Year-End Tax Tips + November News

Onto the investment world, below are some interesting personal finance stories and themes from November, plus a few year-end tax-saving tips.

- Tax-Loss Harvesting – If you have any investments that you’re not attached to, and are sitting on a loss, selling those is worth considering. That loss can offset gains from other stocks. And if your total losses exceed your total gains, you can deduct up to $3,000 of the losses against your income, which reduces your taxes. Any excess losses are carried forward to future years.

- Max Out 401(k)’s – If it’s part of your financial plan to max out your 401(k), make sure you do so by year end. Also, consider after-tax 401(k)’s if your company offers them and you don’t need as much cash from your paycheck.

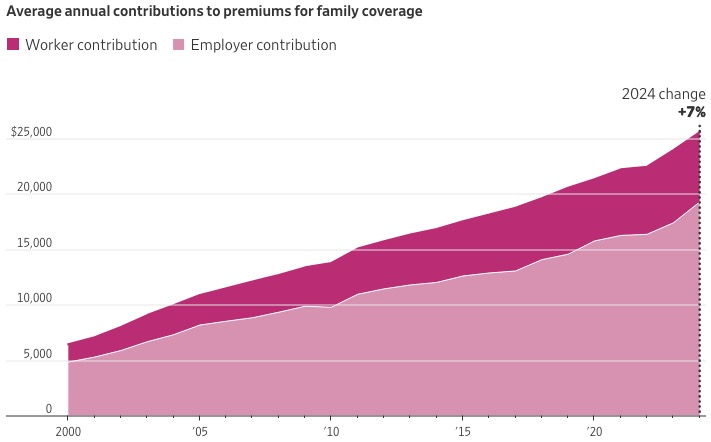

- Maximize HSA Contributions – For clients with high-deductible health plans, contribute the maximum allowed to your HSA before year-end ($4,150 for an individual, or $8,300 for a family). Contributions are tax deductible, grow tax free, and can be withdrawn tax free if used for qualified medical expenses.

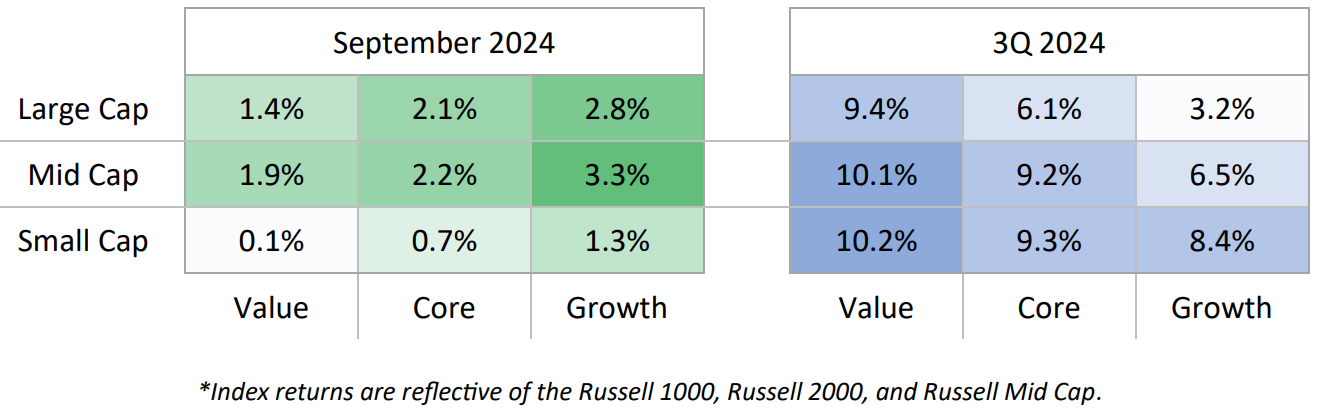

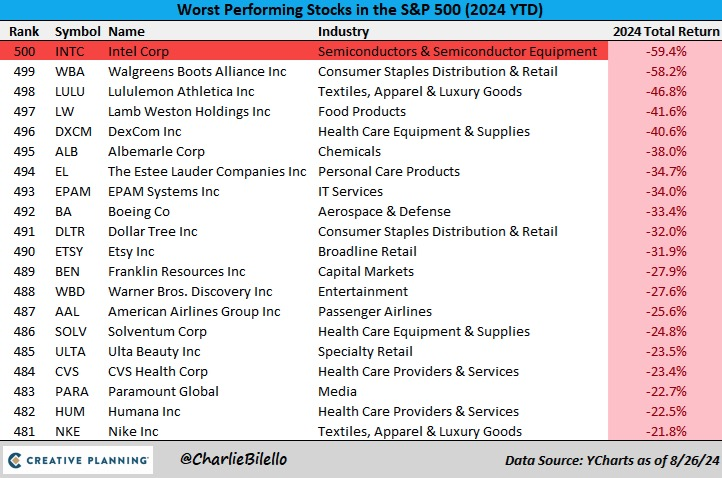

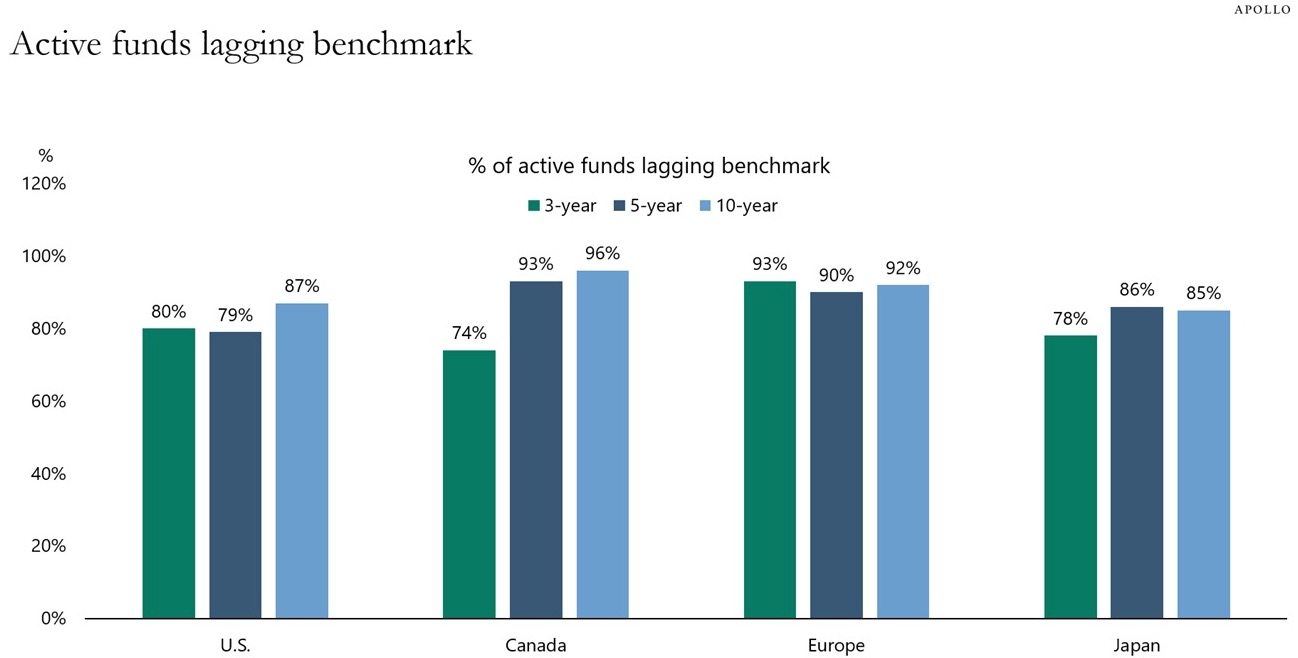

- 🤕 Underperformance – The vast majority of funds underperform their benchmark. Over a 10-year time horizon, 87% of funds focused on the US market fail to beat their benchmark.

- This is why index funds work. They simply mirror the index, as opposed to picking and choosing which subset of stocks to hold.

