Hack of National Public Data

I’d like to inform you of a data breach involving a company called National Public Data.

This company is involved in running background checks, and a few months ago they were hacked. As a result, a significant amount of personal information – including Social Security numbers, addresses, phone numbers, and dates of birth – was stolen and released publicly.

You can read about the hack in this article.

To see if your information was compromised, click here.

Whether your data was affected or not, I recommend placing a freeze on your credit. This is free, won’t affect your credit score, and should only take 10-15 minutes. Just set up an account with Experian, TransUnion, and Equifax.

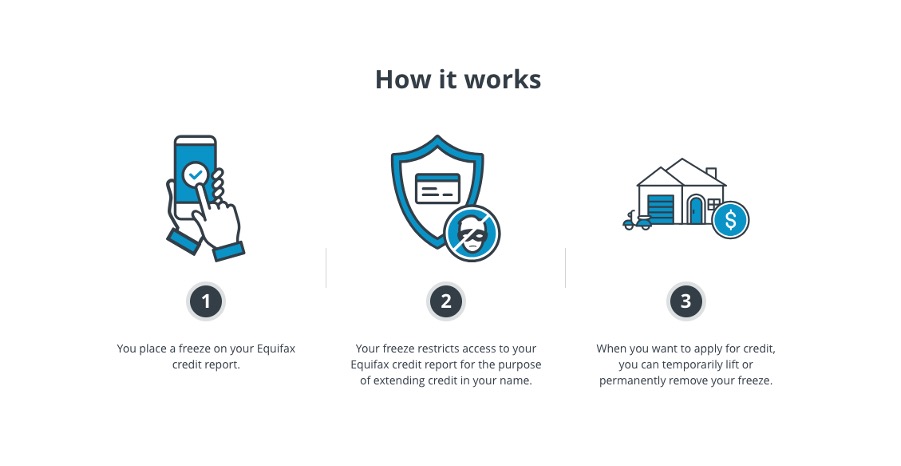

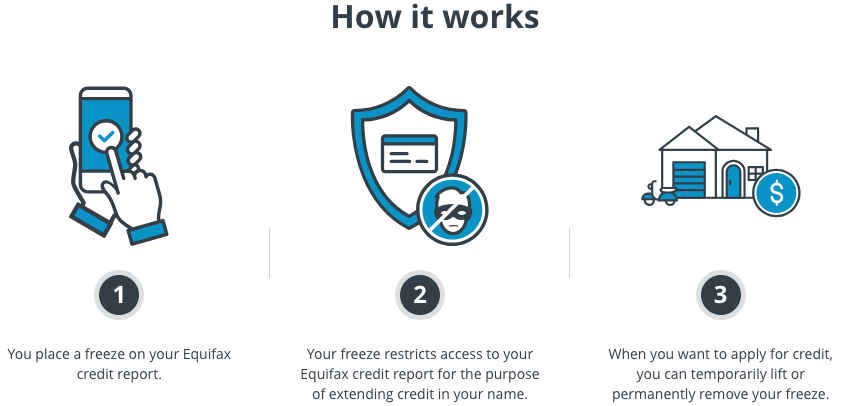

Here’s a nice explainer from Equifax on how a freeze helps:

Please reach out if you have any questions or need further assistance.