Monthly Financial News – September 2024

- 📈 The Everything Rally – Every asset class is positive: US and international stocks, US and international bonds, real estate, commodities, Bitcoin, and cash.

- This happened before in 2019, 2017, and 2016, but it’s pretty rare.

- Simply put: Times are good!

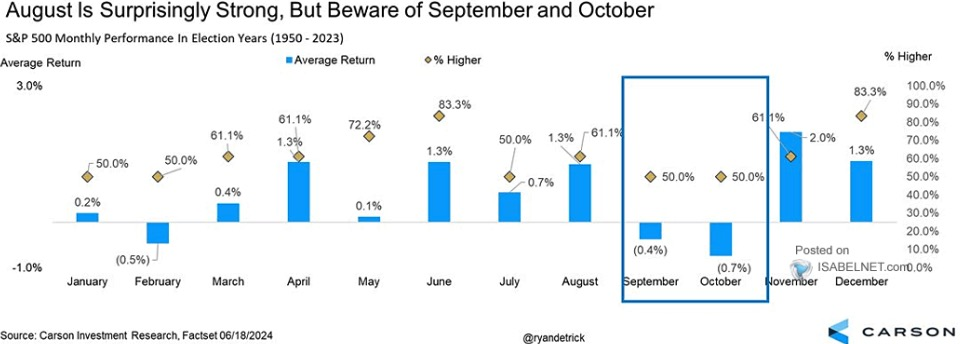

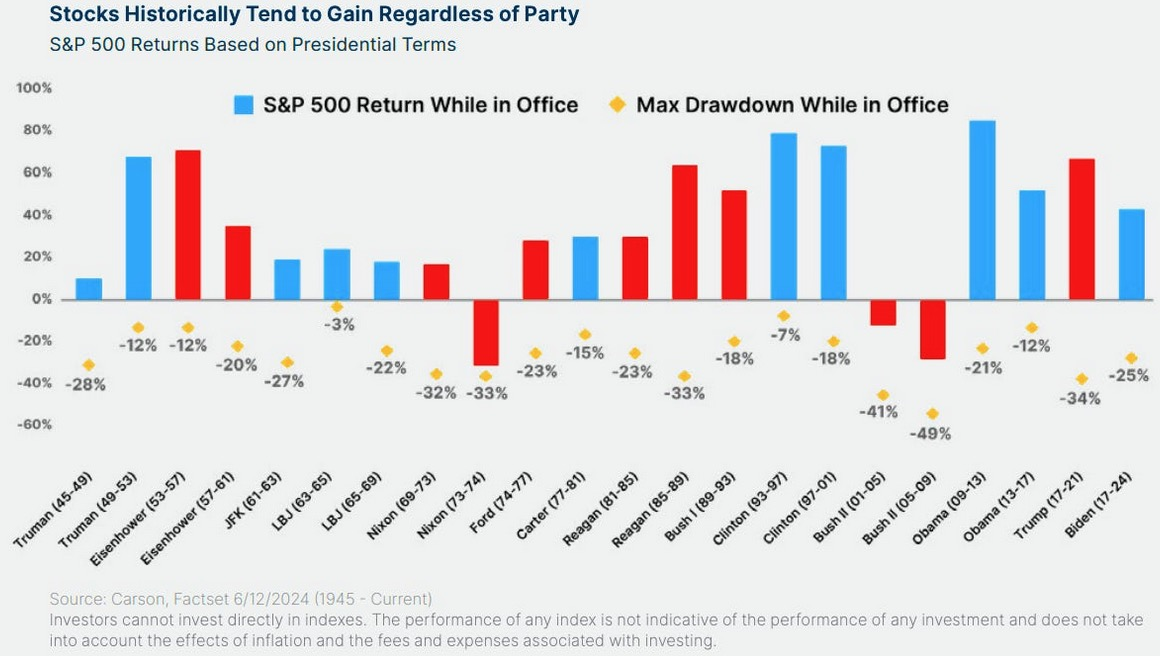

- 🎃 Choppy October? – Heading into October, the S&P 500 is up 20.8% for the year.

- Historically, October has seen a downturn after such gains, with stocks falling 7 of the last 9 times they were up over 20% going into the month. But Q4 as a whole is typically up in these scenarios.

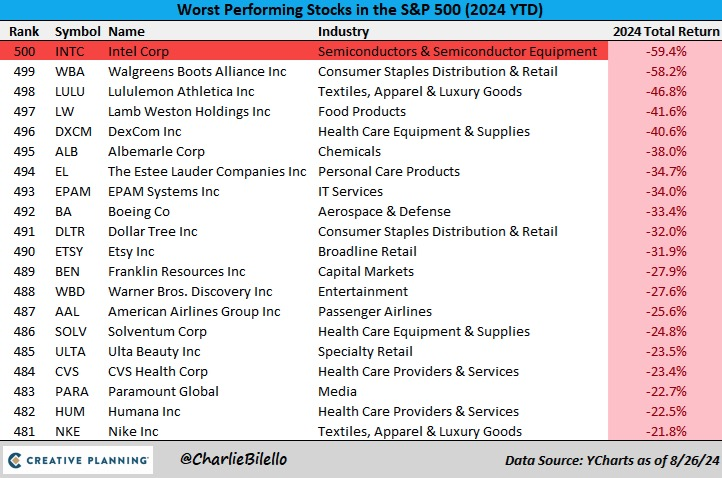

Investing / Stock Market

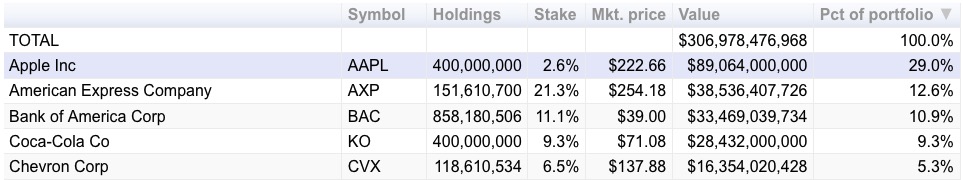

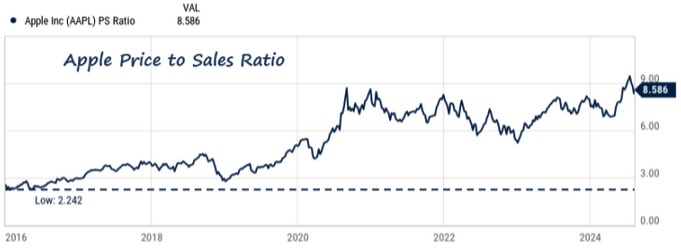

- 💵 Warren Buffett Sold Some Apple Shares. Should You? – An article from me about taking some chips off the table, especially when one position is 50%+ of your portfolio.