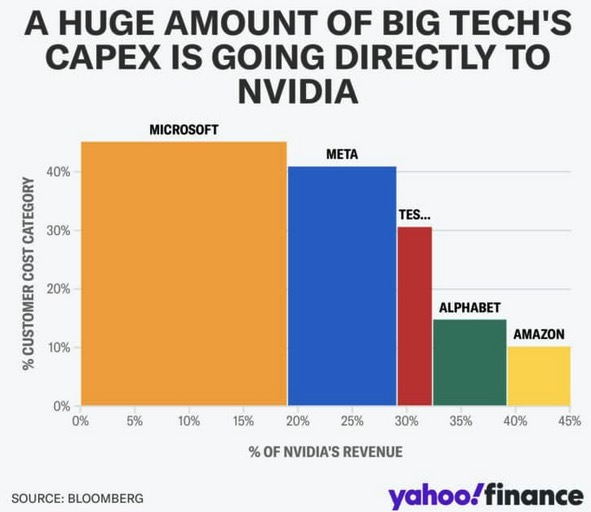

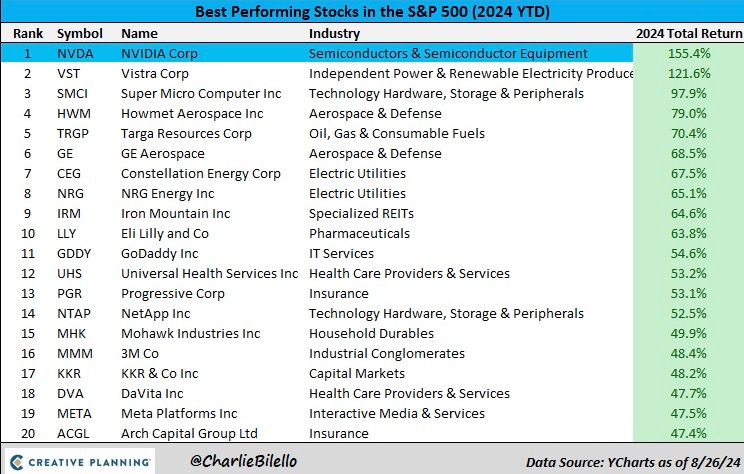

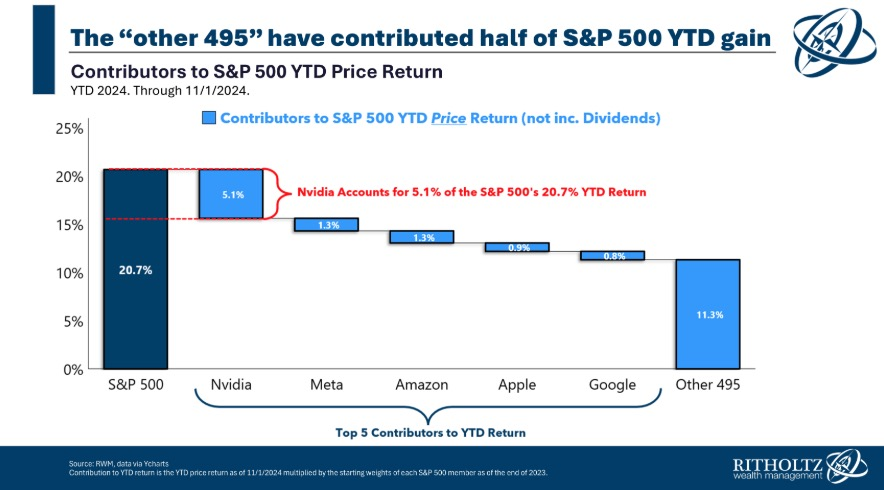

- 📊 S&P 500 Year-to-Date Return Breakdown – Nvidia has driven ~25% of the S&P 500’s return this year. Meta, Amazon, Apple, and Google have also been big contributors.

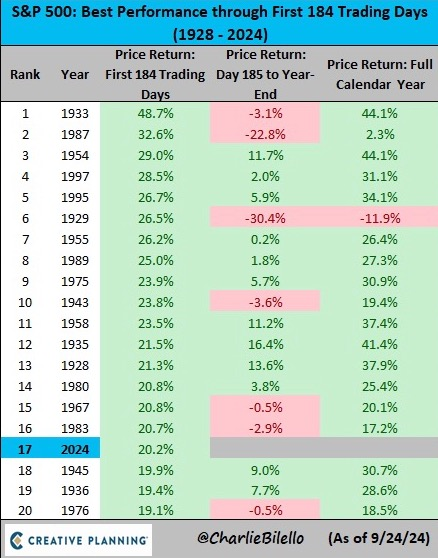

- 🐂 Bullishness – The largest share of Americans on record believe the stock market will continue to do well over the next year.

