Foreign Investors Are Avoiding America

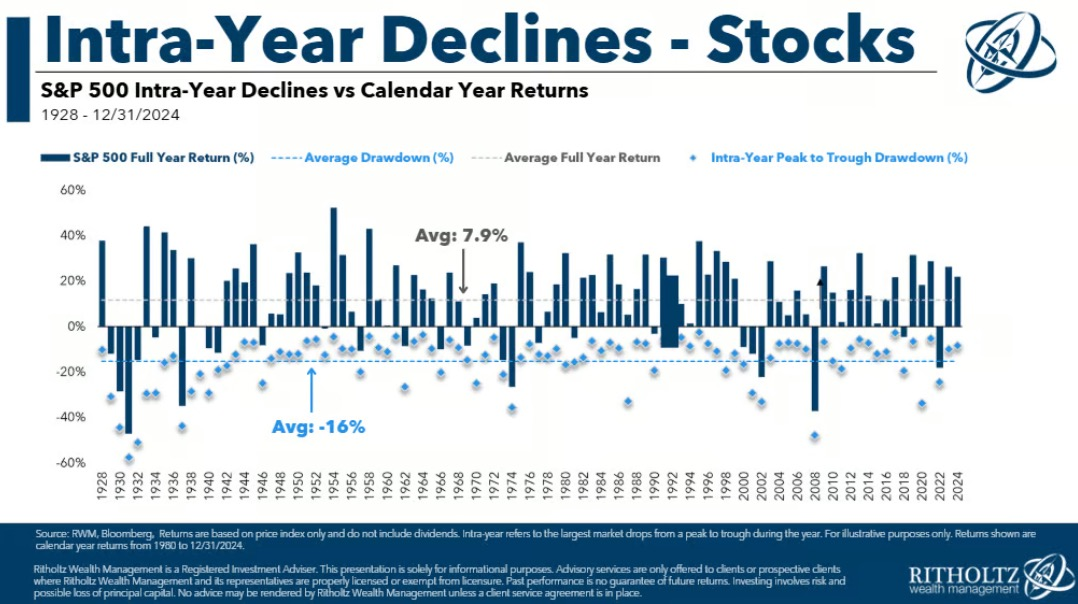

With the historic amount of volatility in April, many are happy that month is behind us. A quick summary of the investment activity:

- The S&P 500 fell 10.6% over two days.

- It soon rebounded 9.5% — the third-best single day on record (!).

- U.S. stocks ended April down around ~1%. Quite the round trip.

On the trade front, tariffs are apparently postponed until July 8th. Right now, the market seems optimistic that those will not fully go into effect. I don’t see Trump walking away completely, but it feels like everyone is hoping that they’ll be minimized from the current plan. Perhaps we’re in a brief respite from the tariff-induced madness we just experienced, or perhaps the stock market is right, and the worst is behind us. Only time will tell.

It’s still early days in the China-US trade war, but the early data is worrying:

- China’s export orders have declined, and container ship bookings to the U.S. have dropped sharply.

- 👩🍼 Quick Tip: China produces a very large share of strollers, cribs, and toys sold in the America. If you or someone you know has a baby on the way, it’s smart to stock up on these essentials sooner rather than later.

- Businesses are pulling back on investment.

- Consumers are growing anxious about unemployment, inflation, and general sentiment is low.

We’re also seeing an interesting trend with international investors: Foreign investors are on a “buyers’ strike” for U.S. assets, according to Deutsche Bank. This is showing up in a) the decline of the dollar, b) a sharp drop in overseas purchases of U.S. investments, and c) reduced international travel (at least from Europe) to the America. International attitudes toward the U.S. has declined, which is now showing up in the data.

As for interest rates, betting markets are pricing in two interest rate cuts this year. But it may be a tricky situation — tariffs are inflationary, so cutting rates in an inflationary environment is not the typical playbook. Plus, as we learned during the pandemic, rate cuts can’t fix broken supply chains, and may even add to inflation when goods are scarce.

In short: we’re a long way from calm waters. The stock market remains a strong early indicator of recovery, but right now, unpredictability is the only constant. To that point, around 40 companies have withdrawn or lowered their forward guidance for the year, citing economic uncertainty. Examples include General Motors, JetBlue, Kraft Heinz, and Logitech.

Please let me know if you have any questions or concerns about how your financial plan is being affected or how your portfolio is allocated.

Below I’ve summarized a few interesting data points from from the past month related to the summary above.

- Nearly Flat – With all the volatility in April, the S&P 500 ended down 1%.

- That said, stocks are still about 10% below their all-time high in February.