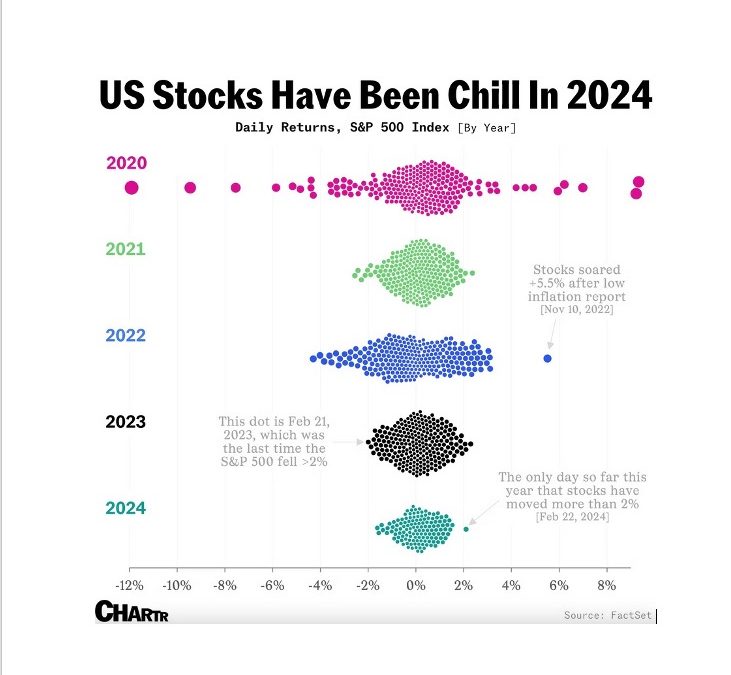

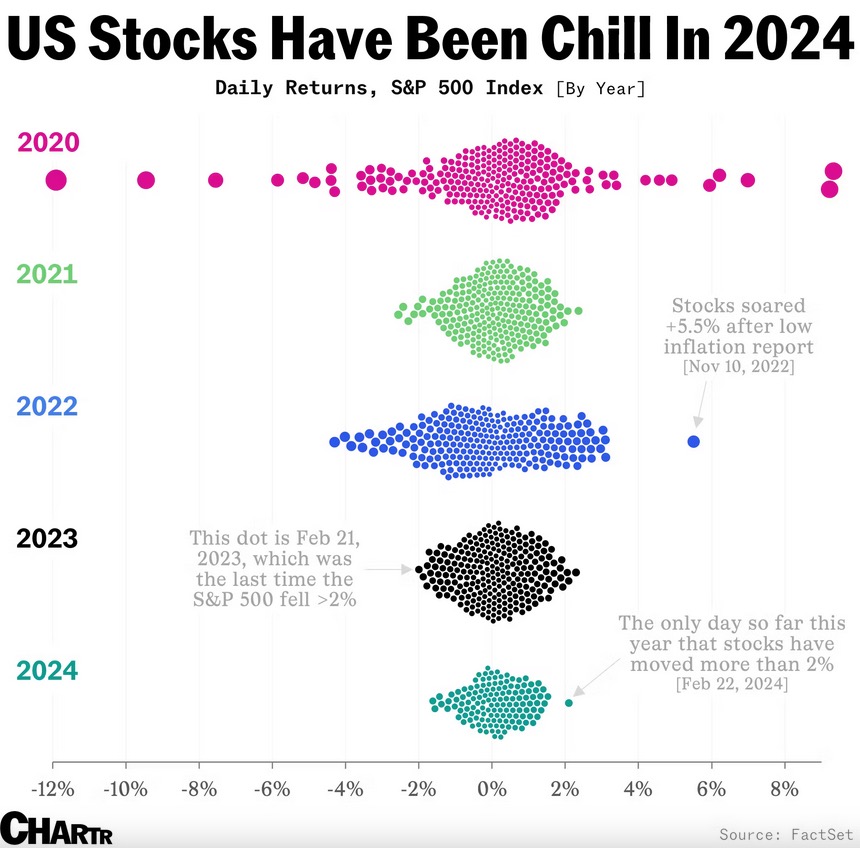

- 🤩 Best Week of the Year – In September the S&P 500 had its best week of the year, up 4% in 5 days.

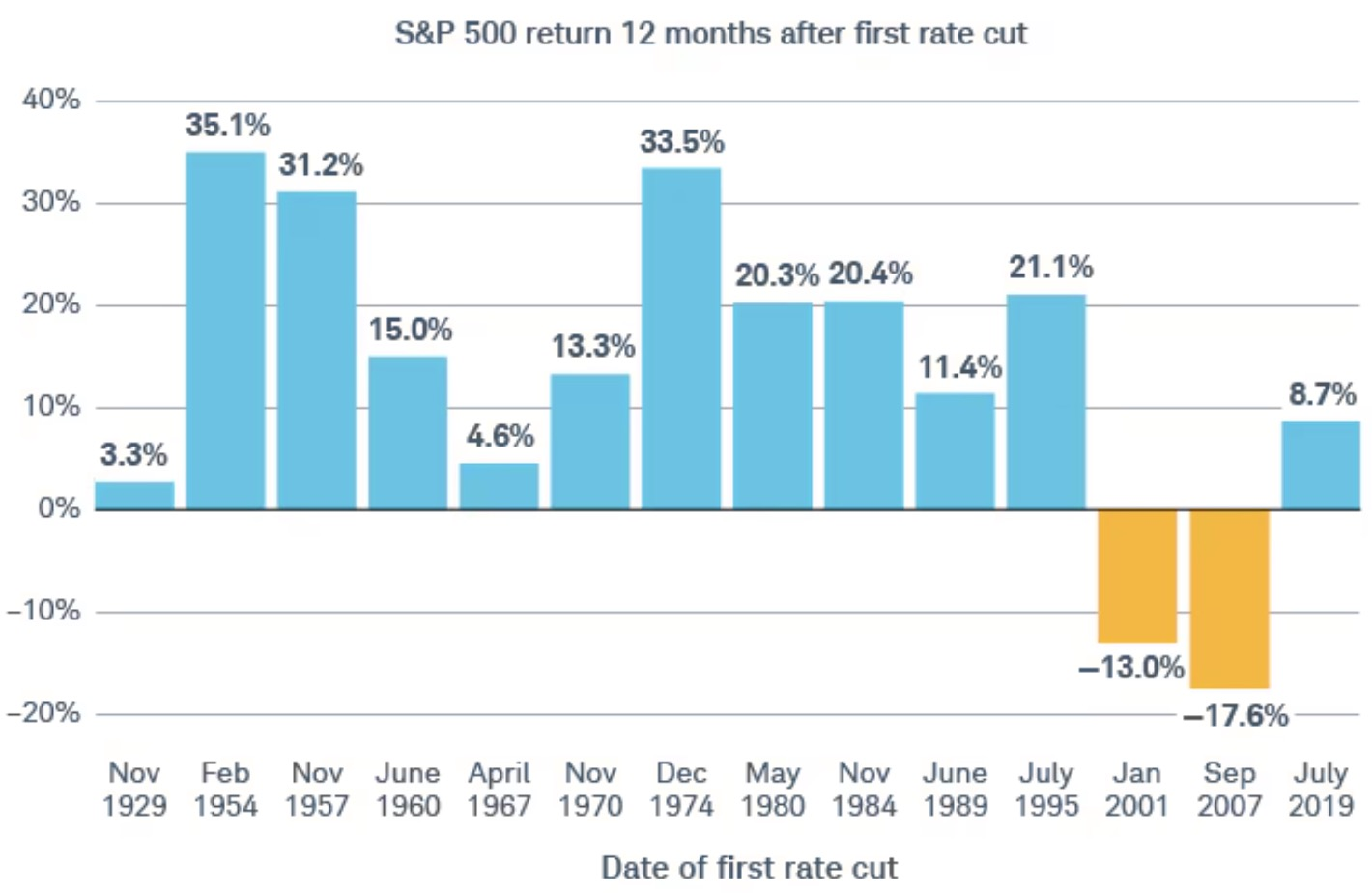

- 📉 Rate Cuts – They usually lead to good 1-year returns.