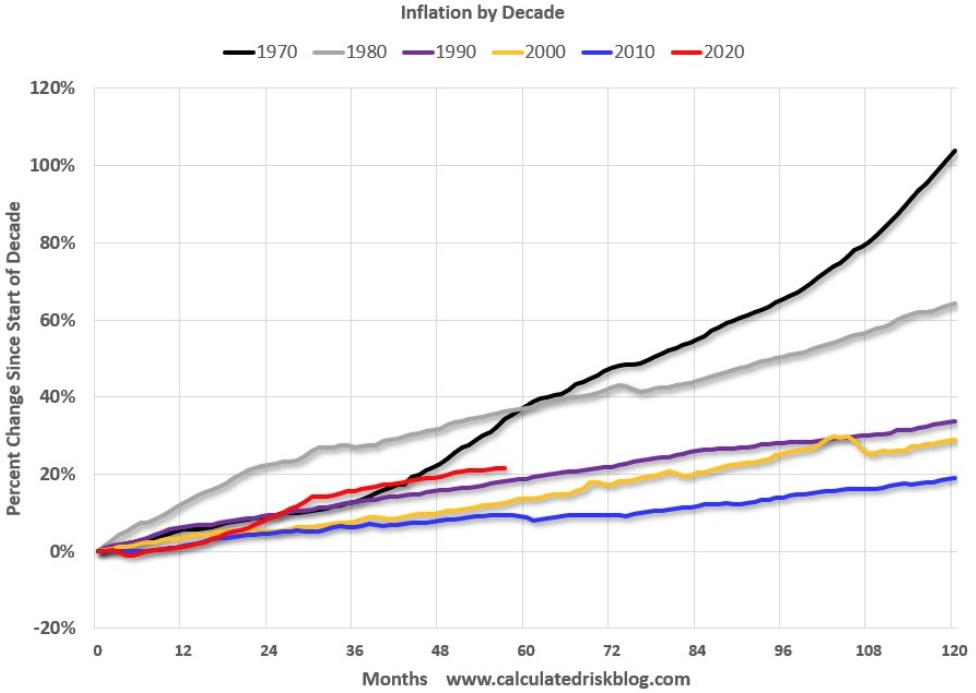

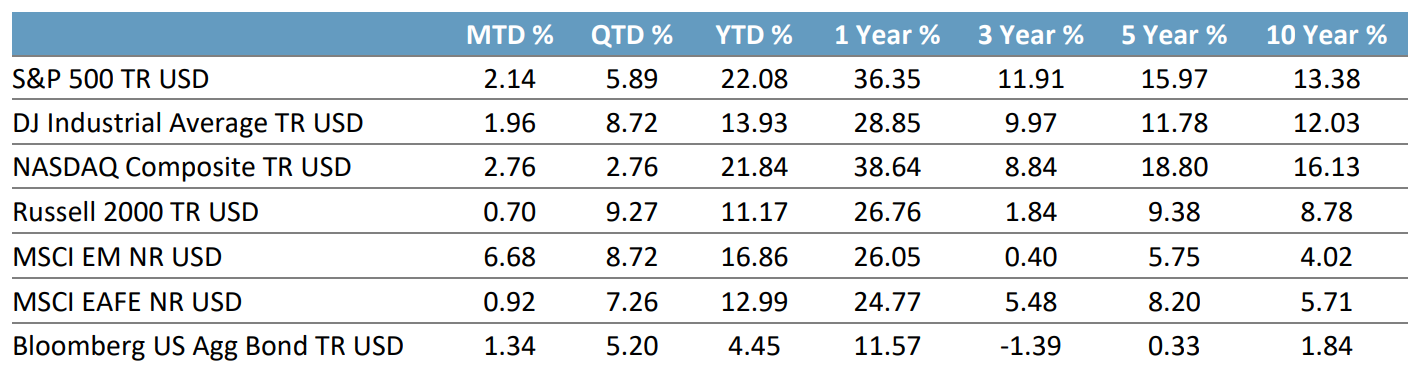

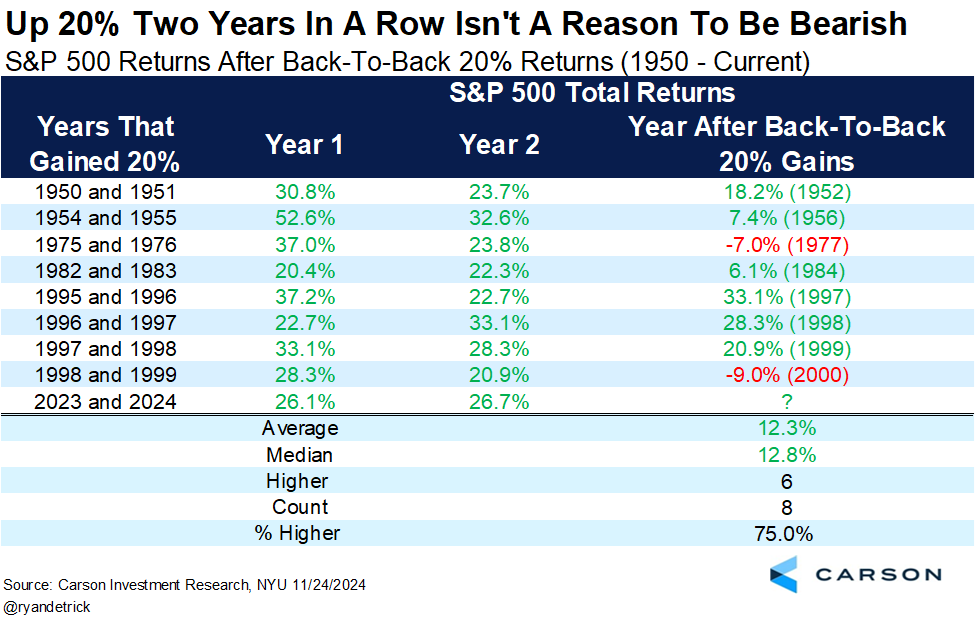

🤔 Maybe They’re Right? – The S&P 500 is on course to be up more than 20% in 2023 and 2024.

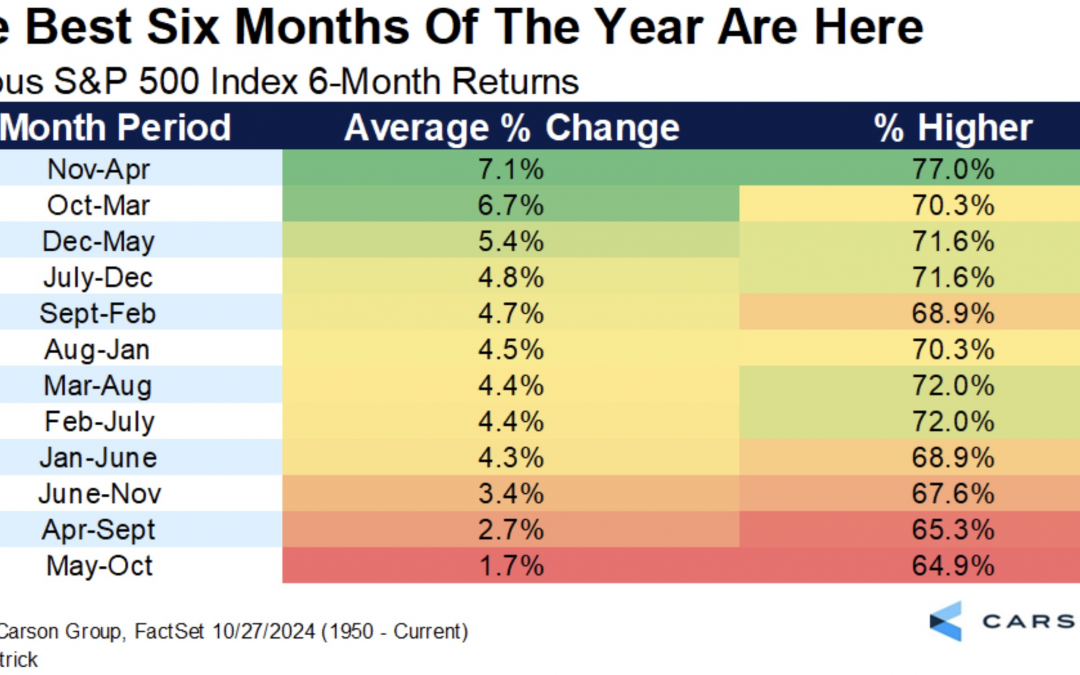

Those types of back-to-back gains have occurred before. In those instances, the average gain in the third year is about 12%:

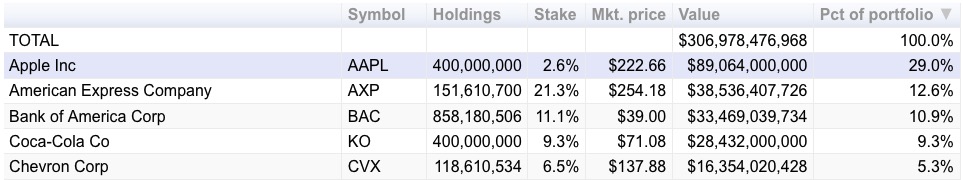

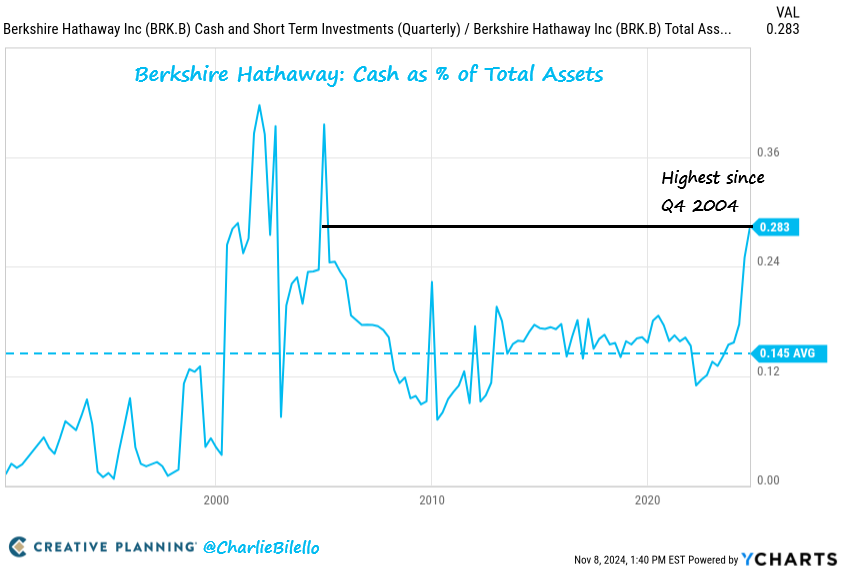

- ⚖️ On the Other Hand… – Many followers of Warren Buffett are wondering if he’s turning bearish (i.e., cautious).

- From Charlie Bilello: “Berkshire Hathaway is now holding over 28% of their assets in cash, the highest percentage since 2004. Its historical average cash position: 14%.

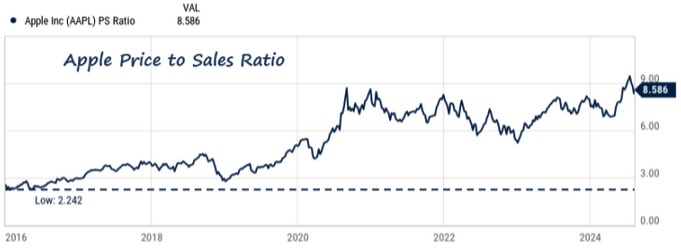

- Why might the greatest value investor of all time be raising cash? Higher valuations and the lack of compelling opportunities.

- Berkshire’s largest holding, Apple, now trades at 37x earnings and 9x sales. Back when Berkshire first purchased the stock in 2016 it sold for just 10x earnings and 2x sales.”