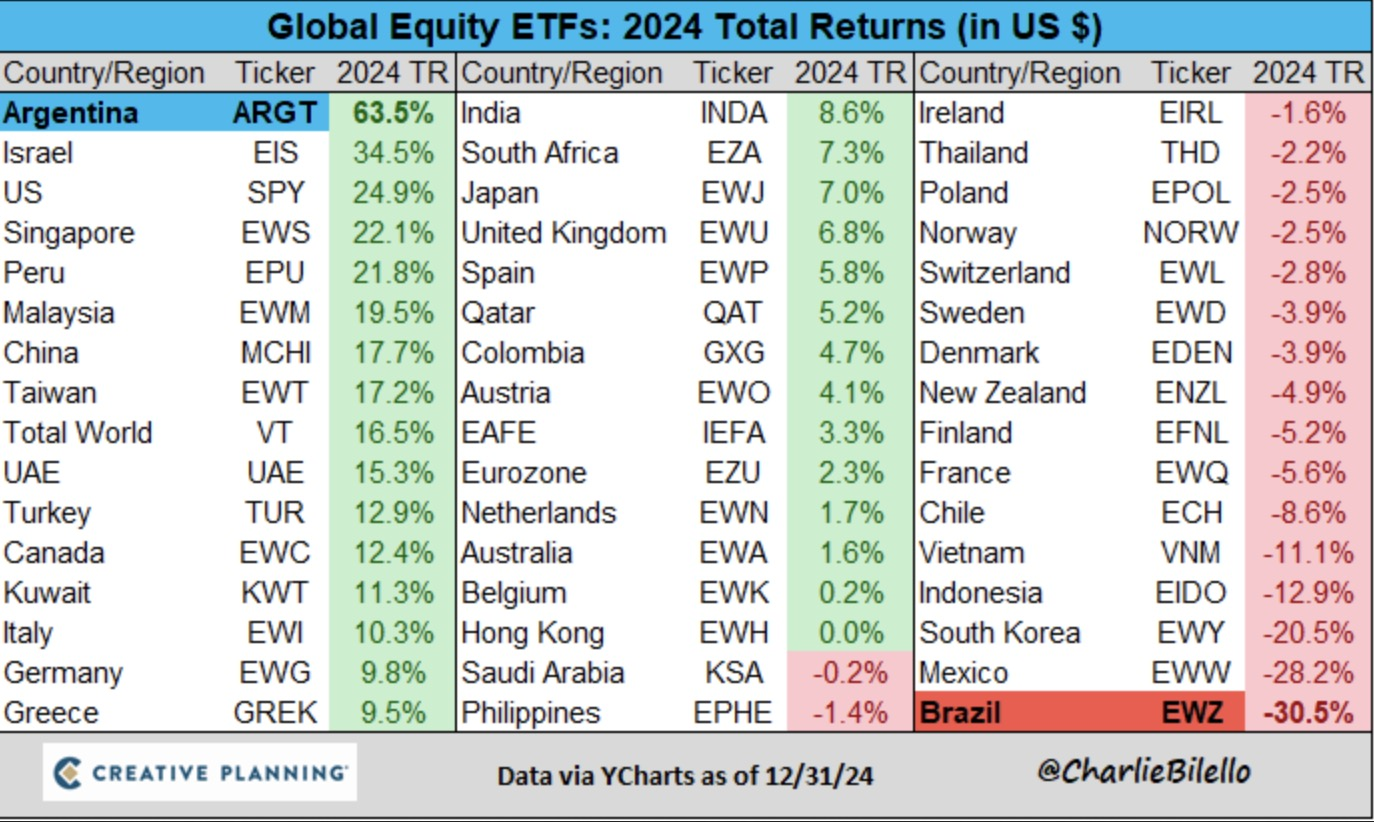

- 🌎 Country Returns – Going back to the start of 2025, the US is underperforming the international markets.

- 📈 Biggest 1-Day Gains – On April 9th the S&P 500 went up 9.5%.

- Looking at previous big 1-day moves up, the forward-looking returns 100% positive. As always, past performance does not guarantee future results, but it’s interesting.

- 🏠 Housing Inventory Up – The number of homes for sale across the U.S. is quite a bit higher than in recent years.

- 🇺🇸 State by State Inventory Growth – California in particular has seen a big increase in homes for sale.

- 🚢 GDP Down 0.3% in Q1 – GDP shrank 0.3% in the first quarter — the first drop in three years.

- A big chunk of that decline came from a growing trade deficit (meaning we imported more than we exported), as businesses scrambled to import goods ahead of Trump’s tariffs. Imports, which count as a negative in the GDP calculation, were up 41% versus the previous quarter.

- 🛫 Europeans Traveling to America Less – Not a great sign for our tourism industry.

- 💵 US Dollar Down – The value of the dollar has declined ~8% since the start of this year.

- Most people are familiar with how a lower/weaker dollar increases the cost when traveling internationally.