- From Schwab: “Of the 14 rate cycles since 1929, 12 of them saw positive S&P 500 returns for the 12-month period following the first rate cut:”

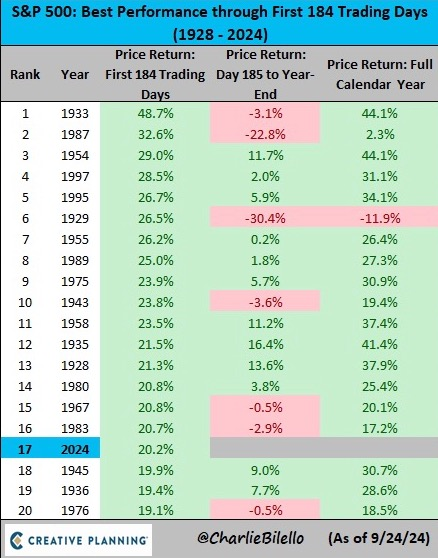

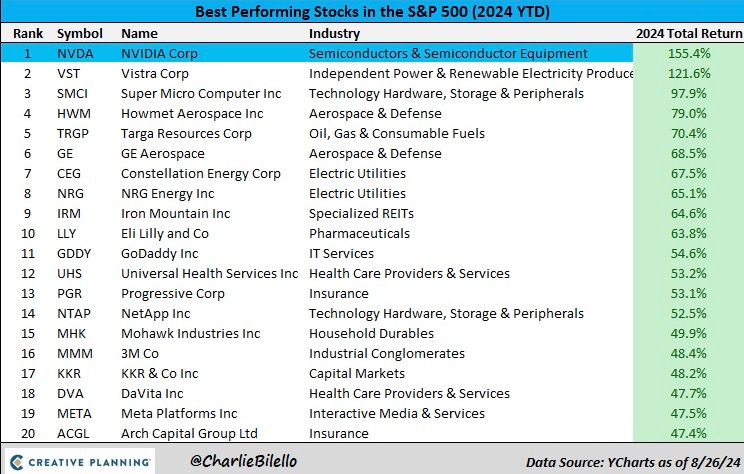

- 💰 A Great Start – From Charlie Bilello: “The 20% gain in the S&P 500 is the best start to a year since 1997 and 17th best in history.”

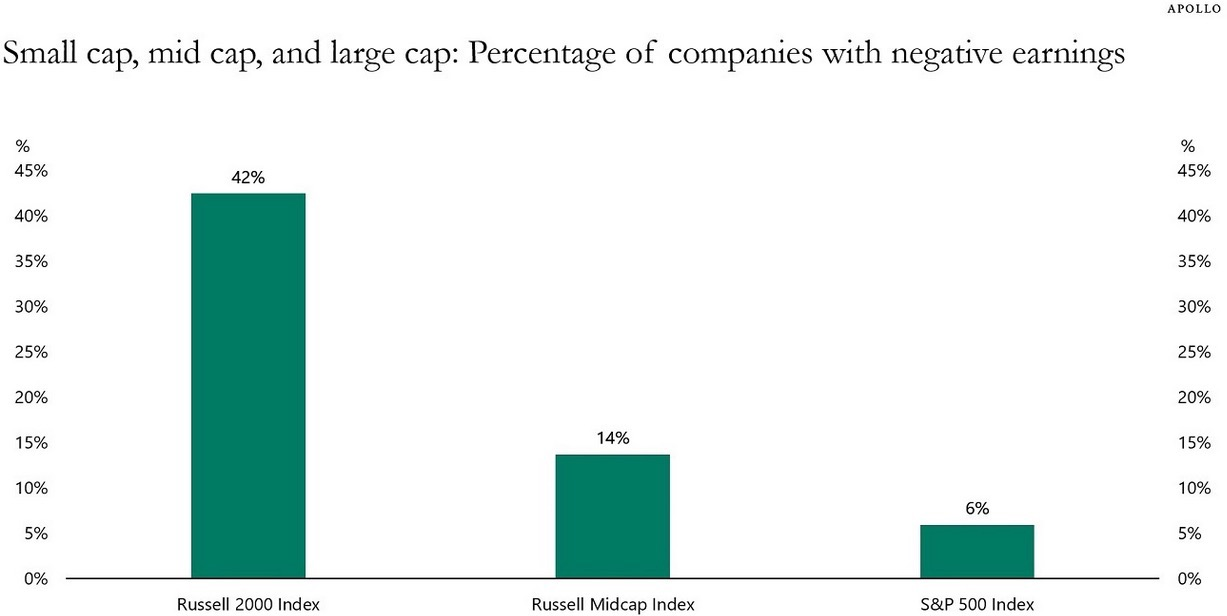

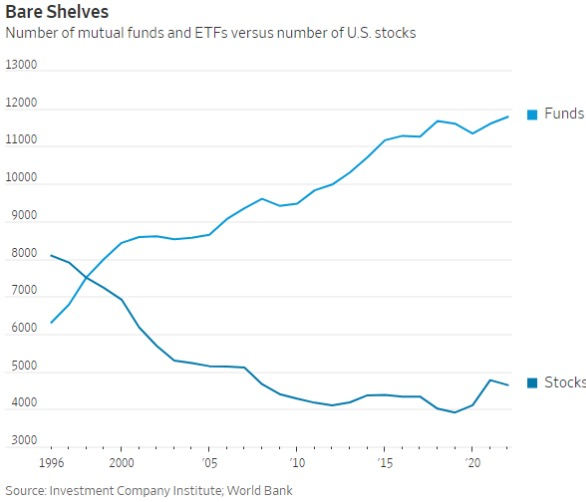

- 🔥 Unprofitable Companies – We’ve all heard about startups that aren’t profitable. Many publicly traded companies aren’t either (especially the smaller ones):

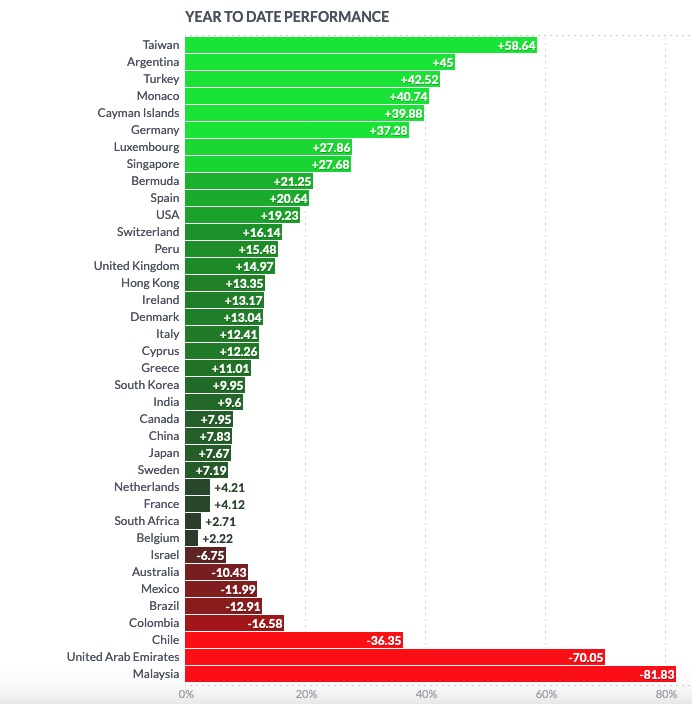

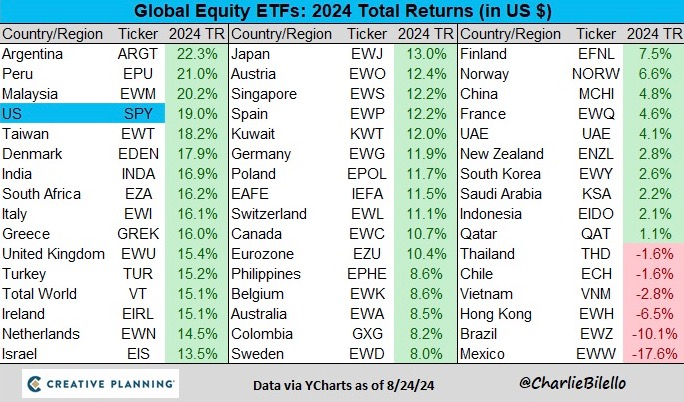

- 🌎 Global Stock Performance – Taiwan, Argentina, and Turkey lead the world with the best performing stock markets this year.

- Malaysia, The United Arab Emirates, and Chile are the bottom three performers.

