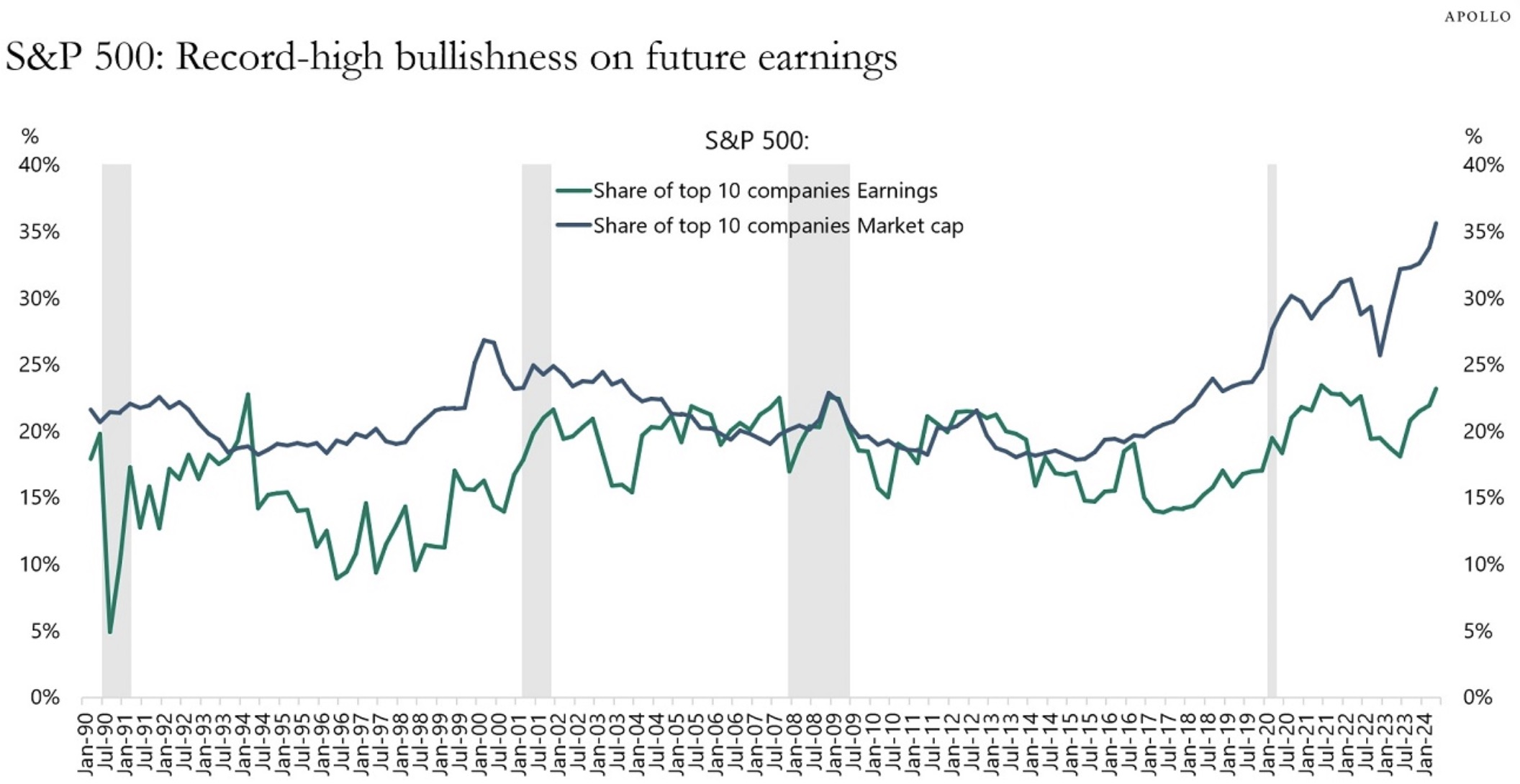

- High Expectations – “The top 10 companies in the S&P 500 make up 35% of the market cap but only 23% of earnings…the problem for the S&P 500 today is not only the high concentration but also the record-high bullishness on future earnings from a small group of companies.”