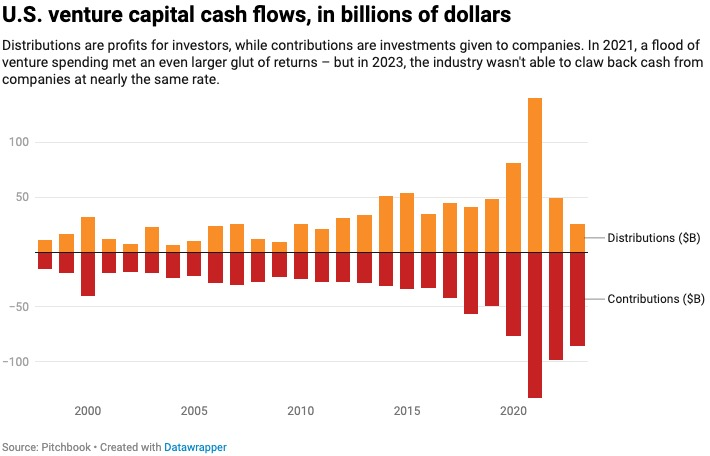

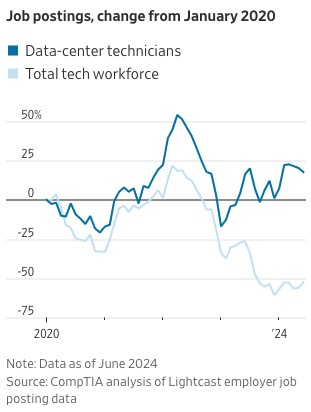

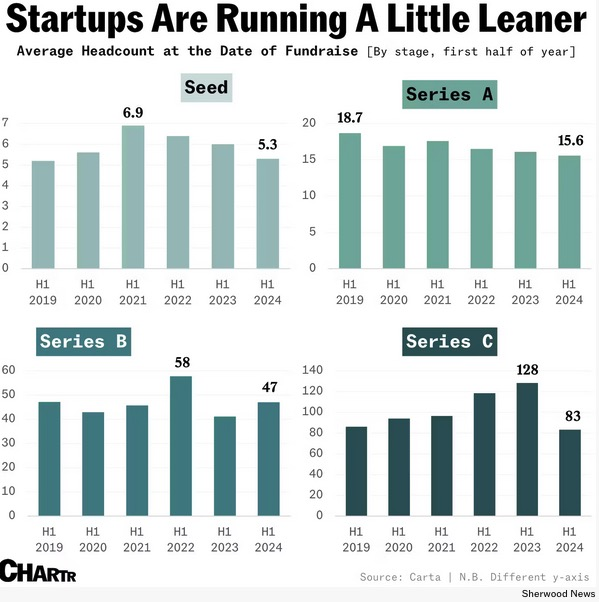

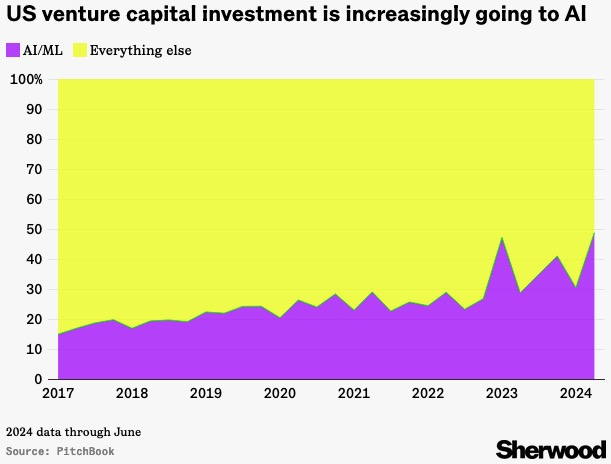

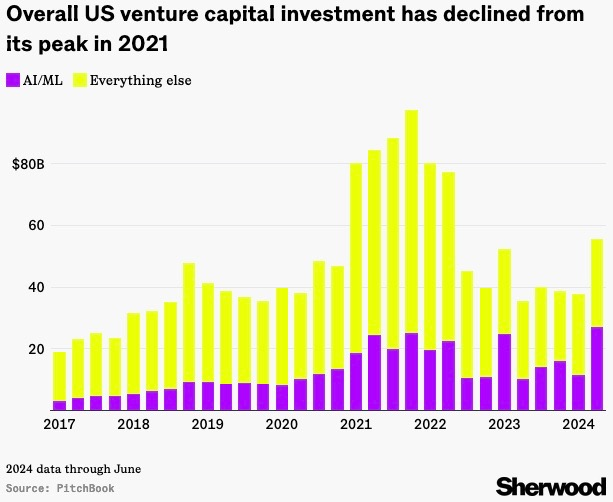

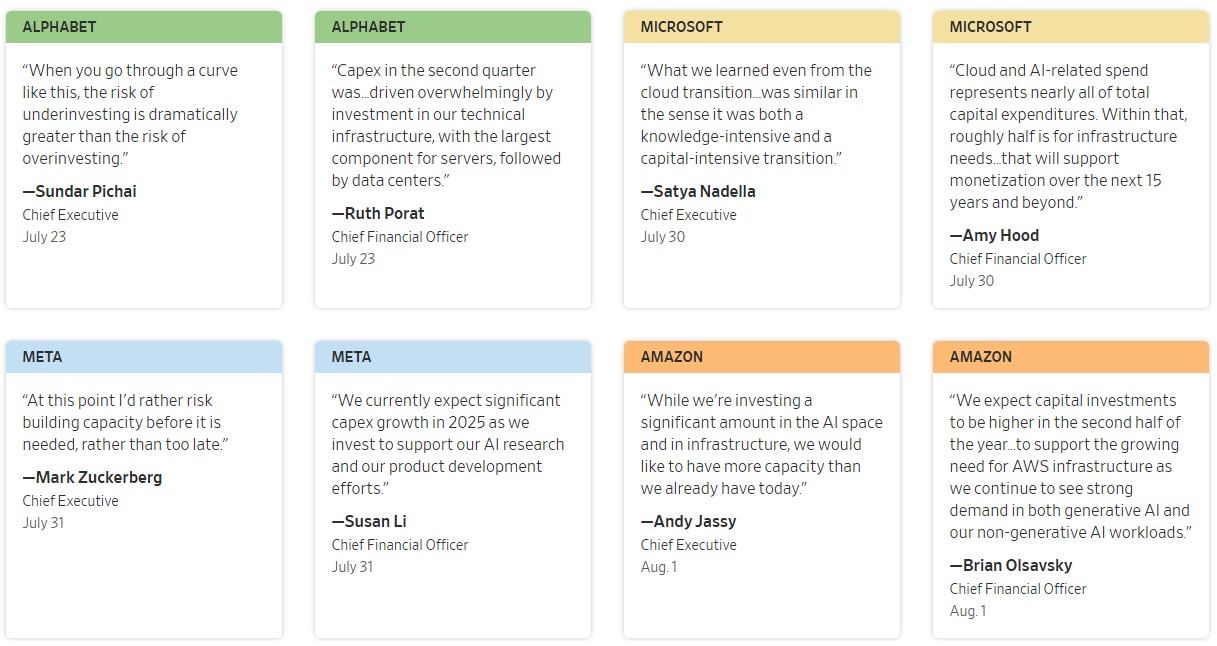

- 💸 Venture Capital – 2023 was venture’s worst year of profits since 2011. Initial public offerings, private equity buyouts, and mergers are all down:

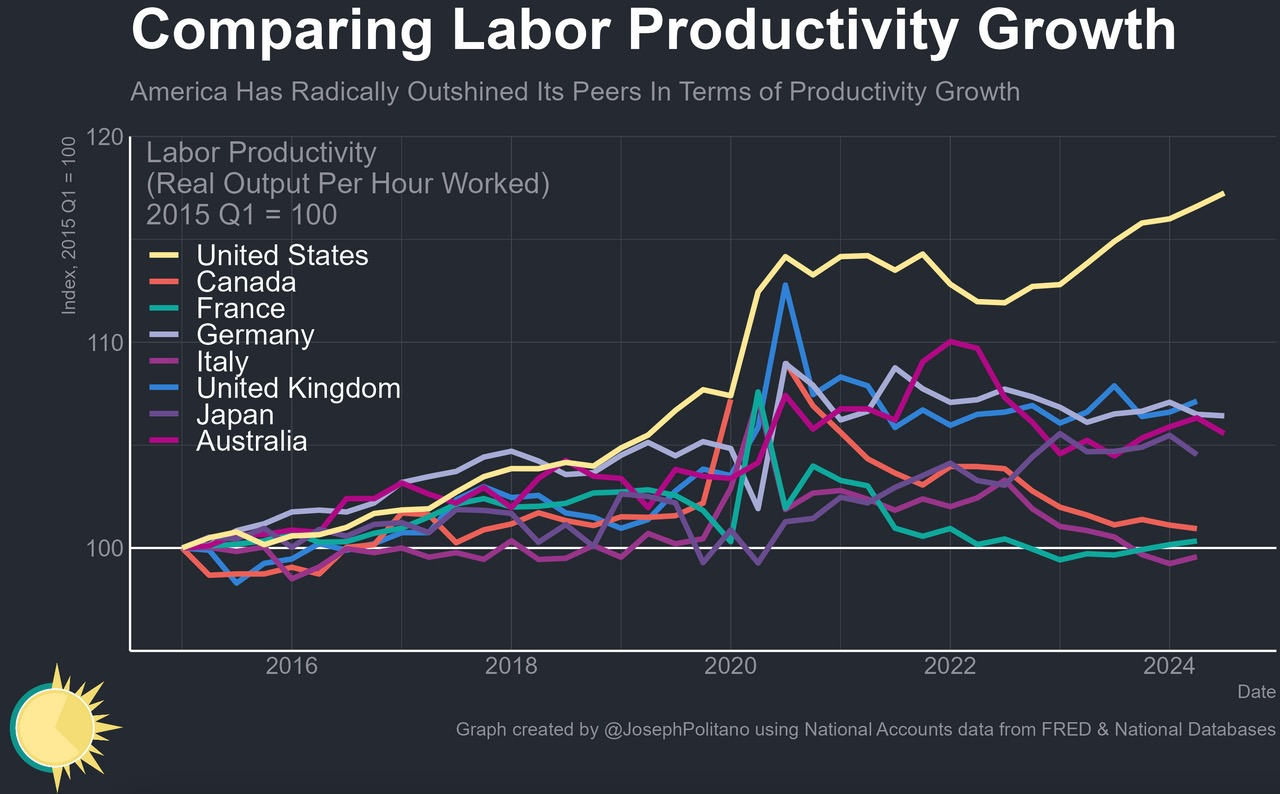

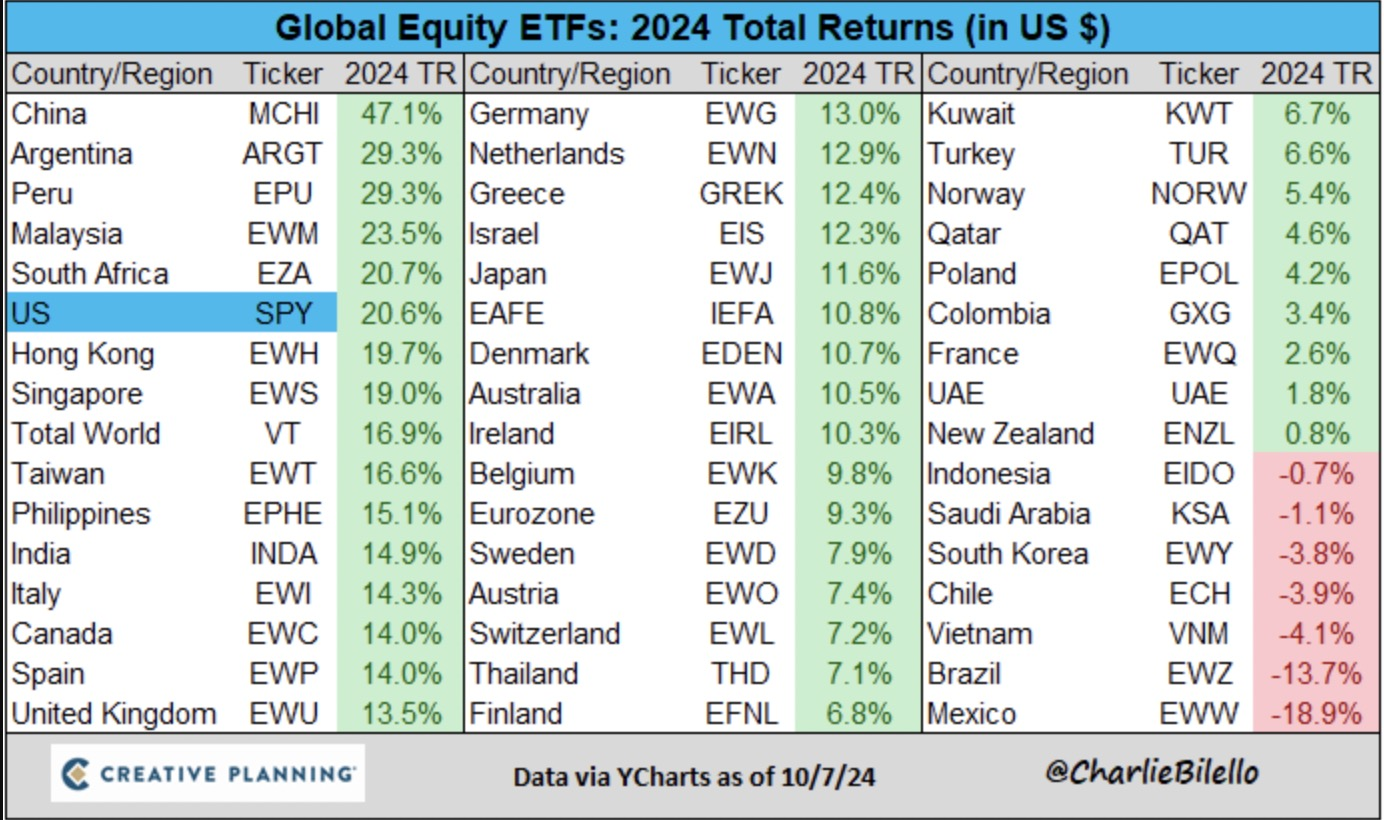

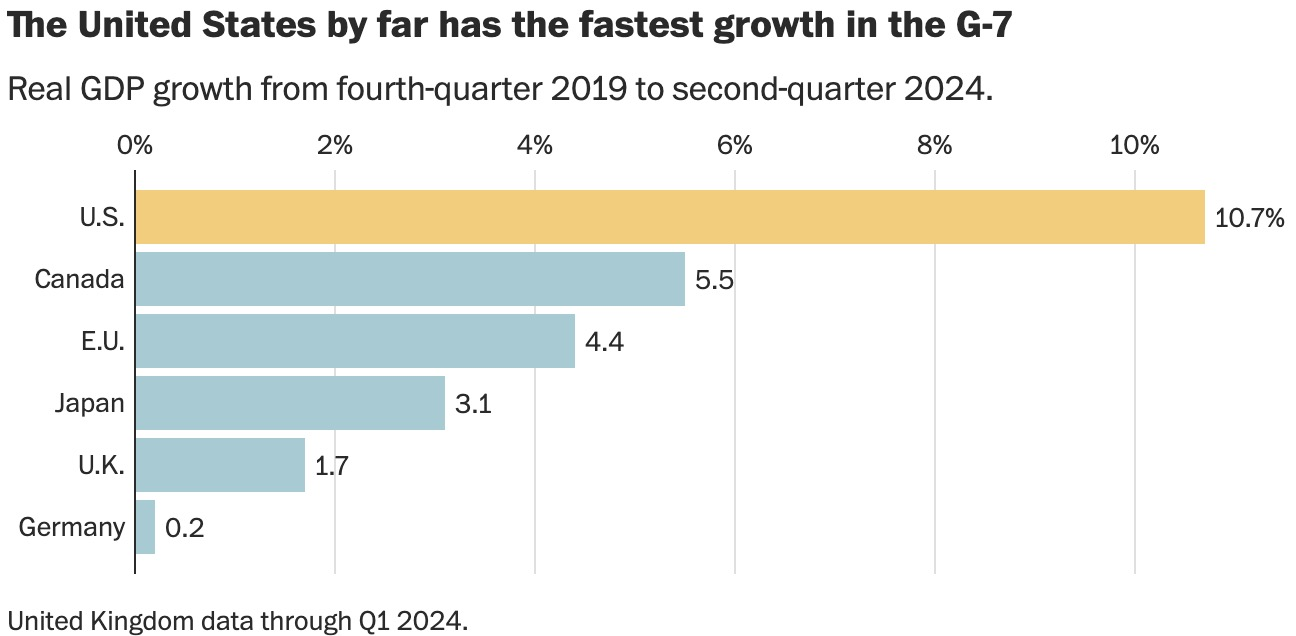

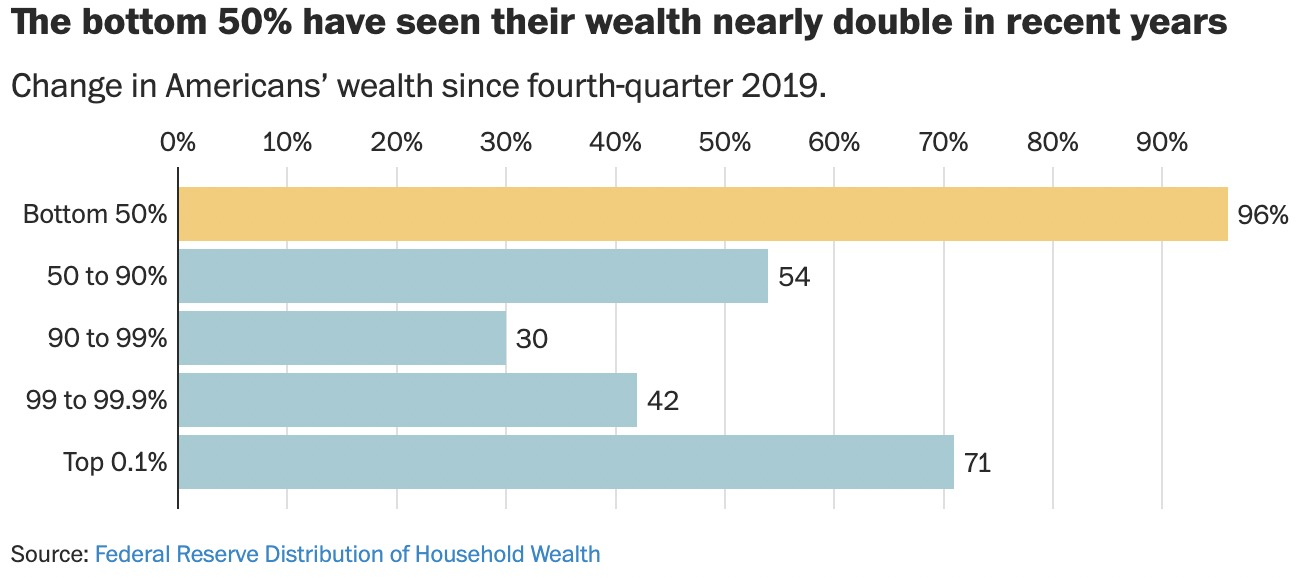

- 🇺🇸 US = More Productive – A great stat from Joseph Politano: “Since late 2019, the US has seen more than double the productivity growth of the next-fastest major comparable economy, building on an already significant lead it built up in the years before COVID.”