Jobs & Economy

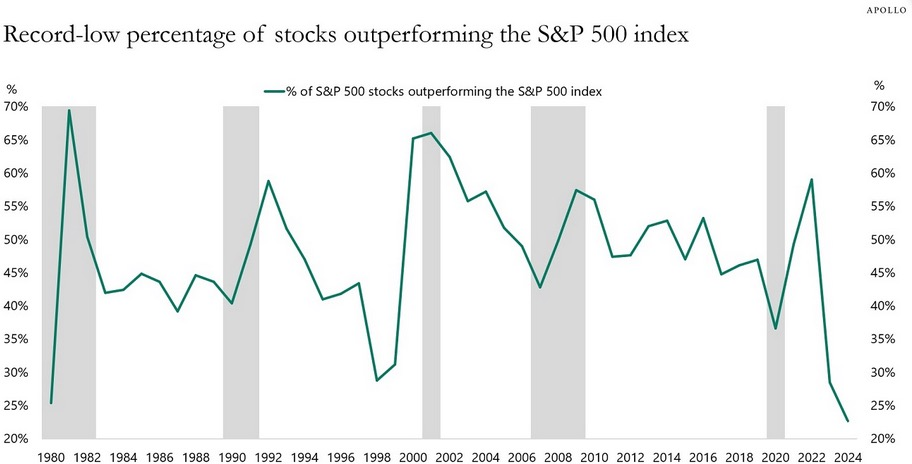

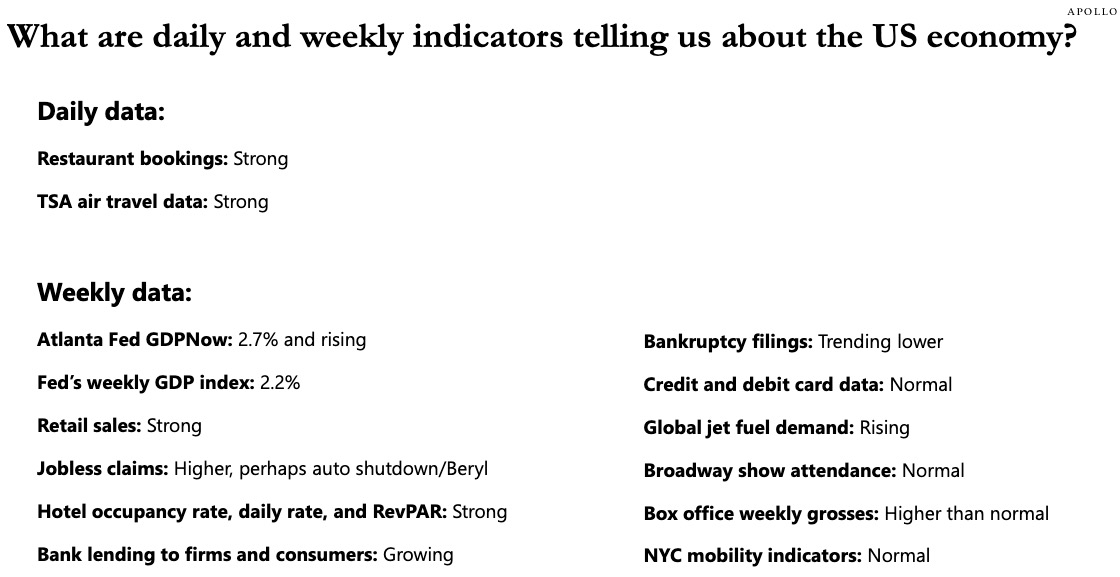

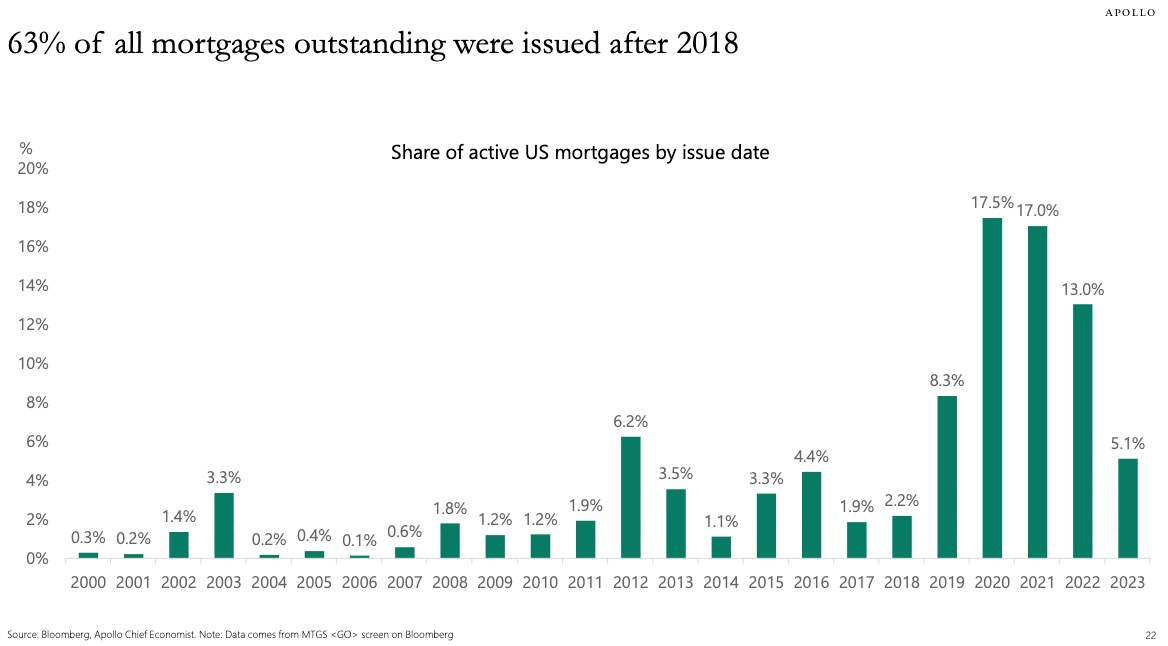

- 🐢 Economic Summary – It’s hard to summarize our economy better than this (from Torsten Slok of Apollo):

- “Today, we are experiencing a gradual slowdown engineered by the Fed. The Fed raised interest rates to slow down the economy and to slow down inflation.

- Inflation has now come down, and the Fed can begin to focus on other parts of the economy, particularly the labor market but also the housing market. If the Fed doesn’t like what they see, they will lower interest rates faster.”

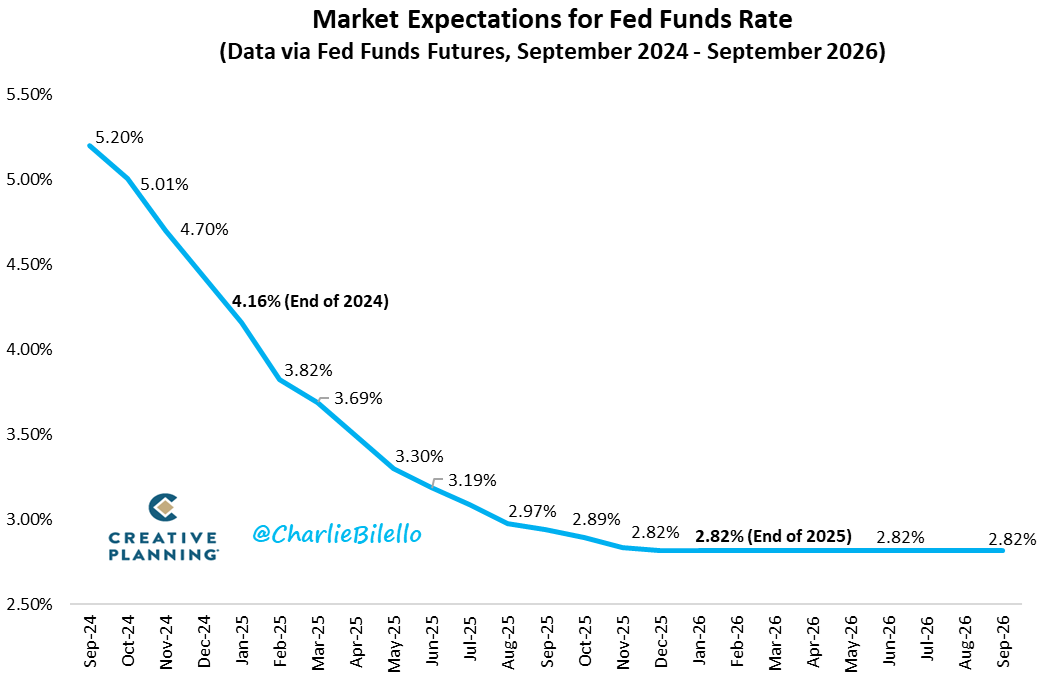

- 🔮 Interest Rate Expectations – The market expects interest rates to decline through 2025.