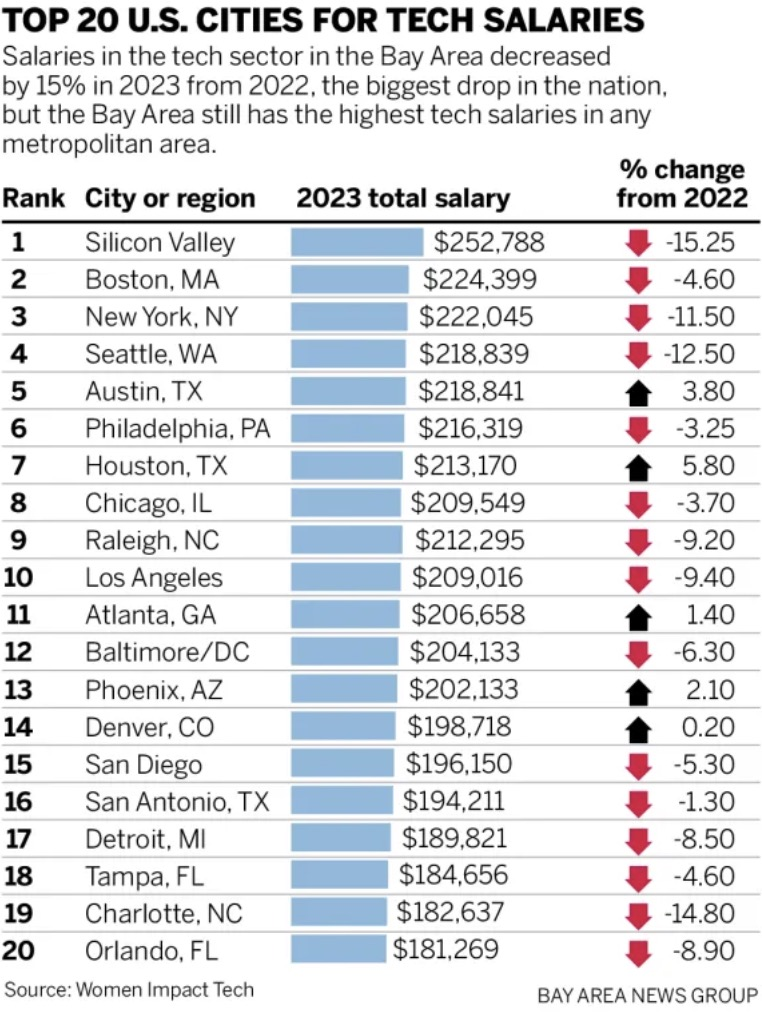

- Silicon Valley Salaries are Shrinking – Despite having the highest tech salaries in the country, Silicon Valley has experienced the biggest drop in pay compared to other tech hubs, falling 15% from 2022 to 2023

- Promotion Recession – “Out of 68 million white collar workers, just 1.3% were promoted in the first quarter, the lowest rate in five years. Employers now hold more leverage, reducing the need to move employees up the ladder in order to retain them.”

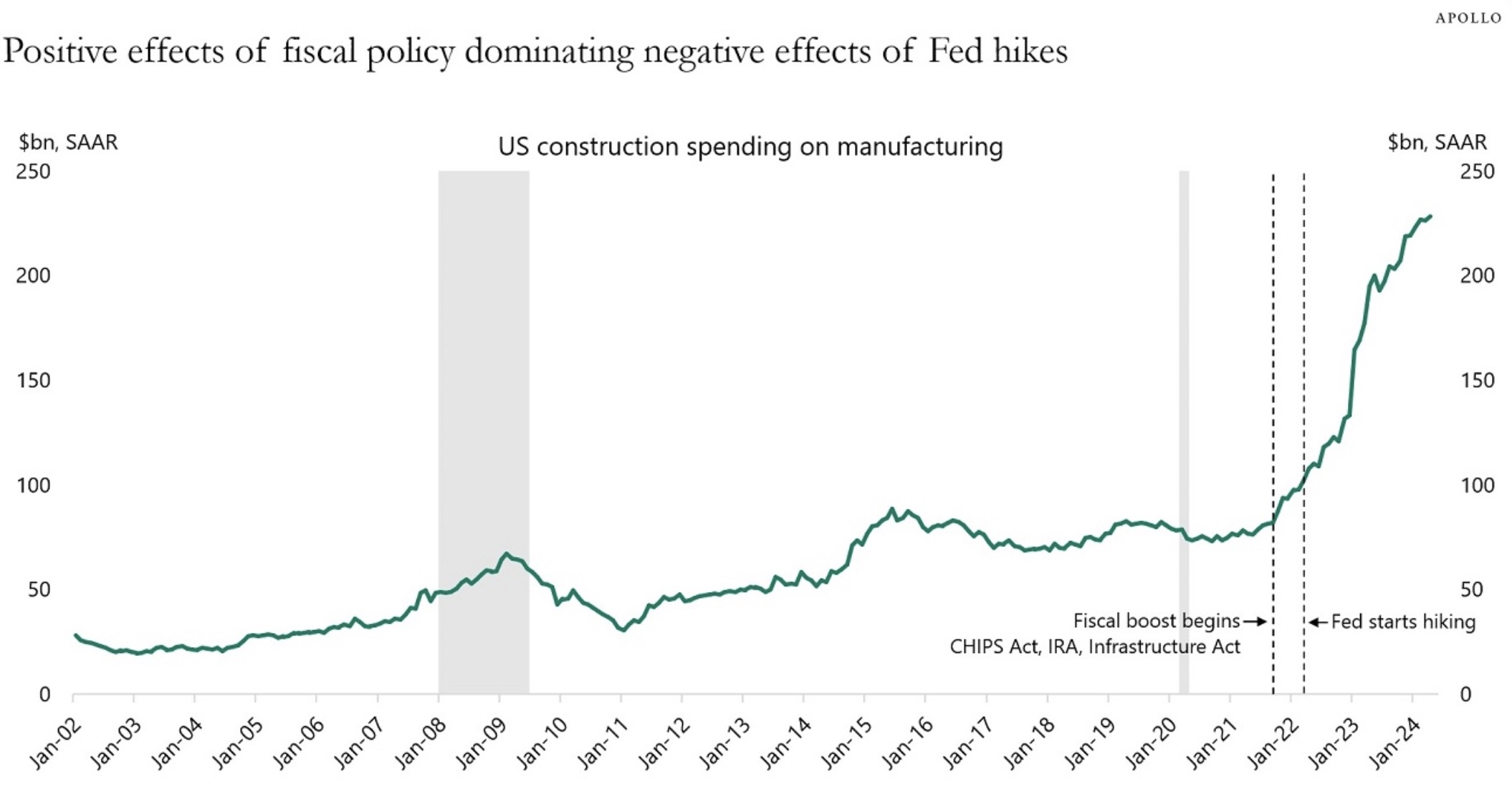

- Lots of Construction Spending – As a result of the CHIPS Act, the Inflation Reduction Act, and the Infrastructure Act, construction spending on manufacturing has skyrocketed:

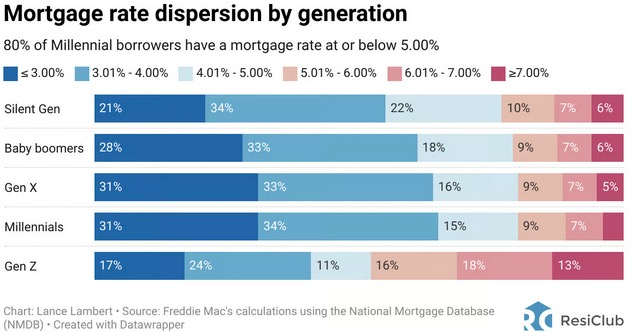

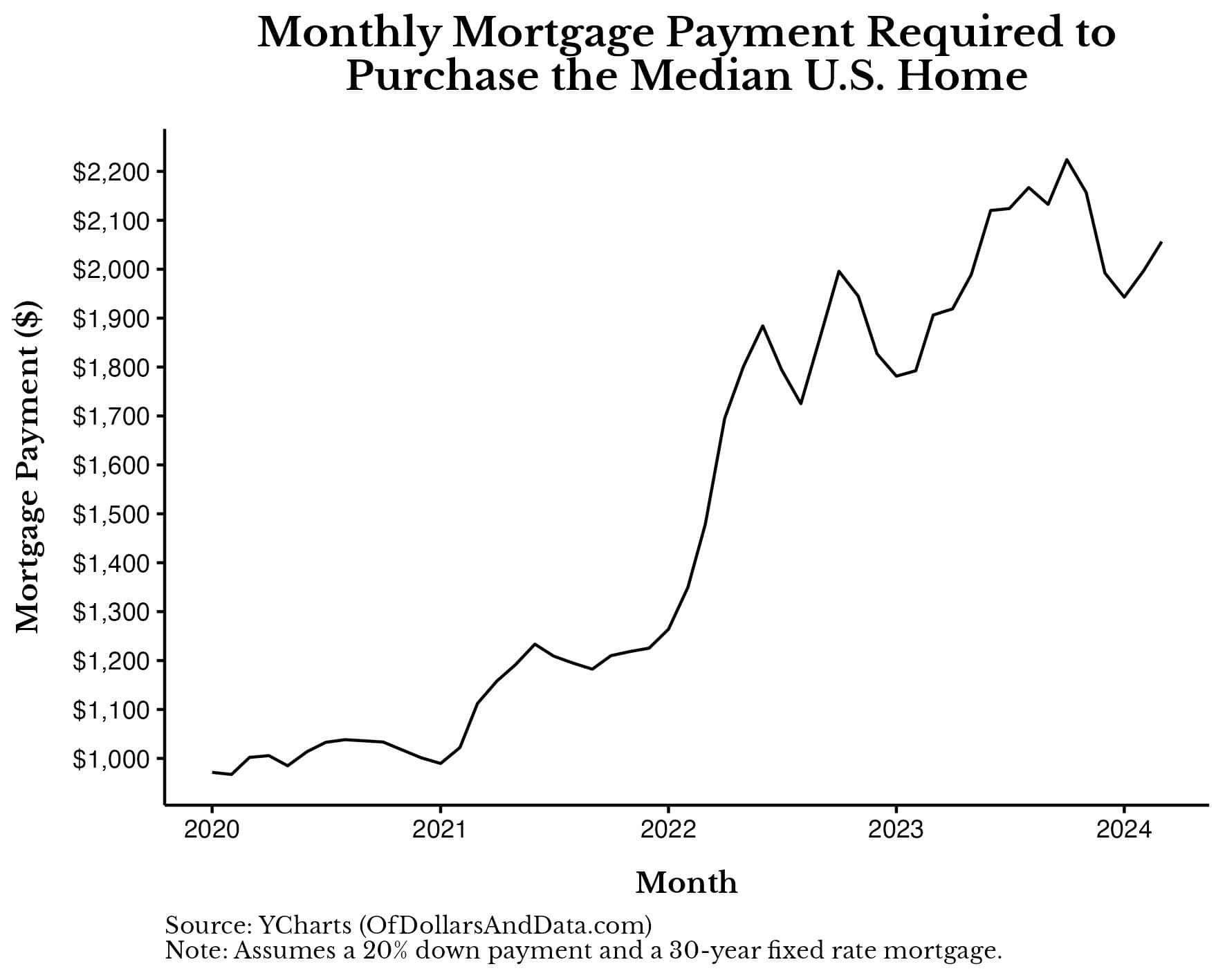

- Mortgage Rate Dispersion – 80% of millennials have a mortgage rate under 5%. Only 52% of Gen Z borrowers can say the same:

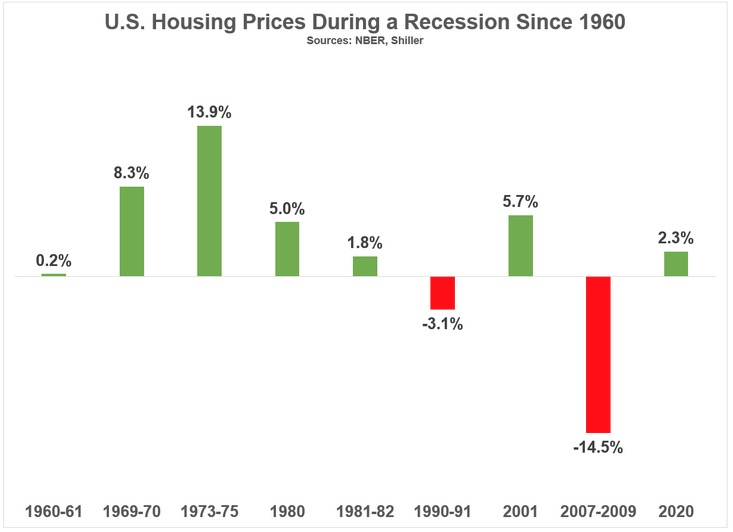

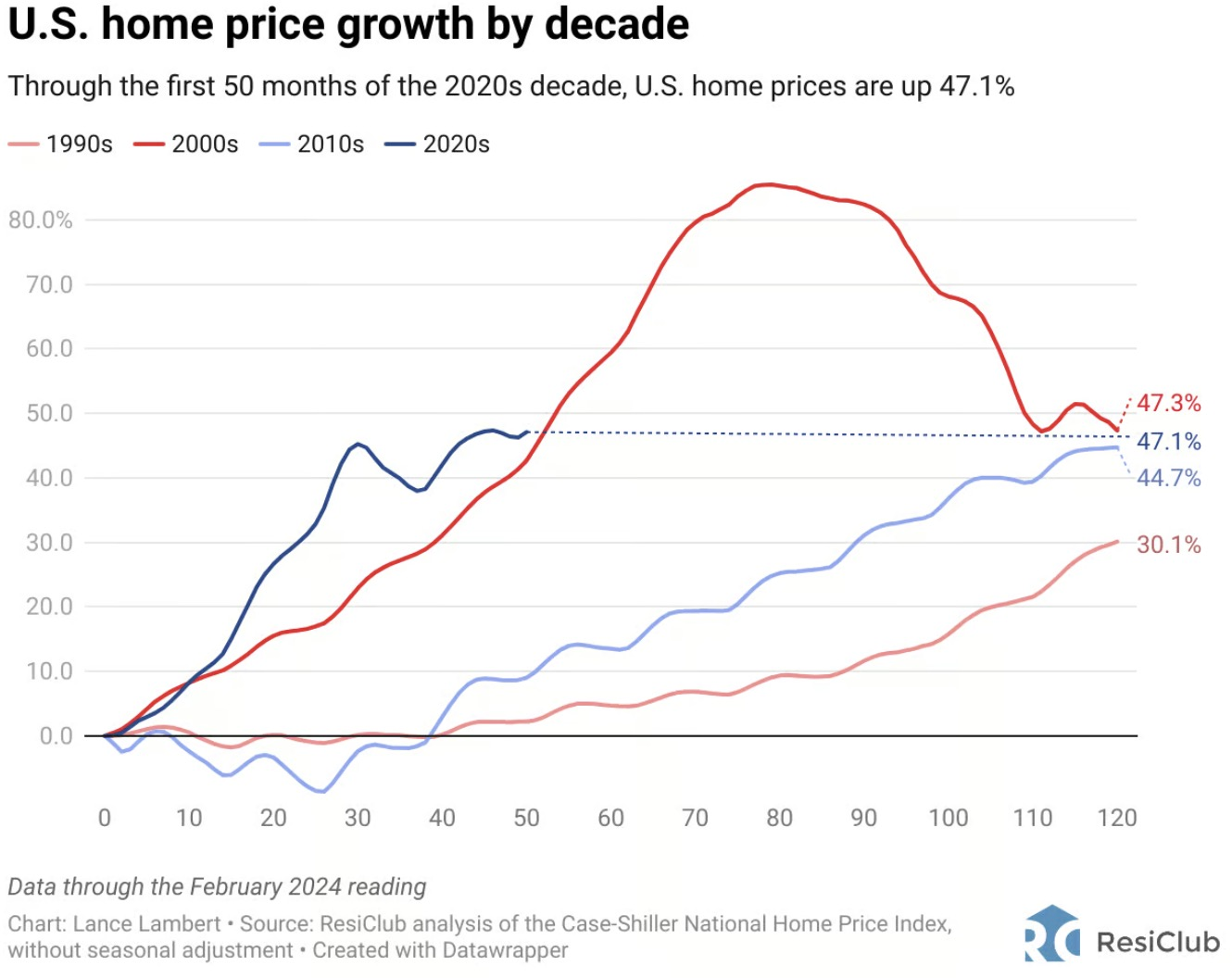

- Housing Prices During Recessions – Aside from 2007 – 2009, nationwide home prices have held up well during recessions:

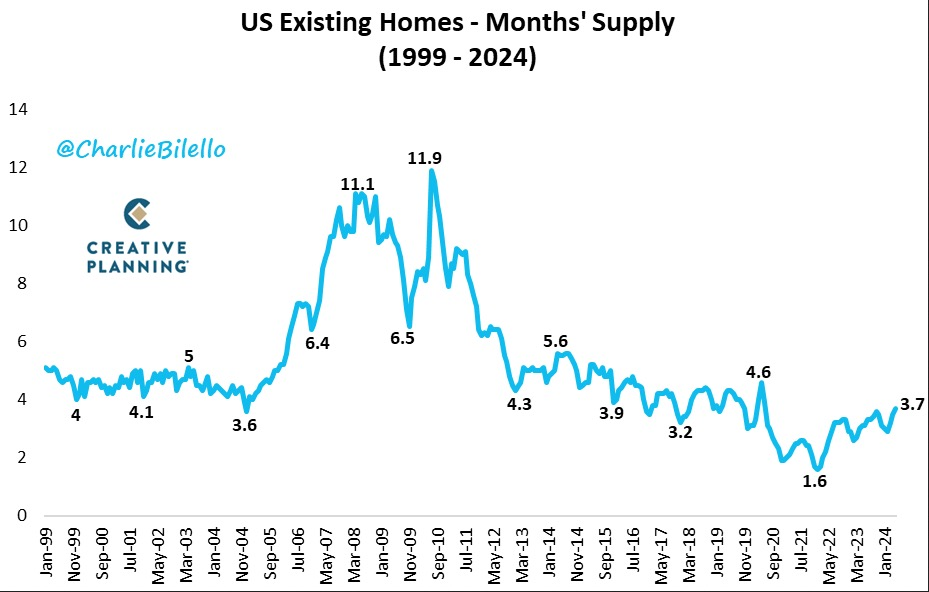

- “Months Supply” – This measure tracks how many months it would take to sell all the homes currently on the market if no new homes were listed for sale. Recently it has moved up, indicating that the supply of homes for sale is trending up:

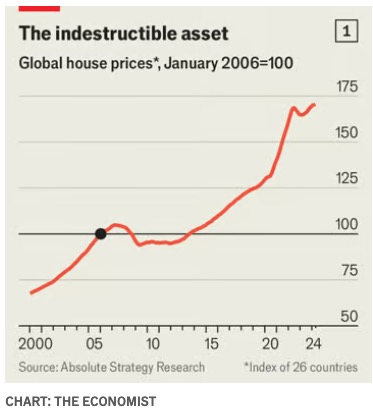

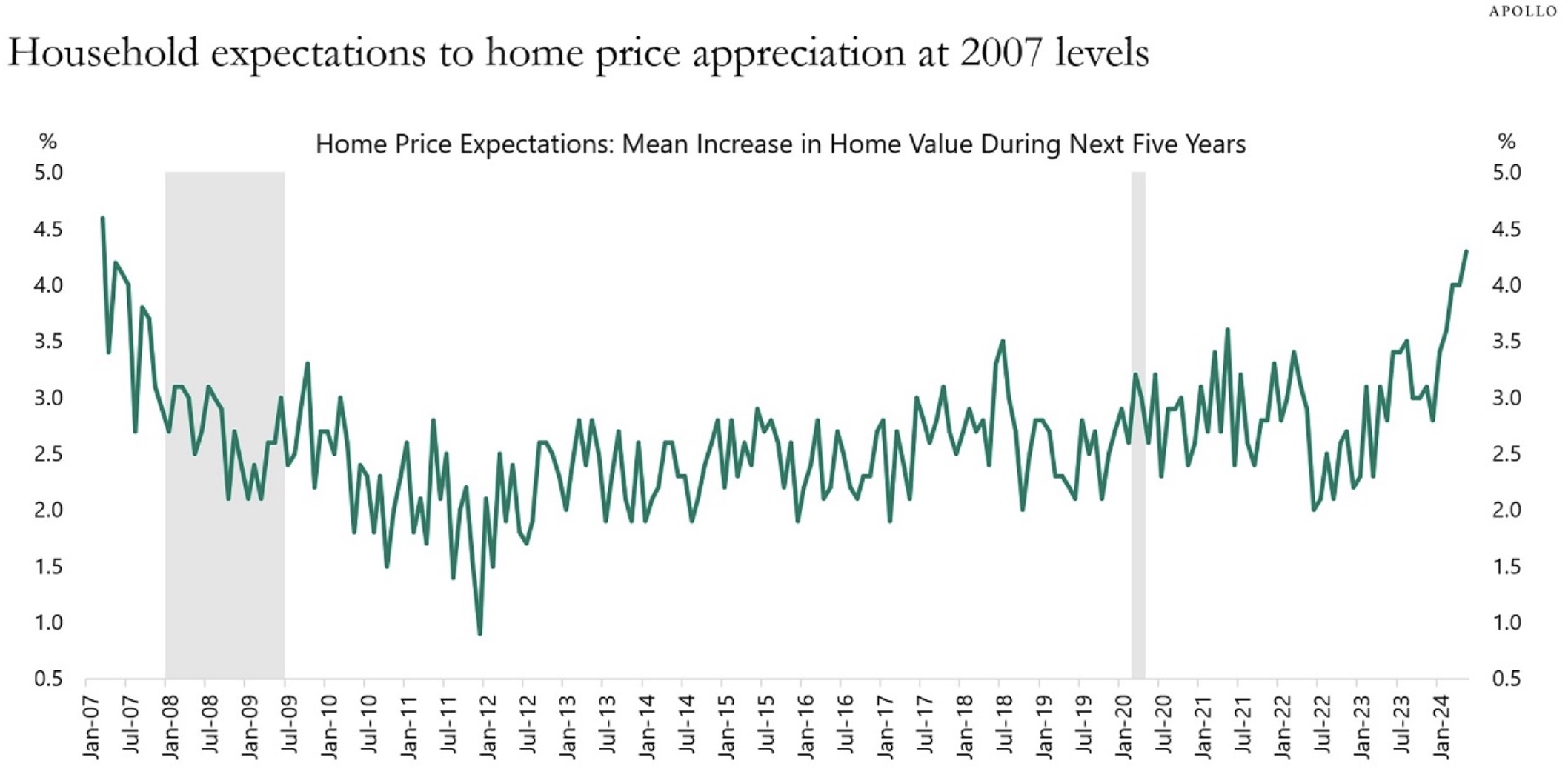

- Global Housing Prices – Global home prices are up 3% over the past year, and up 6.5% in America.

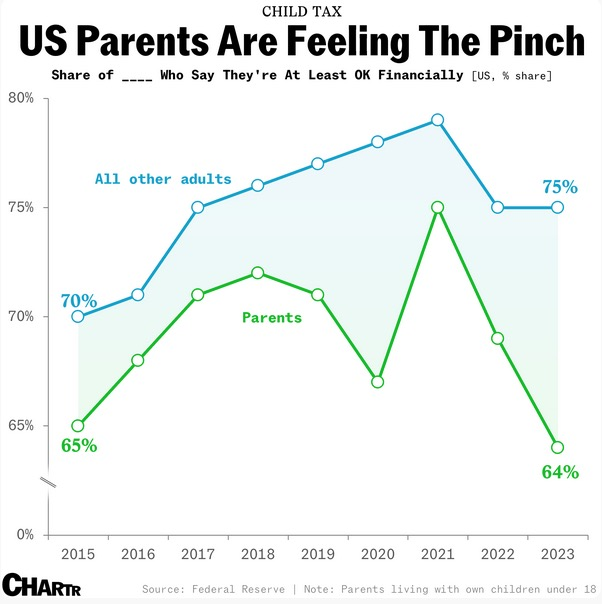

- American Parents Are Not OK – “American parents appear to be under more financial pressure than usual as inflation and rising childcare costs continue to bite, with less than two-thirds of American parents saying they’re doing “at least okay.”

- It’s also interesting to note the huge disparity during the Covid years.