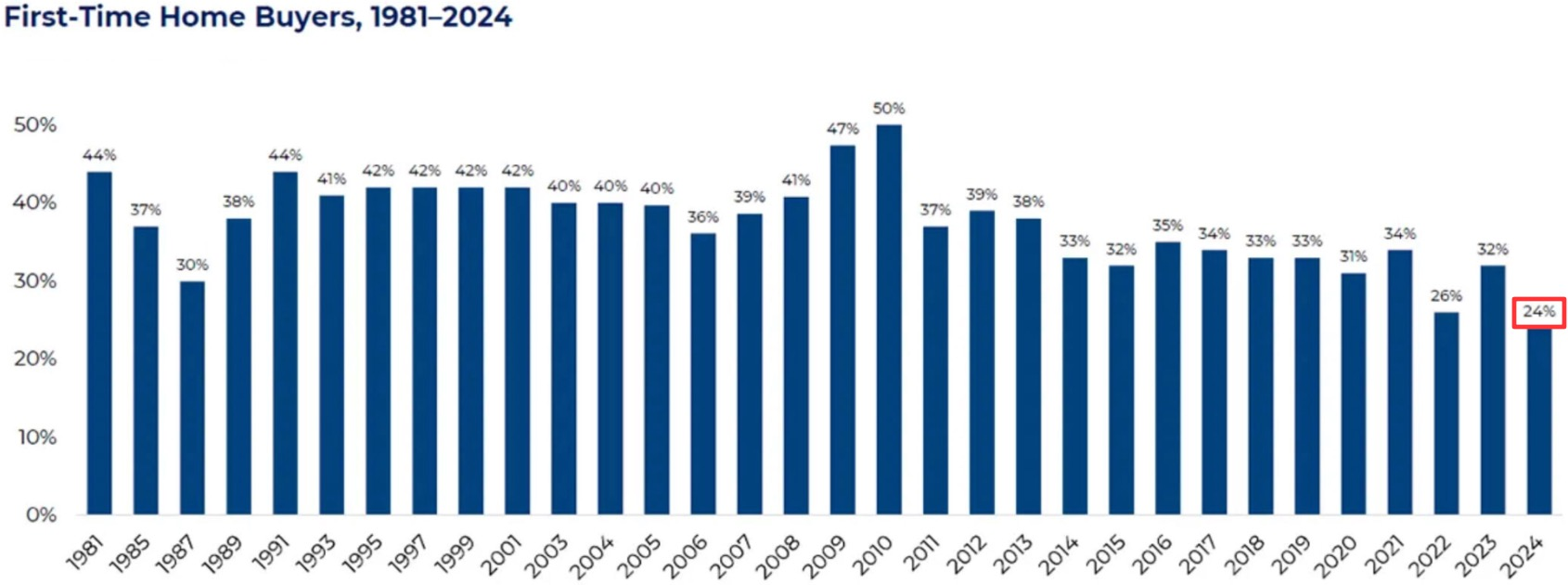

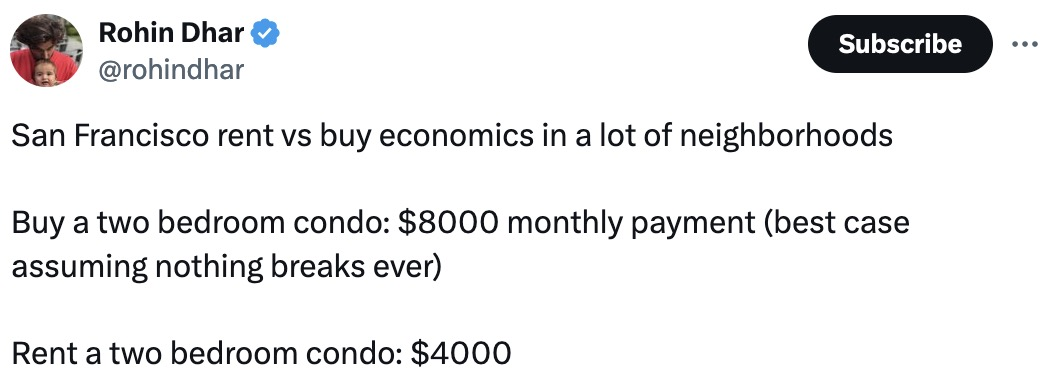

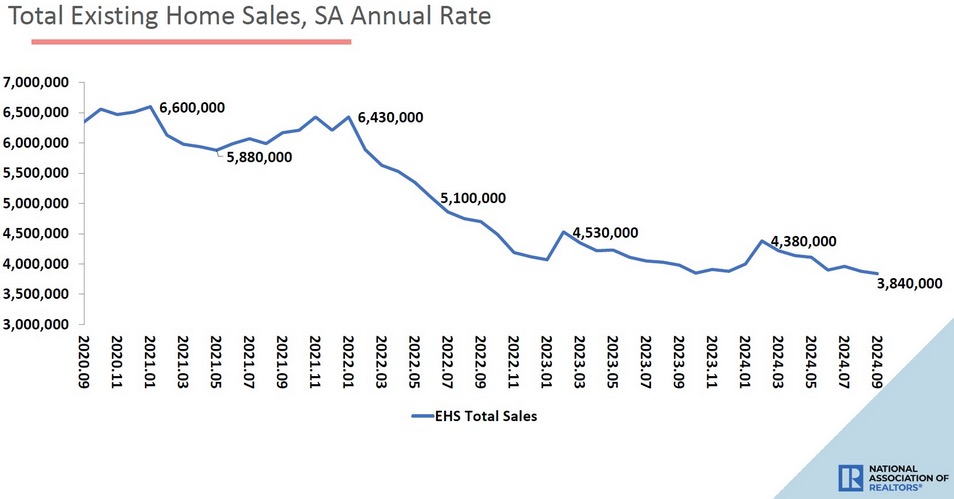

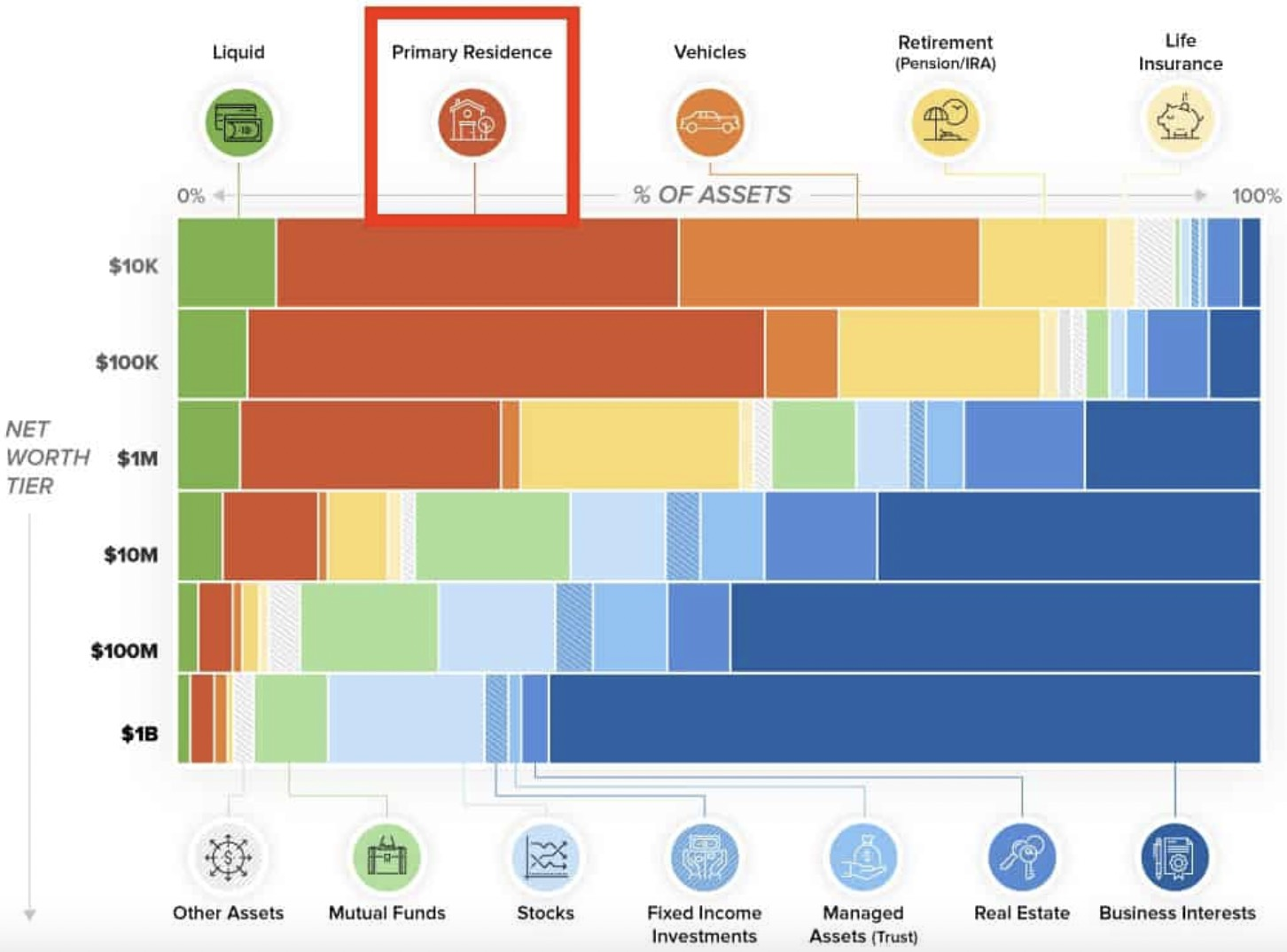

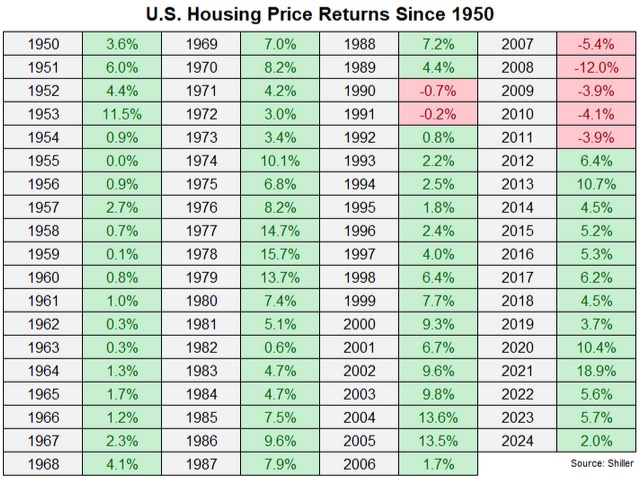

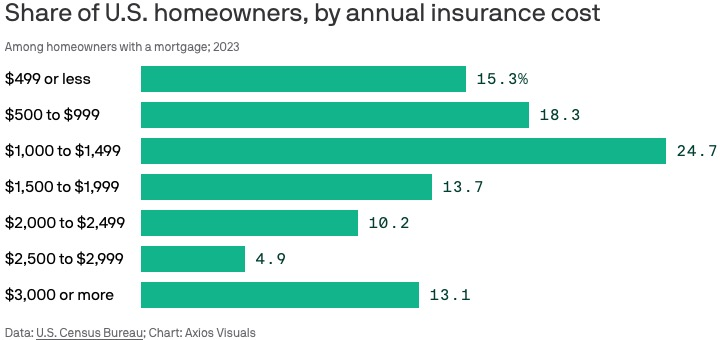