- On the downside, this would decrease interest payments from cash. On the positive side, it would lower the cost to borrowing, such as with mortgage rates or business loans:

- 🚛 Moving Patterns for Young, High Earners – SmartAsset ranked states based on the net migration of young households (ages 26 to 35) that earned at least $200,000 a year.

- The states with the biggest losses were: California (-3,226), Illinois (-1,323), and Massachusetts (-1,102).

- The state with the biggest gains were Florida (+1,786) and Texas (+1,660).

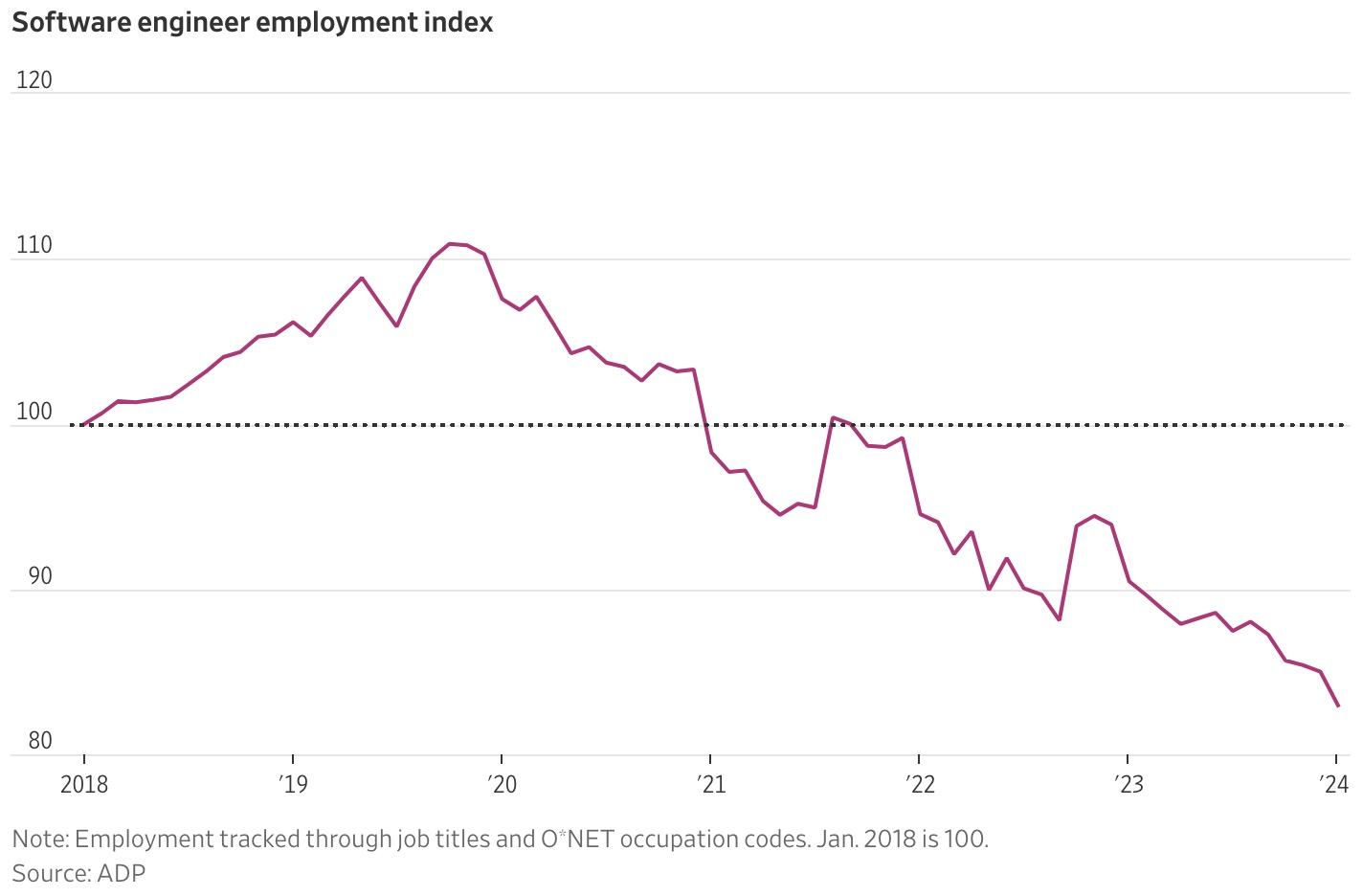

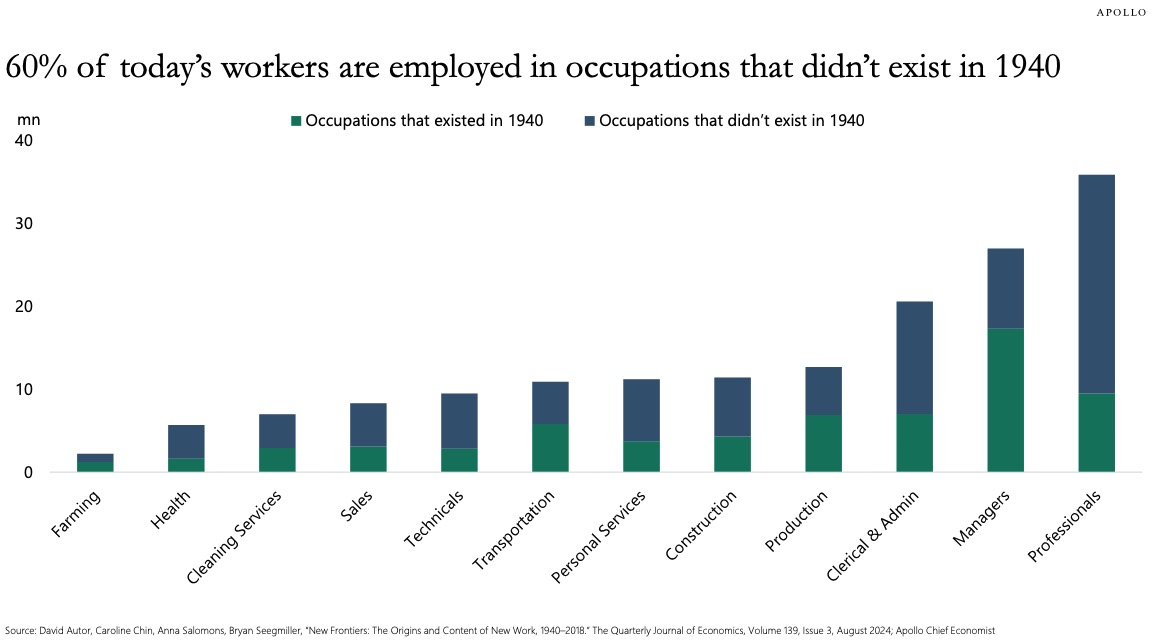

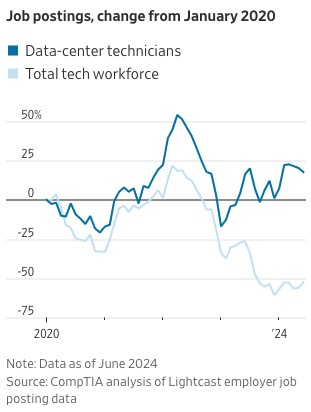

- Software Engineer Job Postings in Decline – Postings for software development jobs are down more than 30% since February 2020.