- A lower dollar also affects your foreign investments: A declining US dollar amplifies gains from foreign investments. When the dollar weakens, the value of foreign currencies rises relative to the dollar. So for U.S. investors, this means that the returns from international stocks, when converted back into dollars, are higher.y.

- For example, say a European stock rises 0% in euro terms, but the euro appreciates 5% against the dollar. In that case, a U.S. investor would see a 5% gain in dollar terms.

- For more on how the U.S. Dollar affects your investments, see here.

- The theme that may be emerging is that international investors are starting to question America’s stability. With that, there’s a real risk they’ll pull back from U.S. assets generally (stocks, bonds, the dollar, travel to America).

- 👨💼 Job Worries – Many are concerned about losing their job. You have to go back to 2008 to see this level of fear.

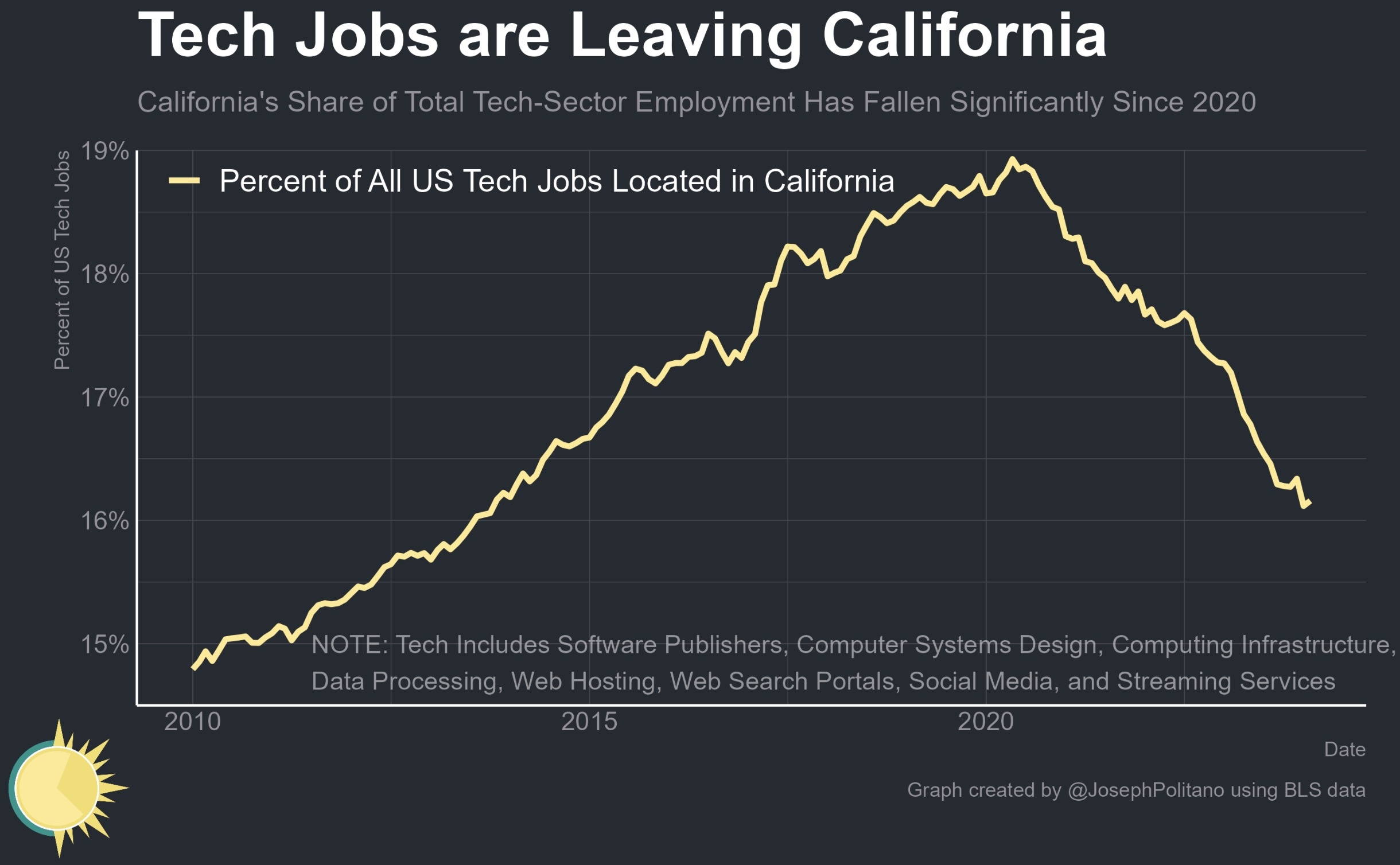

- 💸 State Tax Changes since 2000 – An interesting look at how state taxes have changed since 2000. California has moved up quite a bit.

Quote of the Month

“Everybody in the world is a long-term investor until the market goes down.”

As always, please reach out if you have any questions or would like to connect.