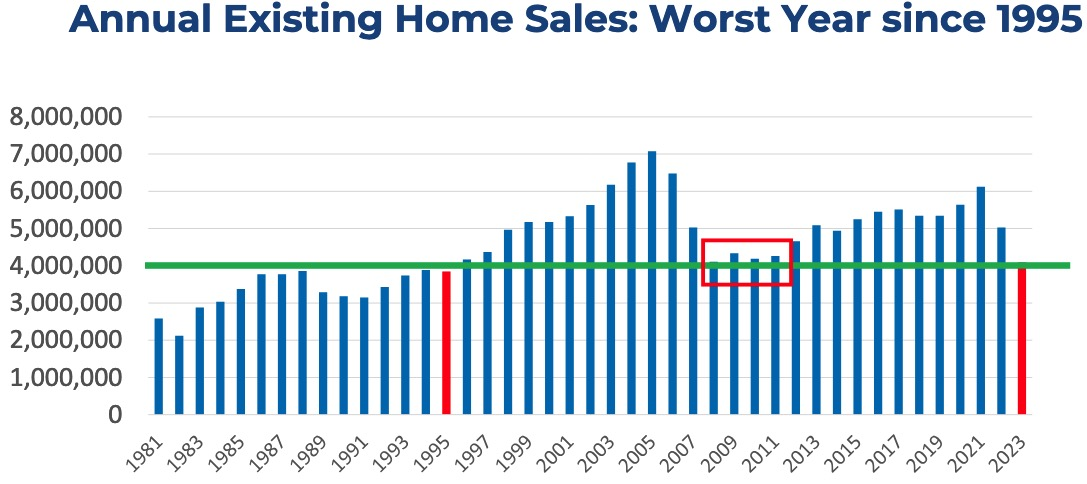

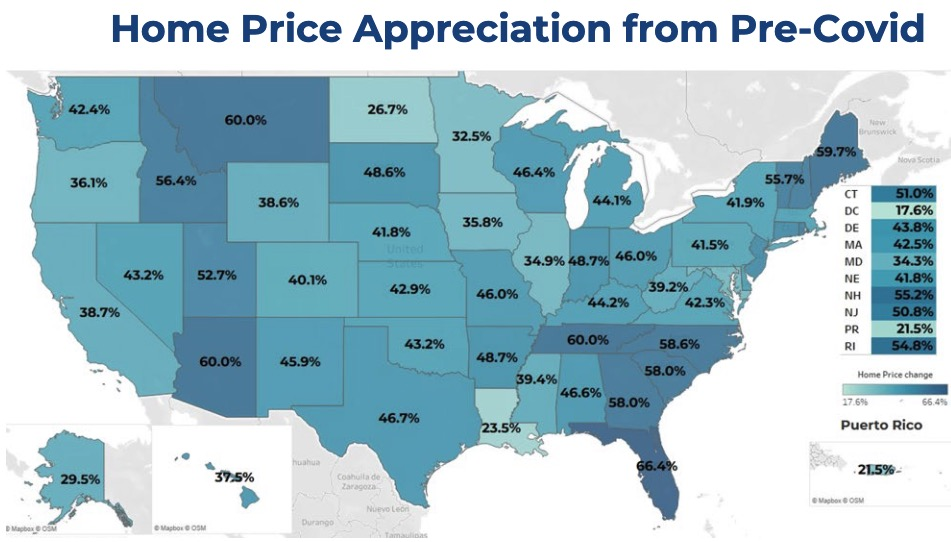

- 🏠 First Timer Buyers are Rare – 24% of homes purchased are bought by first-time homebuyers, a record low. This largely relates to interest rates and high housing prices, which makes buying difficult.