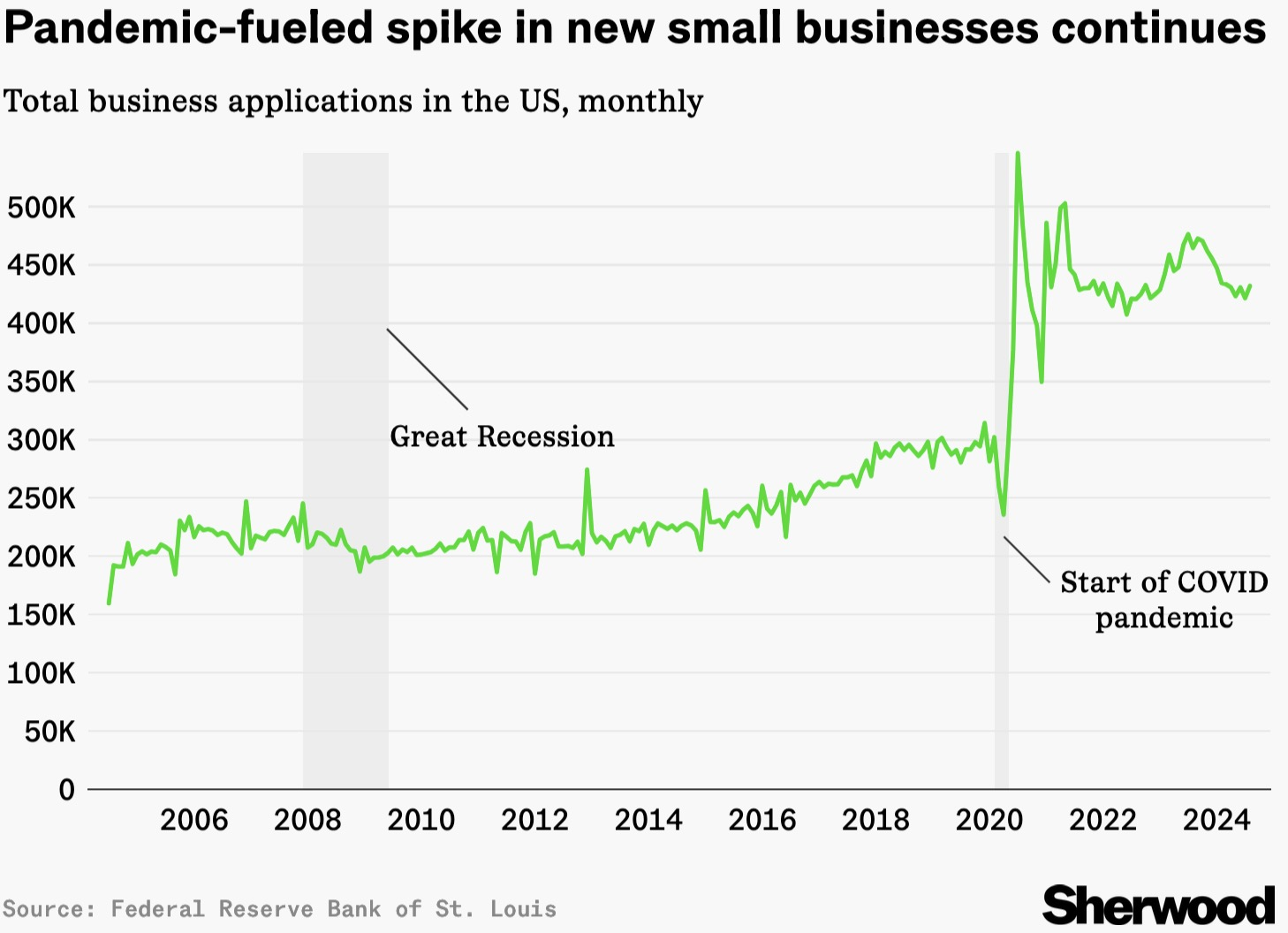

- 🏢 New Business Formation Up Big – The number of small businesses being formed had been relatively flat for decades. But four months into the pandemic, the rate of new small businesses spiked and hasn’t let up:

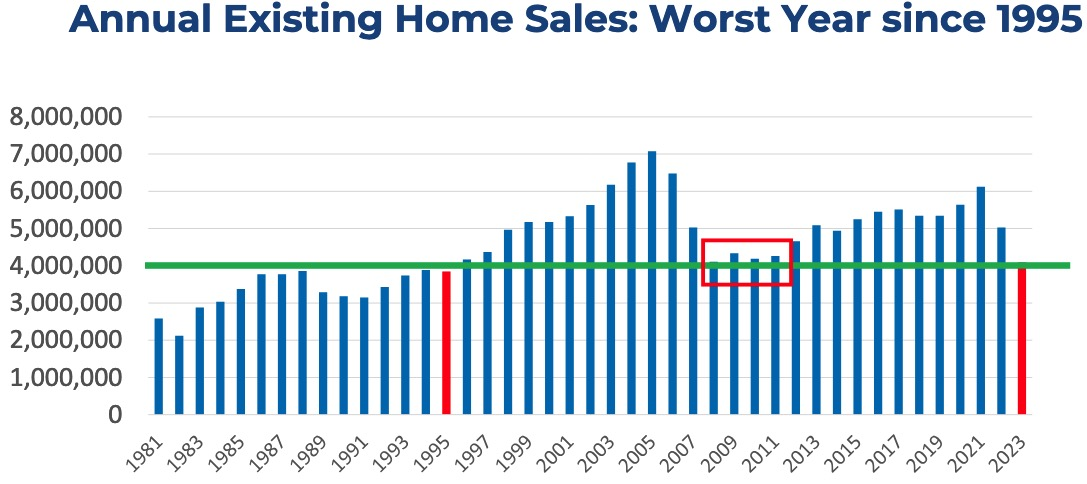

Housing

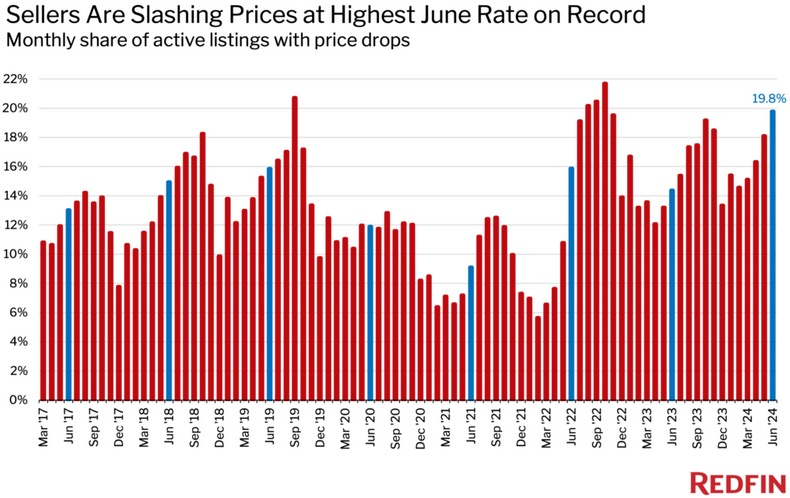

- 📈 Inventory Surge – In August, the number of homes for sale jumped 35.8% year-over-year, marking the 10th consecutive month of rising inventory.

- As a result, actively listed homes are at their highest level since May, 2020.