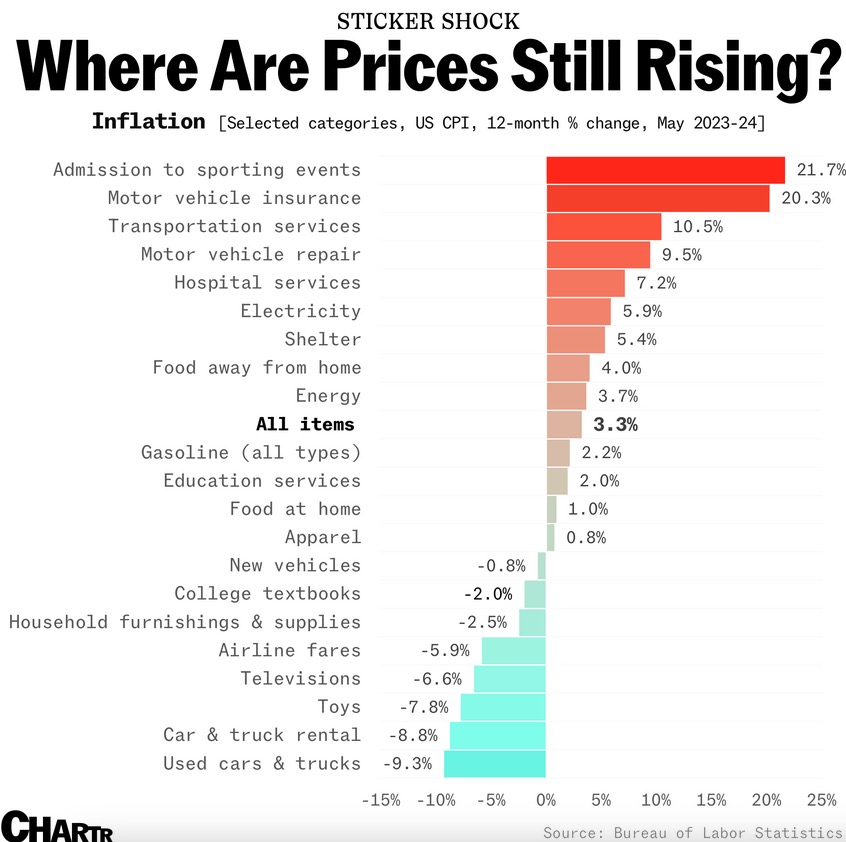

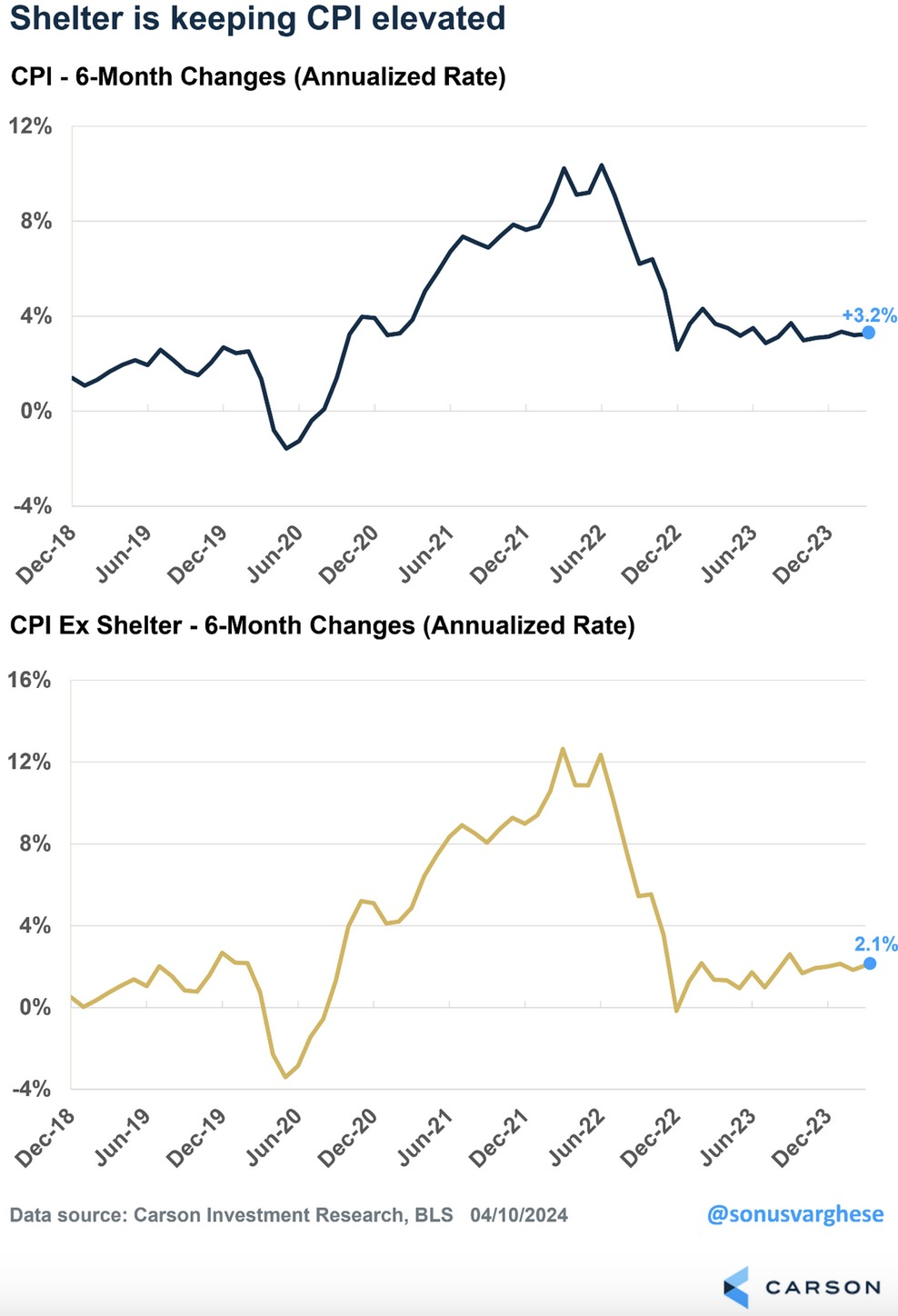

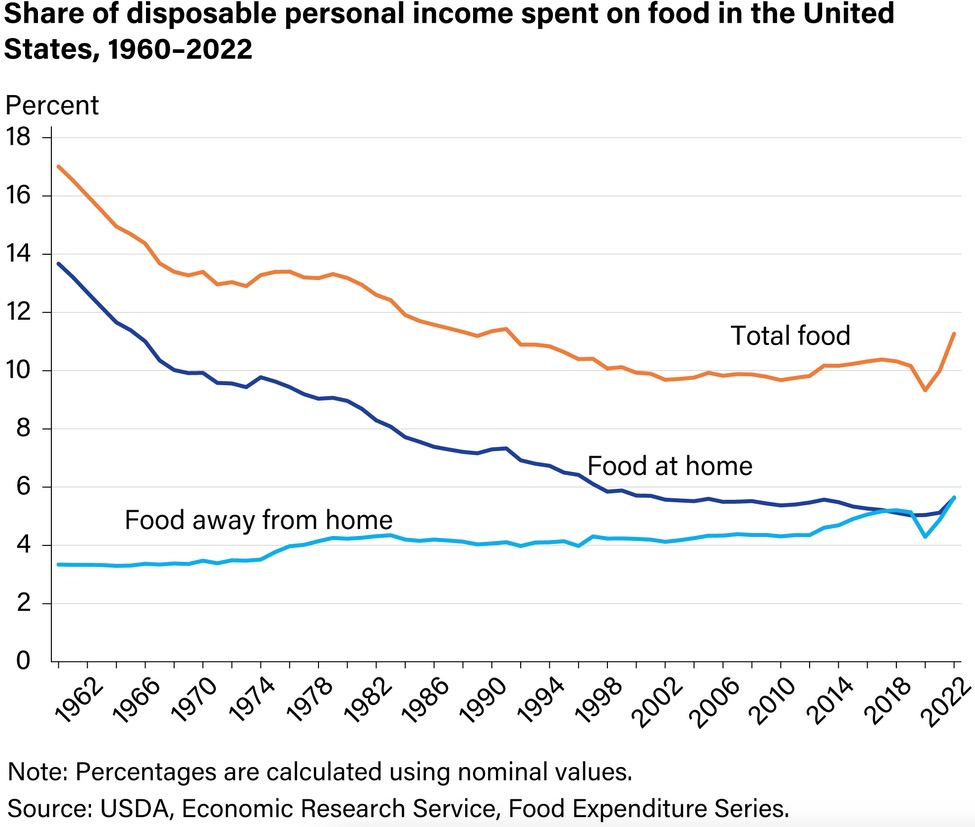

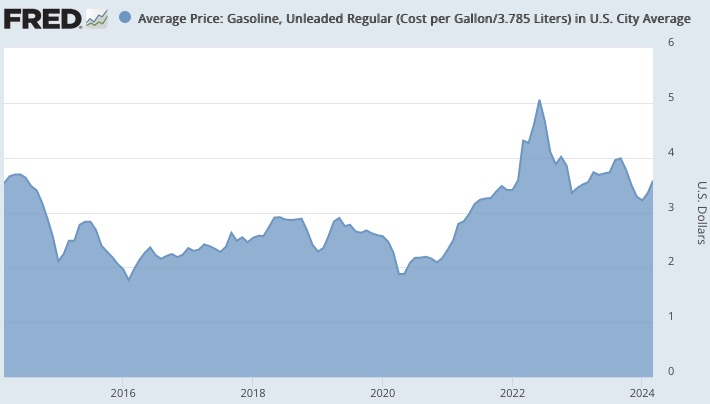

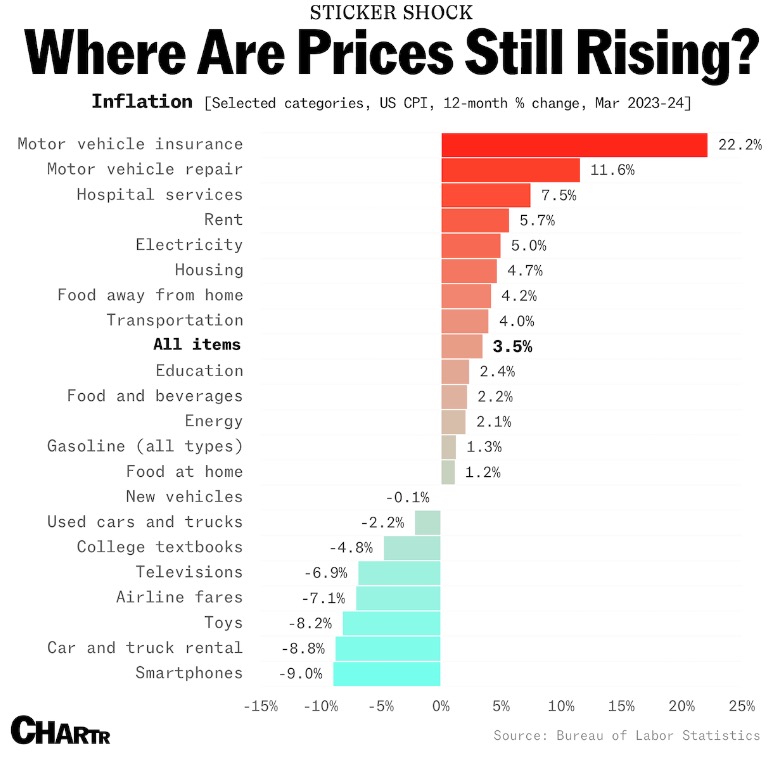

- Inflation Categories – Where costs are rising and falling:

- The C Word – One of my favorite financial writers, Jonathan Clements, recently learned that he has terminal cancer. He has about 1 year left to live, and at age 61 his take on receiving the news is well worth reading.

- Lazy Work, Good Work – “Productive work today does not look like productive work did for most of history. If your job was to pull a lever, you were only productive if you were pulling the lever. But if your job is to create a marketing campaign, you might be productive sitting quietly with your eyes closed, thinking about design.”

“No one compares themselves [financially] to the average American. It’s who you hang out with”

Michael Batnick

Animal Spirits

As always, please reach out if you have any questions or would like to connect.