Life

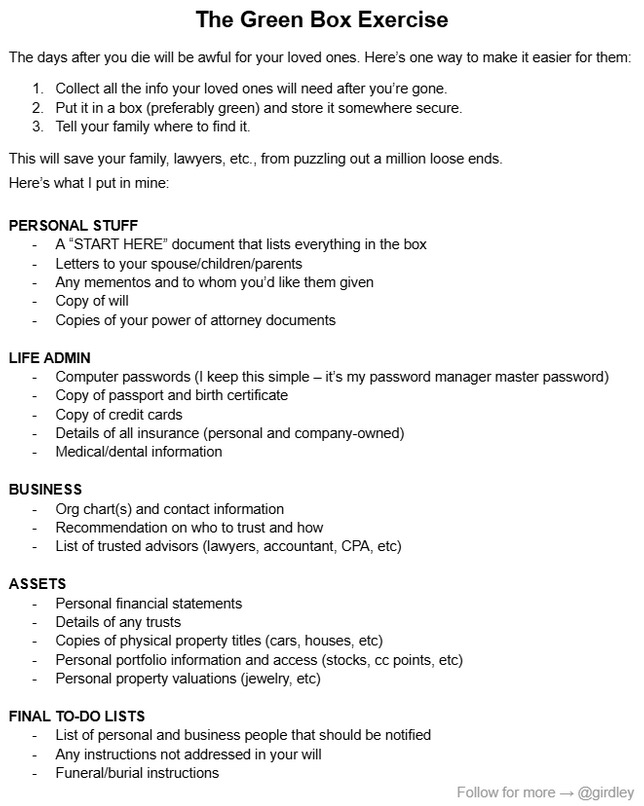

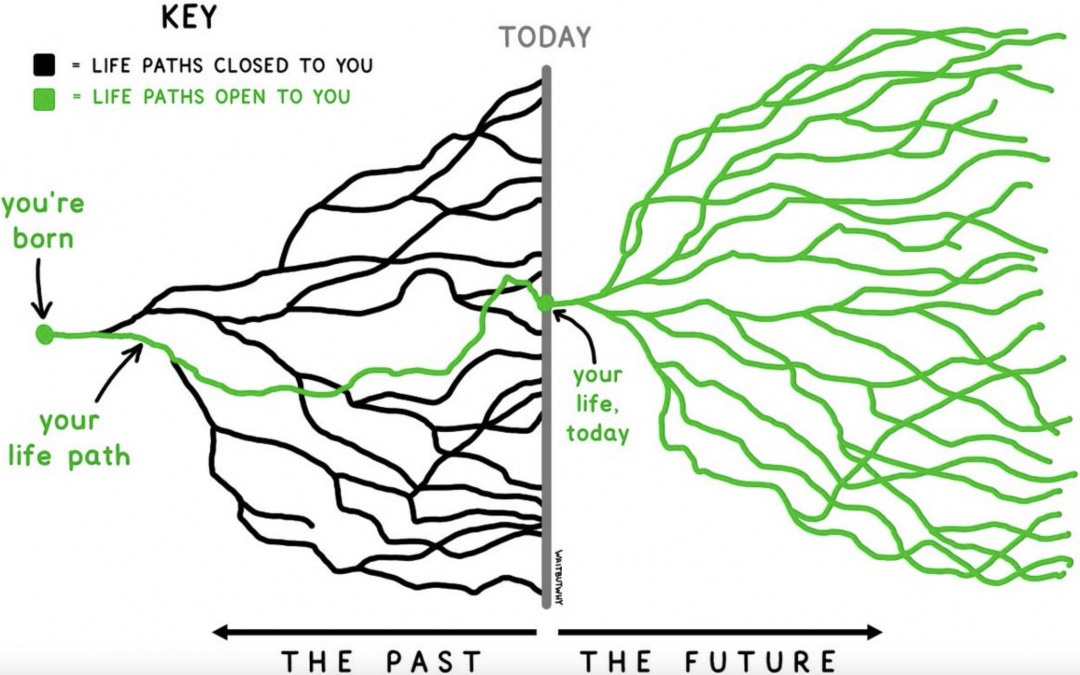

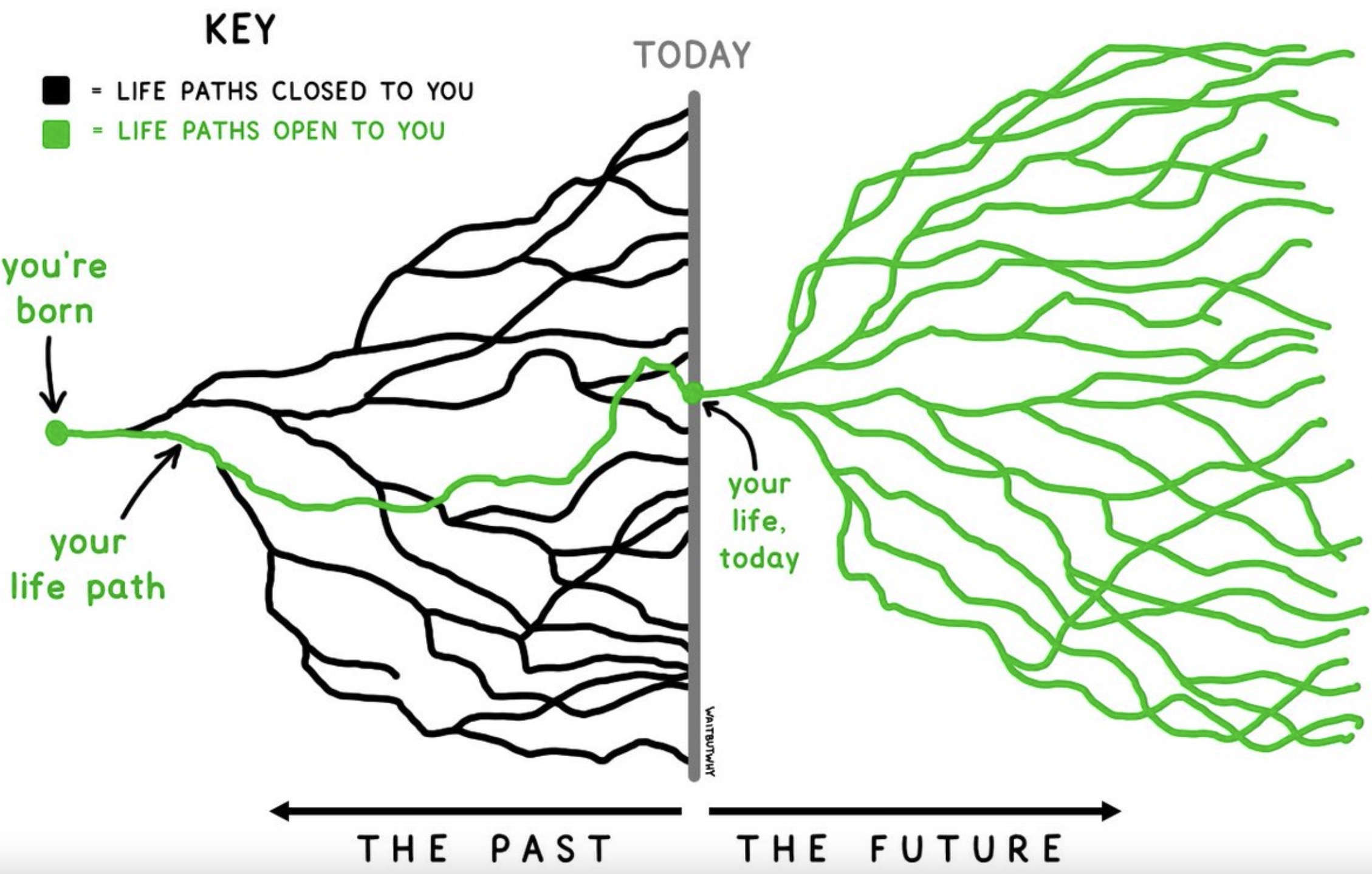

- ☑️ Estate Planning Checklist – If you’re thinking about estate planning, the checklist below might be of interest:

“It is not that we have a short time to live, but that we waste a lot of it. Life is long enough, and a sufficiently generous amount has been given to us for the highest achievements if it were all well invested.”

– Seneca

As always, please reach out if you have any questions or would like to connect.