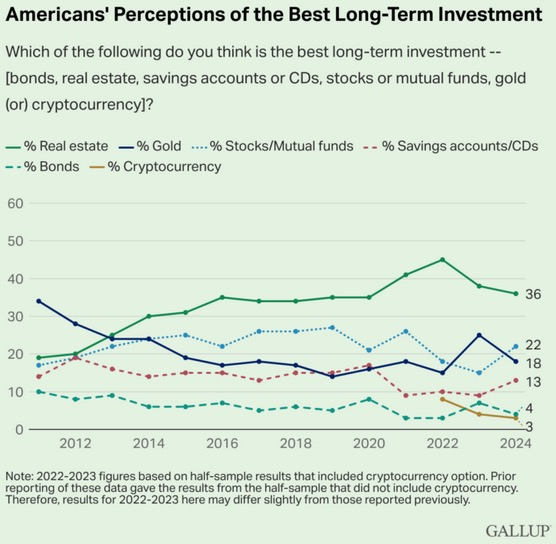

- 🏠 Everyone’s Favorite Investment – A new survey showed that real estate remains the top choice for long-term investment.

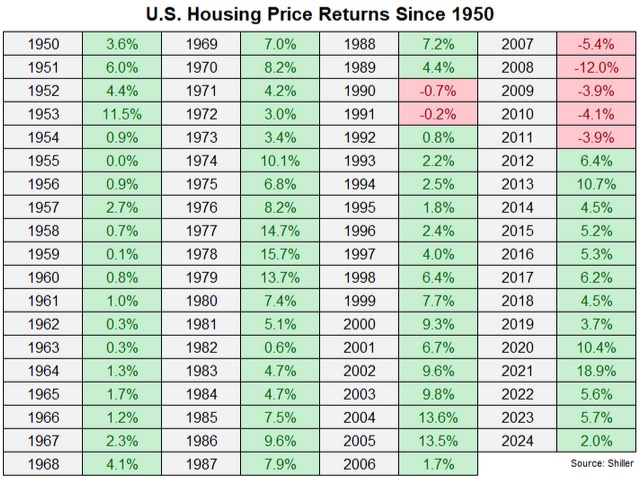

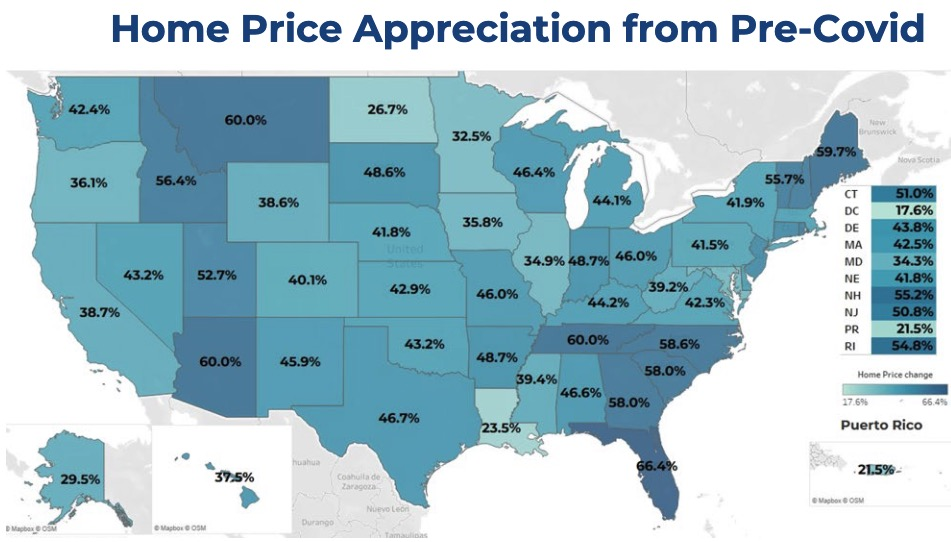

- 📊 Great Returns – Why housing is most people’s favorite investment is clear: The returns are rarely negative, it offers a lot of tax benefits, it allows for a lot of leverage, and it’s in DNA of America as owning a home is part of the American Dream.

- From Ben Carlson, “There have been just seven down years for the U.S. housing market over the past 75 years. That’s losses just 9% of the time.”

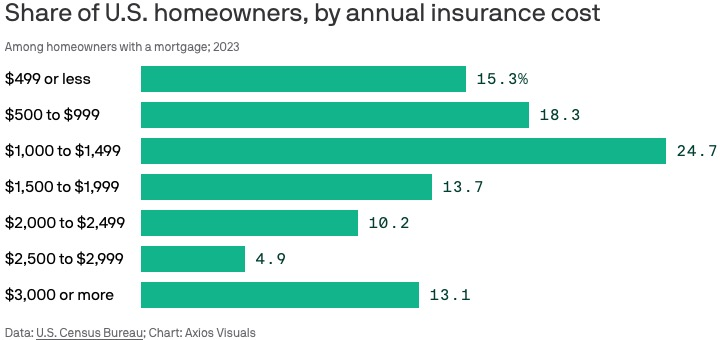

- ⛈️ Homeowners Insurance Costs – About 60% of homeowners pay less than $1,500 per year for insurance.

- Approximately one in eight homes pay $3,000+ per year. This high cost is concentrated in specific areas, such as Florida, where over one-third of homes pay more than $3,000.

Life

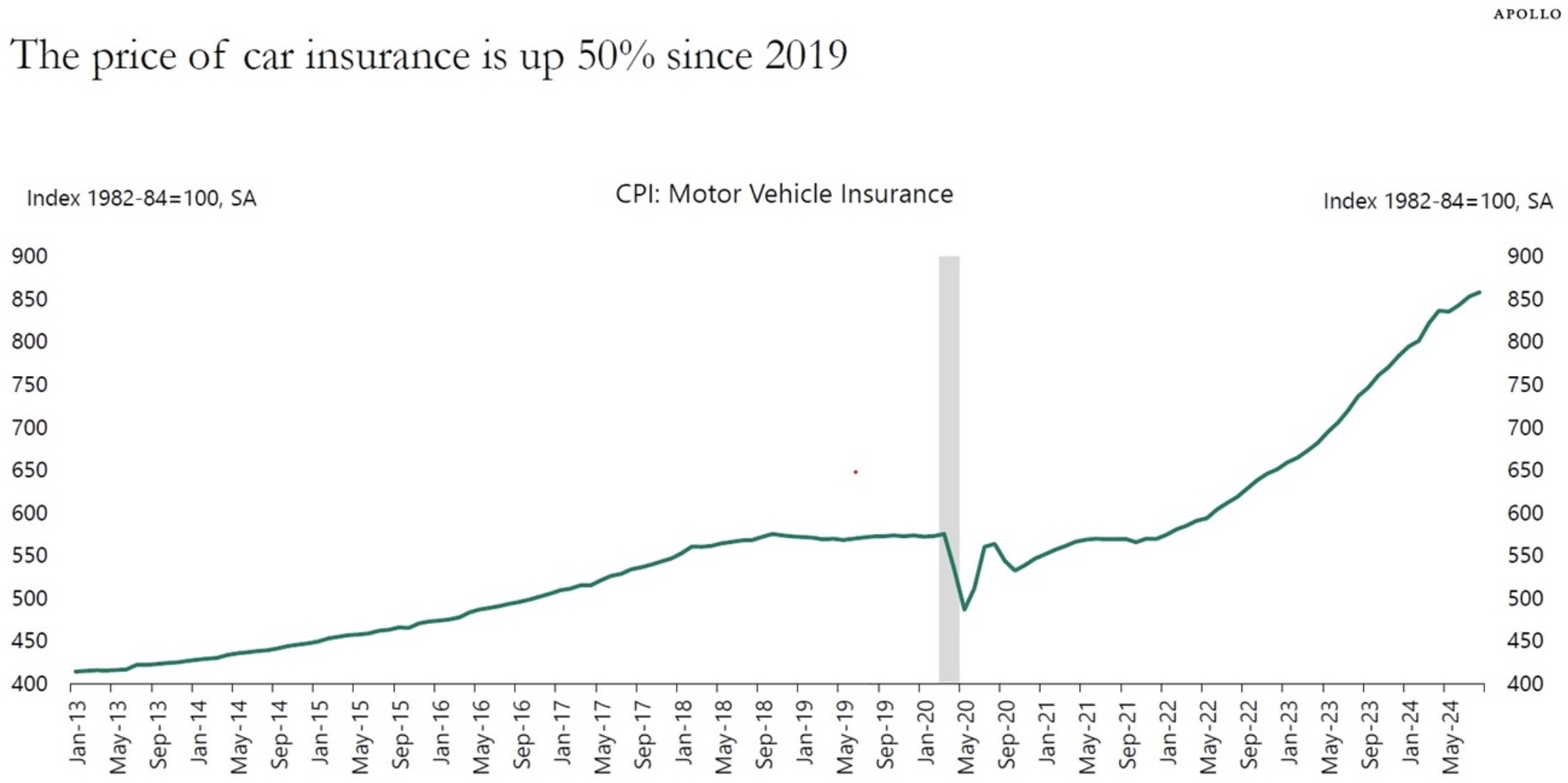

- 🚘 Searching For a New Car? – Check out Real Car Tips. They have great information about lease or purchase deals available from all the big brands.

