Homeowners & Renters Insurance: Is Your Coverage Enough?

Right now many people are wondering how their home insurance would protect them in the event of a total loss.

Below is an overview for both homeowners and renters.

Homeowners Insurance

- Coverage A – Dwelling Coverage (each “coverage area” protects a different aspect of the property. They can be increased or decreased individually)

-

-

- Purpose. Covers the cost to rebuild your home in the event of a total loss (e.g., fire, etc.). For this reason, it is the most important part of your policy.

-

-

-

- Recommendation. 100% of your home’s replacement cost. To calculate this, multiply your home’s square footage by local, per-square-foot building costs.

-

-

-

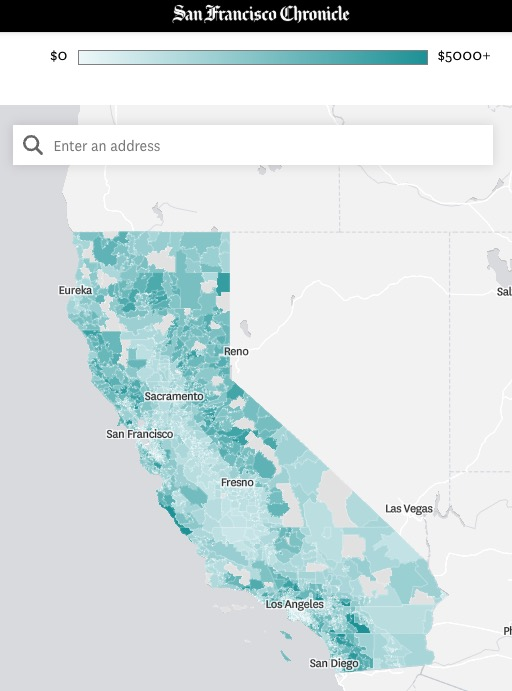

- In the Bay Area it costs approximately $700 – $800 per square foot to build a new, mid-range home. So for a 2,500 square foot home, it would cost approximately $1,875,000 to replace (give or take quite a bit depending on how you rebuild).

-

-

-

- Additional Tips

- Extended Replacement Cost comes into play when there is a covered, widespread disaster in your area. Recommended coverage is 20%-25% above the Coverage A amount.

- Additional Tips

-

-

-

-

-

- What’s typically not covered (check with your insurance to confirm):

-

- Earthquake damage (consider adding if in California)

- Flood damage

- Landslides

- Sinkholes

-

- What’s typically not covered (check with your insurance to confirm):

-

-

-

- Coverage B – Other Structures

-

-

- Purpose. Insures detached structures on your property, such as sheds, fences, guest houses, swimming pools (in some cases), and detached garages.

-

-

-

- Recommendation. Many policies provide Coverage B at a percentage of the Coverage A amount, often 10 – 20%. Consider the unique setup of your home and increase or decrease accordingly.

-

- Coverage C – Personal Property

-

-

- Purpose. Covers your personal belongings, such as furniture, clothing, and other personal items.

-

-

-

- Recommendation. It of course depends on how valuable your personal belongings are, but many policies default to ~50% of your Coverage A amount. Estimate how much it would cost to fully replace everything in your home.

-

-

-

- Additional Tips

- Your car is not considered personal property. So if your car is parked in your garage and destroyed in a natural disaster, it is not covered. Your car insurance would cover that damage.

- Additional Tips

-

-

-

-

-

- It’s a good idea to record a video of everything in your home about once a year. This is helpful for insurance claim purposes.

-

-

-

- Coverage D – Loss of Use

-

-

- Purpose. Covers the cost of temporary living arrangements if your home is uninhabitable.

-

-

-

- Recommendation. Consider how long it might take to rebuild your home, and how much it would cost per month to rent a home you’d be happy in. Some policies also have a time limit on how long you can receive this benefit, so that’s worth checking. The typical range is 20% – 50% of your Coverage A amount.

-

- Coverage E – Personal Liability

-

-

- Purpose. Protects you against legal liability for bodily injury or property damage that you may cause to others. This coverage kicks in when you are found legally responsible for an incident.

-

-

-

- Recommendation. $1,000,000 if you have a sizable net worth. $300,000 – $500,000 if not.

- If you have a substantial net worth or just want extra protection, consider an umbrella policy. This provides additional liability coverage.

- Recommendation. $1,000,000 if you have a sizable net worth. $300,000 – $500,000 if not.

-

- Coverage F – Medical Payments to Others

-

-

- Purpose. Provides coverage for medical expenses incurred by guests who are injured on your property, regardless of fault. Examples include an ambulance rides and hospital stays.

-

-

-

- Recommendation. $1,000 per person, minimum.

-

- Personal Property

-

-

- Purpose. Covers your personal belongings, such as furniture, clothing, and electronics, against risks like fire, theft, vandalism, and certain natural disasters.

-

-

-

- Recommendation. Usually ranges from $10,000 to $100,000, depending on the policy and the value of your belongings. Consider the value of your belongings and increase or decrease accordingly.

-

-

-

- Additional Tip. Renters insurance can provide coverage on an “actual cash value” basis – which factors in depreciation – or a “replacement cost” basis – which covers the cost to replace items without depreciation. Replacement cost coverage is recommended, but typically has higher premiums.

-

- Additional Living Expenses (ALE)

-

-

- Purpose. Covers temporary housing. This can include costs for hotel stays, meals, and other near-term expenses following a disaster.

-

-

-

- Recommendation. Often set as a percentage of your personal property coverage limit (e.g., 20% to 30%).

- ALE only covers temporary living expenses incurred as a result of the loss, not the cost of a new long-term rental.

- Coverage usually applies for a limited time, often up to 12 months.

- Recommendation. Often set as a percentage of your personal property coverage limit (e.g., 20% to 30%).

-

- Liability

-

-

- Purpose. Provides liability coverage if someone is injured in your rented home, or if you accidentally cause damage to someone else’s property.

-

-

-

- Recommendation. This is a personal preference. It often starts at $100,000 and maxes out at $500,000.

-

I hope you found this helpful.

As always, please reach out if you have any questions or would like to connect.