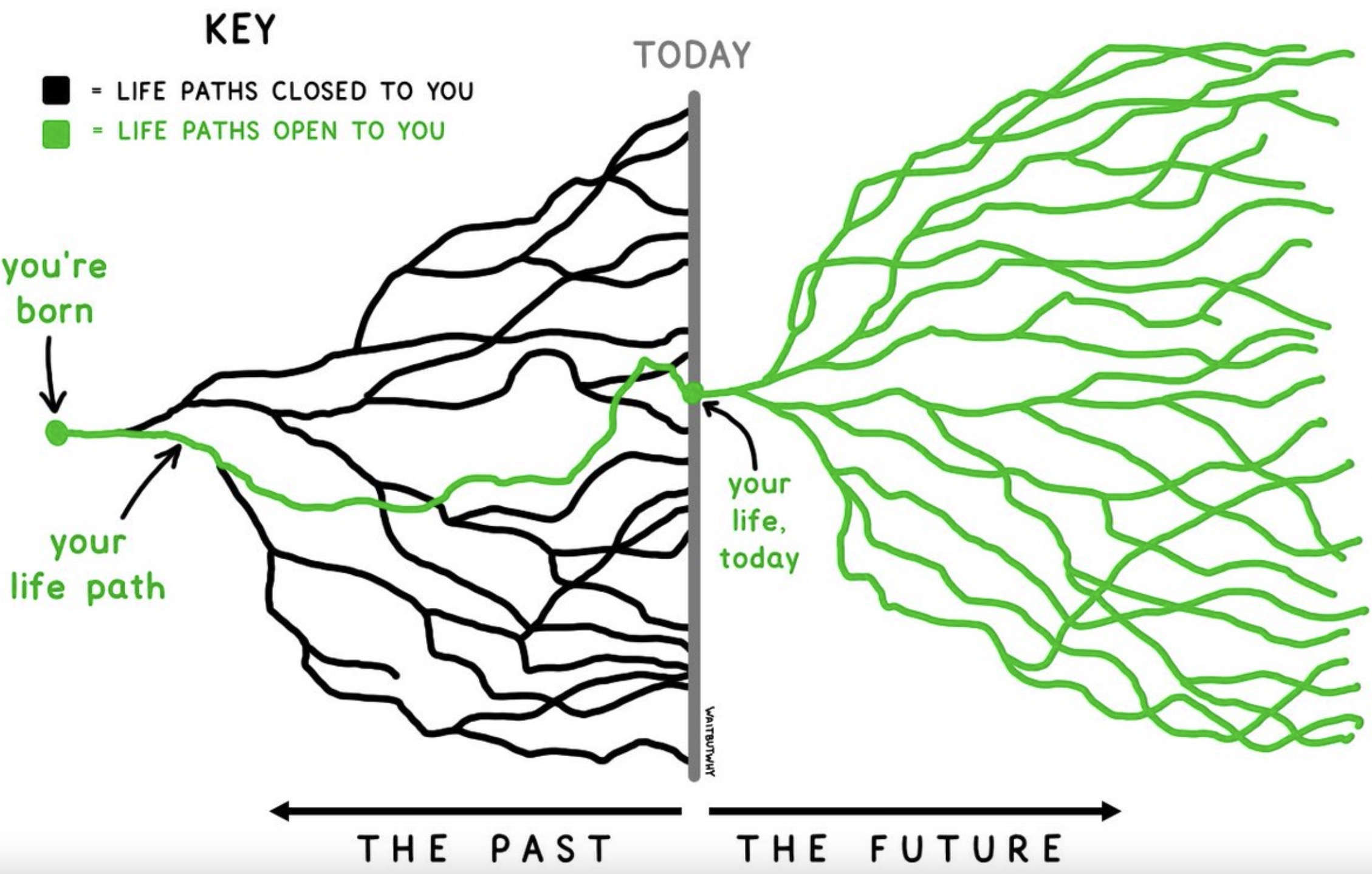

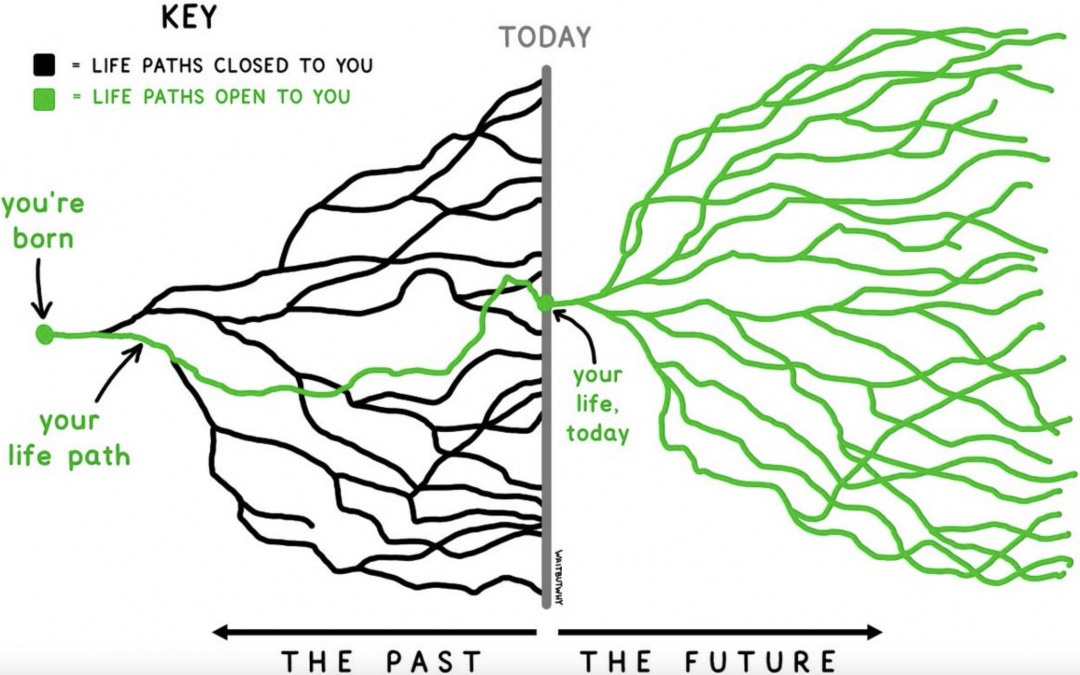

- 🚶♂️➡️Life Path – The image below is a nice way to think your past and your future.

- It was created by Tim Urban, who says, “We think a lot about those black lines, forgetting that it’s all still in our hands.”

Somewhat related to the life path image above:

“You can’t change your past, but you can reframe it.

Find the lesson in it. Find the opportunity in it. Pull the teachable moment out of it and share with others.

You can’t choose your history, but you can choose the story you tell about it.”

As always, please reach out if you have any questions or would like to connect.